-

市场

-

产品

-

资讯

-

Moo社区

-

课堂

-

查看更多

-

功能介绍

-

费用费用透明,无最低余额限制

投资选择、功能介绍、费用相关信息由Moomoo Financial Inc.提供

- English

- 中文繁體

- 中文简体

- 深色

- 浅色

Options Corner: A Deep Dive Into Market Sentiment for Goldman Sachs

Options Corner: A Deep Dive Into Market Sentiment for Goldman Sachs

Financial giants have made a conspicuous bearish move on $Goldman Sachs (GS.US)$. Our analysis of options history for Goldman revealed 33 unusual trades.

Delving into the details, we found 48% of traders were bullish, while 51% showed bearish tendencies. Out of all the trades we spotted, 10 were puts, with a value of $1,080,375, and 23 were calls, valued at $1,068,999.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $290.0 to $435.0 for Goldman Sachs Gr over the last 3 months.

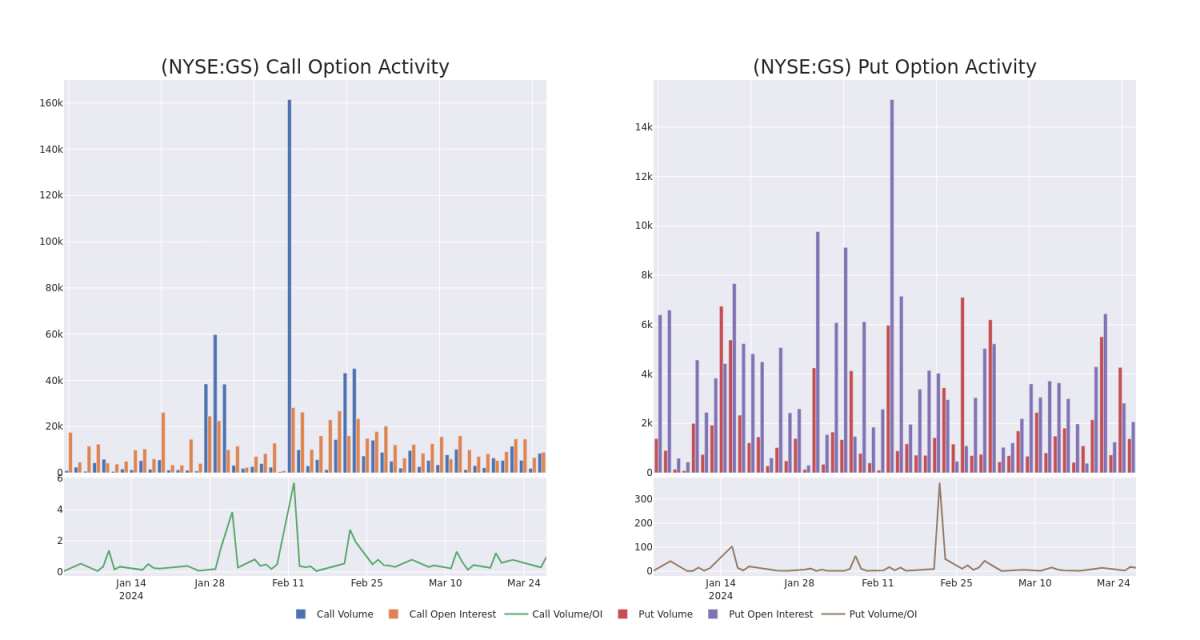

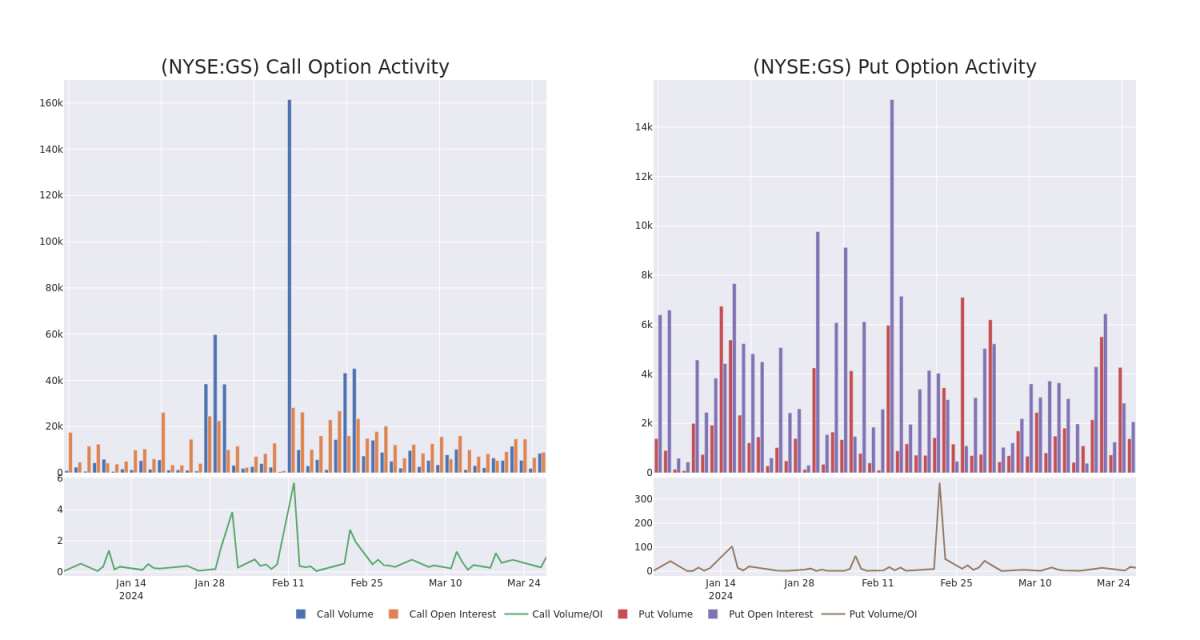

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Goldman Sachs Gr's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Goldman Sachs Gr's substantial trades, within a strike price spectrum from $290.0 to $435.0 over the preceding 30 days.

Goldman Sachs Gr Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

GS | PUT | TRADE | BULLISH | 11/15/24 | $24.5 | $24.25 | $24.35 | $410.00 | $487.0K | 147 | 202 |

GS | PUT | TRADE | BULLISH | 01/17/25 | $21.85 | $21.55 | $21.58 | $390.00 | $129.4K | 1.2K | 60 |

GS | PUT | SWEEP | BEARISH | 05/17/24 | $9.85 | $9.65 | $9.75 | $410.00 | $115.0K | 265 | 271 |

GS | PUT | SWEEP | BEARISH | 05/17/24 | $9.55 | $9.5 | $9.55 | $410.00 | $95.5K | 265 | 613 |

GS | CALL | SWEEP | BULLISH | 04/19/24 | $4.7 | $4.55 | $4.66 | $430.00 | $93.9K | 1.3K | 442 |

About Goldman Sachs

Goldman Sachs is a leading global investment banking and asset management firm. Approximately 20% of its revenue comes from investment banking, 45% from trading, 20% from asset management and 15% from wealth management and retail financial services. Around 60% of the company's net revenue is generated in the Americas, 15% in Asia, and 25% in Europe, the Middle East, and Africa.

