-

市场

-

产品

-

资讯

-

Moo社区

-

课堂

-

查看更多

-

功能介绍

-

费用费用透明,无最低余额限制

投资选择、功能介绍、费用相关信息由Moomoo Financial Inc.提供

- English

- 中文繁體

- 中文简体

- 深色

- 浅色

Boasting A 35% Return On Equity, Is Hovnanian Enterprises, Inc. (NYSE:HOV) A Top Quality Stock?

Boasting A 35% Return On Equity, Is Hovnanian Enterprises, Inc. (NYSE:HOV) A Top Quality Stock?

While some investors are already well versed in financial metrics (hat tip), this article is for those who would like to learn about Return On Equity (ROE) and why it is important. We'll use ROE to examine Hovnanian Enterprises, Inc. (NYSE:HOV), by way of a worked example.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

How Do You Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Hovnanian Enterprises is:

35% = US$211m ÷ US$607m (Based on the trailing twelve months to January 2024).

The 'return' is the amount earned after tax over the last twelve months. Another way to think of that is that for every $1 worth of equity, the company was able to earn $0.35 in profit.

Does Hovnanian Enterprises Have A Good Return On Equity?

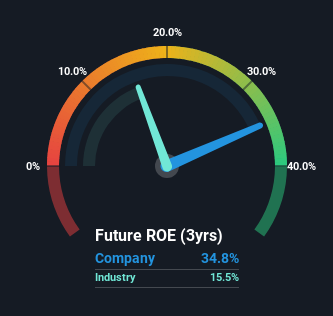

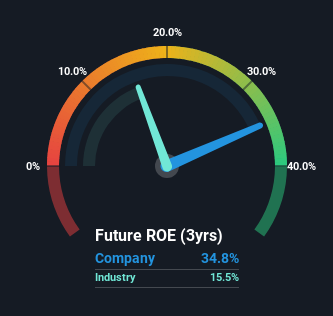

By comparing a company's ROE with its industry average, we can get a quick measure of how good it is. Importantly, this is far from a perfect measure, because companies differ significantly within the same industry classification. As you can see in the graphic below, Hovnanian Enterprises has a higher ROE than the average (16%) in the Consumer Durables industry.

That is a good sign. Bear in mind, a high ROE doesn't always mean superior financial performance. Especially when a firm uses high levels of debt to finance its debt which may boost its ROE but the high leverage puts the company at risk. Our risks dashboardshould have the 2 risks we have identified for Hovnanian Enterprises.

The Importance Of Debt To Return On Equity

Companies usually need to invest money to grow their profits. That cash can come from retained earnings, issuing new shares (equity), or debt. In the first two cases, the ROE will capture this use of capital to grow. In the latter case, the debt used for growth will improve returns, but won't affect the total equity. Thus the use of debt can improve ROE, albeit along with extra risk in the case of stormy weather, metaphorically speaking.

Hovnanian Enterprises' Debt And Its 35% ROE

Hovnanian Enterprises does use a high amount of debt to increase returns. It has a debt to equity ratio of 1.84. While no doubt that its ROE is impressive, we would have been even more impressed had the company achieved this with lower debt. Investors should think carefully about how a company might perform if it was unable to borrow so easily, because credit markets do change over time.

Conclusion

Return on equity is one way we can compare its business quality of different companies. A company that can achieve a high return on equity without debt could be considered a high quality business. If two companies have the same ROE, then I would generally prefer the one with less debt.

But ROE is just one piece of a bigger puzzle, since high quality businesses often trade on high multiples of earnings. The rate at which profits are likely to grow, relative to the expectations of profit growth reflected in the current price, must be considered, too. Check the past profit growth by Hovnanian Enterprises by looking at this visualization of past earnings, revenue and cash flow.

If you would prefer check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

While some investors are already well versed in financial metrics (hat tip), this article is for those who would like to learn about Return On Equity (ROE) and why it is important. We'll use ROE to examine Hovnanian Enterprises, Inc. (NYSE:HOV), by way of a worked example.

尽管一些投资者已经精通财务指标(帽子提示),但本文适用于那些想了解股本回报率(ROE)及其重要性的人。举一个有效的例子,我们将使用投资回报率来考察霍夫纳尼亚企业有限公司(纽约证券交易所代码:HOV)。

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

股本回报率或投资回报率是股东需要考虑的重要因素,因为它可以告诉他们资本再投资的有效性。换句话说,它是衡量公司股东提供的资本回报率的盈利比率。

How Do You Calculate Return On Equity?

你如何计算股本回报率?

