Baltimore Port Shutdown Triggers Coal Price Hike: Energy Information Administration Warns Of Export Disruptions

Baltimore Port Shutdown Triggers Coal Price Hike: Energy Information Administration Warns Of Export Disruptions

Coal prices have risen in the past couple of days since the Port of Baltimore was closed following the collapse of the Francis Scott Key Bridge, cutting off many of the port's facilities.

自弗朗西斯·斯科特·基大桥倒塌导致巴尔的摩港关闭以来,过去几天煤炭价格一直在上涨,该港的许多设施被切断。

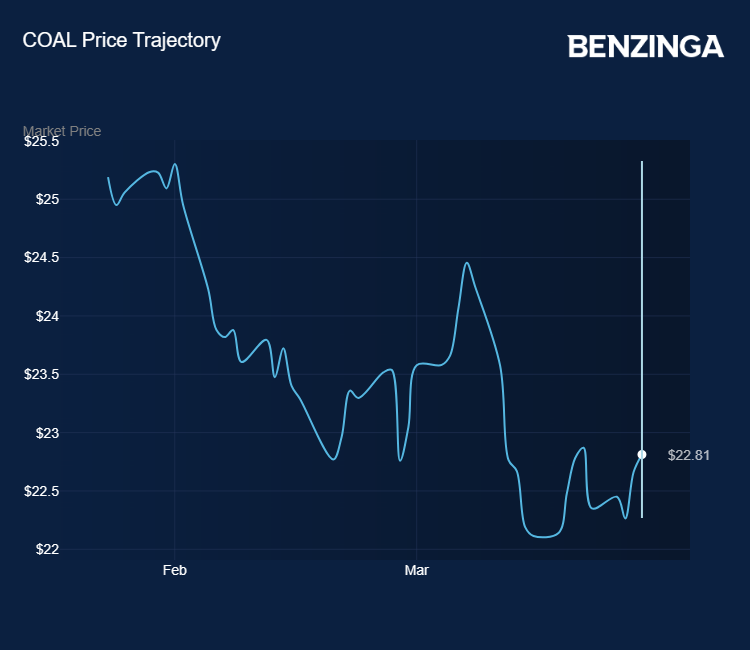

The price of a ton of U.S. coal rose by 0.6% on Thursday to $113.25. Meanwhile, the Range Global Coal ETF (NYSE:COAL), which tracks several different miners of differing grades of coal, rose 0.7% to $22.81, and is up 2.7% over the last two trading sessions.

周四,美国一吨煤炭的价格上涨了0.6%,至113.25美元。同时,追踪几家不同煤炭等级的不同矿商的Range Global Coal ETF(纽约证券交易所代码:COAL)上涨0.7%,至22.81美元,在过去两个交易日中上涨2.7%。

Consol Energy Inc (NYSE:CEIX) is one of the biggest exporters through the port's coal terminal. The Pennsylvania-based company said following the incident that it was working with port authorities to restore access to the terminal.

康索尔能源公司(纽约证券交易所代码:CEIX)是该港口煤炭码头最大的出口商之一。这家总部位于宾夕法尼亚州的公司在事件发生后表示,它正在与港务局合作恢复码头的通道。

It added, however: "At this moment, we do not have a definitive timeline of when vessel access or normal operations will resume. We are looking at all available options to us to minimize or address direct and indirect impacts to the Company and its operations."

但是,它补充说:“目前,我们还没有明确的时间表来确定何时恢复船只准入或正常运营。我们正在研究所有可用的选择,以最大限度地减少或解决对公司及其运营的直接和间接影响。”

Consol's shares fell nearly 7% on Tuesday, but recovered some ground in subsequent sessions.

Consol的股价周二下跌了近7%,但在随后的交易日中有所回升。

Also Read: Tesla, GM, Ford Supply Chain Concerns: Baltimore Port Closure 'Going To Have An Impact'

另请阅读:特斯拉、通用汽车、福特供应链问题:巴尔的摩港口关闭 “将产生影响”

Coal Export Hub

煤炭出口中心

The U.S. Energy Information Administration (EIA) said the port is the second-largest coal exporting hub in the country, accounting for 28% of total coal exports in 2023. Much of this is delivered to Asia.

美国能源信息管理局(EIA)表示,该港口是该国第二大煤炭出口中心,占2023年煤炭出口总额的28%。其中大部分已运送到亚洲。

The EIA warned: "The interruption in operations in Baltimore may affect the volume of exports this year."

环境影响评估警告说:“巴尔的摩运营中断可能会影响今年的出口量。”

Baltimore's coal terminal is attractively situated to receive coal from the northern Appalachia fields in western Pennsylvania and northern West Virginia, which produce both premium quality metallurgical for steel production and smelting, and steam coal for use in power stations.

巴尔的摩的煤炭码头地理位置优越,可以从宾夕法尼亚州西部和西弗吉尼亚州北部的阿巴拉契亚油田接收煤炭,这些油田既生产用于钢铁生产和冶炼的优质冶金产品,也生产用于发电站的动力煤。

Shipments of the predominant steam coal from Baltimore averaged 12 million tons between 2019-22, but surged to 19 million in 2023 after rising demand from Asia, particularly India.

2019-22年间,巴尔的摩的主要动力煤的出货量平均为1200万吨,但在亚洲,尤其是印度的需求增加之后,到2023年激增至1900万吨。

The EIA concluded: "Other nearby ports, most notably Hampton Roads, have additional capacity to export coal, although factors including coal quality, pricing, and scheduling will affect how easily companies can switch to exporting from another port."

环境影响评估得出结论:“附近的其他港口,最著名的是汉普顿路,有额外的煤炭出口能力,尽管煤炭质量、定价和日程安排等因素将影响公司转向从另一个港口出口的难易程度。”

Metal Imports

金属进口

Baltimore is not only a hub for exporting commodities, it is also a key destination for U.S. imports, with cobalt among the metals — with over half of total shipments arriving in Baltimore.

巴尔的摩不仅是大宗商品的出口中心,也是美国进口的主要目的地,其中有钴——超过一半的货物抵达巴尔的摩。

In addition, Baltimore was the third-largest destination for imports of unwrought primary aluminum last year.

此外,巴尔的摩是去年未锻造原铝进口的第三大目的地。

On commodity exchanges, the price of aluminum futures rose 2% on Thursday as the market faced supply chain glitches. The iShares U.S. Basic Materials ETF (NYSE:IYM), which tracks producers of metals and other raw materials, has gained 2.1% over the past couple of session.

在大宗商品交易所,由于市场面临供应链故障,铝期货价格周四上涨了2%。追踪金属和其他原材料生产商的iShares美国基础材料ETF(纽约证券交易所代码:IYM)在过去几个交易日中上涨了2.1%。

Meanwhile, shipments of tin, copper and zinc are also expected to face delays as other ports are found to receive the extra capacity.

同时,由于发现其他港口将获得额外的运力,锡、铜和锌的出货预计也将面临延误。

Now Read: Baltimore Bridge: Ship Collisions Not Uncommon — 5 More US Fatal Accidents

立即阅读:巴尔的摩大桥:船舶碰撞并不少见——美国又有5起致命事故

Image by Shutterstock

图片来自 Shutterstock