A Closer Look at Nike's Options Market Dynamics

A Closer Look at Nike's Options Market Dynamics

Investors with significant funds have taken a bullish position in Nike (NYSE:NKE), a development that retail traders should be aware of.

拥有大量资金的投资者对耐克(纽约证券交易所代码:NKE)持看涨立场,零售交易者应该注意这一事态发展。

This was brought to our attention today through our monitoring of publicly accessible options data at Benzinga. The exact nature of these investors remains a mystery, but such a major move in NKE usually indicates foreknowledge of upcoming events.

今天,通过对本辛加可公开访问的期权数据的监控,这引起了我们的注意。这些投资者的确切性质仍然是个谜,但是NKE的如此重大举动通常表明对即将发生的事件的预感。

Today, Benzinga's options scanner identified 8 options transactions for Nike. This is an unusual occurrence. The sentiment among these large-scale traders is mixed, with 62% being bullish and 0% bearish. Of all the options we discovered, 7 are puts, valued at $509,057, and there was a single call, worth $91,350.

今天,Benzinga的期权扫描仪为耐克确定了8笔期权交易。这是一种不寻常的事件。这些大型交易者的情绪喜忧参半,62%的人看涨,0%的人看跌。在我们发现的所有期权中,有7个是看跌期权,价值509,057美元,还有一个看涨期权,价值91,350美元。

Projected Price Targets

预计价格目标

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $80.0 to $105.0 for Nike during the past quarter.

分析这些合约的交易量和未平仓合约,看来大型企业一直在关注耐克在过去一个季度的价格范围从80.0美元到105.0美元不等。

Volume & Open Interest Trends

交易量和未平仓合约趋势

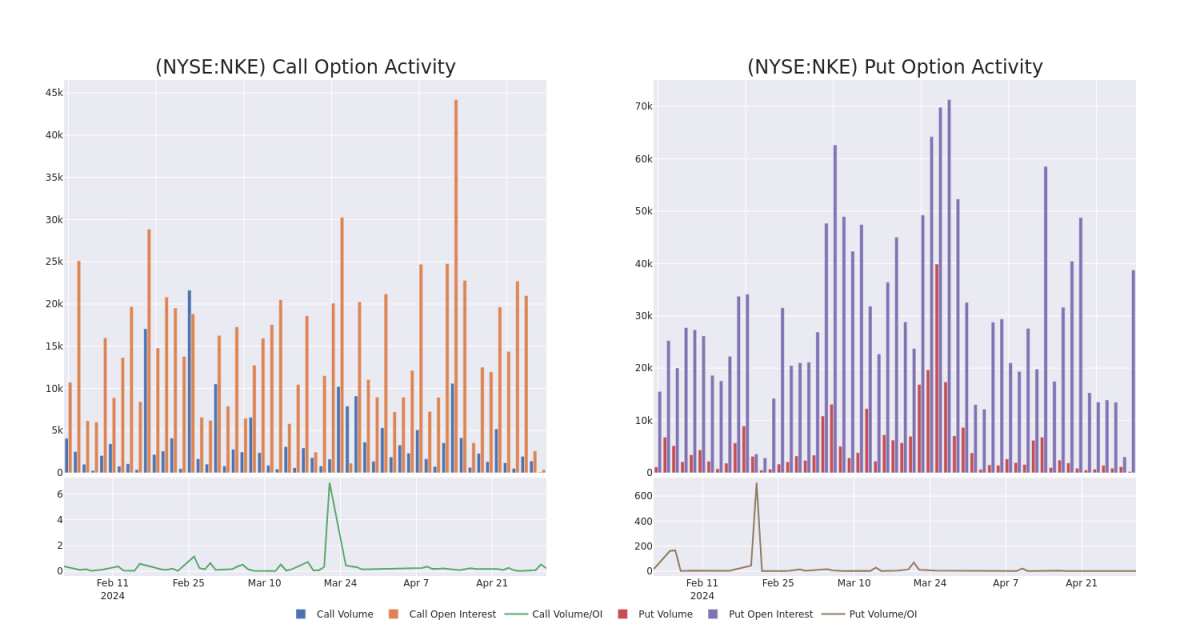

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Nike's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Nike's substantial trades, within a strike price spectrum from $80.0 to $105.0 over the preceding 30 days.

