Spotlight on Trade Desk: Analyzing the Surge in Options Activity

Spotlight on Trade Desk: Analyzing the Surge in Options Activity

Whales with a lot of money to spend have taken a noticeably bearish stance on Trade Desk.

有大量资金可以花的鲸鱼在Trade Desk上采取了明显的看跌立场。

Looking at options history for Trade Desk (NASDAQ:TTD) we detected 12 trades.

查看交易台(纳斯达克股票代码:TTD)的期权历史记录,我们发现了12笔交易。

If we consider the specifics of each trade, it is accurate to state that 41% of the investors opened trades with bullish expectations and 58% with bearish.

如果我们考虑每笔交易的具体情况,可以准确地说,有41%的投资者以看涨的预期开仓,58%的投资者以看跌的预期开盘。

From the overall spotted trades, 3 are puts, for a total amount of $132,000 and 9, calls, for a total amount of $603,182.

在已发现的全部交易中,有3笔是看跌期权,总额为13.2万美元,9笔看涨期权,总额为603,182美元。

Expected Price Movements

预期的价格走势

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $60.0 to $87.5 for Trade Desk over the last 3 months.

考虑到这些合约的交易量和未平仓合约,在过去的3个月中,鲸鱼似乎一直将Trade Desk的价格定在60.0美元至87.5美元之间。

Insights into Volume & Open Interest

对交易量和未平仓合约的见解

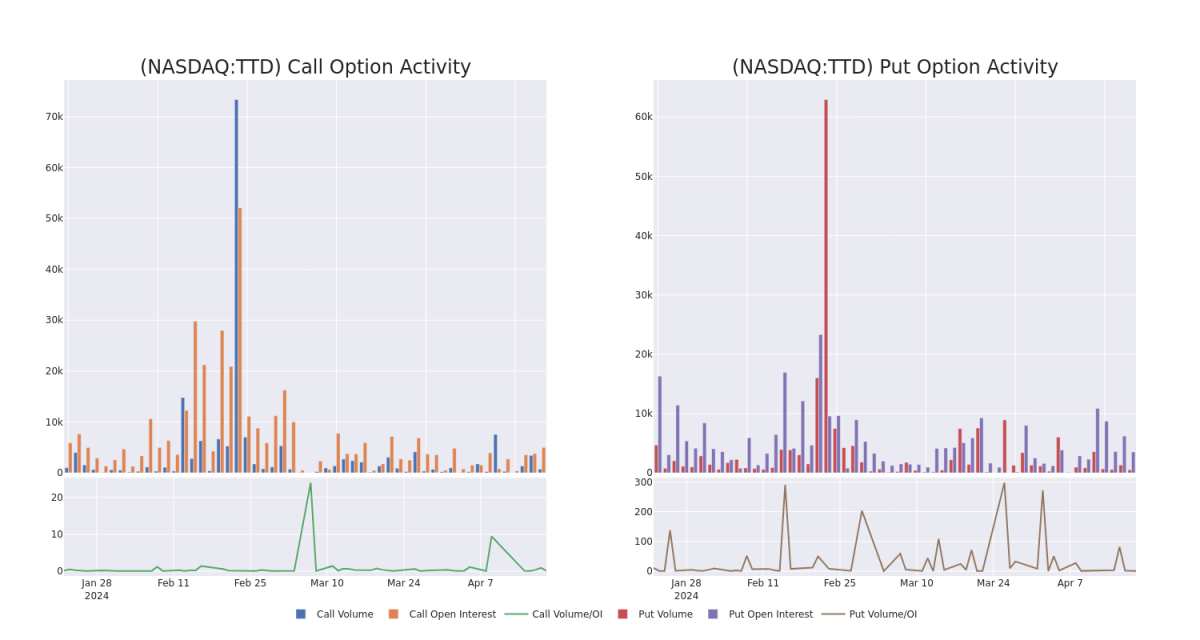

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

查看交易量和未平仓合约是一种对股票进行尽职调查的有见地的方法。

This data can help you track the liquidity and interest for Trade Desk's options for a given strike price.

这些数据可以帮助您跟踪Trade Desk期权在给定行使价下的流动性和利息。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Trade Desk's whale activity within a strike price range from $60.0 to $87.5 in the last 30 days.

