Huationg Global CEO Increases Interest to 7.75%

Huationg Global CEO Increases Interest to 7.75%

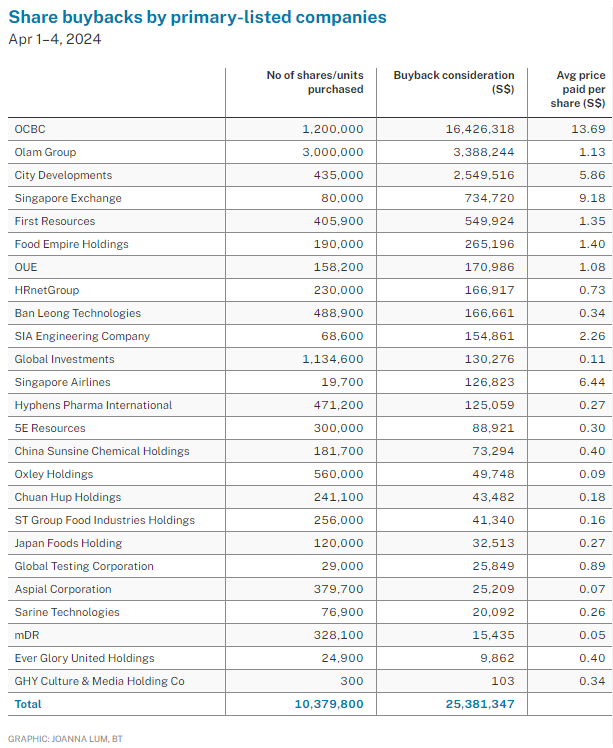

INSTITUTIONS were net buyers of Singapore stocks over the four trading sessions until Apr 4 inclusive, with S$49 million of net institutional inflow, as 25 primary-listed companies conducted buybacks with a total consideration of S$25.4 million.

在截至4月4日(含4月4日)的四个交易日中,机构是新加坡股票的净买家,机构净流入量为4900万新元,25家主要上市公司进行了回购,总对价为2540万新元。

Olam Group bought back a total of three million shares at S$1.13 apiece over the four sessions. Its buybacks on the current mandate in the period under review represented 0.79 per cent of its total outstanding shares (excluding Treasury shares). Secondary-listed Jardine Matheson Holdings also acquired 89,500 shares over the week at an average price of US$36.88 per share.

Olam集团在四个交易日中以每股1.13新元的价格共回购了300万股股票。在本报告所述期间,其对当前授权的回购占其已发行股份总额(不包括库存股)的0.79%。二级上市的怡和控股本周还收购了89,500股股票,平均价格为每股36.88美元。

Leading the net institutional inflow over the four sessions were OCBC, DBS, Sembcorp Industries, Mapletree Pan Asia Commercial Trust, Seatrium, Mapletree Logistics Trust, ComfortDelGro, Thai Beverage, Yangzijiang Shipbuilding and UOB.

在这四个交易日中,引领净流入的机构是华侨银行、星展银行、胜科工业、丰树泛亚商业信托、Seatrium、丰树物流信托、ComfortdelGro、泰国饮料、扬子江造船和大华银行。

Meanwhile, Singtel, Singapore Exchange, CapitaLand Investment, Hongkong Land, City Developments Limited, Frasers Centrepoint Trust, Singapore Airlines, AEM Holdings, Jardine Matheson Holdings and Keppel Infrastructure Trust led the net institutional outflow over the four sessions.

同时,新加坡电信、新加坡交易所、凯德置地投资、香港置地、城市发展有限公司、弗雷泽Centerpoint信托、新加坡航空、AEM控股、怡和控股和吉宝基础设施信托在四个交易日中引领机构净流出。

The four trading sessions had close to 90 changes to director interests and substantial shareholdings filed for nearly 50 primary-listed stocks.

这四个交易日对近50只主要上市股票的董事权益进行了近90次变动,并申请了大量股权。

Directors or chief executive officers filed 19 acquisitions and four disposals, while substantial shareholders filed six acquisitions and four disposals.

