-

市场

-

产品

-

资讯

-

Moo社区

-

课堂

-

查看更多

-

功能介绍

-

费用费用透明,无最低余额限制

投资选择、功能介绍、费用相关信息由Moomoo Financial Inc.提供

- English

- 中文繁體

- 中文简体

- 深色

- 浅色

MicroStrategy's Bitcoin Holdings Help Company Surpass EBay, Delta in Market Cap

MicroStrategy's Bitcoin Holdings Help Company Surpass EBay, Delta in Market Cap

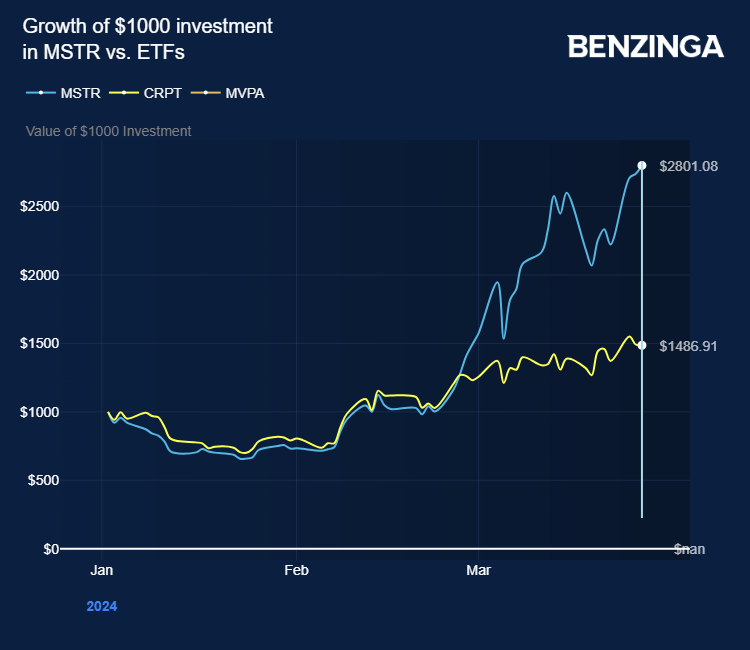

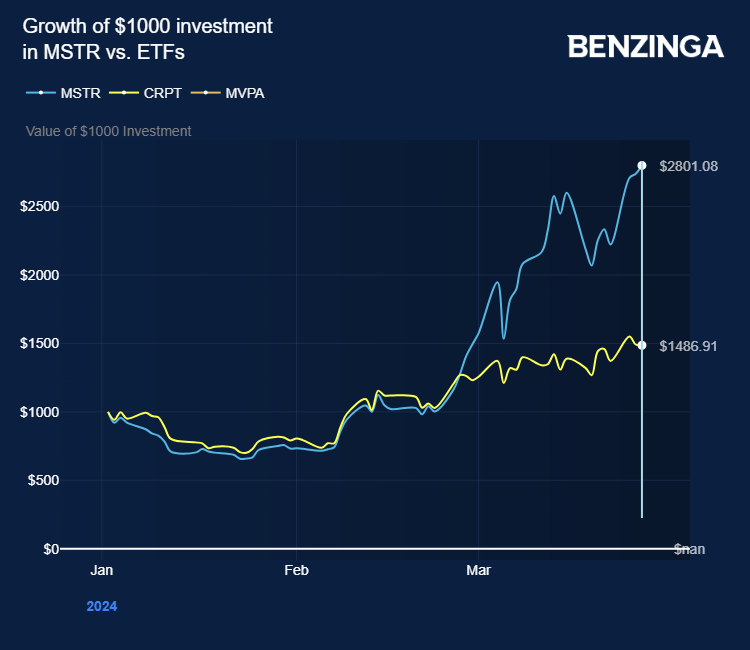

$MicroStrategy (MSTR.US)$, known for its substantial $Bitcoin (BTC.CC)$ holdings, has seen its stock surge by a staggering 204% this year, reaching $1,919 by Wednesday's close.

This surge has propelled its market capitalization to over $32 billion, surpassing 237 companies in the S&P 100, including well-established names like $eBay (EBAY.US)$ and $Delta Air Lines (DAL.US)$.

