Investigating Mastercard's Standing In Financial Services Industry Compared To Competitors

Investigating Mastercard's Standing In Financial Services Industry Compared To Competitors

In today's rapidly evolving and fiercely competitive business landscape, it is crucial for investors and industry analysts to conduct comprehensive company evaluations. In this article, we will undertake an in-depth industry comparison, assessing Mastercard (NYSE:MA) alongside its primary competitors in the Financial Services industry. By meticulously examining crucial financial indicators, market positioning, and growth potential, we aim to provide valuable insights to investors and shed light on company's performance within the industry.

在当今瞬息万变且竞争激烈的商业格局中,投资者和行业分析师进行全面的公司评估至关重要。在本文中,我们将进行深入的行业比较,评估 万事达卡(纽约证券交易所代码:MA) 以及其在金融服务行业的主要竞争对手。通过仔细研究关键财务指标、市场定位和增长潜力,我们的目标是为投资者提供宝贵的见解,并阐明公司在行业内的表现。

Mastercard Background

万事达背景

Mastercard is the second-largest payment processor in the world, having processed close to over $9 trillion in volume during 2023. Mastercard operates in over 200 countries and processes transactions in over 150 currencies.

万事达卡是全球第二大支付处理商,2023年处理的交易量超过9万亿美元。万事达卡在 200 多个国家开展业务,处理超过 150 种货币的交易。

| Company | P/E | P/B | P/S | ROE | EBITDA (in billions) | Gross Profit (in billions) | Revenue Growth |

|---|---|---|---|---|---|---|---|

| Mastercard Inc | 39.09 | 62.26 | 17.43 | 42.16% | $3.67 | $5.02 | 12.57% |

| Visa Inc | 30.71 | 14.22 | 16.54 | 11.86% | $5.84 | $6.98 | 9.89% |

| Fiserv Inc | 29.25 | 3.17 | 4.87 | 2.51% | $1.96 | $2.88 | 7.39% |

| PayPal Holdings Inc | 17.18 | 3.30 | 2.45 | 6.87% | $2.14 | $3.67 | 8.71% |

| Block Inc | 3724 | 2.45 | 2.09 | 0.98% | $0.15 | $2.03 | 24.13% |

| Fidelity National Information Services Inc | 81.88 | 2.10 | 4.19 | 1.3% | $0.66 | $0.97 | -0.59% |

| Global Payments Inc | 33.04 | 1.38 | 3.38 | 1.59% | $0.99 | $1.51 | 8.03% |

| Corpay Inc | 23.02 | 6.65 | 6.01 | 8.07% | $0.51 | $0.74 | 6.08% |

| Jack Henry & Associates Inc | 32.27 | 6.97 | 5.57 | 5.43% | $0.17 | $0.22 | 7.99% |

