Decoding Walmart's Options Activity: What's the Big Picture?

Decoding Walmart's Options Activity: What's the Big Picture?

Financial giants have made a conspicuous bullish move on Walmart. Our analysis of options history for Walmart (NYSE:WMT) revealed 10 unusual trades.

金融巨头对沃尔玛采取了明显的看涨举动。我们对沃尔玛(纽约证券交易所代码:WMT)期权历史的分析显示了10笔不寻常的交易。

Delving into the details, we found 50% of traders were bullish, while 50% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $215,051, and 5 were calls, valued at $322,532.

深入研究细节,我们发现50%的交易者看涨,而50%的交易者表现出看跌趋势。在我们发现的所有交易中,有5笔是看跌期权,价值215,051美元,5笔是看涨期权,价值322,532美元。

Predicted Price Range

预测的价格区间

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $53.33 to $65.0 for Walmart during the past quarter.

分析这些合约的交易量和未平仓合约,大型企业似乎一直在关注沃尔玛在过去一个季度的价格范围从53.33美元到65.0美元不等。

Volume & Open Interest Development

交易量和未平仓合约的发展

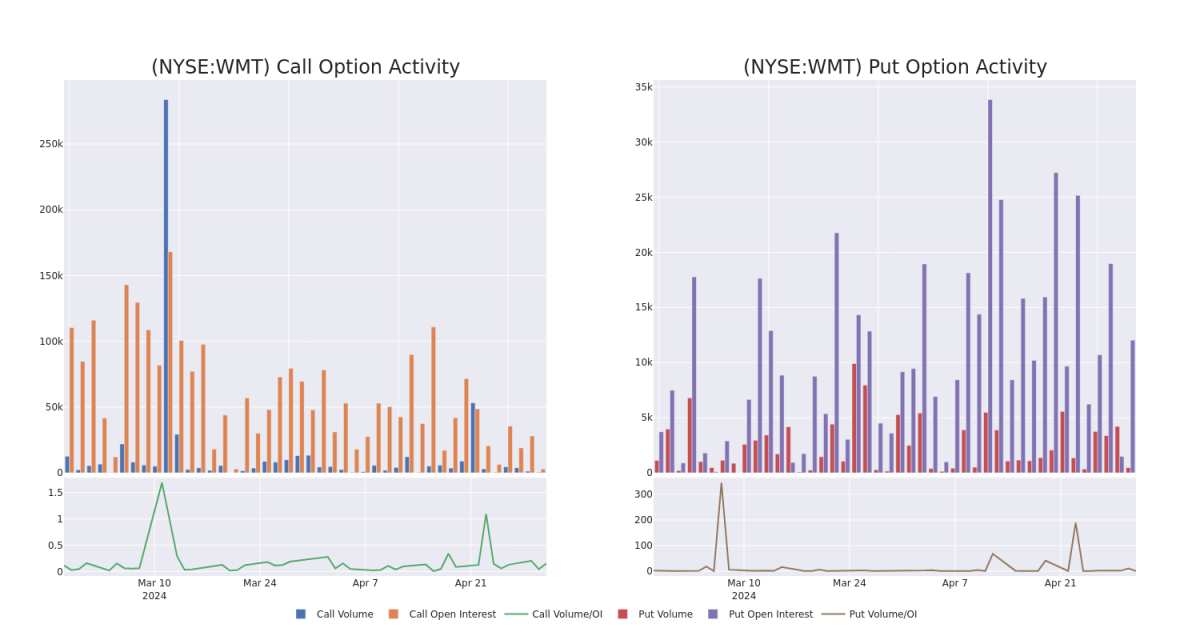

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Walmart's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Walmart's whale trades within a strike price range from $53.33 to $65.0 in the last 30 days.

交易期权时,查看交易量和未平仓合约是一个强有力的举动。这些数据可以帮助您跟踪给定行使价下沃尔玛期权的流动性和利息。下面,我们可以观察到过去30天内沃尔玛所有鲸鱼交易的看涨期权和看跌期权交易量和未平仓合约的变化,其行使价在53.33美元至65.0美元之间。

