-

市场

-

产品

-

资讯

-

Moo社区

-

课堂

-

查看更多

-

功能介绍

-

费用费用透明,无最低余额限制

投资选择、功能介绍、费用相关信息由Moomoo Financial Inc.提供

- English

- 中文繁體

- 中文简体

- 深色

- 浅色

Shopify Options Trading: A Deep Dive Into Market Sentiment

Shopify Options Trading: A Deep Dive Into Market Sentiment

Deep-pocketed investors have adopted a bearish approach towards Shopify (NYSE:SHOP), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in SHOP usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 10 extraordinary options activities for Shopify. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 30% leaning bullish and 60% bearish. Among these notable options, 2 are puts, totaling $81,800, and 8 are calls, amounting to $611,974.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $69.0 to $80.0 for Shopify during the past quarter.

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Shopify options trades today is 2681.33 with a total volume of 1,994.00.

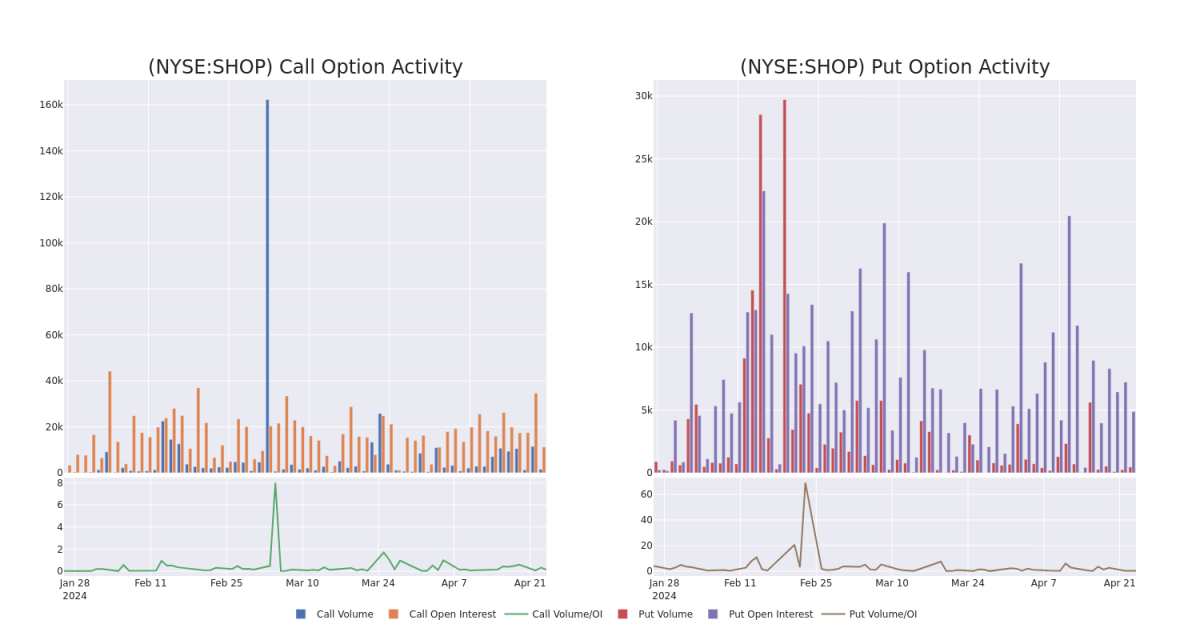

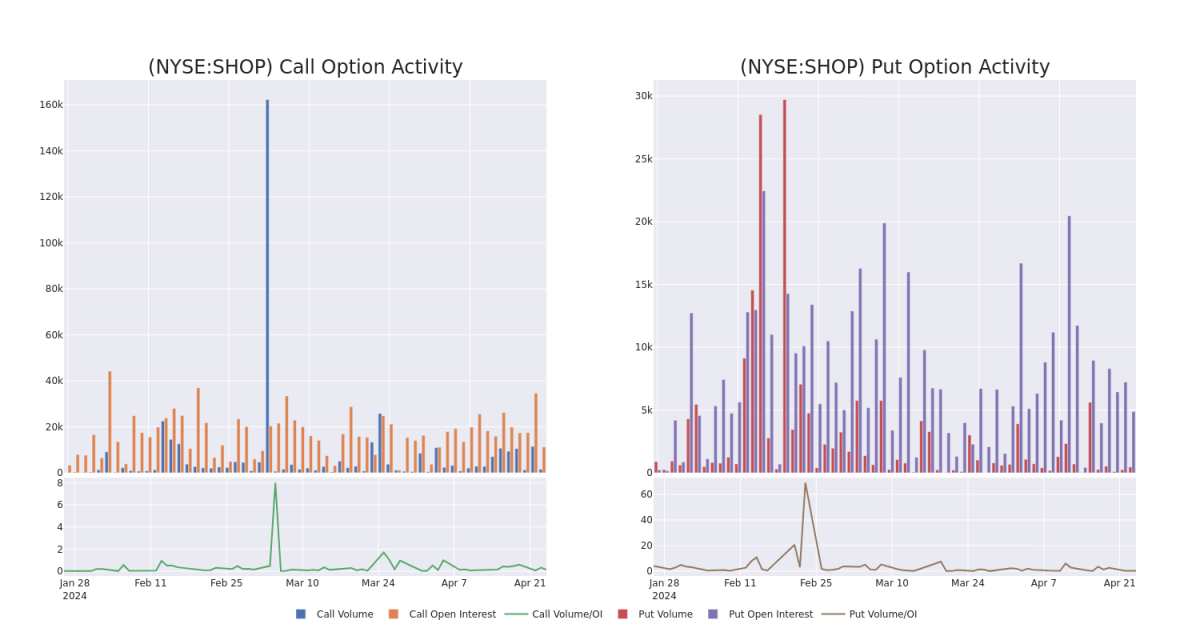

In the following chart, we are able to follow the development of volume and open interest of call and put options for Shopify's big money trades within a strike price range of $69.0 to $80.0 over the last 30 days.

Shopify Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SHOP | CALL | SWEEP | BEARISH | 07/19/24 | $7.4 | $7.35 | $7.35 | $75.00 | $140.4K | 1.3K | 0 |

| SHOP | CALL | SWEEP | BEARISH | 05/17/24 | $2.28 | $2.2 | $2.2 | $80.00 | $110.0K | 5.7K | 56 |

| SHOP | CALL | SWEEP | BEARISH | 07/19/24 | $7.1 | $7.0 | $7.0 | $75.00 | $105.0K | 1.3K | 519 |

| SHOP | CALL | TRADE | BULLISH | 07/19/24 | $7.2 | $7.15 | $7.2 | $75.00 | $72.0K | 1.3K | 269 |

