-

市场

-

产品

-

资讯

-

Moo社区

-

课堂

-

查看更多

-

功能介绍

-

费用费用透明,无最低余额限制

投资选择、功能介绍、费用相关信息由Moomoo Financial Inc.提供

- English

- 中文繁體

- 中文简体

- 深色

- 浅色

Lucid Gr Unusual Options Activity

Lucid Gr Unusual Options Activity

Investors with significant funds have taken a bearish position in Lucid Gr (NASDAQ:LCID), a development that retail traders should be aware of.

This was brought to our attention today through our monitoring of publicly accessible options data at Benzinga. The exact nature of these investors remains a mystery, but such a major move in LCID usually indicates foreknowledge of upcoming events.

Today, Benzinga's options scanner identified 9 options transactions for Lucid Gr. This is an unusual occurrence. The sentiment among these large-scale traders is mixed, with 22% being bullish and 77% bearish. Of all the options we discovered, 8 are puts, valued at $1,339,015, and there was a single call, worth $30,200.

What's The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $1.0 to $3.0 for Lucid Gr during the past quarter.

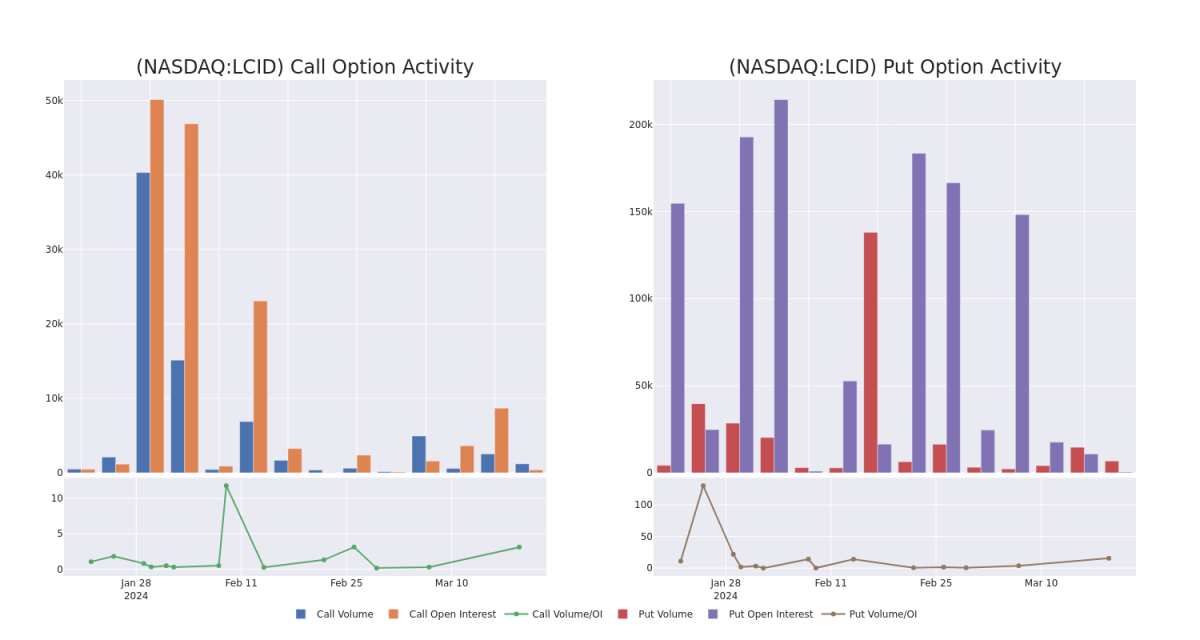

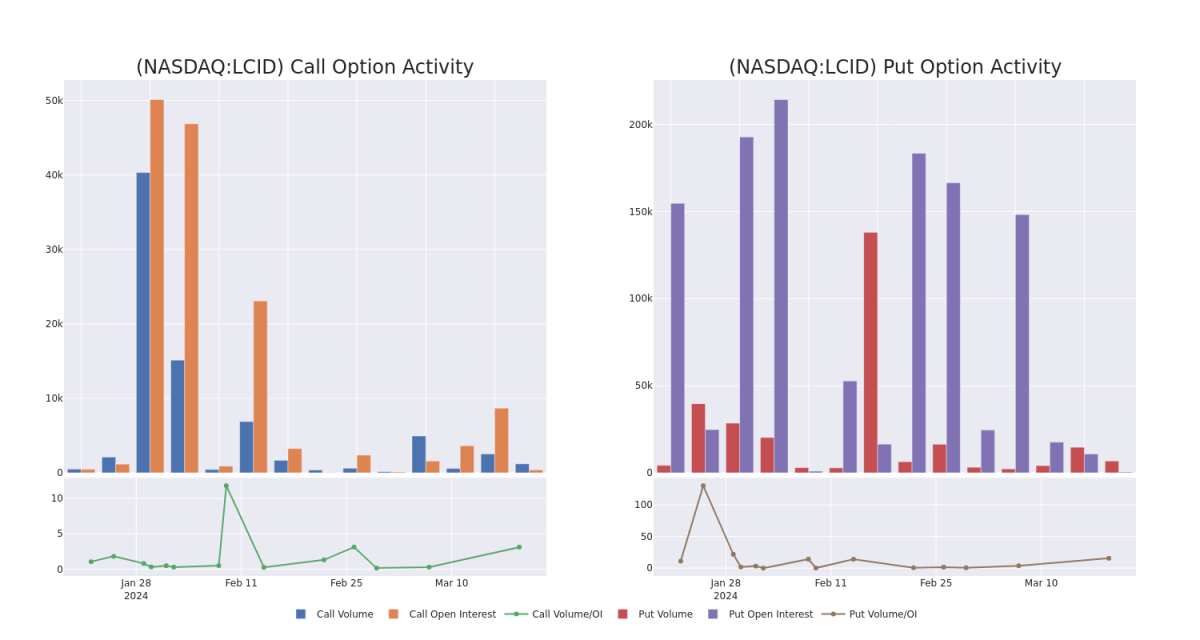

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Lucid Gr's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Lucid Gr's substantial trades, within a strike price spectrum from $1.0 to $3.0 over the preceding 30 days.

Lucid Gr 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LCID | PUT | SWEEP | BEARISH | 01/17/25 | $0.67 | $0.58 | $0.67 | $2.00 | $334.0K | 28.6K | 5.0K |

| LCID | PUT | TRADE | BEARISH | 01/17/25 | $0.68 | $0.6 | $0.66 | $2.00 | $222.3K | 28.6K | 8.5K |

| LCID | PUT | SWEEP | BEARISH | 08/16/24 | $0.69 | $0.65 | $0.69 | $2.50 | $207.0K | 6.3K | 4.8K |

| LCID | PUT | TRADE | BULLISH | 05/17/24 | $0.76 | $0.68 | $0.7 | $3.00 | $140.0K | 67.7K | 1 |

