Options Corner: McDonald's Sees Whales Place Bullish Bets

Options Corner: McDonald's Sees Whales Place Bullish Bets

Whales with a lot of money to spend have taken a noticeably bullish stance on McDonald's.

有很多钱可以花的鲸鱼对麦当劳采取了明显的看涨立场。

Looking at options history for $McDonald's (MCD.US)$ we detected 10 trades.

查看期权历史记录 $麦当劳 (MCD.US)$ 我们检测到了 10 笔交易。

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 30% with bearish.

如果我们考虑每笔交易的具体情况,可以准确地说,50%的投资者以看涨的预期开启交易,30%的投资者持看跌预期。

From the overall spotted trades, 2 are puts, for a total amount of $111,612 and 8, calls, for a total amount of $344,592.

在已发现的全部交易中,有2笔是看跌期权,总额为111,612美元,8笔是看涨期权,总额为344,592美元。

What's The Price Target?

目标价格是多少?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $140.0 and $370.0 for McDonald's, spanning the last three months.

在评估了交易量和未平仓合约之后,很明显,主要市场走势者将注意力集中在麦当劳过去三个月的价格区间上,价格区间介于140.0美元至370.0美元之间。

Insights into Volume & Open Interest

对交易量和未平仓合约的见解

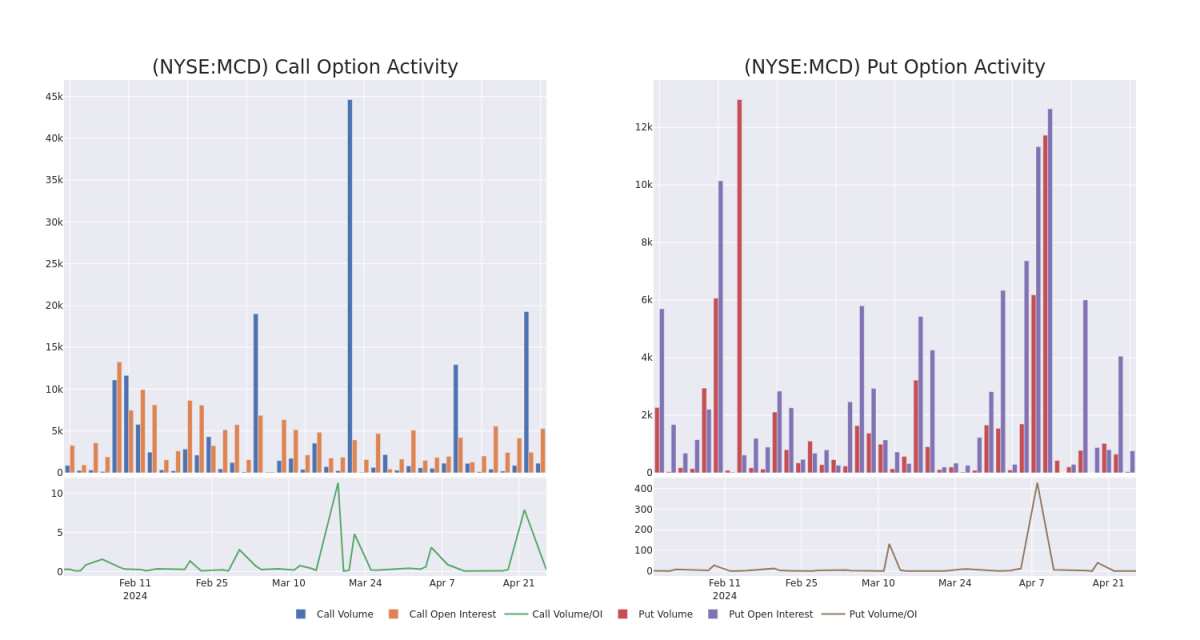

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for McDonald's's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of McDonald's's whale trades within a strike price range from $140.0 to $370.0 in the last 30 days.