| SHOP | CALL | SWEEP | BULLISH | 05/10/24 | $6.6 | $6.45 | $6.6 | $69.00 | $65.9K | 38 | 100 |

About Shopify

Shopify offers an e-commerce platform primarily to small and medium-size businesses. The firm has two segments. The subscription solutions segment allows Shopify merchants to conduct e-commerce on a variety of platforms, including the company's website, physical stores, pop-up stores, kiosks, social networks (Facebook), and Amazon. The merchant solutions segment offers add-on products for the platform that facilitate e-commerce and include Shopify Payments, Shopify Shipping, and Shopify Capital.

Where Is Shopify Standing Right Now?

- Trading volume stands at 2,076,687, with SHOP's price down by -2.36%, positioned at $72.26.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 14 days.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

Deep-pocketed investors have adopted a bearish approach towards Shopify (NYSE:SHOP), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in SHOP usually suggests something big is about to happen.

财力雄厚的投资者对Shopify(纽约证券交易所代码:SHOP)采取了看跌的态度,这是市场参与者不容忽视的。我们对本辛加公开期权记录的追踪今天揭示了这一重大举措。这些投资者的身份仍然未知,但是SHOP的如此实质性的变动通常表明大事即将发生。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 10 extraordinary options activities for Shopify. This level of activity is out of the ordinary.

我们今天从观察中收集了这些信息,当时Benzinga的期权扫描仪重点介绍了Shopify的10项非同寻常的期权活动。这种活动水平与众不同。

The general mood among these heavyweight investors is divided, with 30% leaning bullish and 60% bearish. Among these notable options, 2 are puts, totaling $81,800, and 8 are calls, amounting to $611,974.

