Gilead Sciences Unusual Options Activity For May 06

Gilead Sciences Unusual Options Activity For May 06

Financial giants have made a conspicuous bearish move on Gilead Sciences. Our analysis of options history for Gilead Sciences (NASDAQ:GILD) revealed 13 unusual trades.

金融巨头对吉利德科学采取了明显的看跌举动。我们对吉利德科学(纳斯达克股票代码:GILD)期权历史的分析显示了13笔不寻常的交易。

Delving into the details, we found 38% of traders were bullish, while 61% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $274,737, and 7 were calls, valued at $398,087.

深入研究细节,我们发现38%的交易者看涨,而61%的交易者表现出看跌倾向。在我们发现的所有交易中,有6笔是看跌期权,价值为274,737美元,7笔是看涨期权,价值398,087美元。

What's The Price Target?

目标价格是多少?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $55.0 to $77.5 for Gilead Sciences over the last 3 months.

考虑到这些合约的交易量和未平仓合约,在过去的3个月中,鲸鱼似乎一直将吉利德科学的价格定在55.0美元至77.5美元之间。

Volume & Open Interest Development

交易量和未平仓合约的发展

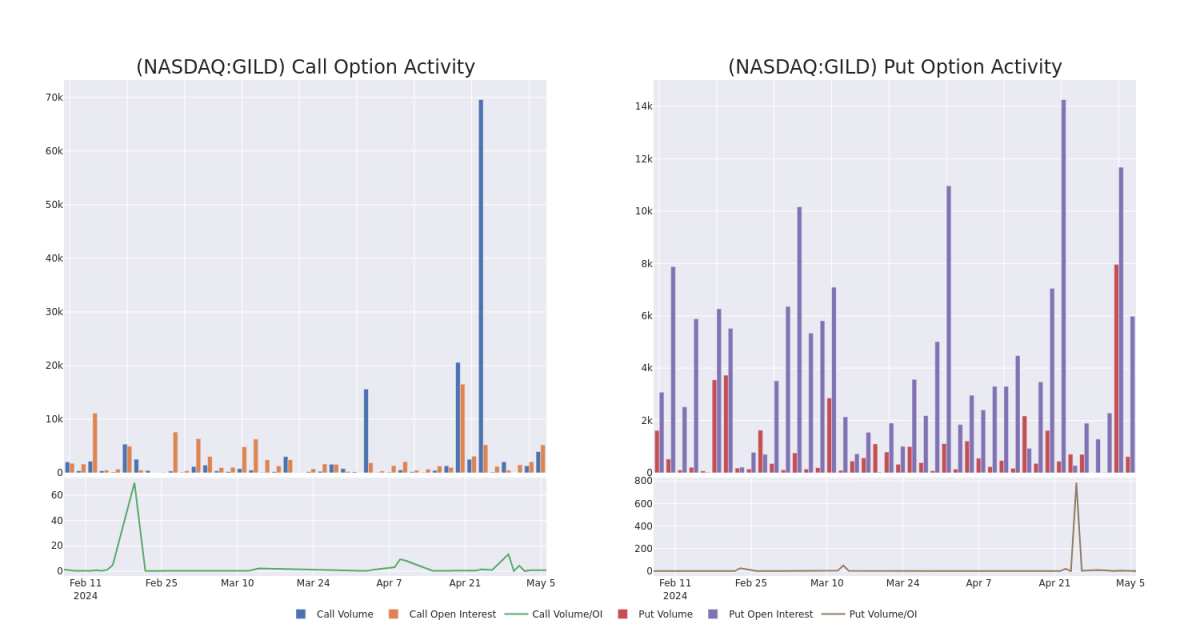

In today's trading context, the average open interest for options of Gilead Sciences stands at 860.38, with a total volume reaching 4,585.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Gilead Sciences, situated within the strike price corridor from $55.0 to $77.5, throughout the last 30 days.

