Looking At Schlumberger's Recent Unusual Options Activity

Looking At Schlumberger's Recent Unusual Options Activity

Whales with a lot of money to spend have taken a noticeably bearish stance on Schlumberger.

有很多钱可以花的鲸鱼对斯伦贝谢采取了明显的看跌立场。

Looking at options history for Schlumberger (NYSE:SLB) we detected 8 trades.

查看斯伦贝谢(纽约证券交易所代码:SLB)的期权历史记录,我们发现了8笔交易。

If we consider the specifics of each trade, it is accurate to state that 37% of the investors opened trades with bullish expectations and 62% with bearish.

如果我们考虑每笔交易的具体情况,可以准确地说,37%的投资者以看涨的预期开仓,62%的投资者以看跌的预期开盘。

From the overall spotted trades, 5 are puts, for a total amount of $226,568 and 3, calls, for a total amount of $268,475.

在所有已发现的交易中,有5笔是看跌期权,总金额为226,568美元,3笔是看涨期权,总额为268,475美元。

What's The Price Target?

目标价格是多少?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $47.5 and $75.0 for Schlumberger, spanning the last three months.

在评估了交易量和未平仓合约之后,很明显,主要市场推动者将注意力集中在斯伦贝谢过去三个月的47.5美元至75.0美元的价格区间上。

Volume & Open Interest Development

交易量和未平仓合约的发展

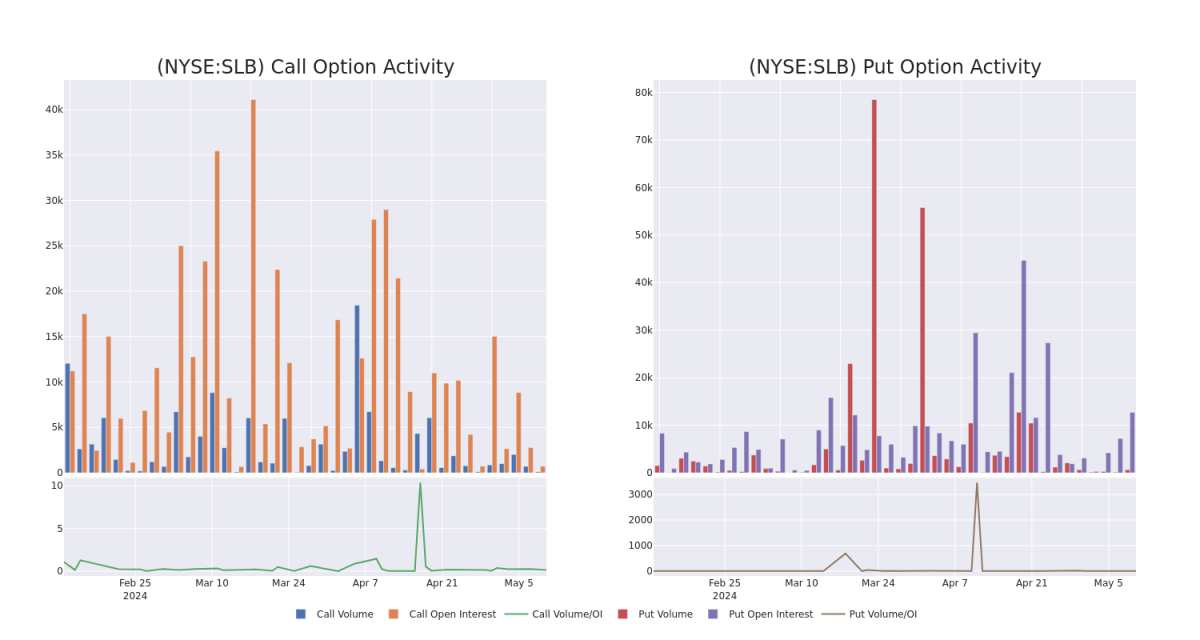

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Schlumberger's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Schlumberger's whale trades within a strike price range from $47.5 to $75.0 in the last 30 days.