| LCID | PUT | SWEEP | BEARISH | 01/17/25 | $1.36 | $1.24 | $1.36 | $3.00 | $132.0K | 149.9K | 2.1K |

About Lucid Gr

Lucid Group Inc is a technology and automotive company. It develops the next generation of electric vehicle (EV) technologies. It is a vertically integrated company that designs, engineers, and builds electric vehicles, EV powertrains, and battery systems in-house using our own equipment and factory.

In light of the recent options history for Lucid Gr, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Lucid Gr

- With a volume of 6,608,517, the price of LCID is up 0.2% at $2.44.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 17 days.

Expert Opinions on Lucid Gr

1 market experts have recently issued ratings for this stock, with a consensus target price of $3.0.

- An analyst from Morgan Stanley persists with their Underweight rating on Lucid Gr, maintaining a target price of $3.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

Investors with significant funds have taken a bearish position in Lucid Gr (NASDAQ:LCID), a development that retail traders should be aware of.

拥有大量资金的投资者对Lucid Gr(纳斯达克股票代码:LCID)持看跌立场,零售交易者应该注意这一事态发展。

This was brought to our attention today through our monitoring of publicly accessible options data at Benzinga. The exact nature of these investors remains a mystery, but such a major move in LCID usually indicates foreknowledge of upcoming events.

今天,通过对本辛加可公开访问的期权数据的监控,这引起了我们的注意。这些投资者的确切性质仍然是个谜,但是LCID的如此重大变动通常表明对即将发生的事件的预感。

Today, Benzinga's options scanner identified 9 options transactions for Lucid Gr. This is an unusual occurrence. The sentiment among these large-scale traders is mixed, with 22% being bullish and 77% bearish. Of all the options we discovered, 8 are puts, valued at $1,339,015, and there was a single call, worth $30,200.

