Rocket Companies Introduces Rocket Logic – Synopsis AI Tool to Analyze and Transcribe Calls, Personalizing Client Interactions

Rocket Companies Introduces Rocket Logic – Synopsis AI Tool to Analyze and Transcribe Calls, Personalizing Client Interactions

AI-based tool saves team members approximately 60,000 total hours annually

基于 AI 的工具每年总共为团队成员节省大约 60,000 小时

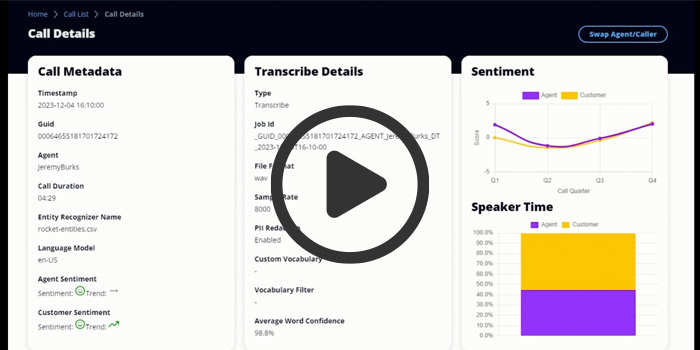

Detroit, April 23, 2024 – Rocket Mortgage, America's largest retail mortgage lender and part of Rocket Companies (NYSE: RKT), today unveiled its latest technology innovation: Rocket Logic – Synopsis. This new tool leverages generative AI to listen to, transcribe and search client calls, analyze sentiment and record client patterns and preferences, creating bespoke experiences for the company's millions of current and potential clients. Rocket Logic – Synopsis represents the next building block in the Rocket Logic ecosystem, the company's proprietary and patented AI-driven technology platform aimed to streamline the homeownership process.

"Rocket Logic unlocked the transformative power of AI to begin streamlining and modernizing the homebuying process. Now, with Rocket Logic – Synopsis, we have harnessed generative AI to create a tool that both anticipates and solves clients' needs, effectively changing the future of homeownership," explained Varun Krishna, CEO of Rocket Companies and Rocket Mortgage. "Each year, our teams participate in 65 million calls with our clients, and Rocket Logic – Synopsis is woven into each interaction. The importance and promise of AI is shining through, allowing our team members to focus on building deep relationships with clients while the technology handles the mundane tasks."

“Rocket Logic释放了人工智能的变革力量,开始简化和现代化购房流程。现在,借助《Rocket Logic — 概要》,我们利用生成式人工智能创建了一种既能预测又能解决客户需求的工具,从而有效地改变了房屋所有权的未来。” 火箭公司和火箭抵押贷款首席执行官瓦伦·克里希纳解释说。“每年,我们的团队参与与客户的6500万次通话,每次互动都融入了Rocket Logic — 概要。人工智能的重要性和前景显而易见,这使我们的团队成员能够专注于与客户建立深厚的关系,而技术可以处理平凡的任务。”

Built on Amazon Web Services (AWS) and using Amazon Bedrock, the Rocket Logic – Synopsis technology is active for calls handled by Rocket's client experience teams, including loans from mortgage brokers who work with Rocket Pro TPO. The tool is also used by the company's servicing team, who oversee Rocket Mortgage's 2.5 million serviced loans.

Rocket Logic — Synopsiss技术建立在亚马逊网络服务(AWS)上,使用亚马逊基石,适用于Rocket的客户体验团队处理的呼叫,包括与Rocket Pro TPO合作的抵押贷款经纪人提供的贷款。该公司的服务团队也使用该工具,负责监督Rocket Mortgage的250万笔服务贷款。

In 2023, Rocket Mortgage's servicing team facilitated 3.1 million client phone calls, with the majority of inquiries related to payments and escrow. To offer clients the best experience, Rocket's servicing calls and chats are increasingly powered by AI, resulting in approximately 70% of the interactions being fully self-serve without the need for team member intervention. Rocket Logic – Synopsis will save the servicing team nearly 40,000 hours annually by employing transcription capabilities and tracking client sentiment. With this generative AI solution, running on AWS, Rocket's team members can concentrate on cultivating strong, meaningful client relationships, while AI manages routine tasks like call summaries.