这些重量级投资者的总体情绪存在分歧,30%的人倾向于看涨,60%的人看跌。在这些值得注意的期权中,有两个是看跌期权,总额为81,800美元,8个是看涨期权,总额为611,974美元。

Expected Price Movements

预期的价格走势

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $69.0 to $80.0 for Shopify during the past quarter.

分析这些合约的交易量和未平仓合约,看来大型企业一直在关注Shopify在过去一个季度的价格范围从69.0美元到80.0美元不等。

Volume & Open Interest Development

交易量和未平仓合约的发展

In terms of liquidity and interest, the mean open interest for Shopify options trades today is 2681.33 with a total volume of 1,994.00.

就流动性和利息而言,今天Shopify期权交易的平均未平仓合约为2681.33,总交易量为1,994.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Shopify's big money trades within a strike price range of $69.0 to $80.0 over the last 30 days.

在下图中,我们可以跟踪过去30天Shopify在69.0美元至80.0美元行使价区间内的看涨期权和看跌期权的交易量和未平仓合约的变化。

Shopify Option Volume And Open Interest Over Last 30 Days

过去 30 天的 Shopify 期权交易量和未平仓合约

Biggest Options Spotted:

发现的最大选择:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SHOP | CALL | SWEEP | BEARISH | 07/19/24 | $7.4 | $7.35 | $7.35 | $75.00 | $140.4K | 1.3K | 0 |

| SHOP | CALL | SWEEP | BEARISH | 05/17/24 | $2.28 | $2.2 | $2.2 | $80.00 | $110.0K | 5.7K | 56 |

| SHOP | CALL | SWEEP | BEARISH | 07/19/24 | $7.1 | $7.0 | $7.0 | $75.00 | $105.0K | 1.3K | 519 |

| SHOP | CALL | TRADE | BULLISH | 07/19/24 | $7.2 | $7.15 | $7.2 | $75.00 | $72.0K | 1.3K | 269 |

| SHOP | CALL | SWEEP | BULLISH | 05/10/24 | $6.6 | $6.45 | $6.6 | $69.00 | $65.9K | 38 | 100 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 商店 | 打电话 | 扫 | 粗鲁的 | 07/19/24 | 7.4 美元 | 7.35 美元 | 7.35 美元 | 75.00 美元 | 140.4 万美元 | 1.3K | 0 |

| 商店 | 打电话 | 扫 | 粗鲁的 | 05/17/24 | 2.28 美元 | 2.2 美元 | 2.2 美元 | 80.00 美元 | 11.0 万美元 | 5.7K | 56 |

| 商店 | 打电话 | 扫 | 粗鲁的 | 07/19/24 | 7.1 美元 | 7.0 美元 | 7.0 美元 | 75.00 美元 | 105.0 万美元 | 1.3K | 519 |

| 商店 | 打电话 | 贸易 | 看涨 | 07/19/24 | 7.2 美元 | 7.15 美元 | 7.2 美元 | 75.00 美元 | 72.0 万美元 | 1.3K | 269 |

| 商店 | 打电话 | 扫 | 看涨 | 05/10/24 | 6.6 美元 | 6.45 美元 | 6.6 美元 | 69.00 美元 | 65.9 万美元 | 38 | 100 |

About Shopify

关于 Shopi

Shopify offers an e-commerce platform primarily to small and medium-size businesses. The firm has two segments. The subscription solutions segment allows Shopify merchants to conduct e-commerce on a variety of platforms, including the company's website, physical stores, pop-up stores, kiosks, social networks (Facebook), and Amazon. The merchant solutions segment offers add-on products for the platform that facilitate e-commerce and include Shopify Payments, Shopify Shipping, and Shopify Capital.

Shopify 主要为中小型企业提供电子商务平台。该公司有两个部门。订阅解决方案部门允许 Shopify 商家在各种平台上进行电子商务,包括公司的网站、实体店、快闪店、自助服务亭、社交网络 (Facebook) 和亚马逊。商家解决方案部门为该平台提供促进电子商务的附加产品,包括Shopify Payments、Shopify Shipping和Shopify Capital。

Where Is Shopify Standing Right Now?

Shopify 现在的立场在哪里?

- Trading volume stands at 2,076,687, with SHOP's price down by -2.36%, positioned at $72.26.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 14 days.