董事或首席执行官提交了19项收购和4项出售,而大股东提交了6项收购和4项出售。

Grand Bank Yachts

大银行游艇

Willimbury, a private company incorporated in Australia, increased its substantial shareholding in Grand Banks Yachts above the 15 per cent threshold on Mar 28.

在澳大利亚注册的私营公司威利姆伯里于3月28日将其在Grand Banks Yachts的大量股权增加到15%的门槛以上。

The married deal involved 1,709,500 shares being acquired at S$0.31 apiece, boosting the company's direct interest to 15.79 per cent from 14.86 per cent. It had raised its direct interest above the 14 per cent threshold in June 2022, with that acquisition also transacted at an average price of S$0.31 per share.

这笔婚姻交易涉及以每股0.31新元的价格收购1,709,500股股票,将该公司的直接权益从14.86%提高到15.79%。该公司在2022年6月将其直接权益提高到14%的门槛以上,此次收购的平均价格也为每股0.31新元。

On Feb 13, Grand Banks Yachts reported that its first-half profit after tax for the financial year 2024 ended Dec 31, 2023, increased 91.7 per cent to S$6.9 million year on year. This was amid higher revenue and gross profit margin as it accelerated the construction and sales of luxury boats.

2月13日,大银行游艇公司报告称,其截至2023年12月31日的2024财政年度的上半年税后利润同比增长91.7%,至690万新元。这是在收入和毛利率提高之际,它加速了豪华游艇的建造和销售。

The luxury recreational motor yachts manufacturer also declared an interim dividend of S$0.005 per share, its first interim dividend since 2008.

这家豪华休闲机动游艇制造商还宣布派发每股0.005新元的中期股息,这是自2008年以来的首次中期股息。

While ranking just outside the top 200 stocks by trading turnover in the 2024 year to date, the stock has ranked just outside the top 40 stocks by net institutional inflow. It also maintains a return-on-equity ratio of 19.5 per cent, with a 0.9 time price-to-book ratio and 4.9 times price-to-earnings ratio as at Apr 4.

尽管该股在2024年迄今的交易额排名仅次于前200只股票,但按机构净流入量计算,该股的排名仅次于前40名股票。截至4月4日,它还保持了19.5%的股本回报率,其市盈率为0.9倍,市盈率为4.9倍。

Huationg Global

华通环球

On Apr 1, Huationg Global CEO and executive director Patrick Ng Kian Ann acquired 12.5 million shares in a married deal at S$0.142 per share. With a consideration of nearly S$1.8 million, this increased his direct interest in the civil engineering services provider to 7.75 per cent, from 0.69 per cent.

4月1日,华通环球首席执行官兼执行董事Patrick Ng Kian Ann以每股0.142新元的价格通过婚姻交易收购了1,250万股股票。以近180万新元的对价,这使他在土木工程服务提供商的直接权益从0.69%增加到7.75%。

Mehta Vimesh Piyush was on the other side of the married deal, with his direct interest in the Catalist-listed company reduced to 0.96 per cent from 8.1 per cent. His previous acquisition was on Aug 31, 2023, with 200,000 shares acquired at an average price of S$0.131 apiece.

梅塔·维梅什·皮尤什站在婚姻协议的另一边,他在这家Catalist上市公司的直接权益从8.1%降至0.96%。他之前的收购是在2023年8月31日,以每股0.131新元的平均价格收购了20万股股票。

Ng also maintained a 68.7 per cent deemed interest in Huationg Global by virtue of his 25 per cent shareholding interest in Dandelion Capital, which is the immediate and ultimate holding company of Huationg. The acquisition brings his total interest in the Catalist-listed company to 76.45 per cent.

吴还凭借其持有蒲公英资本25%的股权,维持了华通环球68.7%的认定权益,蒲公英资本是华通的直接和最终控股公司。此次收购使他在这家Catalist上市公司的总权益达到76.45%。

With more than 20 years of experience in the civil engineering construction industry, Ng has been responsible for the overall management, operations, strategic planning and business expansion of Huationg Global since 2000.

Ng在土木工程建筑行业拥有20多年的经验,自2000年以来一直负责华通环球的整体管理、运营、战略规划和业务扩展。

For its FY2023 ended Dec 31, the group's revenue increased 15.1 per cent to S$174.6 million, from S$151.7 million in FY2022. This was attributed to higher occupancy in the dormitory operations segment, and work done for existing and new projects in the civil engineering service segment.