2023年,Rocket Mortgage的服务团队为310万个客户通话提供了便利,其中大多数查询与付款和托管有关。为了向客户提供最佳体验,Rocket的服务电话和聊天越来越多地由人工智能提供支持,从而使大约70%的互动完全自助服务,无需团队成员干预。Rocket Logic — 概要通过使用转录功能和跟踪客户情绪,每年将为服务团队节省近40,000个小时。借助这种在 AWS 上运行的生成式 AI 解决方案,Rocket 的团队成员可以集中精力培养牢固、有意义的客户关系,而 AI 则可以管理通话摘要等日常任务。

"Technology innovation is all about taking on the undifferentiated heavy lifting, enabling businesses to focus on problem-solving and enhancing customer experiences," said Werner Vogels, Chief Technology Officer at Amazon. "It's inspiring to see how Rocket Companies is optimizing its powerful data platform on AWS and utilizing Amazon Bedrock to develop innovative generative AI solutions like Rocket Logic – Synopsis. This approach reallocates routine tasks to AI systems, empowering teams to devise tailored, impactful solutions that simplify the historically complex homeownership journey."

亚马逊首席技术官沃纳·沃格尔斯表示:“技术创新就是要承担无差异的繁重工作,使企业能够专注于解决问题和改善客户体验。”“看到火箭公司如何优化其在AWS上的强大数据平台,并利用亚马逊基岩开发创新的生成式人工智能解决方案,例如Rocket Logic——概要,这令人鼓舞。这种方法将日常任务重新分配给人工智能系统,使团队能够设计量身定制、有影响力的解决方案,简化历史上复杂的房屋所有权之旅。”

As Rocket Logic – Synopsis continues to develop, it will leverage the vast amount of data gathered from Rocket's call transcripts to enhance its predictive capabilities. This will enable the tool to proactively offer solutions for clients before they even call Rocket. This technology has already led to a nearly 10% increase in resolutions reached during a client's first call to Rocket, which on an annual basis, saves approximately 20,000 team member hours.

随着Rocket Logic — Synopsiss的不断发展,它将利用从Rocket的通话记录中收集的大量数据来增强其预测能力。这将使该工具能够在客户致电Rocket之前主动为他们提供解决方案。这项技术已经使客户首次致电Rocket时达成的分辨率增加了近10%,每年可为团队成员节省约20,000个小时。

In the future, Rocket Logic – Synopsis will help Rocket team members understand homeowners' preferences and communication habits. Whether a homeowner prefers email communications instead of phone calls, the ever-evolving technology will take note of these patterns. For example, if a client mentions during a call with Rocket that they work an overnight shift at a local manufacturing plant, the tool's automatic transcription feature captures this information. The next time a Rocket team member needs to reach that client by phone, Rocket Logic – Synopsis will flag a recommendation to avoid calling the client in the morning, as they are likely sleeping.

将来,《火箭逻辑—概要》将帮助火箭团队成员了解房主的偏好和沟通习惯。无论房主更喜欢电子邮件通信而不是电话,不断发展的技术都会注意到这些模式。例如,如果客户在与Rocket通话时提到他们在当地制造工厂通宵工作,则该工具的自动转录功能会捕获这些信息。下次火箭团队成员需要通过电话联系该客户时,Rocket Logic — Synopsis将举报一项建议,避免在早上给客户打电话,因为他们可能正在睡觉。

Rocket Logic – Synopsis is one of the many tools in the Rocket Logic platform that the company plans to launch as part of their ongoing mission to integrate AI-powered homeownership into the client experience. Currently, Rocket Logic – Synopsis is being rolled out to bankers, further enhancing the homeownership journey.

Rocket Logic —概要是该公司计划在Rocket Logic平台中推出的众多工具之一,这是其将人工智能驱动的房屋所有权整合到客户体验中的持续使命的一部分。目前,Rocket Logic — 概要正在向银行家推出,进一步改善房屋所有权之旅。

Forward Looking Statements

前瞻性陈述

Some of the statements contained in this document are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are generally identified by the use of words such as "anticipate," "believe," "could," "estimate," "expect," "intend," "may," "plan," "potential," "predict," "project," "should," "target," "will," "would" and, in each case, their negative or other various or comparable terminology. These forward-looking statements reflect our views with respect to future events as of the date of this document and are based on our management's current expectations, estimates, forecasts, projections, assumptions, beliefs and information. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to have been correct. All such forward-looking statements are subject to risks and uncertainties, many of which are outside of our control, and could cause future events or results to be materially different from those stated or implied in this document. It is not possible to predict or identify all such risks. These risks include, but are not limited to, the risk factors that are described under the section titled "Risk Factors" in our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and other filings with the Securities and Exchange Commission ("SEC"). These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this document and in our SEC filings. We expressly disclaim any obligation to publicly update or review any forward-looking statements, whether as a result of new information, future developments or otherwise, except as required by applicable law.

