Results: Columbia Sportswear Company Exceeded Expectations And The Consensus Has Updated Its Estimates

Results: Columbia Sportswear Company Exceeded Expectations And The Consensus Has Updated Its Estimates

Columbia Sportswear Company (NASDAQ:COLM) investors will be delighted, with the company turning in some strong numbers with its latest results. It was overall a positive result, with revenues beating expectations by 3.6% to hit US$770m. Columbia Sportswear also reported a statutory profit of US$0.71, which was an impressive 111% above what the analysts had forecast. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. We thought readers would find it interesting to see the analysts latest (statutory) post-earnings forecasts for next year.

哥伦比亚运动服公司(纳斯达克股票代码:COLM)的投资者将感到高兴,该公司的最新业绩带来了一些强劲的数字。总体而言,这是一个积极的结果,收入比预期高出3.6%,达到7.7亿美元。哥伦比亚运动服还公布了0.71美元的法定利润,比分析师的预测高出111%,令人印象深刻。对于投资者来说,盈利是一个重要时刻,因为他们可以追踪公司的业绩,查看分析师对明年的预测,看看对公司的情绪是否发生了变化。我们认为,读者会发现分析师对明年最新(法定)财报后的预测很有趣。

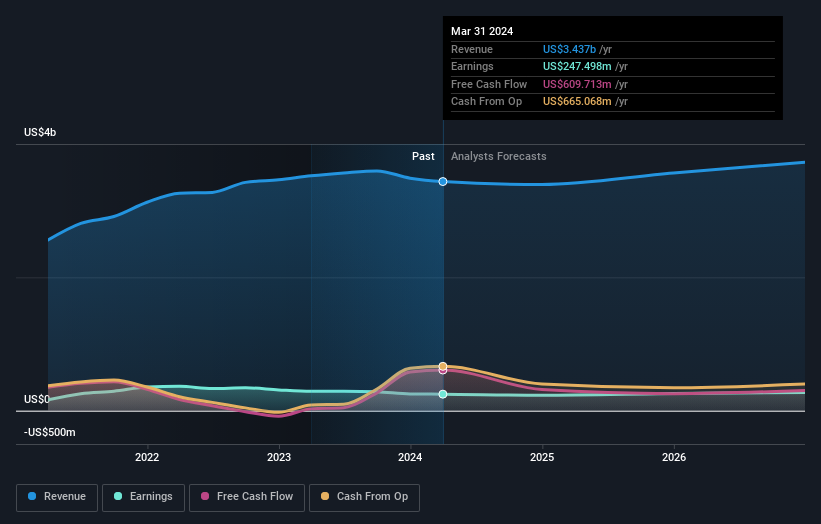

Following last week's earnings report, Columbia Sportswear's eleven analysts are forecasting 2024 revenues to be US$3.39b, approximately in line with the last 12 months. Statutory earnings per share are forecast to dip 7.6% to US$3.85 in the same period. Before this earnings report, the analysts had been forecasting revenues of US$3.39b and earnings per share (EPS) of US$3.70 in 2024. The analysts seems to have become more bullish on the business, judging by their new earnings per share estimates.

继上周的财报之后,哥伦比亚运动服的11位分析师预测2024年的收入为33.9亿美元,与过去12个月大致持平。预计同期法定每股收益将下降7.6%,至3.85美元。在本财报发布之前,分析师一直预测2024年的收入为33.9亿美元,每股收益(EPS)为3.70美元。从他们新的每股收益估计来看,分析师似乎对该业务更加看好。

The analysts have been lifting their price targets on the back of the earnings upgrade, with the consensus price target rising 5.3% to US$77.30. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. Currently, the most bullish analyst values Columbia Sportswear at US$96.00 per share, while the most bearish prices it at US$60.00. These price targets show that analysts do have some differing views on the business, but the estimates do not vary enough to suggest to us that some are betting on wild success or utter failure.

在收益上调的背景下,分析师一直在提高目标股价,共识目标股价上涨5.3%,至77.30美元。但是,固定单一价格目标可能是不明智的,因为共识目标实际上是分析师目标股价的平均值。因此,一些投资者喜欢查看估计范围,看看对公司的估值是否有任何分歧。目前,最看涨的分析师对哥伦比亚运动服的估值为每股96.00美元,而最看跌的分析师估值为每股60.00美元。这些目标股价表明,分析师对该业务的看法确实有所不同,但这些估计的差异不足以向我们表明,有些人押注取得巨大成功或彻底失败。

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. We would highlight that revenue is expected to reverse, with a forecast 1.7% annualised decline to the end of 2024. That is a notable change from historical growth of 5.7% over the last five years. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 6.0% per year. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Columbia Sportswear is expected to lag the wider industry.

现在从大局来看,我们理解这些预测的方法之一是看看它们与过去的表现和行业增长估计相比如何。我们要强调的是,收入预计将逆转,预计到2024年底年化下降1.7%。与过去五年5.7%的历史增长相比,这是一个显著的变化。相比之下,我们的数据表明,总体而言,同一行业的其他公司的收入预计每年将增长6.0%。因此,尽管预计其收入将萎缩,但这种阴云并没有带来一线希望——预计哥伦比亚运动服将落后于整个行业。

The Bottom Line

底线

The biggest takeaway for us is the consensus earnings per share upgrade, which suggests a clear improvement in sentiment around Columbia Sportswear's earnings potential next year. Fortunately, the analysts also reconfirmed their revenue estimates, suggesting that it's tracking in line with expectations. Although our data does suggest that Columbia Sportswear's revenue is expected to perform worse than the wider industry. There was also a nice increase in the price target, with the analysts clearly feeling that the intrinsic value of the business is improving.

对我们来说,最大的收获是共识的每股收益上调,这表明人们对哥伦比亚运动服明年盈利潜力的看法明显改善。幸运的是,分析师还重申了他们的收入预期,表明收入符合预期。尽管我们的数据确实表明,哥伦比亚运动服的收入预计将比整个行业差。目标股价也大幅提高,分析师显然认为该业务的内在价值正在提高。

With that in mind, we wouldn't be too quick to come to a conclusion on Columbia Sportswear. Long-term earnings power is much more important than next year's profits. We have forecasts for Columbia Sportswear going out to 2026, and you can see them free on our platform here.

考虑到这一点,我们不会很快就哥伦比亚运动服得出结论。长期盈利能力比明年的利润重要得多。我们对Columbia Sportswear的预测将持续到2026年,你可以在我们的平台上免费查看。

You can also see our analysis of Columbia Sportswear's Board and CEO remuneration and experience, and whether company insiders have been buying stock.

您还可以看到我们对哥伦比亚运动服董事会和首席执行官薪酬和经验的分析,以及公司内部人士是否一直在购买股票。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧?直接联系我们。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St的这篇文章本质上是笼统的。我们仅使用公正的方法根据历史数据和分析师的预测提供评论,我们的文章无意作为财务建议。它不构成买入或卖出任何股票的建议,也没有考虑到您的目标或财务状况。我们的目标是为您提供由基本数据驱动的长期重点分析。请注意,我们的分析可能不考虑最新的价格敏感型公司公告或定性材料。简而言之,华尔街没有持有任何上述股票的头寸。