Gold Glitters On Stagflation Tailwinds: Newmont Soars 13% In Biggest Gain Post-Covid, Leads Mining Sector Surge

Gold Glitters On Stagflation Tailwinds: Newmont Soars 13% In Biggest Gain Post-Covid, Leads Mining Sector Surge

Newmont Corp. (NYSE:NEM), the world's largest gold miner, saw its share price spike 13% on Thursday after the Denver-based company posted stronger-than-expected earnings.

全球最大的黄金矿商纽蒙特公司(纽约证券交易所代码:NEM)周四股价飙升了13%,此前这家总部位于丹佛的公司公布的收益强于预期。

This ignited a broad-based rally in the gold mining industry, despite the overall weak investor sentiment elsewhere.

尽管其他地方的投资者情绪总体疲软,但这引发了金矿开采业的广泛反弹。

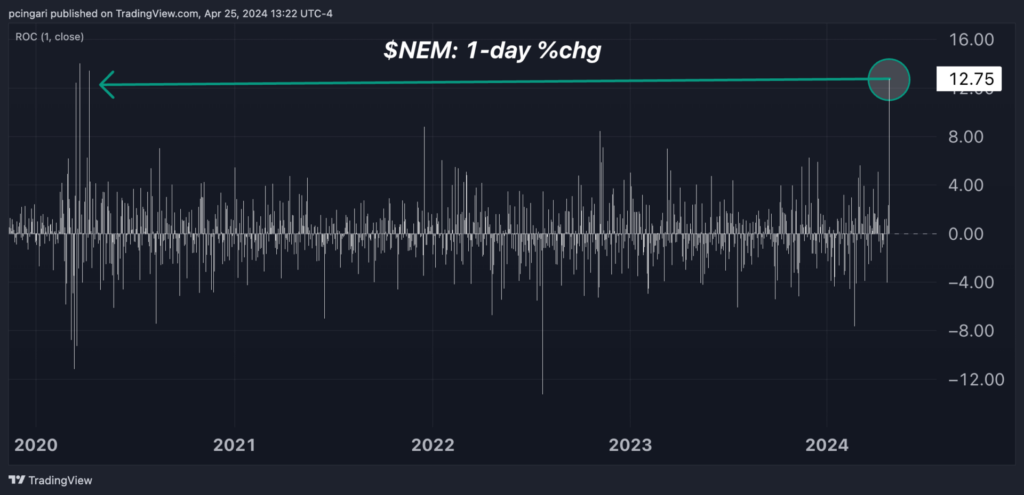

Newmont is currently on track to achieve its best-performing session since April 2020, when the mining giant rallied following a major volatility event due to the Covid-19 pandemic.

纽蒙特目前有望实现自2020年4月以来的最佳表现,当时这家矿业巨头在Covid-19疫情导致的重大波动事件后反弹。

Chart: Newmont Eyes Top-Performing Session Since April 2020

图表:纽蒙特预计自2020年4月以来表现最佳的交易日

Newmont Sharply Beats Estimates, Declares First Quarter Dividend

纽蒙特大幅超出预期,宣布第一季度派息

- Newmont reported earnings per share (EPS) of $0.55 in Q1 2024, marking a 38% increase from the corresponding quarter of the previous year and surpassing Street's consensus estimates of $0.36 by a significant 54%, according to Benzinga Pro platform.

- Revenue for the quarter amounted to $4.02 billion, indicating a 50% rise from Q1 2023 and surpassing forecasts of $3.66 billion by a noteworthy 10% margin.

- Newmont delivered $288 million in dividends to shareholders and declared a dividend of $0.25 per share of common stock for the first quarter of 2024.

- Newmont reported gold Costs Applicable to Sales (CAS) per ounce of $1,057 and gold All-In Sustaining Costs (AISC) per ounce of $1,439, both notably lower than the average realized gold price of $2,090 per ounce. This stark contrast indicates wide profit margins for the company.

- "Newmont delivered a strong first quarter operational performance, producing 2.2 million gold equivalent ounces and generating over $1.4 billion in cash from operations before working capital changes," Tom Palmer, Newmont's president and CEO, stated.