The formula for ROE is:

ROE 的公式是:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

股本回报率 = 净利润(来自持续经营业务)÷ 股东权益

So, based on the above formula, the ROE for Hovnanian Enterprises is:

因此,根据上述公式,霍夫纳尼亚企业的投资回报率为:

35% = US$211m ÷ US$607m (Based on the trailing twelve months to January 2024).

35% = 2.11亿美元 ÷ 6.07亿美元(基于截至2024年1月的过去十二个月)。

The 'return' is the amount earned after tax over the last twelve months. Another way to think of that is that for every $1 worth of equity, the company was able to earn $0.35 in profit.

“回报” 是过去十二个月的税后收入。另一种思考方式是,每持有价值1美元的股权,该公司就能获得0.35美元的利润。

Does Hovnanian Enterprises Have A Good Return On Equity?

霍夫纳尼亚企业的股本回报率是否良好?

By comparing a company's ROE with its industry average, we can get a quick measure of how good it is. Importantly, this is far from a perfect measure, because companies differ significantly within the same industry classification. As you can see in the graphic below, Hovnanian Enterprises has a higher ROE than the average (16%) in the Consumer Durables industry.

通过将公司的投资回报率与其行业平均水平进行比较,我们可以快速衡量其表现如何。重要的是,这远非一个完美的衡量标准,因为各公司在相同的行业分类中差异很大。如下图所示,Hovnanian Enterprises的投资回报率高于耐用消费品行业的平均水平(16%)。

That is a good sign. Bear in mind, a high ROE doesn't always mean superior financial performance. Especially when a firm uses high levels of debt to finance its debt which may boost its ROE but the high leverage puts the company at risk. Our risks dashboardshould have the 2 risks we have identified for Hovnanian Enterprises.

这是一个好兆头。请记住,高投资回报率并不总是意味着卓越的财务业绩。尤其是当一家公司使用高额债务为其债务融资时,这可能会提高其投资回报率,但高杠杆率会使公司面临风险。我们的风险仪表板应该包含我们为Hovnanian Enterprises确定的两种风险。

The Importance Of Debt To Return On Equity

债务对股本回报率的重要性

Companies usually need to invest money to grow their profits. That cash can come from retained earnings, issuing new shares (equity), or debt. In the first two cases, the ROE will capture this use of capital to grow. In the latter case, the debt used for growth will improve returns, but won't affect the total equity. Thus the use of debt can improve ROE, albeit along with extra risk in the case of stormy weather, metaphorically speaking.

公司通常需要投资资金来增加利润。这些现金可以来自留存收益、发行新股(股权)或债务。在前两个案例中,投资回报率将涵盖这种资本用于增长的用途。在后一种情况下,用于增长的债务将提高回报,但不会影响总资产。因此,使用债务可以提高投资回报率,尽管可以隐喻地说,暴风雨天气会带来额外的风险。

Hovnanian Enterprises' Debt And Its 35% ROE

霍夫纳尼亚企业的债务及其35%的投资回报率

Hovnanian Enterprises does use a high amount of debt to increase returns. It has a debt to equity ratio of 1.84. While no doubt that its ROE is impressive, we would have been even more impressed had the company achieved this with lower debt. Investors should think carefully about how a company might perform if it was unable to borrow so easily, because credit markets do change over time.

Hovnanian Enterprises确实使用大量债务来增加回报。它的债务与权益比率为1.84。尽管毫无疑问,其投资回报率令人印象深刻,但如果该公司以较低的债务实现这一目标,我们会给我们留下更深刻的印象。投资者应该仔细考虑如果一家公司无法如此轻易地借款,其表现会如何,因为信贷市场确实会随着时间的推移而发生变化。

Conclusion

结论

Return on equity is one way we can compare its business quality of different companies. A company that can achieve a high return on equity without debt could be considered a high quality business. If two companies have the same ROE, then I would generally prefer the one with less debt.

股本回报率是我们可以比较不同公司的业务质量的一种方式。能够在没有债务的情况下实现高股本回报率的公司可以被视为高质量的企业。如果两家公司的投资回报率相同,那么我通常更喜欢负债较少的公司。

But ROE is just one piece of a bigger puzzle, since high quality businesses often trade on high multiples of earnings. The rate at which profits are likely to grow, relative to the expectations of profit growth reflected in the current price, must be considered, too. Check the past profit growth by Hovnanian Enterprises by looking at this visualization of past earnings, revenue and cash flow.