| WEX Inc | 35.22 | 5.10 | 3.60 | 3.66% | $0.23 | $0.39 | 6.65% |

| StoneCo Ltd | 17.76 | 1.78 | 2.36 | 4.53% | $1.13 | $2.3 | 20.35% |

| Euronet Worldwide Inc | 18.88 | 3.81 | 1.45 | 5.79% | $0.15 | $0.36 | 10.63% |

| The Western Union Co | 7.97 | 11.45 | 1.12 | 32.55% | $0.24 | $0.41 | 1.18% |

| PagSeguro Digital Ltd | 12.79 | 1.63 | 2.34 | 3.74% | $1.79 | $0.2 | 7.56% |

| DLocal Ltd | 29.31 | 9.11 | 6.69 | 6.44% | $-0.02 | $0.07 | 58.75% |

| Shift4 Payments Inc | 41.31 | 5.64 | 1.40 | 2.6% | $0.09 | $0.2 | 31.19% |

| Paymentus Holdings Inc | 115.44 | 6 | 4.23 | 2.22% | $0.02 | $0.05 | 24.68% |

| Evertec Inc | 31.76 | 4.17 | 3.64 | 2.04% | $0.06 | $0.1 | 20.29% |

| Payoneer Global Inc | 20.88 | 2.81 | 2.37 | 4.15% | $0.03 | $0.19 | 22.21% |

| Average | 239.04 | 5.1 | 4.13 | 5.91% | $0.9 | $1.29 | 15.28% |

| 公司 | P/E | P/B | 市销率 | 罗伊 | 息税折旧摊销前利润(单位:十亿) | 毛利(单位:十亿) | 收入增长 |

|---|---|---|---|---|---|---|---|

| 万事达卡公司 | 39.09 | 62.26 | 17.43 | 42.16% | 3.67 | 5.02 美元 | 12.57% |

| Visa Inc | 30.71 | 14.22 | 16.54 | 11.86% | 5.84 美元 | 6.98 美元 | 9.89% |

| Fiserv Inc. | 29.25 | 3.17 | 4.87 | 2.51% | 1.96 美元 | 2.88 美元 | 7.39% |

| 贝宝控股公司 | 17.18 | 3.30 | 2.45 | 6.87% | 2.14 美元 | 3.67 | 8.71% |

| Block Inc | 3724 | 2.45 | 2.09 | 0.98% | 0.15 美元 | 2.03 美元 | 24.13% |

| 富达国家信息服务公司 | 81.88 | 2.10 | 4.19 | 1.3% | 0.66 美元 | 0.97 美元 | -0.59% |

| 全球支付公司 | 33.04 | 1.38 | 3.38 | 1.59% | 0.99 美元 | 1.51 | 8.03% |

| Corpay Inc | 23.02 | 6.65 | 6.01 | 8.07% | 0.51 美元 | 0.74 美元 | 6.08% |

| 杰克·亨利律师事务所 | 32.27 | 6.97 | 5.57 | 5.43% | 0.17 美元 | 0.22 美元 | 7.99% |

| WEX Inc | 35.22 | 5.10 | 3.60 | 3.66% | 0.23 美元 | 0.39 美元 | 6.65% |

| Stoneco Ltd | 17.76 | 1.78 | 2.36 | 4.53% | 1.13 | 2.3 美元 | 20.35% |

| Euronet 全球公司 | 18.88 | 3.81 | 1.45 | 5.79% | 0.15 美元 | 0.36 美元 | 10.63% |

| 西联汇款公司 | 7.97 | 11.45 | 1.12 | 32.55% | 0.24 美元 | 0.41 美元 | 1.18% |

| PagSeguro 数字有限公司 | 12.79 | 1.63 | 2.34 | 3.74% | 1.79 美元 | 0.2 美元 | 7.56% |

| dLocal 有限公司 | 29.31 | 9.11 | 6.69 | 6.44% | -0.02 美元 | 0.07 美元 | 58.75% |

| Shift4 Payments | 41.31 | 5.64 | 1.40 | 2.6% | 0.09 | 0.2 美元 | 31.19% |

| Paymentus 控股公司 | 115.44 | 6 | 4.23 | 2.22% | 0.02 | 0.05 美元 | 24.68% |

| 埃弗泰克公司 | 31.76 | 4.17 | 3.64 | 2.04% | 0.06 美元 | 0.1 美元 | 20.29% |

| Payoneer Global Inc | 20.88 | 2.81 | 2.37 | 4.15% | 0.03 美元 | 0.19 美元 | 22.21% |

| 平均值 | 239.04 | 5.1 | 4.13 | 5.91% | 0.9 美元 | 1.29 美元 | 15.28% |

By thoroughly analyzing Mastercard, we can discern the following trends:

通过深入分析万事达卡,我们可以辨别出以下趋势:

The Price to Earnings ratio of 39.09 is 0.16x lower than the industry average, indicating potential undervaluation for the stock.

The elevated Price to Book ratio of 62.26 relative to the industry average by 12.21x suggests company might be overvalued based on its book value.

The Price to Sales ratio of 17.43, which is 4.22x the industry average, suggests the stock could potentially be overvalued in relation to its sales performance compared to its peers.

The Return on Equity (ROE) of 42.16% is 36.25% above the industry average, highlighting efficient use of equity to generate profits.

The company has higher Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) of $3.67 Billion, which is 4.08x above the industry average, indicating stronger profitability and robust cash flow generation.

