Shenzhen Capol International & Associatesco.Ltd (SZSE:002949) Strong Profits May Be Masking Some Underlying Issues

Shenzhen Capol International & Associatesco.Ltd (SZSE:002949) Strong Profits May Be Masking Some Underlying Issues

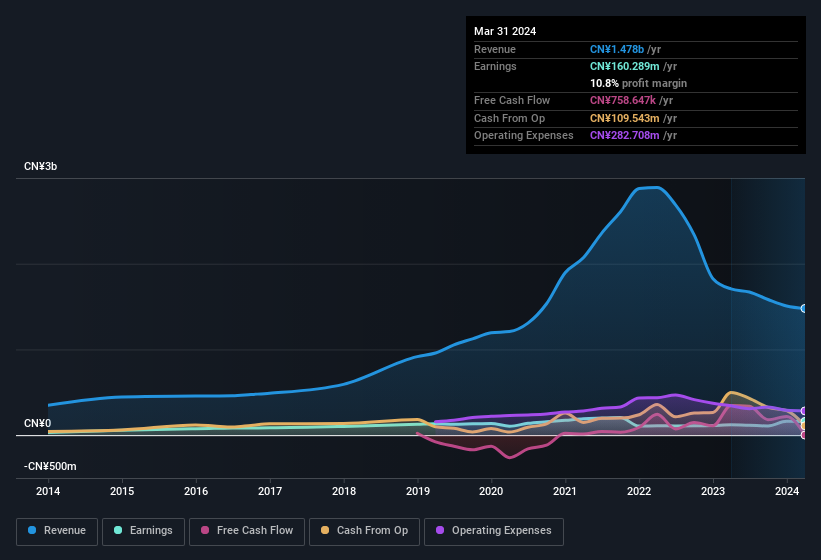

Shenzhen Capol International & Associatesco.,Ltd's (SZSE:002949) healthy profit numbers didn't contain any surprises for investors. We think this is due to investors looking beyond the statutory profits and being concerned with what they see.

深圳嘉宝国际律师事务所,Ltd(深圳证券交易所:002949)的健康利润数字并没有让投资者感到意外。我们认为这是由于投资者将目光投向了法定利润之外并关注他们所看到的情况。

The Impact Of Unusual Items On Profit

不寻常物品对利润的影响

Importantly, our data indicates that Shenzhen Capol International & Associatesco.Ltd's profit received a boost of CN¥31m in unusual items, over the last year. We can't deny that higher profits generally leave us optimistic, but we'd prefer it if the profit were to be sustainable. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. Assuming those unusual items don't show up again in the current year, we'd thus expect profit to be weaker next year (in the absence of business growth, that is).

重要的是,我们的数据表明,与去年相比,深圳Capol International & Associatesco.Ltd的不寻常项目利润增加了3100万元人民币。我们不能否认更高的利润通常会让我们感到乐观,但如果利润是可持续的,我们更愿意这样做。当我们分析全球绝大多数上市公司时,我们发现重大不寻常的事项往往不会重演。而且,毕竟,这正是会计术语的含义。假设这些不寻常的项目在本年度不会再次出现,因此我们预计明年的利润将疲软(也就是说,在业务没有增长的情况下)。

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

这可能会让你想知道分析师对未来盈利能力的预测。幸运的是,您可以单击此处查看根据他们的估计描绘未来盈利能力的交互式图表。

Our Take On Shenzhen Capol International & Associatesco.Ltd's Profit Performance

我们对深圳Capol International & Associatesco.Ltd的盈利表现的看法

Arguably, Shenzhen Capol International & Associatesco.Ltd's statutory earnings have been distorted by unusual items boosting profit. Therefore, it seems possible to us that Shenzhen Capol International & Associatesco.Ltd's true underlying earnings power is actually less than its statutory profit. But at least holders can take some solace from the 33% EPS growth in the last year. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. If you want to do dive deeper into Shenzhen Capol International & Associatesco.Ltd, you'd also look into what risks it is currently facing. In terms of investment risks, we've identified 1 warning sign with Shenzhen Capol International & Associatesco.Ltd, and understanding it should be part of your investment process.

可以说,深圳Capol International & Associatesco.Ltd的法定收益被提振利润的不寻常项目所扭曲。因此,在我们看来,深圳Capol International & Associatesco.Ltd的真正基础盈利能力实际上可能低于其法定利润。但是,至少持有人可以从去年33%的每股收益增长中得到一些安慰。当然,我们只是在分析其收益时才浮出水面;人们还可以考虑利润率、预测增长和投资回报率等因素。如果你想更深入地了解深圳Capol International & Associatesco.Ltd,你还需要研究它目前面临的风险。在投资风险方面,我们已经向深圳Capol International & Associatesco.Ltd确定了1个警告信号,并知道这应该是您投资过程的一部分。

Today we've zoomed in on a single data point to better understand the nature of Shenzhen Capol International & Associatesco.Ltd's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

今天,我们放大了单一数据点,以更好地了解深圳Capol国际与协会有限公司利润的性质。但是,如果你能够将注意力集中在细节上,总会有更多的事情需要发现。有些人认为高股本回报率是优质业务的好兆头。虽然可能需要你进行一些研究,但你可能会发现这份免费收集的拥有高股本回报率的公司,或者这份内部人士正在购买的股票清单很有用。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧?直接联系我们。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St的这篇文章本质上是笼统的。我们仅使用公正的方法根据历史数据和分析师的预测提供评论,我们的文章无意作为财务建议。它不构成买入或卖出任何股票的建议,也没有考虑到您的目标或财务状况。我们的目标是为您提供由基本数据驱动的长期重点分析。请注意,我们的分析可能不考虑最新的价格敏感型公司公告或定性材料。简而言之,华尔街没有持有任何上述股票的头寸。