United Airlines Holdings Unusual Options Activity For April 25

United Airlines Holdings Unusual Options Activity For April 25

Whales with a lot of money to spend have taken a noticeably bullish stance on $United Airlines (UAL.US)$.

有很多钱可以花的鲸鱼已经采取了明显的看涨立场 $联合大陆航空 (UAL.US)$。

Looking at options history for United Airlines Holdings we detected 11 trades.

查看联合航空控股公司的期权历史记录,我们发现了11笔交易。

If we consider the specifics of each trade, it is accurate to state that 72% of the investors opened trades with bullish expectations and 18% with bearish.

如果我们考虑每笔交易的具体情况,可以准确地说,72%的投资者以看涨的预期开启交易,18%的投资者持看跌预期。

From the overall spotted trades, 3 are puts, for a total amount of $126,282 and 8, calls, for a total amount of $518,400.

在已发现的全部交易中,有3笔是看跌期权,总额为126,282美元,8笔是看涨期权,总额为518,400美元。

Expected Price Movements

预期的价格走势

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $25.0 to $55.0 for United Airlines Holdings over the last 3 months.

考虑到这些合约的交易量和未平仓合约,在过去的3个月中,鲸鱼似乎一直将联合航空控股的价格定在25.0美元至55.0美元之间。

Volume & Open Interest Development

交易量和未平仓合约的发展

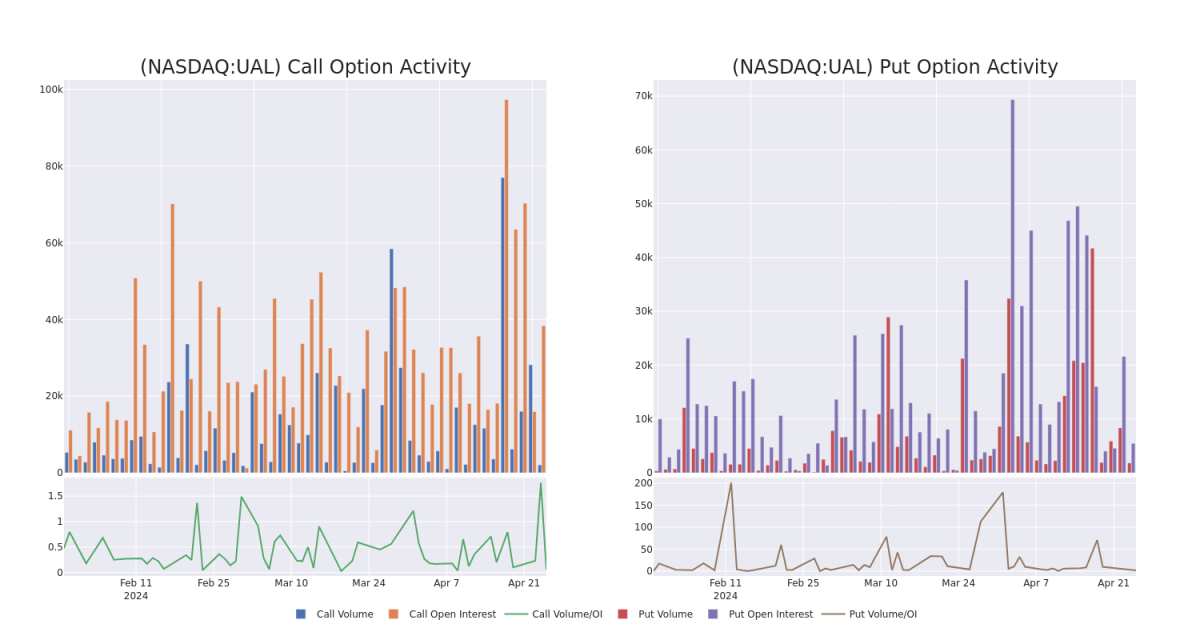

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in United Airlines Holdings's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to United Airlines Holdings's substantial trades, within a strike price spectrum from $25.0 to $55.0 over the preceding 30 days.

评估交易量和未平仓合约是期权交易的战略步骤。这些指标揭示了联合航空控股公司在指定行使价下期权的流动性和投资者对该期权的兴趣。即将发布的数据可视化了与联合航空控股公司大量交易相关的看涨期权和看跌期权交易量和未平仓合约的波动,行使价在前30天从25.0美元到55.0美元不等。

United Airlines Holdings 30-Day Option Volume & Interest Snapshot

联合航空控股30天期权交易量和利息快照

Noteworthy Options Activity:

值得注意的期权活动:

Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

UAL |

CALL |

SWEEP |

BULLISH |

08/16/24 |

$3.2 |

$3.15 |

$3.2 |

$55.00 |

$222.0K |

4.0K |

22 |

UAL |

CALL |

SWEEP |

BULLISH |

05/17/24 |

$18.65 |

$18.55 |

$18.65 |

$34.00 |

$82.0K |

30 |

4 |

UAL |

PUT |

SWEEP |

BULLISH |

05/17/24 |

$1.76 |

$1.75 |

$1.75 |

$53.00 |

$45.8K |

2.8K |

797 |

UAL |

CALL |

TRADE |

BULLISH |

06/21/24 |

$4.5 |

$4.1 |

$4.5 |

$50.00 |

$45.0K |

17.3K |

0 |

UAL |

CALL |

TRADE |

BULLISH |

09/20/24 |

$4.25 |

$4.25 |

$4.25 |

$55.00 |

$42.5K |

9.9K |

51 |

符号 |

看跌/看涨 |

交易类型 |

情绪 |

Exp。日期 |

问 |

出价 |

价格 |

行使价 |

总交易价格 |

未平仓合约 |

音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

UAL |

打电话 |

扫 |

看涨 |

08/16/24 |

3.2 美元 |

3.15 美元 |

3.2 美元 |

55.00 美元 |

222.0 万美元 |

4.0K |

22 |

UAL |

打电话 |

扫 |

看涨 |

05/17/24 |

18.65 美元 |

18.55 美元 |

18.65 美元 |

34.00 美元 |

82.0 万美元 |

30 |

4 |

UAL |

放 |

扫 |

看涨 |

05/17/24 |

1.76 美元 |

1.75 美元 |

1.75 美元 |

53.00 美元 |

45.8 万美元 |

2.8K |

797 |

UAL |

打电话 |

贸易 |

看涨 |

06/21/24 |

4.5 美元 |

4.1 美元 |

4.5 美元 |

50.00 美元 |

45.0 万美元 |

17.3K |

0 |

UAL |

打电话 |

贸易 |

看涨 |

09/20/24 |

4.25 美元 |

4.25 美元 |

4.25 美元 |

55.00 美元 |

42.5 万美元 |

9.9K |

51 |

About United Airlines Holdings

关于联合航空控股公司

United Airlines is a major us network carrier with hubs in San Francisco, Chicago, Houston, Denver, Los Angeles, New York/Newark, and Washington, D.C. United operates a hub-and-spoke system that is more focused on international and long-haul travel than its large U.S. peers.

联合航空是美国主要的网络运营商,在旧金山、芝加哥、休斯顿、丹佛、洛杉矶、纽约/纽瓦克和华盛顿特区设有枢纽。美联航运营的枢纽辐射系统比美国大型同行更侧重于国际和长途旅行。

Having examined the options trading patterns of United Airlines Holdings, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了联合航空控股公司的期权交易模式之后,我们的注意力现在直接转向了该公司。这种转变使我们能够深入研究其目前的市场地位和表现

Present Market Standing of United Airlines Holdings

联合航空控股公司目前的市场地位

Currently trading with a volume of 5,958,462, the UAL's price is up by 0.22%, now at $52.78.

RSI readings suggest the stock is currently may be approaching overbought.

Anticipated earnings release is in 83 days.

UAL目前的交易量为5,958,462美元,价格上涨了0.22%,目前为52.78美元。

RSI读数表明,该股目前可能接近超买。

预计财报将在83天后发布。

Professional Analyst Ratings for United Airlines Holdings

联合航空控股公司的专业分析师评级

5 market experts have recently issued ratings for this stock, with a consensus target price of $67.0.

5位市场专家最近发布了该股的评级,共识目标价为67.0美元。

Consistent in their evaluation, an analyst from Raymond James keeps a Outperform rating on United Airlines Holdings with a target price of $70.

An analyst from Susquehanna has decided to maintain their Positive rating on United Airlines Holdings, which currently sits at a price target of $55.

An analyst from Susquehanna has decided to maintain their Positive rating on United Airlines Holdings, which currently sits at a price target of $60.

An analyst from Morgan Stanley persists with their Overweight rating on United Airlines Holdings, maintaining a target price of $80.

Maintaining their stance, an analyst from B of A Securities continues to hold a Buy rating for United Airlines Holdings, targeting a price of $70.

雷蒙德·詹姆斯的一位分析师在评估中保持了对联合航空控股的跑赢大盘的评级,目标价为70美元。

萨斯奎哈纳的一位分析师决定维持对联合航空控股公司的正面评级,目前该公司的目标股价为55美元。

萨斯奎哈纳的一位分析师决定维持对联合航空控股公司的正面评级,目前该公司的目标股价为60美元。

摩根士丹利的一位分析师坚持对联合航空控股公司的增持评级,维持80美元的目标价格。

Bof A Securities的一位分析师维持其立场,继续对联合航空控股公司持有买入评级,目标价格为70美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest United Airlines Holdings options trades with real-time alerts from Benzinga Pro.

期权交易具有更高的风险和潜在的回报。精明的交易者通过不断自我教育、调整策略、监控多个指标以及密切关注市场走势来管理这些风险。借助Benzinga Pro的实时提醒,随时了解最新的联合航空控股期权交易。