This Is What Whales Are Betting On PENN Entertainment

This Is What Whales Are Betting On PENN Entertainment

Investors with a lot of money to spend have taken a bearish stance on PENN Entertainment (NASDAQ:PENN).

有大量资金可以花的投资者对宾夕法尼亚娱乐公司(纳斯达克股票代码:PENN)采取了看跌立场。

And retail traders should know.

零售交易者应该知道。

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

今天,当交易出现在我们在本辛加追踪的公开期权历史记录上时,我们注意到了这一点。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with PENN, it often means somebody knows something is about to happen.

无论这些是机构还是仅仅是富人,我们都不知道。但是,当宾夕法尼亚大学发生这么大的事情时,通常意味着有人知道某件事即将发生。

So how do we know what these investors just did?

那么我们怎么知道这些投资者刚才做了什么?

Today, Benzinga's options scanner spotted 11 uncommon options trades for PENN Entertainment.

今天,本辛加的期权扫描仪发现了宾夕法尼亚娱乐公司11笔不常见的期权交易。

This isn't normal.

这不正常。

The overall sentiment of these big-money traders is split between 27% bullish and 63%, bearish.

这些大资金交易者的整体情绪在27%的看涨和63%的看跌之间。

Out of all of the special options we uncovered, 3 are puts, for a total amount of $129,200, and 8 are calls, for a total amount of $637,858.

在我们发现的所有特殊期权中,有3个是看跌期权,总额为129,200美元,8个是看涨期权,总额为637,858美元。

Expected Price Movements

预期的价格走势

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $10.0 to $37.5 for PENN Entertainment during the past quarter.

通过分析这些合约的交易量和未平仓合约,大型企业似乎一直在关注PENN Entertainment在上个季度的价格范围从10.0美元到37.5美元不等。

Volume & Open Interest Development

交易量和未平仓合约的发展

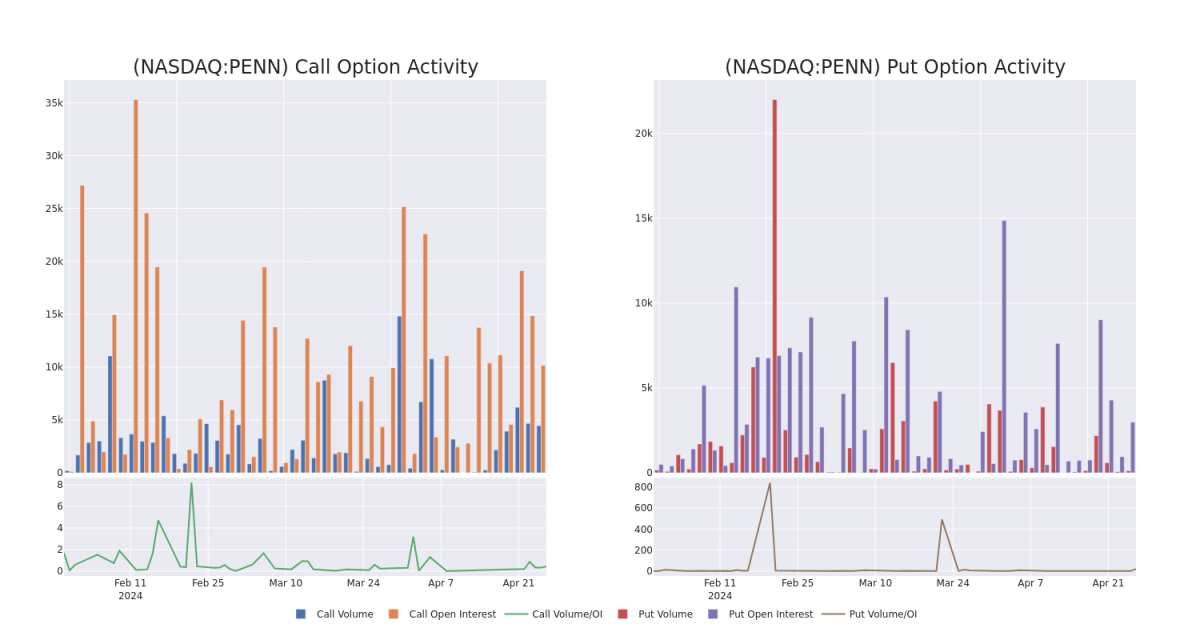

In today's trading context, the average open interest for options of PENN Entertainment stands at 1640.5, with a total volume reaching 4,577.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in PENN Entertainment, situated within the strike price corridor from $10.0 to $37.5, throughout the last 30 days.