今天,Benzinga的期权扫描仪为Lucid Gr确定了9笔期权交易。这是一种不寻常的事件。这些大型交易者的情绪喜忧参半,22%的人看涨,77%的人看跌。在我们发现的所有期权中,有8个是看跌期权,价值1,339,015美元,还有一个看涨期权,价值30,200美元。

What's The Price Target?

目标价格是多少?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $1.0 to $3.0 for Lucid Gr during the past quarter.

分析这些合约的交易量和未平仓合约,看来大型企业一直在关注Lucid Gr在过去一个季度的价格范围从1.0美元到3.0美元不等。

Volume & Open Interest Trends

交易量和未平仓合约趋势

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Lucid Gr's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Lucid Gr's substantial trades, within a strike price spectrum from $1.0 to $3.0 over the preceding 30 days.

评估交易量和未平仓合约是期权交易的战略步骤。这些指标揭示了Lucid Gr在指定行使价下期权的流动性和投资者对Lucid Gr期权的兴趣。即将发布的数据可视化了与Lucid Gr的大量交易相关的看涨期权和未平仓合约的波动,在过去的30天内,行使价范围从1.0美元到3.0美元不等。

Lucid Gr 30-Day Option Volume & Interest Snapshot

Lucid Gr 30 天期权交易量和利息快照

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LCID | PUT | SWEEP | BEARISH | 01/17/25 | $0.67 | $0.58 | $0.67 | $2.00 | $334.0K | 28.6K | 5.0K |

| LCID | PUT | TRADE | BEARISH | 01/17/25 | $0.68 | $0.6 | $0.66 | $2.00 | $222.3K | 28.6K | 8.5K |

| LCID | PUT | SWEEP | BEARISH | 08/16/24 | $0.69 | $0.65 | $0.69 | $2.50 | $207.0K | 6.3K | 4.8K |

| LCID | PUT | TRADE | BULLISH | 05/17/24 | $0.76 | $0.68 | $0.7 | $3.00 | $140.0K | 67.7K | 1 |

| LCID | PUT | SWEEP | BEARISH | 01/17/25 | $1.36 | $1.24 | $1.36 | $3.00 | $132.0K | 149.9K | 2.1K |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LCID | 放 | 扫 | 粗鲁的 | 01/17/25 | 0.67 美元 | 0.58 美元 | 0.67 美元 | 2.00 美元 | 334.0 万美元 | 28.6K | 5.0K |

| LCID | 放 | 贸易 | 粗鲁的 | 01/17/25 | 0.68 美元 | 0.6 美元 | 0.66 美元 | 2.00 美元 | 222.3 万美元 | 28.6K | 8.5K |

| LCID | 放 | 扫 | 粗鲁的 | 08/16/24 | 0.69 美元 | 0.65 美元 | 0.69 美元 | 2.50 美元 | 207.0 万美元 | 6.3K | 4.8K |

| LCID | 放 | 贸易 | 看涨 | 05/17/24 | 0.76 美元 | 0.68 美元 | 0.7 美元 | 3.00 美元 | 140.0K | 67.7K | 1 |

| LCID | 放 | 扫 | 粗鲁的 | 01/17/25 | 1.36 | 1.24 美元 | 1.36 | 3.00 美元 | 132.0 万美元 | 149.9 万 | 2.1K |

About Lucid Gr

关于 Lucid Gr

Lucid Group Inc is a technology and automotive company. It develops the next generation of electric vehicle (EV) technologies. It is a vertically integrated company that designs, engineers, and builds electric vehicles, EV powertrains, and battery systems in-house using our own equipment and factory.

Lucid Group Inc是一家科技和汽车公司。它开发下一代电动汽车(EV)技术。它是一家垂直整合的公司,使用我们自己的设备和工厂在内部设计、工程和制造电动汽车、电动汽车动力总成和电池系统。

In light of the recent options history for Lucid Gr, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鉴于Lucid Gr最近的期权历史,现在应该将重点放在公司本身上。我们的目标是探索其目前的表现。

Current Position of Lucid Gr

Lucid Gr 的当前位置

- With a volume of 6,608,517, the price of LCID is up 0.2% at $2.44.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 17 days.

- LCID的交易量为6,608,517美元,价格上涨0.2%,至2.44美元。

- RSI 指标暗示标的股票可能已接近超卖。

- 下一份财报预计将在17天后公布。

Expert Opinions on Lucid Gr

关于 Lucid Gr 的专家意见

1 market experts have recently issued ratings for this stock, with a consensus target price of $3.0.