但是投资回报率只是更大难题的一部分,因为高质量的企业通常以高倍的收益进行交易。相对于当前价格所反映的利润增长预期,还必须考虑利润可能的增长速度。通过查看过去收益、收入和现金流的可视化,查看Hovnanian Enterprises过去的利润增长。

If you would prefer check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

如果你更愿意去另一家公司——一家财务状况可能优越的公司——那么千万不要错过这份免费的股本回报率高、债务低的有趣公司的名单。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧?直接联系我们。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St的这篇文章本质上是笼统的。我们仅使用公正的方法根据历史数据和分析师的预测提供评论,我们的文章无意作为财务建议。它不构成买入或卖出任何股票的建议,也没有考虑到您的目标或财务状况。我们的目标是为您提供由基本数据驱动的长期重点分析。请注意,我们的分析可能不考虑最新的价格敏感型公司公告或定性材料。简而言之,华尔街没有持有任何上述股票的头寸。

moomoo是Moomoo Technologies Inc.公司提供的金融信息和交易应用程序。

在美国,moomoo上的投资产品和服务由Moomoo Financial Inc.提供,一家受美国证券交易委员会(SEC)监管的持牌主体。 Moomoo Financial Inc.是金融业监管局(FINRA)和证券投资者保护公司(SIPC)的成员。

在新加坡,moomoo上的投资产品和服务是通过Moomoo Financial Singapore Pte. Ltd.提供,该公司受新加坡金融管理局(MAS)监管(牌照号码︰CMS101000) ,持有资本市场服务牌照 (CMS) ,持有财务顾问豁免(Exempt Financial Adviser)资质。本内容未经新加坡金融管理局的审查。

在澳大利亚,moomoo上的金融产品和服务是通过Futu Securities (Australia) Ltd提供,该公司是受澳大利亚证券和投资委员会(ASIC)监管的澳大利亚金融服务许可机构(AFSL No. 224663)。请阅读并理解我们的《金融服务指南》、《条款与条件》、《隐私政策》和其他披露文件,这些文件可在我们的网站 https://www.moomoo.com/au中获取。

在加拿大,通过moomoo应用提供的仅限订单执行的券商服务由Moomoo Financial Canada Inc.提供,并受加拿大投资监管机构(CIRO)监管。

在马来西亚,moomoo上的投资产品和服务是通过Moomoo Securities Malaysia Sdn. Bhd. 提供,该公司受马来西亚证券监督委员会(SC)监管(牌照号码︰eCMSL/A0397/2024) ,持有资本市场服务牌照 (CMSL) 。本内容未经马来西亚证券监督委员会的审查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd., Futu Securities (Australia) Ltd, Moomoo Financial Canada Inc.,和Moomoo Securities Malaysia Sdn. Bhd.是关联公司。

风险及免责提示

moomoo是Moomoo Technologies Inc.公司提供的金融信息和交易应用程序。

在美国,moomoo上的投资产品和服务由Moomoo Financial Inc.提供,一家受美国证券交易委员会(SEC)监管的持牌主体。 Moomoo Financial Inc.是金融业监管局(FINRA)和证券投资者保护公司(SIPC)的成员。

在新加坡,moomoo上的投资产品和服务是通过Moomoo Financial Singapore Pte. Ltd.提供,该公司受新加坡金融管理局(MAS)监管(牌照号码︰CMS101000) ,持有资本市场服务牌照 (CMS) ,持有财务顾问豁免(Exempt Financial Adviser)资质。本内容未经新加坡金融管理局的审查。

在澳大利亚,moomoo上的金融产品和服务是通过Futu Securities (Australia) Ltd提供,该公司是受澳大利亚证券和投资委员会(ASIC)监管的澳大利亚金融服务许可机构(AFSL No. 224663)。请阅读并理解我们的《金融服务指南》、《条款与条件》、《隐私政策》和其他披露文件,这些文件可在我们的网站 https://www.moomoo.com/au中获取。

在加拿大,通过moomoo应用提供的仅限订单执行的券商服务由Moomoo Financial Canada Inc.提供,并受加拿大投资监管机构(CIRO)监管。

在马来西亚,moomoo上的投资产品和服务是通过Moomoo Securities Malaysia Sdn. Bhd. 提供,该公司受马来西亚证券监督委员会(SC)监管(牌照号码︰eCMSL/A0397/2024) ,持有资本市场服务牌照 (CMSL) 。本内容未经马来西亚证券监督委员会的审查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd., Futu Securities (Australia) Ltd, Moomoo Financial Canada Inc.,和Moomoo Securities Malaysia Sdn. Bhd.是关联公司。

- 分享到weixin

- 分享到qq

- 分享到facebook

- 分享到twitter

- 分享到微博

- 粘贴板

使用浏览器的分享功能,分享给你的好友吧