Unpacking the Latest Options Trading Trends in Cigna Group

Unpacking the Latest Options Trading Trends in Cigna Group

Financial giants have made a conspicuous bullish move on Cigna Group. Our analysis of options history for Cigna Group (NYSE:CI) revealed 11 unusual trades.

金融巨头对信诺集团采取了明显的看涨举动。我们对信诺集团(纽约证券交易所代码:CI)期权历史的分析显示了11笔不寻常的交易。

Delving into the details, we found 72% of traders were bullish, while 27% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $212,800, and 6 were calls, valued at $301,199.

深入研究细节,我们发现72%的交易者看涨,而27%的交易者表现出看跌倾向。在我们发现的所有交易中,有5笔是看跌期权,价值212,800美元,6笔是看涨期权,价值301,199美元。

Projected Price Targets

预计价格目标

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $270.0 to $390.0 for Cigna Group over the recent three months.

根据交易活动,看来重要投资者的目标是信诺集团在最近三个月的价格区间内从270.0美元到390.0美元不等。

Volume & Open Interest Development

交易量和未平仓合约的发展

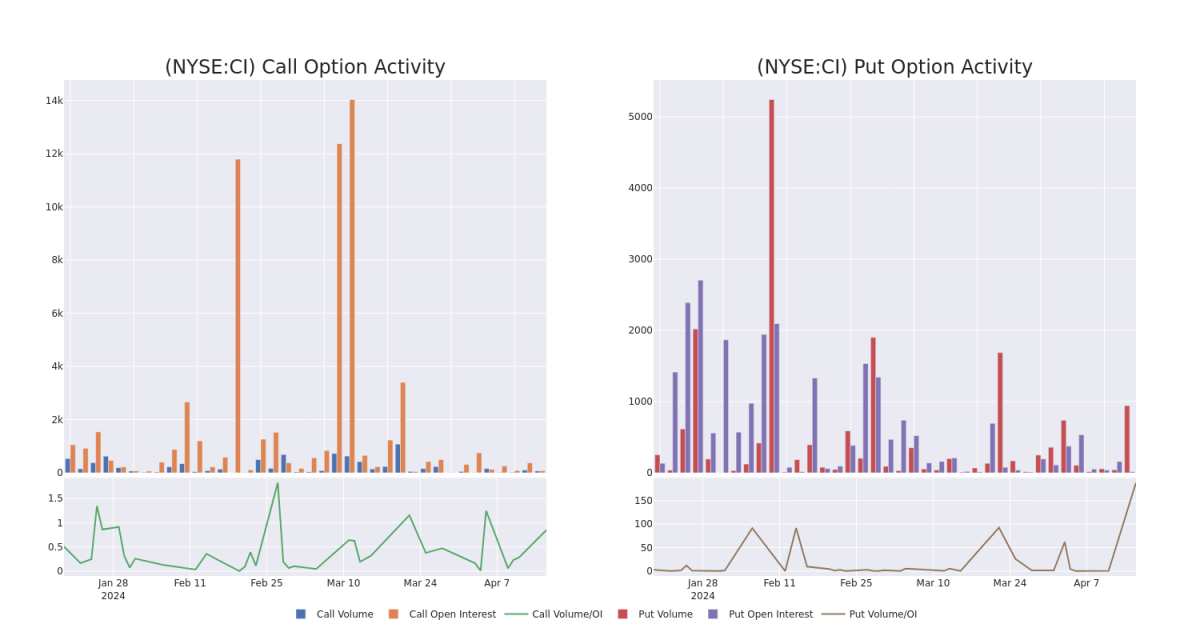

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Cigna Group's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Cigna Group's significant trades, within a strike price range of $270.0 to $390.0, over the past month.