Despite being classified under the Russell 2000 Index, typically comprising smaller-cap stocks, its market value rivals that of much larger entities, Bloomberg reports.

However, MicroStrategy's inclusion in the $S&P 500 Index (.SPX.US)$ is not straightforward, as its revenue model primarily hinges on its Bitcoin holdings rather than conventional business operations.

Some analysts, like Steve Sosnick from Interactive Brokers, view MicroStrategy as a leveraged holding company for Bitcoin, raising questions about its suitability for S&P 500 inclusion.

Despite its profitability in the fourth quarter of 2023, driven by a tax benefit from its Bitcoin stash, MicroStrategy has faced setbacks due to Bitcoin's volatile valuation.

It has incurred losses in quarters when Bitcoin's value declined, complicating its eligibility for S&P 500 inclusion.

Also this week, MicroStrategy introduced an innovative AI-powered bot, MicroStrategy AutoTM, streamlining the delivery of business intelligence (BI) across organizations.

The Auto AI Bot, which is lightweight and embeddable, can operate independently within the MicroStrategy ONE library or seamlessly integrate into third-party applications, offering extensive customization options like appearance, language, and detail level adjustments.

The stock surged over 141% year-to-date.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

$MicroStrategy (MSTR.US)$, known for its substantial $Bitcoin (BTC.CC)$ holdings, has seen its stock surge by a staggering 204% this year, reaching $1,919 by Wednesday's close.

$MicroStrategy (MSTR.US)$,以其实质性而闻名 $比特币 (BTC.CC)$ 持股量,其股票今年飙升了惊人的204%,截至周三收盘时达到1,919美元。

This surge has propelled its market capitalization to over $32 billion, surpassing 237 companies in the S&P 100, including well-established names like $eBay (EBAY.US)$ and $Delta Air Lines (DAL.US)$.

这种激增使其市值超过320亿美元,超过了标准普尔100指数中的237家公司,其中包括知名公司,例如 $eBay (EBAY.US)$ 和 $达美航空 (DAL.US)$。

Despite being classified under the Russell 2000 Index, typically comprising smaller-cap stocks, its market value rivals that of much larger entities, Bloomberg reports.

彭博社报道,尽管被归类为罗素2000指数(通常包括小盘股),但其市值可与大型实体的市值相媲美。

However, MicroStrategy's inclusion in the $S&P 500 Index (.SPX.US)$ is not straightforward, as its revenue model primarily hinges on its Bitcoin holdings rather than conventional business operations.

但是,MicroStrategy 已纳入 $标普500指数 (.SPX.US)$ 并不简单,因为其收入模式主要取决于其持有的比特币,而不是传统的业务运营。

Some analysts, like Steve Sosnick from Interactive Brokers, view MicroStrategy as a leveraged holding company for Bitcoin, raising questions about its suitability for S&P 500 inclusion.

一些分析师,例如盈透证券的史蒂夫·索斯尼克,将微策略视为比特币的杠杆控股公司,这引发了人们对其是否适合纳入标准普尔500指数的质疑。

Despite its profitability in the fourth quarter of 2023, driven by a tax benefit from its Bitcoin stash, MicroStrategy has faced setbacks due to Bitcoin's volatile valuation.

尽管受比特币储备税收优惠的推动,MicroStrategy在2023年第四季度实现了盈利,但由于比特币估值的波动,MicroStrategy仍面临挫折。

It has incurred losses in quarters when Bitcoin's value declined, complicating its eligibility for S&P 500 inclusion.

在比特币价值下跌的几个季度中,它蒙受了损失,这使其入选标准普尔500指数的资格变得复杂。

Also this week, MicroStrategy introduced an innovative AI-powered bot, MicroStrategy AutoTM, streamlining the delivery of business intelligence (BI) across organizations.

同样在本周,微策略推出了一款由人工智能驱动的创新机器人MicroStrategy AutoTM,它简化了组织间商业智能(BI)的交付。

The Auto AI Bot, which is lightweight and embeddable, can operate independently within the MicroStrategy ONE library or seamlessly integrate into third-party applications, offering extensive customization options like appearance, language, and detail level adjustments.