本文件中包含的某些陈述是经修订的1933年《证券法》第27A条和经修订的1934年《证券交易法》第21E条所指的前瞻性陈述。这些前瞻性陈述通常使用诸如 “预期”、“相信”、“可能”、“估计”、“预期”、“打算”、“可能”、“计划”、“潜在”、“预测”、“项目”、“应该”、“目标”、“将” 等词语来识别,在每种情况下,还包括其否定或其他各种或可比的术语。这些前瞻性陈述反映了截至本文件发布之日我们对未来事件的看法,并基于我们管理层当前的预期、估计、预测、预测、假设、信念和信息。尽管管理层认为这些前瞻性陈述中反映的预期是合理的,但它无法保证这些预期会被证明是正确的。所有这些前瞻性陈述都存在风险和不确定性,其中许多是我们无法控制的,并可能导致未来的事件或结果与本文件中陈述或暗示的事件或结果存在重大差异。不可能预测或识别所有这些风险。这些风险包括但不限于我们在10-K表年度报告、10-Q表季度报告、8-K表最新报告以及向美国证券交易委员会(“SEC”)提交的其他文件中 “风险因素” 部分中描述的风险因素。不应将这些因素解释为详尽无遗,应与本文档和美国证券交易委员会文件中包含的其他警告声明一起阅读。除非适用法律要求,否则我们明确表示没有义务公开更新或审查任何前瞻性陈述,无论是由于新信息、未来发展还是其他原因。

About Rocket Mortgage

关于火箭抵押贷款

Detroit-based Rocket Mortgage is the largest retail mortgage lender, closing more mortgage volume than any other lender in 2022, and is a part of Rocket Companies (NYSE: RKT).

总部位于底特律的Rocket Mortgage是最大的零售抵押贷款机构,2022年完成的抵押贷款量超过任何其他贷款机构,并且是火箭公司(纽约证券交易所代码:RKT)的一部分。

The lender enables the American Dream of homeownership and financial freedom through its obsession with an industry-leading, digital-driven client experience. In late 2015, it introduced the first fully digital, completely online mortgage experience. Since its founding in 1985, Rocket Mortgage has closed more than $1.6 trillion of mortgage volume across all 50 states.

该贷款机构通过对行业领先的、数字驱动的客户体验的痴迷,实现了房屋所有权和财务自由的美国梦。2015年底,它推出了第一个完全数字化、完全在线的抵押贷款体验。自1985年成立以来,Rocket Mortgage已在所有50个州完成了超过1.6万亿美元的抵押贷款。

Rocket Mortgage is ranked highest in the country for client satisfaction in mortgage origination and servicing by J.D. Power. Rocket Companies, Rocket Mortgage's parent company, ranked #11 on Fortune's list of the "100 Best Companies to Work For" in 2022 and has placed in the top third of the list for 21 consecutive years.

在J.D. Power的抵押贷款发放和服务方面,Rocket Mortgage的客户满意度在全国排名最高。火箭抵押贷款的母公司火箭公司在《财富》杂志2022年的 “100家最佳工作公司” 名单中排名第 #11 位,并连续21年位居该榜单的前三分之一。

About Rocket Companies

关于火箭公司

Founded in 1985, Rocket Companies (NYSE: RKT) is a Detroit-based fintech platform company consisting of personal finance and consumer technology brands including Rocket Mortgage, Rocket Homes, Amrock, Rocket Money, Rocket Loans, Rocket Mortgage Canada, Lendesk and Core Digital Media.

火箭公司(纽约证券交易所代码:RKT)成立于1985年,是一家总部位于底特律的金融科技平台公司,由个人理财和消费科技品牌组成,包括Rocket Mortgage、Rocket Homes、Amrock、Rocket Money、火箭贷款、加拿大火箭抵押贷款、Lendesk和Core Digital Media。

Rocket Companies' mission is to be the best at creating certainty in life's most complex moments so its clients can pursue their financial dreams. The Company helps clients achieve the goal of home ownership and financial freedom through industry-leading client experiences powered by its simple, fast and trusted digital solutions. J.D. Power has ranked Rocket Mortgage, part of Rocket Companies, #1 in client satisfaction for both primary mortgage origination and servicing 21 times – the most of any mortgage lender.

Rocket Companies的使命是最擅长在生活中最复杂的时刻创造确定性,以便其客户能够追求自己的财务梦想。该公司通过其简单、快速和值得信赖的数字解决方案提供行业领先的客户体验,帮助客户实现房屋所有权和财务自由的目标。J.D. Power将火箭公司旗下的Rocket Mortgage在初级抵押贷款发放和还本付息方面的客户满意度排在第 #1 位,是所有抵押贷款机构中最高的。

For more information and company news visit RocketCompanies.com/PressRoom.

欲了解更多信息和公司新闻,请访问 Rocketcompanies.com/新闻室。