交易期权时,查看交易量和未平仓合约是一个强有力的举动。这些数据可以帮助您跟踪给定行使价下斯伦贝谢期权的流动性和利息。下面,我们可以分别观察过去30天在行使价范围内的斯伦贝谢所有鲸鱼交易的看涨期权和看跌期权交易量和未平仓合约的变化。

Schlumberger Option Activity Analysis: Last 30 Days

斯伦贝谢期权活动分析:过去 30 天

Significant Options Trades Detected:

检测到的重要期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SLB | CALL | SWEEP | BEARISH | 01/16/26 | $1.78 | $1.65 | $1.65 | $75.00 | $164.6K | 648 | 0 |

| SLB | PUT | SWEEP | BULLISH | 09/20/24 | $7.25 | $7.1 | $7.1 | $55.00 | $64.6K | 1.5K | 0 |

| SLB | CALL | SWEEP | BEARISH | 11/15/24 | $4.75 | $4.65 | $4.65 | $47.50 | $54.4K | 81 | 105 |

| SLB | PUT | SWEEP | BULLISH | 09/20/24 | $7.2 | $7.1 | $7.1 | $55.00 | $50.4K | 1.5K | 139 |

| SLB | PUT | TRADE | BEARISH | 01/17/25 | $8.9 | $6.75 | $8.05 | $55.00 | $49.9K | 5.6K | 0 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SLB | 打电话 | 扫 | 粗鲁的 | 01/16/26 | 1.78 美元 | 1.65 美元 | 1.65 美元 | 75.00 美元 | 164.6 万美元 | 648 | 0 |

| SLB | 放 | 扫 | 看涨 | 09/20/24 | 7.25 美元 | 7.1 美元 | 7.1 美元 | 55.00 美元 | 64.6 万美元 | 1.5K | 0 |

| SLB | 打电话 | 扫 | 粗鲁的 | 11/15/24 | 4.75 美元 | 4.65 美元 | 4.65 美元 | 47.50 美元 | 54.4 万美元 | 81 | 105 |

| SLB | 放 | 扫 | 看涨 | 09/20/24 | 7.2 美元 | 7.1 美元 | 7.1 美元 | 55.00 美元 | 50.4 万美元 | 1.5K | 139 |

| SLB | 放 | 贸易 | 粗鲁的 | 01/17/25 | 8.9 美元 | 6.75 美元 | 8.05 美元 | 55.00 美元 | 49.9 万美元 | 5.6K | 0 |

About Schlumberger

关于斯伦贝谢

SLB is the largest oilfield service firm in the world, with expertise in myriad disciplines, including reservoir performance, well construction, production enhancement, and more recently, digital solutions. It maintains a reputation as one of the industry's leading innovators, which has earned it dominant share in numerous end markets.

SLB是世界上最大的油田服务公司,拥有多个学科的专业知识,包括油藏性能、油井建设、产量提高以及最近的数字解决方案。它保持着行业领先创新者之一的声誉,在众多终端市场中赢得了主导份额。

Current Position of Schlumberger

斯伦贝谢的现状

- With a trading volume of 3,380,505, the price of SLB is up by 0.6%, reaching $48.77.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 70 days from now.

- SLB的交易量为3,380,505美元,上涨了0.6%,达到48.77美元。

- 当前的RSI值表明,该股目前在超买和超卖之间处于中立状态。

- 下一份收益报告定于70天后发布。

Professional Analyst Ratings for Schlumberger

斯伦贝谢的专业分析师评级

5 market experts have recently issued ratings for this stock, with a consensus target price of $63.4.

5位市场专家最近发布了该股的评级,共识目标价为63.4美元。

- Maintaining their stance, an analyst from B of A Securities continues to hold a Buy rating for Schlumberger, targeting a price of $63.

- An analyst from B of A Securities persists with their Buy rating on Schlumberger, maintaining a target price of $62.

- An analyst from TD Cowen has decided to maintain their Buy rating on Schlumberger, which currently sits at a price target of $63.

- An analyst from Morgan Stanley has decided to maintain their Overweight rating on Schlumberger, which currently sits at a price target of $65.

- Maintaining their stance, an analyst from BMO Capital continues to hold a Outperform rating for Schlumberger, targeting a price of $64.

- B of A Securities的一位分析师保持立场,继续维持斯伦贝谢的买入评级,目标价格为63美元。

- B of A Securities的一位分析师坚持对斯伦贝谢的买入评级,维持62美元的目标价。

- 道明考恩的一位分析师已决定维持斯伦贝谢的买入评级,目前的目标股价为63美元。

- 摩根士丹利的一位分析师已决定维持斯伦贝谢的增持评级,斯伦贝谢目前的目标股价为65美元。

- BMO Capital的一位分析师坚持其立场,继续维持斯伦贝谢的跑赢大盘评级,目标股价为64美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

与仅交易股票相比,期权是一种风险更高的资产,但它们具有更高的获利潜力。严肃的期权交易者通过每天自我教育、扩大交易规模、关注多个指标以及密切关注市场来管理这种风险。