截至12月31日的 FY2023,该集团的收入从 FY2022 的1.517亿新元增长了15.1%,至1.746亿新元。这归因于宿舍运营部门的入住率增加,以及土木工程服务领域现有和新项目所做的工作。

The cost of sales and services increased 11.3 per cent year on year to S$128.9 million in FY2023, in line with the increased business activities and revenue. The group recorded an attributable net profit of S$14.2 million for the year, a 40.2 per cent increase from S$10.2 million in FY2022.

在 FY2023 中,销售和服务成本同比增长11.3%,达到1.289亿新元,这与业务活动和收入的增加相一致。该集团本年度的应占净利润为1,420万新元,比 FY2022 的1,020万新元增长了40.2%。

It also posted positive net current assets of S$36.6 million as at Dec 31, and its order book for ongoing projects stood at about S$506.5 million as at the same date. These projects are expected to be completed in the next four years.

截至12月31日,该公司还公布了3660万新元的正净流动资产,截至同日,其在建项目的订单约为5.065亿新元。这些项目预计将在未来四年内完成。

In its industry outlook, the group highlighted that it would continue to actively explore business opportunities in Singapore.

该集团在其行业展望中强调将继续积极探索新加坡的商机。

Huationg Global maintains a market capitalisation of S$29 million, which ranks the Catalist-listed stock among the lowest one-third of Singapore stocks by market capitalisation.

华通环球的市值维持在2900万新元,按市值计算,这只在Catalist上市的股票是新加坡股票中最低的三分之一之一。

However, for the year to date, the stock has ranked among the top one-third of Singapore stocks by trading turnover.

但是,今年迄今为止,该股的交易成交量已位居新加坡股票的前三分之一之列。

It also maintains a return-on-equity ratio of 15.8 per cent, with a 0.3 time price-to-book ratio and two times price-to-earnings ratio as at Apr 4.

截至4月4日,它还保持15.8%的股本回报率,市盈率为0.3倍,市盈率为两倍。

The board has proposed a final dividend of S$0.005 per ordinary share, subject to shareholders' approval, for FY2023.

董事会提议,FY2023 的末期股息为每股普通股0.005新元,但须经股东批准。

Together with the interim dividend of S$0.003 per ordinary share paid in September 2023, this brings the group's total declared dividend for the financial year to S$0.008 per ordinary share. This represents a yield of 5.6 per cent, based on its end-FY2023 share price of S$0.143.

再加上2023年9月支付的每股普通股0.003新元的中期股息,这使该集团本财政年度的宣布股息总额达到每股普通股0.008新元。根据其2023财年末0.143新元的股价,收益率为5.6%。

Manulife US Reit

宏利美国房地产投资信托基金

On Apr 4, Manulife US Real Estate Management independent non-executive director Francis Koh Cher Chiew acquired 400,000 units of Manulife US Real Estate Investment Trust (Reit) at US$0.0755 per unit.

4月4日,宏利美国房地产管理独立非执行董事Francis Koh Cher Chiew以每单位0.0755美元的价格收购了40万套宏利美国房地产投资信托基金(REIT)。

This increased his direct interest in the Reit to 450,000 units, or 0.025 per cent.

这使他在房地产投资信托基金的直接权益增加到45万个单位,占0.025%。

Hyphens Pharma International

Hyphens 制药国际

On Apr 1, Hyphens Pharma International non-executive director Tan Kia King acquired 32,000 shares at S$0.275 per share.

4月1日,Hyphens Pharma International非执行董事陈起金以每股0.275新元的价格收购了32,000股股票。

This increased his total interest in the Catalist-listed company marginally to 28.02 per cent from 28.01 per cent.

这使他在这家Catalist上市公司的总权益从28.01%略微增加到28.02%。

Dr Tan has more than 25 years of experience as a medical doctor, starting his career as a medical officer in the Ministry of Health. He was also the managing director of Westpoint Family Hospital, where he was responsible for overseeing the day-to-day operations.