With higher gross profit of $5.02 Billion, which indicates 3.89x above the industry average, the company demonstrates stronger profitability and higher earnings from its core operations.

The company is witnessing a substantial decline in revenue growth, with a rate of 12.57% compared to the industry average of 15.28%, which indicates a challenging sales environment.

的市盈率 39.09 是 0.16 倍 低于行业平均水平,表明该股的估值可能被低估。

价格与账面比率的上升 62.26 相对于行业平均水平 12.21x 表明根据账面价值,公司的估值可能被高估了。

的价格与销售的比率 17.43,这是 4.22x 行业平均水平表明,与同行相比,该股的销售表现可能被高估了。

的股本回报率 (ROE) 42.16% 是 36.25% 高于行业平均水平,突显了有效利用股权来创造利润。

该公司的扣除利息、税项、折旧和摊销前的收益 (EBITDA) 较高 3.67 亿美元,这是 4.08 倍 高于行业平均水平,表明盈利能力更强,现金流产生强劲。

毛利更高 5.02 亿美元,这表明 3.89 倍 高于行业平均水平,该公司表现出更强的盈利能力和更高的核心业务收益。

该公司的收入增长大幅下降,增长率为 12.57% 与行业平均水平相比 15.28%,这表明销售环境充满挑战。

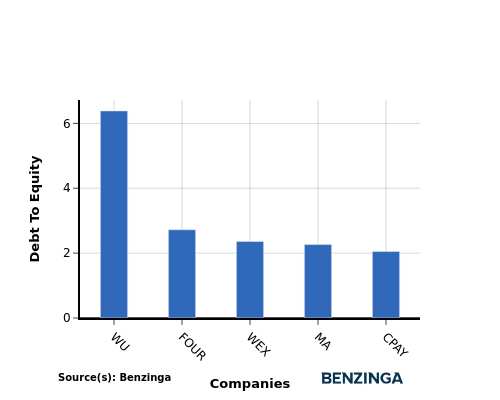

Debt To Equity Ratio

负债权益比率

The debt-to-equity (D/E) ratio assesses the extent to which a company relies on borrowed funds compared to its equity.

债务与权益(D/E)比率评估了公司对借入资金的依赖程度与其权益相比的程度。

Considering the debt-to-equity ratio in industry comparisons allows for a concise evaluation of a company's financial health and risk profile, aiding in informed decision-making.

在行业比较中考虑债务与权益比率可以对公司的财务状况和风险状况进行简明的评估,从而有助于做出明智的决策。

By evaluating Mastercard against its top 4 peers in terms of the Debt-to-Equity ratio, the following observations arise:

通过评估万事达卡在债务与权益比率方面与排名前四的同行,得出以下观察结果:

Mastercard is positioned in the middle in terms of the debt-to-equity ratio compared to its top 4 peers.

This suggests a balanced financial structure, where the company maintains a moderate level of debt while also relying on equity financing with a debt-to-equity ratio of 2.26.

与前四名同行相比,万事达卡在债务与权益比率方面处于中间位置。

这表明财务结构平衡,公司保持适度的债务水平,同时也依赖股权融资,债务与权益比率为 2.26。

Key Takeaways

关键要点

For Mastercard, the PE ratio is low compared to peers, indicating potential undervaluation. The high PB and PS ratios suggest strong market sentiment and revenue multiples. Mastercard's high ROE, EBITDA, and gross profit reflect efficient operations and profitability. However, the low revenue growth may indicate a need for strategic initiatives to drive future performance in the Financial Services industry.

对于万事达卡而言,与同行相比,市盈率较低,这表明估值可能被低估。较高的市盈率和市盈率表明强劲的市场情绪和收入倍数。万事达卡的高投资回报率、息税折旧摊销前利润和毛利润反映了高效的运营和盈利能力。但是,低收入增长可能表明需要采取战略举措来推动金融服务行业的未来表现。

This article was generated by Benzinga's automated content engine and reviewed by an editor.

本文由Benzinga的自动内容引擎生成,并由编辑审阅。