在当今的交易背景下,宾夕法尼亚娱乐公司期权的平均未平仓合约为1640.5,总交易量达到4,577.00。随附的图表描绘了过去30天PENN Entertainment高价值交易的看涨和看跌期权交易量以及未平仓合约的变化情况,行使价走势从10.0美元到37.5美元不等。

PENN Entertainment 30-Day Option Volume & Interest Snapshot

宾夕法尼亚娱乐公司30天期权交易量和利息快照

Biggest Options Spotted:

发现的最大选择:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PENN | CALL | SWEEP | BULLISH | 01/17/25 | $2.68 | $2.57 | $2.68 | $20.00 | $285.6K | 4.5K | 2.0K |

| PENN | CALL | SWEEP | NEUTRAL | 01/17/25 | $2.64 | $2.36 | $2.5 | $20.00 | $125.0K | 4.5K | 8 |

| PENN | PUT | TRADE | BEARISH | 04/26/24 | $0.45 | $0.24 | $0.39 | $17.50 | $63.3K | 1.9K | 0 |

| PENN | CALL | SWEEP | BEARISH | 05/31/24 | $1.88 | $1.87 | $1.86 | $16.00 | $47.2K | 246 | 376 |

| PENN | CALL | SWEEP | BULLISH | 01/16/26 | $9.3 | $9.15 | $9.3 | $10.00 | $44.6K | 103 | 72 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 佩恩 | 打电话 | 扫 | 看涨 | 01/17/25 | 2.68 美元 | 2.57 美元 | 2.68 美元 | 20.00 美元 | 285.6 万美元 | 4.5K | 2.0K |

| 佩恩 | 打电话 | 扫 | 中立 | 01/17/25 | 2.64 美元 | 2.36 美元 | 2.5 美元 | 20.00 美元 | 125.0K | 4.5K | 8 |

| 佩恩 | 放 | 贸易 | 粗鲁的 | 04/26/24 | 0.45 美元 | 0.24 美元 | 0.39 美元 | 17.50 美元 | 63.3 万美元 | 1.9K | 0 |

| 佩恩 | 打电话 | 扫 | 粗鲁的 | 05/31/24 | 1.88 美元 | 1.87 美元 | 1.86 美元 | 16.00 美元 | 47.2 万美元 | 246 | 376 |

| 佩恩 | 打电话 | 扫 | 看涨 | 01/16/26 | 9.3 美元 | 9.15 美元 | 9.3 美元 | 10.00 美元 | 44.6 万美元 | 103 | 72 |

About PENN Entertainment

关于宾夕法尼亚娱乐

Penn Entertainment's origins date back to its 1972 racetrack opening in Pennsylvania. Today, Penn operates 43 properties across 20 states and 12 brands (such as Hollywood Casino and Ameristar), with land-based casinos representing 89% of total sales in 2023 (11% was from the interactive segment, which includes sports, iGaming, and media revenue). The retail portfolio generates mid-30% EBITDAR margins and helps position the company to obtain licenses for the digital wagering markets. Additionally, Penn's media assets, theScore and ESPN (starting with its partnership launch Nov. 14, 2023), provide access to sports betting/iGaming technology and clientele, helping it form a leading digital position.

宾夕法尼亚娱乐公司的起源可以追溯到1972年在宾夕法尼亚州开设的赛马场。如今,宾夕法尼亚大学在20个州经营43处房产和12个品牌(例如好莱坞赌场和Ameristar),其中陆地赌场占2023年总销售额的89%(11%来自互动领域,其中包括体育、iGaming和媒体收入)。零售投资组合的息税折旧摊销前利润率为-30%左右,有助于公司为获得数字博彩市场的许可证做好准备。此外,宾夕法尼亚大学的媒体资产theScore和ESPN(从2023年11月14日启动的合作伙伴关系开始)提供了获得体育博彩/电子博彩技术和客户的机会,帮助其形成了领先的数字地位。

Having examined the options trading patterns of PENN Entertainment, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了宾夕法尼亚娱乐公司的期权交易模式之后,我们的注意力现在直接转向了该公司。这种转变使我们能够深入研究其目前的市场地位和表现

Present Market Standing of PENN Entertainment

宾夕法尼亚娱乐公司目前的市场地位

- Trading volume stands at 2,502,884, with PENN's price down by -1.22%, positioned at $16.98.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 6 days.

- 交易量为2,502,884美元,宾夕法尼亚大学的价格下跌了-1.22%,为16.98美元。

- RSI指标显示,该股目前在超买和超卖之间处于中立状态。

- 预计将在6天后公布财报。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

与仅交易股票相比,期权是一种风险更高的资产,但它们具有更高的获利潜力。严肃的期权交易者通过每天自我教育、扩大交易规模、关注多个指标以及密切关注市场来管理这种风险。