陈博士拥有超过25年的医生经验,他的职业生涯始于卫生部的医疗官员。他还是西点家庭医院的董事总经理,负责监督该医院的日常运营。

On Feb 27, Hyphens Pharma reported a net profit of S$8.6 million for FY2023 (ended Dec 31), on the back of record revenue of S$170.6 million. While the group's net profit declined 24.8 per cent from FY2022, H2 FY2023 net profit increased by 45.7 per cent from H1 FY2023.

2月27日,Hyphens Pharma报告称,FY2023(截至12月31日)的净利润为860万新元,收入为创纪录的1.706亿新元。尽管该集团的净利润比 FY2022 下降了24.8%,但下半年 FY2023 的净利润较上半年 FY2023 增长了45.7%。

The leading speciality pharmaceutical and consumer healthcare group said that it will continue to invest in innovation to develop new and improved products under its respective brands.

这家领先的专业制药和消费者医疗保健集团表示,将继续投资创新,以各自的品牌开发新的和改进的产品。

It has also launched a new line of Ocean Health supplements in gummy form, which is designed for a younger demographic.

它还推出了一系列新的软糖状海洋健康补品,专为年轻人群设计。

This is a strategic move to tap growing new markets and diversify its customer base.

这是一项战略举措,旨在开拓不断增长的新市场并实现其客户群的多元化。

The company's subsidiary, DocMed Technology, is actively pursuing partnerships to enhance its digital healthtech platform to develop an integrated digital healthtech platform that encompasses a diverse range of healthtech solutions.

该公司的子公司DocMed Technology正在积极寻求合作伙伴关系,以增强其数字健康技术平台,以开发涵盖各种健康科技解决方案的综合数字健康技术平台。

For FY2023, Hyphens Pharma also recommended a final dividend of S$0.0086 per share, which, together with the special interim dividend of S$0.036 per share already paid out, amounts to a total dividend of S$0.0446 per share. Based on the end-FY2023 share price of S$0.285, this represents a dividend yield of 15.6 per cent.

对于 FY2023,Hyphens Pharma还建议派发每股0.0086新元的末期股息,加上已经支付的每股0.036新元的特别中期股息,相当于每股0.0446新元的总股息。根据2023财年末0.285新元的股价,这意味着股息收益率为15.6%。

The special interim dividend of S$0.036 per share in H1 FY2023 was to reward shareholders, as part of Hyphens Pharma's fifth anniversary celebration of its initial public offering.

作为Hyphens Pharma首次公开募股五周年庆典的一部分,FY2023 上半年每股0.036新元的特别中期股息旨在奖励股东。

The total dividend of S$0.0446 per share represents 161 per cent of the net profit after tax for FY2023.

每股0.0446新元的总股息占FY2023 税后净利润的161%。

Hyphens Pharma maintains a market capitalisation of S$85 million, and, as at Apr 4, maintains a return-on-equity ratio of 13 per cent, with a 1.4 times price-to-book ratio versus its five-year average price-to-book ratio of 1.5 times. The stock also maintains a 9.9 times price-to-earnings ratio.

Hyphens Pharma的市值维持在8,500万新元,截至4月4日,其股本回报率为13%,市值账面比率为1.4倍,而五年平均市值账面比率为1.5倍。该股还保持了9.9倍的市盈率。

Both Phillip Securities and CGS International maintain S$0.35 target prices on Hyphens Pharma as at Apr 4.

截至4月4日,辉立证券和CGS国际均维持Hyphens Pharma0.35新元的目标价。

Inside Insights is a weekly column on The Business Times, read the original version.

Inside Insights是《商业时报》的每周专栏文章,请阅读原始版本。

Enjoying this read?

喜欢这本书吗?

- Subscribe now to the weekly SGX My Gateway newsletter for a compilation of latest market news, sector performances, new product release updates, and research reports on SGX-listed companies.

- Stay up-to-date with our SGX Invest Telegram channel.

- 立即订阅每周一次的新交所 My Gateway 时事通讯,获取有关新交所上市公司的最新市场新闻、行业表现、新产品发布更新和研究报告的汇编。

- 关注我们的 SGX Invest Telegram 频道的最新动态。