Here's Why Madison Square Garden Entertainment (NYSE:MSGE) Has Caught The Eye Of Investors

Here's Why Madison Square Garden Entertainment (NYSE:MSGE) Has Caught The Eye Of Investors

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Madison Square Garden Entertainment (NYSE:MSGE). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Madison Square Garden Entertainment with the means to add long-term value to shareholders.

How Fast Is Madison Square Garden Entertainment Growing Its Earnings Per Share?

Over the last three years, Madison Square Garden Entertainment has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. So it would be better to isolate the growth rate over the last year for our analysis. Impressively, Madison Square Garden Entertainment's EPS catapulted from US$0.57 to US$1.10, over the last year. It's a rarity to see 92% year-on-year growth like that.

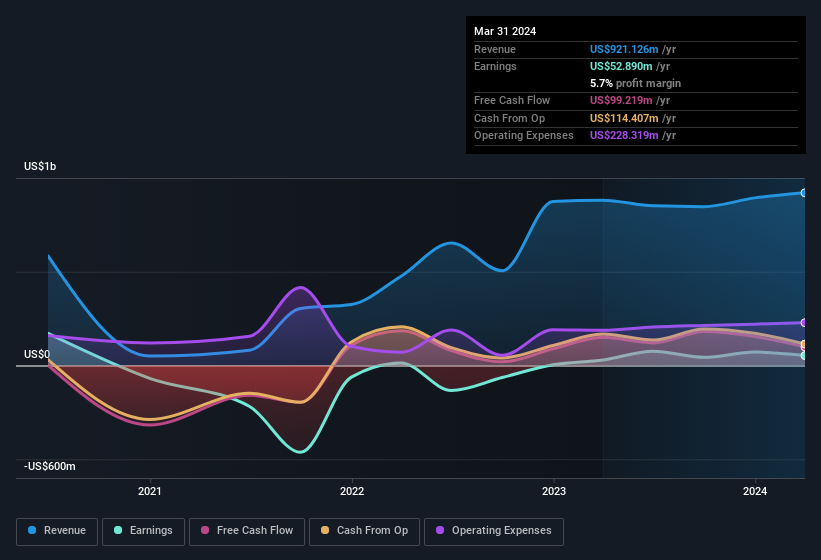

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While Madison Square Garden Entertainment did well to grow revenue over the last year, EBIT margins were dampened at the same time. So if EBIT margins can stabilize, this top-line growth should pay off for shareholders.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Madison Square Garden Entertainment.

Are Madison Square Garden Entertainment Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We did see some selling in the last twelve months, but that's insignificant compared to the whopping US$10.0m that the Director, Thomas Dolan spent acquiring shares. The average price of which was US$31.00 per share. Big purchases like that are well worth noting, especially for those who like to follow the insider money.

Along with the insider buying, another encouraging sign for Madison Square Garden Entertainment is that insiders, as a group, have a considerable shareholding. Indeed, they hold US$42m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. While their ownership only accounts for 2.2%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

Is Madison Square Garden Entertainment Worth Keeping An Eye On?

Madison Square Garden Entertainment's earnings have taken off in quite an impressive fashion. The cherry on top is that insiders own a bunch of shares, and one has been buying more. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Madison Square Garden Entertainment deserves timely attention. You still need to take note of risks, for example - Madison Square Garden Entertainment has 2 warning signs (and 1 which is concerning) we think you should know about.

The good news is that Madison Square Garden Entertainment is not the only growth stock with insider buying. Here's a list of growth-focused companies in the US with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.