Evergy (NASDAQ:EVRG) Seems To Be Using A Lot Of Debt

Evergy (NASDAQ:EVRG) Seems To Be Using A Lot Of Debt

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Evergy, Inc. (NASDAQ:EVRG) makes use of debt. But the more important question is: how much risk is that debt creating?

大卫·伊本说得好,他说:“波动性不是我们关心的风险。我们关心的是避免资本的永久损失。”因此,当你评估公司的风险时,看来聪明的货币知道债务(通常涉及破产)是一个非常重要的因素。与许多其他公司一样,Evergy, Inc.(纳斯达克股票代码:EVRG)也使用债务。但更重要的问题是:这笔债务会带来多大的风险?

What Risk Does Debt Bring?

债务会带来什么风险?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

债务是帮助企业发展的工具,但是如果企业无法还清贷款人,那么债务就任由他们摆布。如果情况变得非常糟糕,贷款人可以控制业务。但是,更常见(但仍然令人痛苦)的情况是它必须以低价筹集新的股权资本,从而永久稀释股东。当然,许多公司使用债务为增长提供资金,而不会产生任何负面后果。在考虑企业使用多少债务时,要做的第一件事是将现金和债务放在一起考虑。

How Much Debt Does Evergy Carry?

Evergy 背负了多少债务?

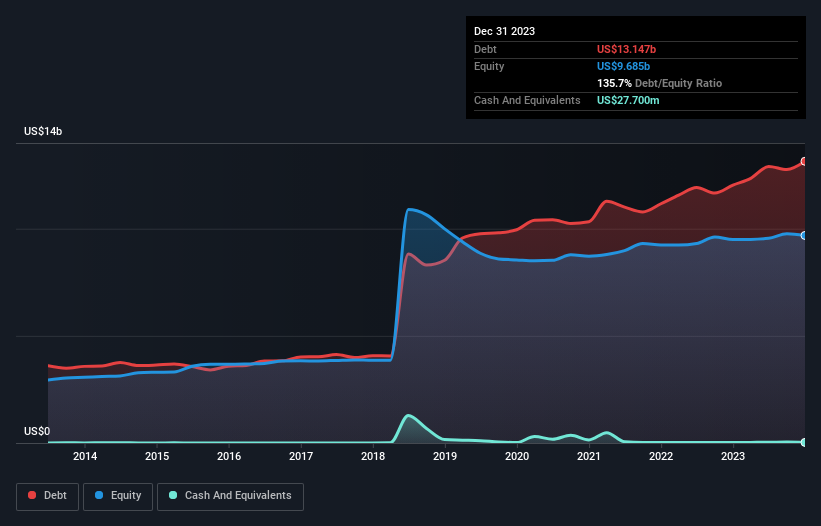

As you can see below, at the end of December 2023, Evergy had US$13.1b of debt, up from US$12.0b a year ago. Click the image for more detail. And it doesn't have much cash, so its net debt is about the same.

如下所示,截至2023年12月底,Evergy的债务为131亿美元,高于去年同期的120亿美元。点击图片查看更多细节。而且它没有太多现金,因此其净负债大致相同。

How Healthy Is Evergy's Balance Sheet?

Evergy 的资产负债表有多健康?

We can see from the most recent balance sheet that Evergy had liabilities of US$3.51b falling due within a year, and liabilities of US$17.8b due beyond that. On the other hand, it had cash of US$27.7m and US$268.4m worth of receivables due within a year. So it has liabilities totalling US$21.0b more than its cash and near-term receivables, combined.

我们可以从最新的资产负债表中看出,Evergy的负债为35.1亿美元,一年后到期的负债为178亿美元。另一方面,它有2770万美元的现金和价值2.684亿美元的应收账款将在一年内到期。因此,它的负债总额比其现金和短期应收账款的总和多出210亿美元。

This deficit casts a shadow over the US$12.1b company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. After all, Evergy would likely require a major re-capitalisation if it had to pay its creditors today.

这笔赤字给这家价值121亿美元的公司蒙上了阴影,就像一个耸立在凡人之上的巨人。因此,毫无疑问,我们将密切关注其资产负债表。毕竟,如果Evergy今天必须向债权人付款,则可能需要进行大规模的资本重组。

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

为了扩大公司相对于收益的负债规模,我们计算其净负债除以利息、税项、折旧和摊销前的收益(EBITDA),将其利息和税前收益(EBIT)除以利息支出(利息保障)。这样,我们既考虑债务的绝对数量,也考虑为债务支付的利率。

Evergy shareholders face the double whammy of a high net debt to EBITDA ratio (5.5), and fairly weak interest coverage, since EBIT is just 2.5 times the interest expense. This means we'd consider it to have a heavy debt load. Given the debt load, it's hardly ideal that Evergy's EBIT was pretty flat over the last twelve months. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Evergy's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

由于息税前利润仅为利息支出的2.5倍,每个股东都面临着净负债与息税折旧摊销前利润比率高(5.5)和利息覆盖率相当薄弱的双重打击。这意味着我们会认为它有沉重的债务负担。考虑到债务负担,Evergy的息税前利润在过去十二个月中保持相当平稳并不理想。资产负债表显然是分析债务时需要关注的领域。但是,未来的收益将决定Evergy未来维持健康资产负债表的能力。因此,如果您专注于未来,可以查看这份显示分析师利润预测的免费报告。

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, Evergy saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

最后,企业需要自由现金流来偿还债务;会计利润根本无法减少债务。因此,值得检查一下息税前利润中有多少是由自由现金流支持的。在过去的三年中,Evergy的自由现金流总额为负数。尽管这可能是增长支出的结果,但它确实使债务风险大大增加。

Our View

我们的观点

On the face of it, Evergy's conversion of EBIT to free cash flow left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. But at least its EBIT growth rate is not so bad. It's also worth noting that Evergy is in the Electric Utilities industry, which is often considered to be quite defensive. Taking into account all the aforementioned factors, it looks like Evergy has too much debt. That sort of riskiness is ok for some, but it certainly doesn't float our boat. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 2 warning signs for Evergy (1 is a bit unpleasant!) that you should be aware of before investing here.

从表面上看,Evergy将息税前利润转换为自由现金流使我们对该股持初步看法,其总负债水平并不比一年中最繁忙的夜晚那家空荡荡的餐厅更具吸引力。但至少其息税前利润增长率还不错。还值得注意的是,Evergy属于电力公用事业行业,人们通常认为该行业具有很强的防御性。考虑到上述所有因素,看来Evergy的债务太多了。这种风险对某些人来说是可以的,但它肯定无法满足我们的需求。资产负债表显然是分析债务时需要关注的领域。但归根结底,每家公司都可以控制资产负债表之外存在的风险。例如,我们发现了 Evergy 的 2 个警告标志(1 个有点不愉快!)在这里投资之前,您应该注意这一点。

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

当然,如果你是那种喜欢在没有债务负担的情况下购买股票的投资者,那么请立即查看我们的独家净现金增长股票清单。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧?直接联系我们。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St的这篇文章本质上是笼统的。我们仅使用公正的方法根据历史数据和分析师的预测提供评论,我们的文章无意作为财务建议。它不构成买入或卖出任何股票的建议,也没有考虑到您的目标或财务状况。我们的目标是为您提供由基本数据驱动的长期重点分析。请注意,我们的分析可能不考虑最新的价格敏感型公司公告或定性材料。简而言之,华尔街没有持有任何上述股票的头寸。