Having examined the options trading patterns of Goldman Sachs Gr, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Goldman Sachs

With a trading volume of 1,089,354, the price of GS is up by 0.36%, reaching $416.75.

Current RSI values indicate that the stock is may be approaching overbought.

Next earnings report is scheduled for 18 days from now.

Professional Analyst Ratings for Goldman Sachs Gr

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $430.0.

Showing optimism, an analyst from Daiwa Capital upgrades its rating to Outperform with a revised price target of $430.

An analyst from JP Morgan has decided to maintain their Overweight rating on Goldman Sachs Gr, which currently sits at a price target of $424.

In a cautious move, an analyst from RBC Capital downgraded its rating to Sector Perform, setting a price target of $390.

Maintaining their stance, an analyst from Oppenheimer continues to hold a Outperform rating for Goldman Sachs Gr, targeting a price of $446.

An analyst from HSBC persists with their Buy rating on Goldman Sachs Gr, maintaining a target price of $460.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

Financial giants have made a conspicuous bearish move on $Goldman Sachs (GS.US)$. Our analysis of options history for Goldman revealed 33 unusual trades.

金融巨头采取了明显的看跌举动 $高盛 (GS.US)$。我们对高盛期权历史的分析显示了33笔不寻常的交易。

Delving into the details, we found 48% of traders were bullish, while 51% showed bearish tendencies. Out of all the trades we spotted, 10 were puts, with a value of $1,080,375, and 23 were calls, valued at $1,068,999.

深入研究细节,我们发现48%的交易者看涨,而51%的交易者表现出看跌趋势。在我们发现的所有交易中,有10笔是看跌期权,价值为1,080,375美元,23笔是看涨期权,价值为1,068,999美元。

Projected Price Targets

预计价格目标

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $290.0 to $435.0 for Goldman Sachs Gr over the last 3 months.

考虑到这些合约的交易量和未平仓合约,在过去的3个月中,鲸鱼似乎一直将高盛集团的价格定在290.0美元至435.0美元之间。

Volume & Open Interest Trends

交易量和未平仓合约趋势

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Goldman Sachs Gr's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Goldman Sachs Gr's substantial trades, within a strike price spectrum from $290.0 to $435.0 over the preceding 30 days.