- 根据Benzinga Pro平台的数据,纽蒙特公布的2024年第一季度每股收益(EPS)为0.55美元,比去年同期增长38%,比华尔街普遍预期的0.36美元高出54%。

- 该季度的收入为40.2亿美元,比2023年第一季度增长了50%,超过了预期的36.6亿美元,增长了10%。

- 纽蒙特向股东派发了2.88亿美元的股息,并宣布在2024年第一季度派发每股普通股0.25美元的股息。

- 纽蒙特报告称,每盎司适用的黄金销售成本(CAS)为1,057美元,黄金全额维持成本(AISC)为每盎司1,439美元,均明显低于每盎司2,090美元的已实现黄金平均价格。这种鲜明的对比表明该公司的利润率很高。

- 纽蒙特总裁兼首席执行官汤姆·帕尔默表示:“纽蒙特在第一季度实现了强劲的运营业绩,生产了220万盎司黄金当量,在营运资金变动之前,运营产生了超过14亿美元的现金。”

Why Gold Miner Newmont Shares Are Surging Today

为什么黄金矿商纽蒙特股价今天飙升

Gold Miners Rally In Response To Newmont's Results

黄金矿商反弹回应纽蒙特的业绩

Newmont's remarkable Q1 earnings report catalyzed a significant rally in gold mining stocks, drawing investors to the industry in anticipation of potentially positive results from other players.

纽蒙特出色的第一季度收益报告催化了金矿业股票的大幅上涨,吸引了投资者进入该行业,因为他们期待其他参与者可能取得积极业绩。

Additionally, miners showed a positive response to the rise in gold prices, with the precious metal gaining 0.7% to $2,330 per ounce, buoyed by escalating stagflationary worries triggered by the latest gross domestic product report.

此外,矿商对金价上涨表现出积极的反应,贵金属价格上涨0.7%,至每盎司2330美元,这得益于最新的国内生产总值报告引发的滞胀担忧升级。

The VanEck Gold Miners ETF (NYSE:GDX) rose 3.1%, while junior gold miners, as tracked by the VanEck Junior Gold Miners ETF (NYSE:GDXJ) rose 1.8%.

VanEck Gold Miners ETF(纽约证券交易所代码:GDX)上涨3.1%,而VanEck Junior Gold Miners ETF(纽约证券交易所代码:GDXJ)追踪的初级黄金矿商上涨1.8%。

The top-performing North American gold miners on Thursday included:

周四表现最好的北美金矿商包括:

| Name | 1-Day % | Market Cap |

| Newmont Corporation | 13.06% | $ 50.54B |

| Buenaventura Mining Company Inc. (NYSE:BVN) | 6.75% | $ 4.30B |

| DRDGOLD Limited (NYSE:DRD) | 4.73% | $ 705.14м |

| AngloGold Ashanti plc (NYSE:AU) | 4.29% | $ 9.57B |

| Coeur Mining, Inc. (NYSE:CDE) | 3.52% | $ 1.88B |

| K92 Mining Inc. (NYSE:KNT) | 2.69% | $ 1.31B |

| OceanaGold Corporation (NYSE:OGC) | 2.31% | $ 1.61B |

| Calibre Mining Corp. (NYSE:CXB) | 2.19% | $ 1.07B |

| Royal Gold, Inc. (NYSE:RGLD) | 1.91% | $ 8.12B |

| Agnico Eagle Mines Limited (NYSE:AEM) | 1.90% | $ 32.36B |

| 姓名 | 1 天% | 市值 |

| 纽蒙特公司 | 13.06% | 50.54亿美元 |

| 布埃纳文图拉矿业公司(纽约证券交易所代码:BVN) | 6.75% | 4.30 亿美元 |

| DRDGOLD 有限公司(纽约证券交易所代码:DRD) | 4.73% | 705.14m 美元 |

| AngloGold Ashanti plc(纽约证券交易所代码:AU) | 4.29% | 9.57 亿美元 |

| Coeur Mining, Inc.(纽约证券交易所代码:CDE) | 3.52% | 1.88 亿美元 |

| K92 矿业公司(纽约证券交易所代码:KNT) | 2.69% | 1.31亿美元 |

| OceanaGold 公司(纽约证券交易所代码:OGC) | 2.31% | 1.61 亿美元 |

| Calibre 矿业公司(纽约证券交易所代码:CXB) | 2.19% | 1.07B 美元 |

| 皇家黄金公司(纽约证券交易所代码:RGLD) | 1.91% | 8.12亿美元 |

| Agnico Eagle Mines Limited(纽约证券交易所代码:AEM) | 1.90% | 32.36亿美元 |

Now Read: Equinox Gold Snaps Up Greenstone Gold Mines For $995M In 'Incredibly Rare' Deal

现在阅读: Equinox Gold以 “极其罕见” 的交易以9.95亿美元的价格收购了绿石金矿

Image: Shutterstock

图片:Shutterstock