评估交易量和未平仓合约是期权交易的战略步骤。这些指标揭示了耐克期权在指定行使价下的流动性和投资者对耐克期权的兴趣。即将发布的数据可视化了与耐克的大量交易相关的看涨期权和看跌期权的交易量和未平仓合约的波动,在过去30天内,行使价范围从80.0美元到105.0美元不等。

Nike Option Volume And Open Interest Over Last 30 Days

耐克过去30天的期权交易量和未平仓合约

Significant Options Trades Detected:

检测到的重要期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NKE | PUT | TRADE | BULLISH | 01/17/25 | $7.45 | $7.35 | $7.35 | $90.00 | $294.0K | 10.5K | 7 |

| NKE | CALL | TRADE | BULLISH | 09/20/24 | $10.15 | $10.0 | $10.15 | $85.00 | $91.3K | 384 | 90 |

| NKE | PUT | TRADE | NEUTRAL | 01/17/25 | $12.8 | $12.55 | $12.67 | $100.00 | $63.3K | 6.4K | 50 |

| NKE | PUT | TRADE | NEUTRAL | 01/17/25 | $3.65 | $3.55 | $3.6 | $80.00 | $36.0K | 8.5K | 0 |

| NKE | PUT | SWEEP | BULLISH | 06/21/24 | $5.55 | $5.5 | $5.5 | $95.00 | $30.2K | 8.8K | 85 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NKE | 放 | 贸易 | 看涨 | 01/17/25 | 7.45 美元 | 7.35 美元 | 7.35 美元 | 90.00 美元 | 294.0 万美元 | 10.5K | 7 |

| NKE | 打电话 | 贸易 | 看涨 | 09/20/24 | 10.15 美元 | 10.0 美元 | 10.15 美元 | 85.00 美元 | 91.3 万美元 | 384 | 90 |

| NKE | 放 | 贸易 | 中立 | 01/17/25 | 12.8 美元 | 12.55 美元 | 12.67 美元 | 100.00 美元 | 63.3 万美元 | 6.4K | 50 |

| NKE | 放 | 贸易 | 中立 | 01/17/25 | 3.65 美元 | 3.55 美元 | 3.6 美元 | 80.00 美元 | 36.0 万美元 | 8.5K | 0 |

| NKE | 放 | 扫 | 看涨 | 06/21/24 | 5.55 美元 | 5.5 美元 | 5.5 美元 | 95.00 美元 | 30.2 万美元 | 8.8K | 85 |

About Nike

关于耐克

Nike is the largest athletic footwear and apparel brand in the world. Key categories include basketball, running, and football (soccer). Footwear generates about two thirds of its sales. Its brands include Nike, Jordan, and Converse (casual footwear). Nike sells products worldwide through company-owned stores, franchised stores, and third-party retailers. The firm also operates e-commerce platforms in more than 40 countries. Nearly all its production is outsourced to contract manufacturers in more than 30 countries. Nike was founded in 1964 and is based in Beaverton, Oregon.

耐克是世界上最大的运动鞋和服装品牌。关键类别包括篮球、跑步和足球(足球)。鞋类约占其销售额的三分之二。其品牌包括耐克、乔丹和匡威(休闲鞋)。耐克通过公司自有门店、特许经营商店和第三方零售商在全球范围内销售产品。该公司还在40多个国家运营电子商务平台。其生产几乎全部外包给了30多个国家的合同制造商。耐克成立于 1964 年,总部位于俄勒冈州比弗顿。

After a thorough review of the options trading surrounding Nike, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在对围绕耐克的期权交易进行了全面审查之后,我们将对该公司进行更详细的审查。这包括评估其当前的市场状况和表现。

Current Position of Nike

耐克的现状

- With a trading volume of 1,640,730, the price of NKE is down by -1.75%, reaching $90.65.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 57 days from now.

- NKE的交易量为1,640,730美元,下跌了-1.75%,至90.65美元。

- 当前的RSI值表明,该股目前在超买和超卖之间处于中立状态。

- 下一份收益报告定于57天后发布。

What Analysts Are Saying About Nike

分析师对耐克的看法

2 market experts have recently issued ratings for this stock, with a consensus target price of $114.0.

2位市场专家最近发布了该股的评级,共识目标价为114.0美元。

- Reflecting concerns, an analyst from Wedbush lowers its rating to Outperform with a new price target of $115.

- In a positive move, an analyst from B of A Securities has upgraded their rating to Buy and adjusted the price target to $113.

- 出于担忧,Wedbush的一位分析师将其评级下调至跑赢大盘,新的目标股价为115美元。

- 一个积极的举动是,Bof A Securities的一位分析师已将其评级上调为买入,并将目标股价调整至113美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Nike with Benzinga Pro for real-time alerts.

交易期权涉及更大的风险,但也提供了获得更高利润的可能性。精明的交易者通过持续的教育、战略交易调整、利用各种指标以及随时关注市场动态来降低这些风险。使用Benzinga Pro了解耐克的最新期权交易,获取实时提醒。