评估交易量和未平仓合约是期权交易的战略步骤。这些指标揭示了高盛集团按指定行使价计算的期权的流动性和投资者对该期权的兴趣。即将发布的数据可视化了与高盛集团的大量交易相关的看涨期权和未平仓合约的波动,在过去30天行使价范围内,从290.0美元到435.0美元不等。

Goldman Sachs Gr Option Activity Analysis: Last 30 Days

高盛 Gr 期权活动分析:过去 30 天

Noteworthy Options Activity:

值得注意的期权活动:

Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

GS |

PUT |

TRADE |

BULLISH |

11/15/24 |

$24.5 |

$24.25 |

$24.35 |

$410.00 |

$487.0K |

147 |

202 |

GS |

PUT |

TRADE |

BULLISH |

01/17/25 |

$21.85 |

$21.55 |

$21.58 |

$390.00 |

$129.4K |

1.2K |

60 |

GS |

PUT |

SWEEP |

BEARISH |

05/17/24 |

$9.85 |

$9.65 |

$9.75 |

$410.00 |

$115.0K |

265 |

271 |

GS |

PUT |

SWEEP |

BEARISH |

05/17/24 |

$9.55 |

$9.5 |

$9.55 |

$410.00 |

$95.5K |

265 |

613 |

GS |

CALL |

SWEEP |

BULLISH |

04/19/24 |

$4.7 |

$4.55 |

$4.66 |

$430.00 |

$93.9K |

1.3K |

442 |

符号 |

看跌/看涨 |

交易类型 |

情绪 |

Exp。日期 |

问 |

出价 |

价格 |

行使价 |

总交易价格 |

未平仓合约 |

音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

GS |

放 |

贸易 |

看涨 |

11/15/24 |

24.5 美元 |

24.25 美元 |

24.35 |

410.00 美元 |

487.0 万美元 |

147 |

202 |

GS |

放 |

贸易 |

看涨 |

01/17/25 |

21.85 美元 |

21.55 美元 |

21.58 美元 |

390.00 美元 |

129.4 万美元 |

1.2K |

60 |

GS |

放 |

扫 |

粗鲁的 |

05/17/24 |

9.85 美元 |

9.65 美元 |

9.75 美元 |

410.00 美元 |

115.0 万美元 |

265 |

271 |

GS |

放 |

扫 |

粗鲁的 |

05/17/24 |

9.55 美元 |

9.5 美元 |

9.55 美元 |

410.00 美元 |

95.5 万美元 |

265 |

613 |

GS |

打电话 |

扫 |

看涨 |

04/19/24 |

4.7 美元 |

4.55 美元 |

4.66 美元 |

430.00 美元 |

93.9 万美元 |

1.3K |

442 |

About Goldman Sachs

关于高盛

Goldman Sachs is a leading global investment banking and asset management firm. Approximately 20% of its revenue comes from investment banking, 45% from trading, 20% from asset management and 15% from wealth management and retail financial services. Around 60% of the company's net revenue is generated in the Americas, 15% in Asia, and 25% in Europe, the Middle East, and Africa.

高盛是一家领先的全球投资银行和资产管理公司。其收入中约有20%来自投资银行,45%来自交易,20%来自资产管理,15%来自财富管理和零售金融服务。该公司约60%的净收入来自美洲,15%来自亚洲,25%来自欧洲、中东和非洲。

Having examined the options trading patterns of Goldman Sachs Gr, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了高盛集团的期权交易模式之后,我们的注意力现在直接转向了该公司。这种转变使我们能够深入研究其目前的市场地位和表现

Present Market Standing of Goldman Sachs

高盛目前的市场状况

With a trading volume of 1,089,354, the price of GS is up by 0.36%, reaching $416.75.

Current RSI values indicate that the stock is may be approaching overbought.

Next earnings report is scheduled for 18 days from now.

GS的交易量为1,089,354美元,上涨了0.36%,达到416.75美元。

当前的RSI值表明该股可能已接近超买。

下一份收益报告定于即日起18天后发布。

Professional Analyst Ratings for Goldman Sachs Gr

高盛集团的专业分析师评级

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $430.0.

在过去的30天中,共有5位专业分析师对该股发表了看法,将平均目标股价定为430.0美元。

Showing optimism, an analyst from Daiwa Capital upgrades its rating to Outperform with a revised price target of $430.

An analyst from JP Morgan has decided to maintain their Overweight rating on Goldman Sachs Gr, which currently sits at a price target of $424.

In a cautious move, an analyst from RBC Capital downgraded its rating to Sector Perform, setting a price target of $390.

Maintaining their stance, an analyst from Oppenheimer continues to hold a Outperform rating for Goldman Sachs Gr, targeting a price of $446.