- 交易量为2,076,687美元,其中SHOP的价格下跌了-2.36%,为72.26美元。

- RSI指标显示该股可能接近超卖。

- 预计将在14天内公布财报。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

与仅交易股票相比,期权是一种风险更高的资产,但它们具有更高的获利潜力。严肃的期权交易者通过每天自我教育、扩大交易规模、关注多个指标以及密切关注市场来管理这种风险。

moomoo是Moomoo Technologies Inc.公司提供的金融信息和交易应用程序。

在美国,moomoo上的投资产品和服务由Moomoo Financial Inc.提供,一家受美国证券交易委员会(SEC)监管的持牌主体。 Moomoo Financial Inc.是金融业监管局(FINRA)和证券投资者保护公司(SIPC)的成员。

在新加坡,moomoo上的投资产品和服务是通过Moomoo Financial Singapore Pte. Ltd.提供,该公司受新加坡金融管理局(MAS)监管(牌照号码︰CMS101000) ,持有资本市场服务牌照 (CMS) ,持有财务顾问豁免(Exempt Financial Adviser)资质。本内容未经新加坡金融管理局的审查。

在澳大利亚,moomoo上的金融产品和服务是通过Futu Securities (Australia) Ltd提供,该公司是受澳大利亚证券和投资委员会(ASIC)监管的澳大利亚金融服务许可机构(AFSL No. 224663)。请阅读并理解我们的《金融服务指南》、《条款与条件》、《隐私政策》和其他披露文件,这些文件可在我们的网站 https://www.moomoo.com/au中获取。

在加拿大,通过moomoo应用提供的仅限订单执行的券商服务由Moomoo Financial Canada Inc.提供,并受加拿大投资监管机构(CIRO)监管。

在马来西亚,moomoo上的投资产品和服务是通过Moomoo Securities Malaysia Sdn. Bhd. 提供,该公司受马来西亚证券监督委员会(SC)监管(牌照号码︰eCMSL/A0397/2024) ,持有资本市场服务牌照 (CMSL) 。本内容未经马来西亚证券监督委员会的审查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd., Futu Securities (Australia) Ltd, Moomoo Financial Canada Inc.,和Moomoo Securities Malaysia Sdn. Bhd.是关联公司。

风险及免责提示

moomoo是Moomoo Technologies Inc.公司提供的金融信息和交易应用程序。

在美国,moomoo上的投资产品和服务由Moomoo Financial Inc.提供,一家受美国证券交易委员会(SEC)监管的持牌主体。 Moomoo Financial Inc.是金融业监管局(FINRA)和证券投资者保护公司(SIPC)的成员。

在新加坡,moomoo上的投资产品和服务是通过Moomoo Financial Singapore Pte. Ltd.提供,该公司受新加坡金融管理局(MAS)监管(牌照号码︰CMS101000) ,持有资本市场服务牌照 (CMS) ,持有财务顾问豁免(Exempt Financial Adviser)资质。本内容未经新加坡金融管理局的审查。

在澳大利亚,moomoo上的金融产品和服务是通过Futu Securities (Australia) Ltd提供,该公司是受澳大利亚证券和投资委员会(ASIC)监管的澳大利亚金融服务许可机构(AFSL No. 224663)。请阅读并理解我们的《金融服务指南》、《条款与条件》、《隐私政策》和其他披露文件,这些文件可在我们的网站 https://www.moomoo.com/au中获取。

在加拿大,通过moomoo应用提供的仅限订单执行的券商服务由Moomoo Financial Canada Inc.提供,并受加拿大投资监管机构(CIRO)监管。

在马来西亚,moomoo上的投资产品和服务是通过Moomoo Securities Malaysia Sdn. Bhd. 提供,该公司受马来西亚证券监督委员会(SC)监管(牌照号码︰eCMSL/A0397/2024) ,持有资本市场服务牌照 (CMSL) 。本内容未经马来西亚证券监督委员会的审查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd., Futu Securities (Australia) Ltd, Moomoo Financial Canada Inc.,和Moomoo Securities Malaysia Sdn. Bhd.是关联公司。

- 分享到weixin

- 分享到qq

- 分享到facebook

- 分享到twitter

- 分享到微博

- 粘贴板

使用浏览器的分享功能,分享给你的好友吧