Trade Alert: Independent Director Of UFP Industries Bruce Merino Has Sold Stock

Trade Alert: Independent Director Of UFP Industries Bruce Merino Has Sold Stock

We wouldn't blame UFP Industries, Inc. (NASDAQ:UFPI) shareholders if they were a little worried about the fact that Bruce Merino, the Independent Director recently netted about US$1.9m selling shares at an average price of US$118. Probably the most concerning element of the whole transaction is that the disposal amounted to 70% of their entire holding.

如果UFP工业公司(纳斯达克股票代码:UFPI)股东对独立董事布鲁斯·梅里诺最近以平均价格118美元净出售股票约190万美元感到担忧,我们就不会责怪他们。整个交易中最令人担忧的因素可能是处置占其全部持股量的70%。

UFP Industries Insider Transactions Over The Last Year

去年 UFP Industries 的内幕交易

In the last twelve months, the biggest single sale by an insider was when the CEO & Chairman, Matthew Missad, sold US$3.4m worth of shares at a price of US$114 per share. That means that an insider was selling shares at slightly below the current price (US$118). We generally consider it a negative if insiders have been selling, especially if they did so below the current price, because it implies that they considered a lower price to be reasonable. However, while insider selling is sometimes discouraging, it's only a weak signal. This single sale was just 7.9% of Matthew Missad's stake.

在过去的十二个月中,内部人士最大的一次出售是首席执行官兼董事长马修·米萨德以每股114美元的价格出售了价值340万美元的股票。这意味着一位内部人士正在以略低于当前价格(118美元)的价格出售股票。如果内部人士一直在卖出,特别是如果他们卖出低于当前价格,我们通常认为这是负面的,因为这意味着他们认为较低的价格是合理的。但是,尽管内幕销售有时令人沮丧,但这只是一个微弱的信号。此次出售仅占马修·米萨德股份的7.9%。

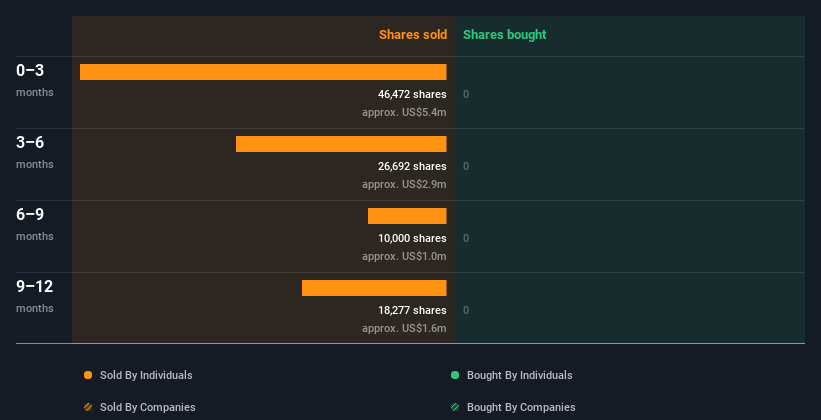

Insiders in UFP Industries didn't buy any shares in the last year. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. By clicking on the graph below, you can see the precise details of each insider transaction!

去年,UFP Industries的内部人士没有购买任何股票。您可以看到下图所示的去年的内幕交易(公司和个人)。通过点击下面的图表,你可以看到每笔内幕交易的确切细节!

If you like to buy stocks that insiders are buying, rather than selling, then you might just love this free list of companies. (Hint: insiders have been buying them).

如果你喜欢买内部人士买入而不是卖出的股票,那么你可能会喜欢这份免费的公司名单。(提示:业内人士一直在购买它们)。

Insider Ownership

内部所有权

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. I reckon it's a good sign if insiders own a significant number of shares in the company. It's great to see that UFP Industries insiders own 2.3% of the company, worth about US$167m. This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

查看公司的内部持股总量可以帮助你了解他们是否与普通股股东保持一致。我认为,如果内部人士拥有该公司的大量股份,这是一个好兆头。很高兴看到UFP Industries内部人士拥有该公司2.3%的股份,价值约1.67亿美元。内部人士的这种重要所有权通常会增加公司为所有股东的利益而经营的机会。

What Might The Insider Transactions At UFP Industries Tell Us?

UFP Industries的内幕交易会告诉我们什么?

Insiders sold stock recently, but they haven't been buying. And there weren't any purchases to give us comfort, over the last year. While insiders do own a lot of shares in the company (which is good), our analysis of their transactions doesn't make us feel confident about the company. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing UFP Industries. Case in point: We've spotted 1 warning sign for UFP Industries you should be aware of.

内部人士最近出售了股票,但他们一直没有买入。在过去的一年里,没有任何能让我们感到安慰的购买。尽管内部人士确实拥有该公司的大量股份(这很好),但我们对他们交易的分析并不能使我们对公司充满信心。除了了解正在进行的内幕交易外,确定UFP Industries面临的风险也是有益的。一个很好的例子:我们发现了你应该注意的UFP Industries的1个警告信号。

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

如果你想看看另一家公司——一家财务状况可能优越的公司——那么千万不要错过这份免费的股本回报率高、债务低的有趣公司的名单。

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

就本文而言,内部人士是指向相关监管机构报告其交易的个人。我们目前只考虑公开市场交易和私下处置的直接利益,不包括衍生品交易或间接权益。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧?直接联系我们。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St的这篇文章本质上是笼统的。我们仅使用公正的方法根据历史数据和分析师的预测提供评论,我们的文章无意作为财务建议。它不构成买入或卖出任何股票的建议,也没有考虑到您的目标或财务状况。我们的目标是为您提供由基本数据驱动的长期重点分析。请注意,我们的分析可能不考虑最新的价格敏感型公司公告或定性材料。简而言之,华尔街没有持有任何上述股票的头寸。