An analyst from HSBC persists with their Buy rating on Goldman Sachs Gr, maintaining a target price of $460.

大和资本的一位分析师表现出乐观的态度,将其评级上调至跑赢大盘,目标股价为430美元。

摩根大通的一位分析师已决定维持对高盛集团的增持评级,目前的目标股价为424美元。

加拿大皇家银行资本的一位分析师谨慎地将其评级下调至行业绩效,将目标股价定为390美元。

奥本海默的一位分析师保持立场,继续维持高盛集团跑赢大盘的评级,目标股价为446美元。

汇丰银行的一位分析师坚持对高盛集团的买入评级,维持460美元的目标价。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

与仅交易股票相比,期权是一种风险更高的资产,但它们具有更高的获利潜力。严肃的期权交易者通过每天自我教育、扩大交易规模、关注多个指标以及密切关注市场来管理这种风险。

moomoo是Moomoo Technologies Inc.公司提供的金融信息和交易应用程序。

在美国,moomoo上的投资产品和服务由Moomoo Financial Inc.提供,一家受美国证券交易委员会(SEC)监管的持牌主体。 Moomoo Financial Inc.是金融业监管局(FINRA)和证券投资者保护公司(SIPC)的成员。

在新加坡,moomoo上的投资产品和服务是通过Moomoo Financial Singapore Pte. Ltd.提供,该公司受新加坡金融管理局(MAS)监管(牌照号码︰CMS101000) ,持有资本市场服务牌照 (CMS) ,持有财务顾问豁免(Exempt Financial Adviser)资质。本内容未经新加坡金融管理局的审查。

在澳大利亚,moomoo上的金融产品和服务是通过Futu Securities (Australia) Ltd提供,该公司是受澳大利亚证券和投资委员会(ASIC)监管的澳大利亚金融服务许可机构(AFSL No. 224663)。请阅读并理解我们的《金融服务指南》、《条款与条件》、《隐私政策》和其他披露文件,这些文件可在我们的网站 https://www.moomoo.com/au中获取。

在加拿大,通过moomoo应用提供的仅限订单执行的券商服务由Moomoo Financial Canada Inc.提供,并受加拿大投资监管机构(CIRO)监管。

在马来西亚,moomoo上的投资产品和服务是通过Moomoo Securities Malaysia Sdn. Bhd. 提供,该公司受马来西亚证券监督委员会(SC)监管(牌照号码︰eCMSL/A0397/2024) ,持有资本市场服务牌照 (CMSL) 。本内容未经马来西亚证券监督委员会的审查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd., Futu Securities (Australia) Ltd, Moomoo Financial Canada Inc.,和Moomoo Securities Malaysia Sdn. Bhd.是关联公司。

风险及免责提示

moomoo是Moomoo Technologies Inc.公司提供的金融信息和交易应用程序。

在美国,moomoo上的投资产品和服务由Moomoo Financial Inc.提供,一家受美国证券交易委员会(SEC)监管的持牌主体。 Moomoo Financial Inc.是金融业监管局(FINRA)和证券投资者保护公司(SIPC)的成员。

在新加坡,moomoo上的投资产品和服务是通过Moomoo Financial Singapore Pte. Ltd.提供,该公司受新加坡金融管理局(MAS)监管(牌照号码︰CMS101000) ,持有资本市场服务牌照 (CMS) ,持有财务顾问豁免(Exempt Financial Adviser)资质。本内容未经新加坡金融管理局的审查。

在澳大利亚,moomoo上的金融产品和服务是通过Futu Securities (Australia) Ltd提供,该公司是受澳大利亚证券和投资委员会(ASIC)监管的澳大利亚金融服务许可机构(AFSL No. 224663)。请阅读并理解我们的《金融服务指南》、《条款与条件》、《隐私政策》和其他披露文件,这些文件可在我们的网站 https://www.moomoo.com/au中获取。

在加拿大,通过moomoo应用提供的仅限订单执行的券商服务由Moomoo Financial Canada Inc.提供,并受加拿大投资监管机构(CIRO)监管。

在马来西亚,moomoo上的投资产品和服务是通过Moomoo Securities Malaysia Sdn. Bhd. 提供,该公司受马来西亚证券监督委员会(SC)监管(牌照号码︰eCMSL/A0397/2024) ,持有资本市场服务牌照 (CMSL) 。本内容未经马来西亚证券监督委员会的审查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd., Futu Securities (Australia) Ltd, Moomoo Financial Canada Inc.,和Moomoo Securities Malaysia Sdn. Bhd.是关联公司。

- 分享到weixin

- 分享到qq

- 分享到facebook

- 分享到twitter

- 分享到微博

- 粘贴板

使用浏览器的分享功能,分享给你的好友吧