Nvidia Stock Trading At 13% Discount To Long-Term Average, Other AI Stocks At 52% Premium

Nvidia Stock Trading At 13% Discount To Long-Term Average, Other AI Stocks At 52% Premium

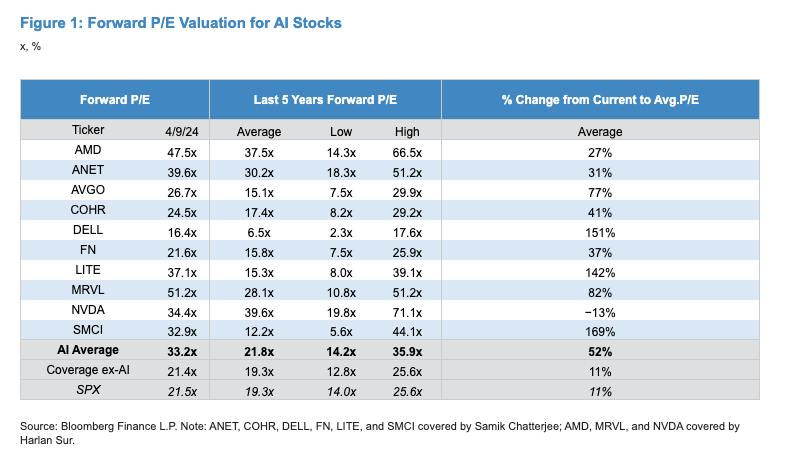

Nvidia Corp (NASDAQ:NVDA) traded 13% below its five-year average as of April 9 while nine other artificial intelligence-related stocks were trading above their five-year average.

截至4月9日,英伟达公司(纳斯达克股票代码:NVDA)的交易价格比其五年平均水平低13%,而其他九只与人工智能相关的股票的交易价格高于其五年平均水平。

The AI average of all 10 stocks is trading at a 52% premium, according to an analyst note from JPMorgan's Samik Chatterjee, citing data from Bloomberg.

摩根大通的萨米克·查特吉援引彭博社数据的一份分析师报告显示,所有10只股票的人工智能平均交易价格为52%。

See below.

见下文。

Table source: JPMorgan analyst note

表格来源:摩根大通分析师报告

As can be seen in the table above:

从上表中可以看出:

- Super Micro Computer (NASDAQ:SMCI) leads the pack with its stock price trading at a 169% premium to its long-term average.

- Dell Technologies (NYSE:DELL) follows next at 151% premium

- Lumentum Holdings (NASDAQ:LITE) follow at 142%

- Marvell Technologies (NASDAQ:MRVL) at 82%.

- 超级微型计算机(纳斯达克股票代码:SMCI)处于领先地位,其股价比长期平均水平高169%。

- 紧随其后的是戴尔科技(纽约证券交易所代码:DELL),溢价151%

- Lumentum Holdings(纳斯达克股票代码:LITE)紧随其后 142%

- Marvell Technologies(纳斯达克股票代码:MRVL)上涨82%。

Also Read: Which Is The Most Undervalued AI5 Stock Right Now?

另请阅读:哪只是目前最被低估的AI5股票?

AI Stock Positioning Earnings

AI 股票定位收益

Despite the sector's growth prospects, AI stocks, on average, are trading at a 52% premium to their long-term valuation multiples.

尽管该行业有增长前景,但平均而言,人工智能股票的交易价格比其长期估值倍数高出52%。

For context, the S&P 500 Index, considered a barometer of the U.S. stock market, is currently 11% above its long-term average.

就背景而言,被认为是美国股市晴雨表的标准普尔500指数目前比其长期平均水平高出11%。

By that measure, Nvidia, trading at 13% below its 5-year average forward P/E multiple – appears to be great pick. Advanced Micro Devices (NASDAQ:AMD) and Arista Networks (NYSE:ANET) at 27% and 31% premium, respectively, may also be offering better value than other AI stocks (ex-Nvidia).

从这个角度来看,英伟达的交易价格比其5年平均远期市盈倍数低13%,这似乎是一个不错的选择。Advanced Micro Devices(纳斯达克股票代码:AMD)和Arista Networks(纽约证券交易所代码:ANET)的溢价分别为27%和31%,也可能比其他人工智能股票(前NVIDIA)提供更好的价值。

The premium on AI stocks' multiples right now, is definitely a dampener on enthusiasm for favorable positioning into earnings.

目前,人工智能股票倍数的溢价无疑抑制了人们对盈利有利定位的热情。

As investors brace for first-quarter earnings, navigating macro headwinds and sector-specific dynamics is crucial. JPMorgan's insights shed light on potential opportunities and challenges in the AI sector, guiding investors in optimizing their portfolios amidst evolving market conditions.

在投资者为第一季度的收益做准备之际,应对宏观不利因素和特定行业的动态至关重要。摩根大通的见解揭示了人工智能领域的潜在机遇和挑战,指导投资者在不断变化的市场条件下优化其投资组合。

Image: Shutterstock

图片:Shutterstock