As Hang Xiao Steel StructureLtd (SHSE:600477) Increases 6.4% This Past Week, Investors May Now Be Noticing the Company's One-year Earnings Growth

As Hang Xiao Steel StructureLtd (SHSE:600477) Increases 6.4% This Past Week, Investors May Now Be Noticing the Company's One-year Earnings Growth

The simplest way to benefit from a rising market is to buy an index fund. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. For example, the Hang Xiao Steel Structure Co.,Ltd (SHSE:600477) share price is down 36% in the last year. That's well below the market decline of 13%. However, the longer term returns haven't been so bad, with the stock down 22% in the last three years. But it's up 6.4% in the last week.

从市场上涨中获益的最简单方法是购买指数基金。活跃的投资者的目标是购买表现大大优于市场的股票,但在此过程中,他们面临表现不佳的风险。例如,杭萧钢结构有限公司, Ltd(上海证券交易所股票代码:600477)的股价在去年下跌了36%。这远低于13%的市场跌幅。但是,长期回报并没有那么糟糕,该股在过去三年中下跌了22%。但上周上涨了6.4%。

While the last year has been tough for Hang Xiao Steel StructureLtd shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

尽管去年对杭萧钢铁结构有限公司的股东来说是艰难的一年,但过去一周显示出希望的迹象。因此,让我们来看看长期基本面,看看它们是否是负回报的驱动力。

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

引用巴菲特的话说:“船只将在世界各地航行,但Flat Earth Society将蓬勃发展。市场上的价格和价值之间将继续存在巨大差异...”研究市场情绪如何随着时间的推移而变化的一种方法是研究公司股价与其每股收益(EPS)之间的相互作用。

During the unfortunate twelve months during which the Hang Xiao Steel StructureLtd share price fell, it actually saw its earnings per share (EPS) improve by 0.8%. It's quite possible that growth expectations may have been unreasonable in the past.

在杭萧钢铁结构有限公司股价下跌的不幸十二个月中,其每股收益(EPS)实际上增长了0.8%。过去的增长预期很可能不合理。

By glancing at these numbers, we'd posit that the the market had expectations of much higher growth, last year. But looking to other metrics might better explain the share price change.

通过浏览这些数字,我们可以假设去年市场对更高的增长抱有预期。但是,看看其他指标可能会更好地解释股价的变化。

With a low yield of 1.8% we doubt that the dividend influences the share price much. Hang Xiao Steel StructureLtd's revenue is actually up 8.9% over the last year. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

由于收益率为1.8%,我们怀疑股息是否会对股价产生很大影响。杭萧钢结构有限公司的收入实际上比去年增长了8.9%。由于我们无法根据这些指标轻松解释股价走势,因此可能值得考虑市场对该股的情绪发生了怎样的变化。

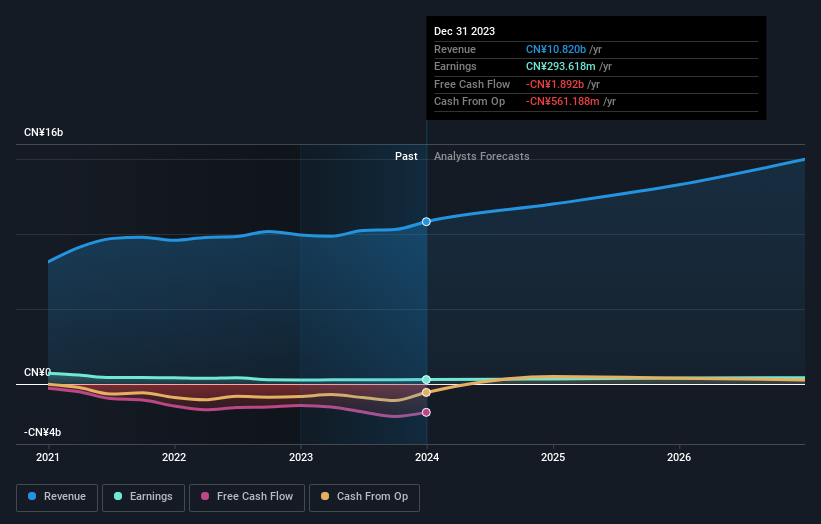

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

您可以在下图中看到收入和收入随时间推移而发生的变化(点击图表查看确切值)。

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

您可以在这张免费的交互式图片中看到其资产负债表如何随着时间的推移而增强(或减弱)。

A Different Perspective

不同的视角

While the broader market lost about 13% in the twelve months, Hang Xiao Steel StructureLtd shareholders did even worse, losing 36% (even including dividends). Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 2% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Hang Xiao Steel StructureLtd is showing 3 warning signs in our investment analysis , and 2 of those don't sit too well with us...

尽管整个市场在十二个月中下跌了约13%,但杭萧钢铁结构有限公司股东的表现甚至更糟,损失了36%(甚至包括股息)。话虽如此,在下跌的市场中,一些股票不可避免地会被超卖。关键是要密切关注基本发展。遗憾的是,去年的业绩结束了糟糕的表现,股东在五年内每年面临2%的总亏损。总的来说,长期股价疲软可能是一个坏兆头,尽管逆势投资者可能希望研究该股以期出现转机。尽管市场状况可能对股价产生的不同影响值得考虑,但还有其他因素更为重要。即便如此,请注意,杭萧钢结构有限公司在我们的投资分析中显示了3个警告信号,其中2个对我们来说并不太合适...

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

对于那些喜欢寻找中奖投资的人来说,这份最近有内幕收购的成长型公司的免费名单可能只是门票。

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

请注意,本文引用的市场回报反映了目前在中国交易所交易的股票的市场加权平均回报。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧?直接联系我们。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St的这篇文章本质上是笼统的。我们仅使用公正的方法根据历史数据和分析师的预测提供评论,我们的文章无意作为财务建议。它不构成买入或卖出任何股票的建议,也没有考虑到您的目标或财务状况。我们的目标是为您提供由基本数据驱动的长期重点分析。请注意,我们的分析可能不考虑最新的价格敏感型公司公告或定性材料。简而言之,华尔街没有持有任何上述股票的头寸。