Auto AI Bot 轻量级且可嵌入,可以在 MicroStrategy ONE 库中独立运行,也可以无缝集成到第三方应用程序中,提供广泛的自定义选项,例如外观、语言和细节级别调整。

The stock surged over 141% year-to-date.

今年迄今为止,该股飙升了141%以上。

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

免责声明:此内容部分是在人工智能工具的帮助下制作的,并由Benzinga的编辑审阅和发布。

moomoo是Moomoo Technologies Inc.公司提供的金融信息和交易应用程序。

在美国,moomoo上的投资产品和服务由Moomoo Financial Inc.提供,一家受美国证券交易委员会(SEC)监管的持牌主体。 Moomoo Financial Inc.是金融业监管局(FINRA)和证券投资者保护公司(SIPC)的成员。

在新加坡,moomoo上的投资产品和服务是通过Moomoo Financial Singapore Pte. Ltd.提供,该公司受新加坡金融管理局(MAS)监管(牌照号码︰CMS101000) ,持有资本市场服务牌照 (CMS) ,持有财务顾问豁免(Exempt Financial Adviser)资质。本内容未经新加坡金融管理局的审查。

在澳大利亚,moomoo上的金融产品和服务是通过Futu Securities (Australia) Ltd提供,该公司是受澳大利亚证券和投资委员会(ASIC)监管的澳大利亚金融服务许可机构(AFSL No. 224663)。请阅读并理解我们的《金融服务指南》、《条款与条件》、《隐私政策》和其他披露文件,这些文件可在我们的网站 https://www.moomoo.com/au中获取。

在加拿大,通过moomoo应用提供的仅限订单执行的券商服务由Moomoo Financial Canada Inc.提供,并受加拿大投资监管机构(CIRO)监管。

在马来西亚,moomoo上的投资产品和服务是通过Moomoo Securities Malaysia Sdn. Bhd. 提供,该公司受马来西亚证券监督委员会(SC)监管(牌照号码︰eCMSL/A0397/2024) ,持有资本市场服务牌照 (CMSL) 。本内容未经马来西亚证券监督委员会的审查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd., Futu Securities (Australia) Ltd, Moomoo Financial Canada Inc.,和Moomoo Securities Malaysia Sdn. Bhd.是关联公司。

风险及免责提示

moomoo是Moomoo Technologies Inc.公司提供的金融信息和交易应用程序。

在美国,moomoo上的投资产品和服务由Moomoo Financial Inc.提供,一家受美国证券交易委员会(SEC)监管的持牌主体。 Moomoo Financial Inc.是金融业监管局(FINRA)和证券投资者保护公司(SIPC)的成员。

在新加坡,moomoo上的投资产品和服务是通过Moomoo Financial Singapore Pte. Ltd.提供,该公司受新加坡金融管理局(MAS)监管(牌照号码︰CMS101000) ,持有资本市场服务牌照 (CMS) ,持有财务顾问豁免(Exempt Financial Adviser)资质。本内容未经新加坡金融管理局的审查。

在澳大利亚,moomoo上的金融产品和服务是通过Futu Securities (Australia) Ltd提供,该公司是受澳大利亚证券和投资委员会(ASIC)监管的澳大利亚金融服务许可机构(AFSL No. 224663)。请阅读并理解我们的《金融服务指南》、《条款与条件》、《隐私政策》和其他披露文件,这些文件可在我们的网站 https://www.moomoo.com/au中获取。

在加拿大,通过moomoo应用提供的仅限订单执行的券商服务由Moomoo Financial Canada Inc.提供,并受加拿大投资监管机构(CIRO)监管。

在马来西亚,moomoo上的投资产品和服务是通过Moomoo Securities Malaysia Sdn. Bhd. 提供,该公司受马来西亚证券监督委员会(SC)监管(牌照号码︰eCMSL/A0397/2024) ,持有资本市场服务牌照 (CMSL) 。本内容未经马来西亚证券监督委员会的审查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd., Futu Securities (Australia) Ltd, Moomoo Financial Canada Inc.,和Moomoo Securities Malaysia Sdn. Bhd.是关联公司。

- 分享到weixin

- 分享到qq

- 分享到facebook

- 分享到twitter

- 分享到微博

- 粘贴板

使用浏览器的分享功能,分享给你的好友吧