交易期权时,查看交易量和未平仓合约是一个强有力的举动。这些数据可以帮助您跟踪麦当劳期权在给定行使价下的流动性和利息。下面,我们可以观察到过去30天内麦当劳所有鲸鱼交易的看涨和看跌期权交易量和未平仓合约的变化,其行使价在140.0美元至370.0美元之间。

McDonald's 30-Day Option Volume & Interest Snapshot

麦当劳的30天期权交易量和利息快照

Biggest Options Spotted:

发现的最大选择:

Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

MCD |

CALL |

SWEEP |

BULLISH |

05/17/24 |

$1.6 |

$1.5 |

$1.6 |

$285.00 |

$76.3K |

1.9K |

543 |

MCD |

PUT |

TRADE |

NEUTRAL |

06/20/25 |

$18.6 |

$17.75 |

$18.25 |

$275.00 |

$73.0K |

101 |

0 |

MCD |

CALL |

SWEEP |

BEARISH |

01/16/26 |

$138.5 |

$134.3 |

$136.0 |

$140.00 |

$68.0K |

8 |

0 |

MCD |

CALL |

SWEEP |

BULLISH |

05/17/24 |

$9.15 |

$9.15 |

$9.15 |

$270.00 |

$41.1K |

1.4K |

51 |

MCD |

PUT |

SWEEP |

BEARISH |

05/17/24 |

$2.96 |

$2.75 |

$2.75 |

$270.00 |

$38.6K |

663 |

39 |

符号 |

看跌/看涨 |

交易类型 |

情绪 |

Exp。日期 |

问 |

出价 |

价格 |

行使价 |

总交易价格 |

未平仓合约 |

音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

MCD |

打电话 |

扫 |

看涨 |

05/17/24 |

1.6 美元 |

1.5 美元 |

1.6 美元 |

285.00 美元 |

76.3 万美元 |

1.9K |

543 |

MCD |

放 |

贸易 |

中立 |

06/20/25 |

18.6 美元 |

17.75 美元 |

18.25 美元 |

275.00 美元 |

73.0 万美元 |

101 |

0 |

MCD |

打电话 |

扫 |

粗鲁的 |

01/16/26 |

138.5 美元 |

134.3 美元 |

136.0 美元 |

140.00 美元 |

68.0 万美元 |

8 |

0 |

MCD |

打电话 |

扫 |

看涨 |

05/17/24 |

9.15 美元 |

9.15 美元 |

9.15 美元 |

270.00 美元 |

41.1 万美元 |

1.4K |

51 |

MCD |

放 |

扫 |

粗鲁的 |

05/17/24 |

2.96 美元 |

2.75 美元 |

2.75 美元 |

270.00 美元 |

38.6 万美元 |

663 |

39 |

About McDonald's

关于麦当劳

McDonald's is the largest restaurant owner-operator in the world, with 2023 system sales of $130 billion across nearly than 42,000 stores and 115 markets. McDonald's pioneered the franchise model, building its footprint through partnerships with independent restaurant franchisees and master franchise partners around the globe. The firm earns roughly 60% of its revenue from franchise royalty fees and lease payments, with most of the remainder coming from company-operated stores across its three core segments: the United States, internationally operated markets, and international developmental/licensed markets.

麦当劳是全球最大的餐厅老板兼运营商,2023年在近42,000家门店和115个市场的系统销售额为1300亿美元。麦当劳开创了特许经营模式,通过与全球各地的独立餐厅加盟商和主要特许经营合作伙伴建立合作伙伴关系,建立了自己的足迹。该公司收入的约60%来自特许经营权使用费和租赁付款,其余大部分来自公司在其三个核心细分市场中运营的门店:美国、国际运营的市场和国际开发/许可市场。

In light of the recent options history for McDonald's, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鉴于麦当劳最近的期权历史,现在应该将重点放在公司本身上。我们的目标是探索其目前的表现。

Where Is McDonald's Standing Right Now?

麦当劳现在在哪里?

Trading volume stands at 2,520,286, with MCD's price down by -1.76%, positioned at $270.75.

RSI indicators show the stock to be is currently neutral between overbought and oversold.

Earnings announcement expected in 4 days.

交易量为2520,286美元,其中MCD的价格下跌了-1.76%,为270.75美元。

RSI指标显示,该股目前在超买和超卖之间处于中立状态。

预计将在4天内公布财报。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest McDonald's options trades with real-time alerts from Benzinga Pro.

期权交易具有更高的风险和潜在的回报。精明的交易者通过不断自我教育、调整策略、监控多个指标以及密切关注市场走势来管理这些风险。借助Benzinga Pro的实时提醒,随时了解麦当劳最新的期权交易。