下面,我们可以分别观察Trade Desk所有鲸鱼活动在过去30天行使价范围内的看涨期权和看跌期权交易量和未平仓合约的变化。

Trade Desk Option Volume And Open Interest Over Last 30 Days

过去 30 天的交易台期权交易量和未平仓合约

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TTD | CALL | SWEEP | BULLISH | 04/19/24 | $19.75 | $19.5 | $19.75 | $60.00 | $136.2K | 389 | 1 |

| TTD | CALL | SWEEP | BULLISH | 01/17/25 | $11.3 | $11.1 | $11.3 | $87.50 | $102.8K | 57 | 91 |

| TTD | CALL | SWEEP | BEARISH | 06/21/24 | $4.8 | $4.7 | $4.75 | $85.00 | $95.0K | 3.3K | 388 |

| TTD | CALL | SWEEP | BEARISH | 06/21/24 | $5.0 | $4.95 | $5.0 | $85.00 | $85.5K | 3.3K | 11 |

| TTD | PUT | SWEEP | BEARISH | 04/19/24 | $3.2 | $3.0 | $3.0 | $82.00 | $60.0K | 1.5K | 242 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TTD | 打电话 | 扫 | 看涨 | 04/19/24 | 19.75 美元 | 19.5 美元 | 19.75 美元 | 60.00 美元 | 136.2 万美元 | 389 | 1 |

| TTD | 打电话 | 扫 | 看涨 | 01/17/25 | 11.3 美元 | 11.1 | 11.3 美元 | 87.50 美元 | 102.8 万美元 | 57 | 91 |

| TTD | 打电话 | 扫 | 粗鲁的 | 06/21/24 | 4.8 美元 | 4.7 美元 | 4.75 美元 | 85.00 美元 | 95.0 万美元 | 3.3K | 388 |

| TTD | 打电话 | 扫 | 粗鲁的 | 06/21/24 | 5.0 美元 | 4.95 美元 | 5.0 美元 | 85.00 美元 | 85.5 万美元 | 3.3K | 11 |

| TTD | 放 | 扫 | 粗鲁的 | 04/19/24 | 3.2 美元 | 3.0 美元 | 3.0 美元 | 82.00 美元 | 60.0 万美元 | 1.5K | 242 |

About Trade Desk

关于交易台

The Trade Desk provides a self-service platform that helps advertisers and ad agencies programmatically find and purchase digital ad inventory (display, video, audio, and social) on different devices like computers, smartphones, and connected TVs. It utilizes data to optimize the performance of ad impressions purchased. The firm's platform is referred to as a demand-side platform in the digital ad industry. The firm generates its revenue from fees based on a percentage of what its clients spend on advertising.

The Trade Desk 提供了一个自助服务平台,可帮助广告商和广告代理商以编程方式在计算机、智能手机和联网电视等不同设备上查找和购买数字广告库存(显示屏、视频、音频和社交)。它利用数据来优化所购买的广告曝光量的效果。该公司的平台被称为数字广告行业的需求方平台。该公司根据客户广告支出的一定百分比从费用中获得收入。

After a thorough review of the options trading surrounding Trade Desk, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在对Trade Desk周围的期权交易进行了全面审查之后,我们将对该公司进行更详细的审查。这包括评估其当前的市场状况和表现。

Trade Desk's Current Market Status

Trade Desk 的当前市场状况

- With a volume of 773,303, the price of TTD is down -2.67% at $78.65.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 19 days.

- TTD的交易量为773,303美元,下跌了-2.67%,至78.65美元。

- RSI 指标暗示标的股票可能已接近超卖。

- 下一份财报预计将在19天后公布。

What The Experts Say On Trade Desk

专家在交易台上说了什么

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $100.0.

在过去的一个月中,1位行业分析师分享了他们对该股的见解,提出平均目标价为100.0美元。

- An analyst from Needham has revised its rating downward to Buy, adjusting the price target to $100.

- 尼德姆的一位分析师已将其评级下调至买入,将目标股价调整为100美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Trade Desk options trades with real-time alerts from Benzinga Pro.

期权交易带来更高的风险和潜在的回报。精明的交易者通过不断自我教育、调整策略、监控多个指标以及密切关注市场走势来管理这些风险。通过 Benzinga Pro 的实时提醒,随时了解最新的交易台期权交易。