在当今的交易背景下,吉利德科学期权的平均未平仓合约为860.38,总交易量达到4,585.00。随附的图表描绘了过去30天内吉利德科学高价值交易的看涨和看跌期权交易量以及未平仓合约的变化,行使价走势从55.0美元到77.5美元不等。

Gilead Sciences Option Volume And Open Interest Over Last 30 Days

吉利德科学过去 30 天的期权交易量和未平仓合约

Biggest Options Spotted:

发现的最大选择:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GILD | CALL | SWEEP | BULLISH | 07/19/24 | $2.27 | $2.13 | $2.26 | $65.00 | $129.1K | 579 | 572 |

| GILD | CALL | TRADE | BEARISH | 06/21/24 | $5.55 | $5.45 | $5.47 | $60.00 | $109.4K | 172 | 200 |

| GILD | PUT | SWEEP | BEARISH | 06/20/25 | $2.8 | $2.42 | $2.8 | $55.00 | $74.4K | 768 | 173 |

| GILD | PUT | SWEEP | BEARISH | 08/16/24 | $4.85 | $4.75 | $4.85 | $67.50 | $51.8K | 1.4K | 108 |

| GILD | PUT | SWEEP | BEARISH | 08/16/24 | $2.17 | $2.16 | $2.17 | $62.50 | $41.6K | 2.0K | 232 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 金 | 打电话 | 扫 | 看涨 | 07/19/24 | 2.27 美元 | 2.13 美元 | 2.26 美元 | 65.00 美元 | 129.1 万美元 | 579 | 572 |

| 金 | 打电话 | 贸易 | 粗鲁的 | 06/21/24 | 5.55 美元 | 5.45 美元 | 5.47 美元 | 60.00 美元 | 109.4 万美元 | 172 | 200 |

| 金 | 放 | 扫 | 粗鲁的 | 06/20/25 | 2.8 美元 | 2.42 美元 | 2.8 美元 | 55.00 美元 | 74.4 万美元 | 768 | 173 |

| 金 | 放 | 扫 | 粗鲁的 | 08/16/24 | 4.85 美元 | 4.75 美元 | 4.85 美元 | 67.50 美元 | 51.8 万美元 | 1.4K | 108 |

| 金 | 放 | 扫 | 粗鲁的 | 08/16/24 | 2.17 美元 | 2.16 美元 | 2.17 美元 | 62.50 美元 | 41.6K | 2.0K | 232 |

About Gilead Sciences

关于吉利德科学

Gilead Sciences develops and markets therapies to treat life-threatening infectious diseases, with the core of its portfolio focused on HIV and hepatitis B and C. The acquisitions of Corus Pharma, Myogen, CV Therapeutics, Arresto Biosciences, and Calistoga have broadened this focus to include pulmonary and cardiovascular diseases and cancer. Gilead's acquisition of Pharmasset brought rights to hepatitis C drug Sovaldi, which is also part of combination drug Harvoni, and the Kite, Forty Seven, and Immunomedics acquisitions boost Gilead's exposure to cell therapy and noncell therapy in oncology.

吉利德科学开发和销售治疗危及生命的传染病的疗法,其产品组合的核心集中在艾滋病毒以及乙型和丙型肝炎上。对Corus Pharma、Myogen、CV Therapeutics、Arresto Biosciences和Calistoga的收购扩大了这一关注范围,将肺部和心血管疾病以及癌症包括在内。吉利德对Pharmasset的收购带来了丙型肝炎药物Sovaldi的版权,该药物也是复方药物Harvoni的一部分,而对Kite、Forty Seven和Immunomedics的收购增加了吉利德在肿瘤学领域接受细胞疗法和非细胞疗法的机会。

Gilead Sciences's Current Market Status

吉利德科学的当前市场状况

- Trading volume stands at 3,631,936, with GILD's price up by 0.63%, positioned at $65.19.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 87 days.

- 交易量为3,631,936美元,GILD的价格上涨了0.63%,为65.19美元。

- RSI指标显示该股可能被超卖。

- 预计将在87天内公布财报。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

与仅交易股票相比,期权是一种风险更高的资产,但它们具有更高的获利潜力。严肃的期权交易者通过每天自我教育、扩大交易规模、关注多个指标以及密切关注市场来管理这种风险。