检查交易量和未平仓合约为股票研究提供了至关重要的见解。这些信息是衡量信诺集团期权在特定行使价下的流动性和利息水平的关键。下面,我们简要介绍了过去一个月信诺集团重大交易的看涨期权和未平仓合约的趋势,行使价区间为270.0美元至390.0美元。

Cigna Group Call and Put Volume: 30-Day Overview

信诺集团看涨和看跌交易量:30天概述

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CI | CALL | SWEEP | BULLISH | 06/20/25 | $43.3 | $41.1 | $43.3 | $360.00 | $99.5K | 2 | 0 |

| CI | CALL | SWEEP | BULLISH | 06/20/25 | $43.5 | $41.1 | $43.3 | $360.00 | $55.9K | 2 | 36 |

| CI | PUT | SWEEP | BULLISH | 11/15/24 | $6.3 | $4.7 | $4.7 | $270.00 | $50.7K | 5 | 198 |

| CI | PUT | SWEEP | BULLISH | 11/15/24 | $6.3 | $4.6 | $4.6 | $270.00 | $49.6K | 5 | 380 |

| CI | CALL | TRADE | BEARISH | 05/03/24 | $9.9 | $9.8 | $9.8 | $350.00 | $49.0K | 45 | 0 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CI | 打电话 | 扫 | 看涨 | 06/20/25 | 43.3 美元 | 41.1 美元 | 43.3 美元 | 360.00 美元 | 99.5 万美元 | 2 | 0 |

| CI | 打电话 | 扫 | 看涨 | 06/20/25 | 43.5 美元 | 41.1 美元 | 43.3 美元 | 360.00 美元 | 55.9 万美元 | 2 | 36 |

| CI | 放 | 扫 | 看涨 | 11/15/24 | 6.3 美元 | 4.7 美元 | 4.7 美元 | 270.00 美元 | 50.7 万美元 | 5 | 198 |

| CI | 放 | 扫 | 看涨 | 11/15/24 | 6.3 美元 | 4.6 美元 | 4.6 美元 | 270.00 美元 | 49.6 万美元 | 5 | 380 |

| CI | 打电话 | 贸易 | 粗鲁的 | 05/03/24 | 9.9 美元 | 9.8 美元 | 9.8 美元 | 350.00 美元 | 49.0 万美元 | 45 | 0 |

About Cigna Group

关于信诺集团

Cigna primarily provides pharmacy benefit management and health insurance services. Its PBM and specialty pharmacy services, which were greatly expanded by its 2018 merger with Express Scripts, are mostly sold to health insurance plans and employers. Its largest PBM contract is the Department of Defense, and it recently won a deal with top-tier insurer Centene. In health insurance and other benefits, Cigna mostly serves employers through self-funding arrangements, and the company operates mostly in the US with 18 million US medical members covered as of December 2023.

信诺主要提供药房福利管理和健康保险服务。其PBM和专业药房服务在2018年与Express Scripts的合并中得到了极大的扩展,主要出售给健康保险计划和雇主。其最大的PBM合同是国防部,最近它赢得了与顶级保险公司Centene的协议。在健康保险和其他福利方面,信诺主要通过自筹资金安排为雇主提供服务,截至2023年12月,该公司主要在美国开展业务,覆盖了1,800万名美国医疗会员。

After a thorough review of the options trading surrounding Cigna Group, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在对信诺集团的期权交易进行了全面审查之后,我们将对该公司进行更详细的审查。这包括评估其当前的市场状况和表现。

Where Is Cigna Group Standing Right Now?

信诺集团现在的立场如何?

- Trading volume stands at 893,618, with CI's price up by 0.07%, positioned at $349.13.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 16 days.

- 交易量为893,618美元,CI的价格上涨了0.07%,为349.13美元。

- RSI指标显示,该股目前在超买和超卖之间处于中立状态。

- 预计将在16天后公布财报。

Professional Analyst Ratings for Cigna Group

信诺集团的专业分析师评级

In the last month, 1 experts released ratings on this stock with an average target price of $384.0.

上个月,1位专家发布了该股的评级,平均目标价为384.0美元。

- An analyst from Cantor Fitzgerald has revised its rating downward to Overweight, adjusting the price target to $384.

- 坎托·菲茨杰拉德的一位分析师已将其评级下调至增持,将目标股价调整为384美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

与仅交易股票相比,期权是一种风险更高的资产,但它们具有更高的获利潜力。严肃的期权交易者通过每天自我教育、扩大交易规模、关注多个指标以及密切关注市场来管理这种风险。