1位市场专家最近发布了该股的评级,共识目标价为3.0美元。

- An analyst from Morgan Stanley persists with their Underweight rating on Lucid Gr, maintaining a target price of $3.

- 摩根士丹利的一位分析师坚持对Lucid Gr的减持评级,维持3美元的目标价。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

与仅交易股票相比,期权是一种风险更高的资产,但它们具有更高的获利潜力。严肃的期权交易者通过每天自我教育、扩大交易规模、关注多个指标以及密切关注市场来管理这种风险。

moomoo是Moomoo Technologies Inc.公司提供的金融信息和交易应用程序。

在美国,moomoo上的投资产品和服务由Moomoo Financial Inc.提供,一家受美国证券交易委员会(SEC)监管的持牌主体。 Moomoo Financial Inc.是金融业监管局(FINRA)和证券投资者保护公司(SIPC)的成员。

在新加坡,moomoo上的投资产品和服务是通过Moomoo Financial Singapore Pte. Ltd.提供,该公司受新加坡金融管理局(MAS)监管(牌照号码︰CMS101000) ,持有资本市场服务牌照 (CMS) ,持有财务顾问豁免(Exempt Financial Adviser)资质。本内容未经新加坡金融管理局的审查。

在澳大利亚,moomoo上的金融产品和服务是通过Futu Securities (Australia) Ltd提供,该公司是受澳大利亚证券和投资委员会(ASIC)监管的澳大利亚金融服务许可机构(AFSL No. 224663)。请阅读并理解我们的《金融服务指南》、《条款与条件》、《隐私政策》和其他披露文件,这些文件可在我们的网站 https://www.moomoo.com/au中获取。

在加拿大,通过moomoo应用提供的仅限订单执行的券商服务由Moomoo Financial Canada Inc.提供,并受加拿大投资监管机构(CIRO)监管。

在马来西亚,moomoo上的投资产品和服务是通过Moomoo Securities Malaysia Sdn. Bhd. 提供,该公司受马来西亚证券监督委员会(SC)监管(牌照号码︰eCMSL/A0397/2024) ,持有资本市场服务牌照 (CMSL) 。本内容未经马来西亚证券监督委员会的审查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd., Futu Securities (Australia) Ltd, Moomoo Financial Canada Inc.,和Moomoo Securities Malaysia Sdn. Bhd.是关联公司。

风险及免责提示

moomoo是Moomoo Technologies Inc.公司提供的金融信息和交易应用程序。

在美国,moomoo上的投资产品和服务由Moomoo Financial Inc.提供,一家受美国证券交易委员会(SEC)监管的持牌主体。 Moomoo Financial Inc.是金融业监管局(FINRA)和证券投资者保护公司(SIPC)的成员。

在新加坡,moomoo上的投资产品和服务是通过Moomoo Financial Singapore Pte. Ltd.提供,该公司受新加坡金融管理局(MAS)监管(牌照号码︰CMS101000) ,持有资本市场服务牌照 (CMS) ,持有财务顾问豁免(Exempt Financial Adviser)资质。本内容未经新加坡金融管理局的审查。

在澳大利亚,moomoo上的金融产品和服务是通过Futu Securities (Australia) Ltd提供,该公司是受澳大利亚证券和投资委员会(ASIC)监管的澳大利亚金融服务许可机构(AFSL No. 224663)。请阅读并理解我们的《金融服务指南》、《条款与条件》、《隐私政策》和其他披露文件,这些文件可在我们的网站 https://www.moomoo.com/au中获取。

在加拿大,通过moomoo应用提供的仅限订单执行的券商服务由Moomoo Financial Canada Inc.提供,并受加拿大投资监管机构(CIRO)监管。

在马来西亚,moomoo上的投资产品和服务是通过Moomoo Securities Malaysia Sdn. Bhd. 提供,该公司受马来西亚证券监督委员会(SC)监管(牌照号码︰eCMSL/A0397/2024) ,持有资本市场服务牌照 (CMSL) 。本内容未经马来西亚证券监督委员会的审查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd., Futu Securities (Australia) Ltd, Moomoo Financial Canada Inc.,和Moomoo Securities Malaysia Sdn. Bhd.是关联公司。

- 分享到weixin

- 分享到qq

- 分享到facebook

- 分享到twitter

- 分享到微博

- 粘贴板

使用浏览器的分享功能,分享给你的好友吧