Are Sa Sa International Holdings Limited's (HKG:178) Fundamentals Good Enough to Warrant Buying Given The Stock's Recent Weakness?

Are Sa Sa International Holdings Limited's (HKG:178) Fundamentals Good Enough to Warrant Buying Given The Stock's Recent Weakness?

It is hard to get excited after looking at Sa Sa International Holdings' (HKG:178) recent performance, when its stock has declined 25% over the past month. However, the company's fundamentals look pretty decent, and long-term financials are usually aligned with future market price movements. Specifically, we decided to study Sa Sa International Holdings' ROE in this article.

看了莎莎国际控股(HKG: 178)最近的表现,很难感到兴奋,当时的股票在过去一个月中下跌了25%。但是,该公司的基本面看起来相当不错,长期财务状况通常与未来的市场价格走势一致。具体而言,我们决定在本文中研究莎莎国际控股的投资回报率。

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

投资回报率或股本回报率是评估公司如何有效地从股东那里获得投资回报的有用工具。简而言之,它衡量公司相对于股东权益的盈利能力。

How Do You Calculate Return On Equity?

你如何计算股本回报率?

The formula for ROE is:

ROE 的公式是:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

股本回报率 = 净利润(来自持续经营业务)÷ 股东权益

So, based on the above formula, the ROE for Sa Sa International Holdings is:

因此,根据上述公式,莎莎国际控股的投资回报率为:

26% = HK$294m ÷ HK$1.1b (Based on the trailing twelve months to September 2023).

26% = 2.94亿港元 ÷ 11亿港元(基于截至2023年9月的过去十二个月)。

The 'return' is the profit over the last twelve months. One way to conceptualize this is that for each HK$1 of shareholders' capital it has, the company made HK$0.26 in profit.

“回报” 是过去十二个月的利润。对此进行概念化的一种方法是,该公司每持有1港元的股本,就能获得0.26港元的利润。

Why Is ROE Important For Earnings Growth?

为什么投资回报率对收益增长很重要?

So far, we've learned that ROE is a measure of a company's profitability. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

到目前为止,我们已经了解到,投资回报率是衡量公司盈利能力的指标。现在,我们需要评估公司再投资或 “保留” 了多少利润以用于未来的增长,从而使我们对公司的增长潜力有所了解。假设其他一切保持不变,那么与不一定具有这些特征的公司相比,投资回报率和利润保留率越高,公司的增长率就越高。

Sa Sa International Holdings' Earnings Growth And 26% ROE

莎莎国际控股的收益增长和26%的投资回报率

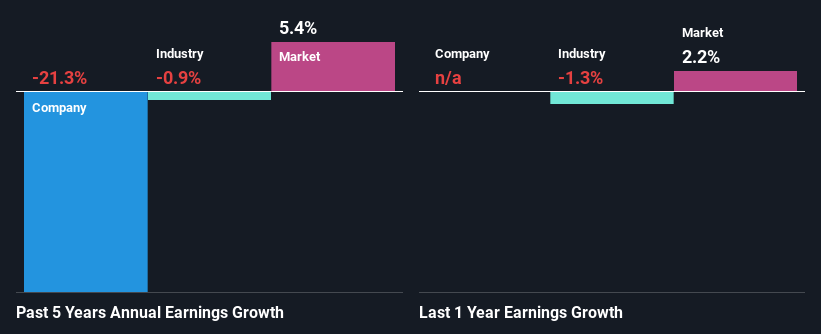

Firstly, we acknowledge that Sa Sa International Holdings has a significantly high ROE. Second, a comparison with the average ROE reported by the industry of 11% also doesn't go unnoticed by us. For this reason, Sa Sa International Holdings' five year net income decline of 21% raises the question as to why the high ROE didn't translate into earnings growth. Based on this, we feel that there might be other reasons which haven't been discussed so far in this article that could be hampering the company's growth. Such as, the company pays out a huge portion of its earnings as dividends, or is faced with competitive pressures.

首先,我们承认莎莎国际控股的投资回报率非常高。其次,与该行业报告的平均投资回报率为11%的比较也不会被我们忽视。出于这个原因,莎莎国际控股五年净收入下降了21%,这就提出了为什么高投资回报率没有转化为收益增长的问题。基于此,我们认为可能还有其他原因本文迄今尚未讨论过,这些原因可能会阻碍公司的发展。例如,该公司将其收益的很大一部分作为股息支付,或者面临竞争压力。

Next, when we compared with the industry, which has shrunk its earnings at a rate of 0.9% in the same 5-year period, we still found Sa Sa International Holdings' performance to be quite bleak, because the company has been shrinking its earnings faster than the industry.

接下来,当我们与该行业进行比较时,该行业的收益在同期以0.9%的速度萎缩,我们仍然发现莎莎国际控股的表现相当惨淡,因为该公司的收益萎缩速度比行业更快。

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. It's important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. If you're wondering about Sa Sa International Holdings''s valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

为公司附加价值的基础在很大程度上与其收益增长息息相关。对于投资者来说,重要的是要知道市场是否对公司的预期收益增长(或下降)进行了定价。通过这样做,他们将知道股票是走向清澈的蓝色海水还是沼泽水域在等着呢。如果你想知道莎莎国际控股的估值,可以看看这个衡量其与行业相比的市盈率指标。

Is Sa Sa International Holdings Using Its Retained Earnings Effectively?

莎莎国际控股是否有效使用其留存收益?

Because Sa Sa International Holdings doesn't pay any regular dividends, we infer that it is retaining all of its profits, which is rather perplexing when you consider the fact that there is no earnings growth to show for it. So there might be other factors at play here which could potentially be hampering growth. For example, the business has faced some headwinds.

由于莎莎国际控股不支付任何定期股息,因此我们推断它保留了所有利润,考虑到它没有盈利增长这一事实,这相当令人困惑。因此,这里可能还有其他因素在起作用,这些因素可能会阻碍增长。例如,该业务面临一些阻力。

Conclusion

结论

On the whole, we do feel that Sa Sa International Holdings has some positive attributes. Although, we are disappointed to see a lack of growth in earnings even in spite of a high ROE and and a high reinvestment rate. We believe that there might be some outside factors that could be having a negative impact on the business. Having said that, looking at current analyst estimates, we found that the company's earnings growth rate is expected to see a huge improvement. To know more about the company's future earnings growth forecasts take a look at this free report on analyst forecasts for the company to find out more.

总的来说,我们确实认为莎莎国际控股有一些积极的属性。但是,尽管投资回报率和再投资率很高,但我们仍然对收益缺乏增长感到失望。我们认为,可能有一些外部因素可能会对业务产生负面影响。话虽如此,从分析师目前的估计来看,我们发现该公司的收益增长率预计将出现巨大改善。要了解有关公司未来收益增长预测的更多信息,请查看这份关于分析师预测的免费报告,以了解更多信息。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧?直接联系我们。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St的这篇文章本质上是笼统的。我们仅使用公正的方法根据历史数据和分析师的预测提供评论,我们的文章无意作为财务建议。它不构成买入或卖出任何股票的建议,也没有考虑到您的目标或财务状况。我们的目标是为您提供由基本数据驱动的长期重点分析。请注意,我们的分析可能不考虑最新的价格敏感型公司公告或定性材料。简而言之,华尔街没有持有任何上述股票的头寸。