Walmart 30-Day Option Volume & Interest Snapshot

沃尔玛 30 天期权交易量和利息快照

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WMT | CALL | SWEEP | BULLISH | 12/20/24 | $8.3 | $8.2 | $8.3 | $53.33 | $103.7K | 1.3K | 126 |

| WMT | CALL | SWEEP | BULLISH | 12/20/24 | $5.95 | $5.85 | $5.95 | $56.67 | $102.9K | 1.2K | 2 |

| WMT | PUT | SWEEP | BEARISH | 06/20/25 | $3.9 | $3.8 | $3.9 | $58.33 | $78.7K | 673 | 0 |

| WMT | CALL | SWEEP | BULLISH | 03/21/25 | $8.1 | $8.0 | $8.1 | $55.00 | $51.0K | 323 | 64 |

| WMT | PUT | SWEEP | BEARISH | 09/20/24 | $6.5 | $6.4 | $6.5 | $65.00 | $49.4K | 1.1K | 143 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WMT | 打电话 | 扫 | 看涨 | 12/20/24 | 8.3 美元 | 8.2 美元 | 8.3 美元 | 53.33 美元 | 103.7 万美元 | 1.3K | 126 |

| WMT | 打电话 | 扫 | 看涨 | 12/20/24 | 5.95 美元 | 5.85 美元 | 5.95 美元 | 56.67 美元 | 102.9 万美元 | 1.2K | 2 |

| WMT | 放 | 扫 | 粗鲁的 | 06/20/25 | 3.9 美元 | 3.8 美元 | 3.9 美元 | 58.33 美元 | 78.7 万美元 | 673 | 0 |

| WMT | 打电话 | 扫 | 看涨 | 03/21/25 | 8.1 美元 | 8.0 美元 | 8.1 美元 | 55.00 美元 | 51.0 万美元 | 323 | 64 |

| WMT | 放 | 扫 | 粗鲁的 | 09/20/24 | 6.5 美元 | 6.4 美元 | 6.5 美元 | 65.00 美元 | 49.4 万美元 | 1.1K | 143 |

About Walmart

关于沃尔玛

Walmart serves as the preeminent retailer in the United States, with its strategy predicated on superior operating efficiency and offering the lowest priced goods to consumers to drive robust store traffic and product turnover. Walmart augmented its low-price business strategy by offering a convenient one-stop shopping destination with the opening of its first supercenter in 1988.Today, Walmart operates over 4,600 stores in the United States (5,200 including Sam's Club) and over 10,000 stores globally. Walmart generated over $440 billion in domestic namesake sales in fiscal 2024, with Sam's Club contributing another $86 billion to the firm's top line. Internationally, Walmart generated $115 billion in sales. The company serves around 240 million customers globally each week.

沃尔玛是美国卓越的零售商,其战略以卓越的运营效率为前提,为消费者提供价格最低的商品,以推动强劲的门店流量和产品营业额。沃尔玛于1988年开设首个超级中心,通过提供便捷的一站式购物目的地来增强其低价业务战略。如今,沃尔玛在美国经营着4,600多家门店(包括山姆俱乐部在内的5,200家门店),在全球经营超过10,000家门店。沃尔玛在2024财年创造了超过4,400亿美元的国内同名销售额,山姆俱乐部为该公司的收入又贡献了860亿美元。在国际上,沃尔玛创造了1150亿美元的销售额。该公司每周为全球约2.4亿客户提供服务。

Having examined the options trading patterns of Walmart, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了沃尔玛的期权交易模式之后,我们的注意力现在直接转向了该公司。这种转变使我们能够深入研究其目前的市场地位和表现

Present Market Standing of Walmart

沃尔玛目前的市场地位

- Trading volume stands at 2,884,058, with WMT's price down by -0.44%, positioned at $59.09.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 15 days.

- 交易量为2,884,058美元,WMT的价格下跌了-0.44%,为59.09美元。

- RSI指标显示,该股目前在超买和超卖之间处于中立状态。

- 预计将在15天后公布财报。

What The Experts Say On Walmart

专家对沃尔玛的看法

In the last month, 1 experts released ratings on this stock with an average target price of $66.0.

上个月,1位专家发布了该股的评级,平均目标价为66.0美元。

- Consistent in their evaluation, an analyst from Evercore ISI Group keeps a Outperform rating on Walmart with a target price of $66.

- Evercore ISI集团的一位分析师在评估中保持了沃尔玛跑赢大盘的评级,目标价为66美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Walmart with Benzinga Pro for real-time alerts.

交易期权涉及更大的风险,但也提供了更高利润的潜力。精明的交易者通过持续的教育、战略贸易调整、利用各种指标以及随时关注市场动态来降低这些风险。使用Benzinga Pro了解沃尔玛的最新期权交易,以获取实时警报。