A Closer Look at Palo Alto Networks's Options Market Dynamics

A Closer Look at Palo Alto Networks's Options Market Dynamics

Whales with a lot of money to spend have taken a noticeably bearish stance on Palo Alto Networks.

有很多钱可以花的鲸鱼对帕洛阿尔托网络采取了明显的看跌立场。

Looking at options history for Palo Alto Networks (NASDAQ:PANW) we detected 21 trades.

查看帕洛阿尔托网络(纳斯达克股票代码:PANW)的期权历史记录,我们发现了21笔交易。

If we consider the specifics of each trade, it is accurate to state that 38% of the investors opened trades with bullish expectations and 61% with bearish.

如果我们考虑每笔交易的具体情况,可以准确地说,38%的投资者以看涨的预期开仓,61%的投资者以看跌的预期开盘。

From the overall spotted trades, 2 are puts, for a total amount of $66,255 and 19, calls, for a total amount of $1,290,185.

在已发现的全部交易中,有2笔是看跌期权,总额为66,255美元,19笔看涨期权,总额为1,290,185美元。

Expected Price Movements

预期的价格走势

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $200.0 to $320.0 for Palo Alto Networks during the past quarter.

分析这些合约的交易量和未平仓合约,看来大型企业一直在关注帕洛阿尔托网络在过去一个季度的价格范围从200.0美元到320.0美元不等。

Insights into Volume & Open Interest

对交易量和未平仓合约的见解

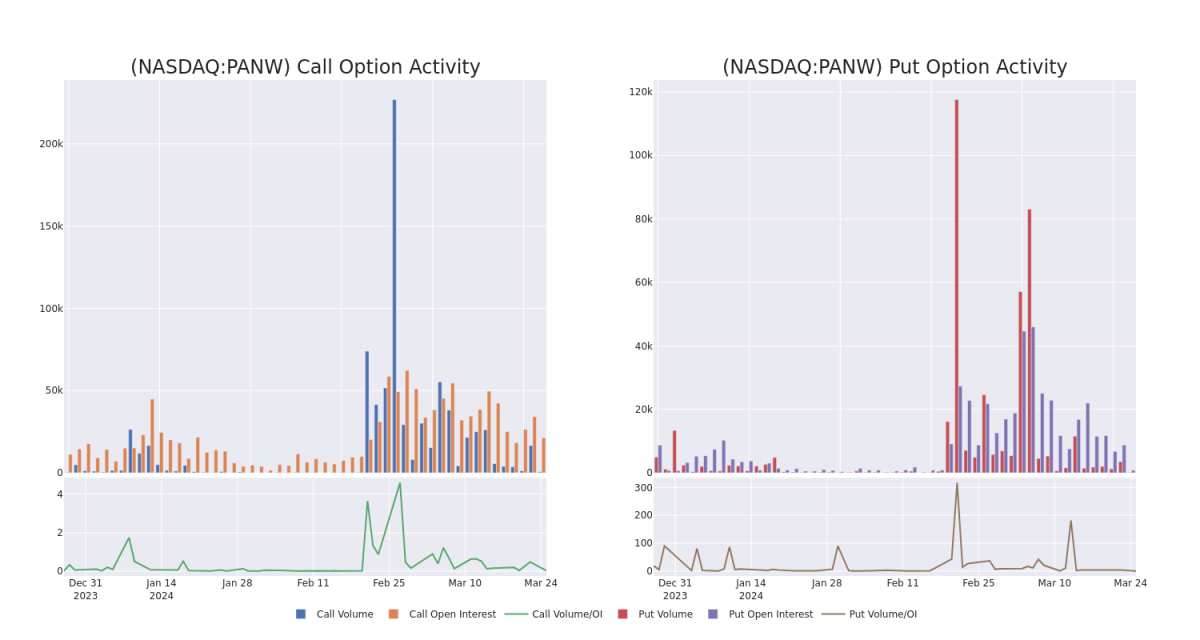

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Palo Alto Networks's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Palo Alto Networks's substantial trades, within a strike price spectrum from $200.0 to $320.0 over the preceding 30 days.

评估交易量和未平仓合约是期权交易的战略步骤。这些指标揭示了Palo Alto Networks按指定行使价计算的期权的流动性和投资者对它们的兴趣。即将发布的数据可视化了与Palo Alto Networks的大量交易相关的看涨期权和未平仓合约的波动,在过去30天内,行使价范围从200美元到320.0美元不等。

Palo Alto Networks Option Volume And Open Interest Over Last 30 Days

帕洛阿尔托网络过去 30 天的期权交易量和未平仓合约

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| PANW | CALL | TRADE | BULLISH | 06/21/24 | $300.00 | $173.5K | 2.8K | 36 |

| PANW | CALL | TRADE | BEARISH | 09/19/25 | $300.00 | $150.9K | 239 | 26 |

| PANW | CALL | TRADE | BULLISH | 06/21/24 | $280.00 | $134.6K | 4.7K | 93 |

| PANW | CALL | TRADE | BULLISH | 01/16/26 | $320.00 | $114.4K | 230 | 0 |

| PANW | CALL | TRADE | BULLISH | 06/21/24 | $290.00 | $108.0K | 1.3K | 57 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|

| 平底锅 | 打电话 | 贸易 | 看涨 | 06/21/24 | 300.00 美元 | 17.35 万美元 | 2.8K | 36 |

| 平底锅 | 打电话 | 贸易 | 粗鲁的 | 09/19/25 | 300.00 美元 | 15.09 万美元 | 239 | 26 |

| 平底锅 | 打电话 | 贸易 | 看涨 | 06/21/24 | 280.00 美元 | 134.6 万美元 | 4.7K | 93 |

| 平底锅 | 打电话 | 贸易 | 看涨 | 01/16/26 | 320.00 美元 | 114.4 万美元 | 230 | 0 |

| 平底锅 | 打电话 | 贸易 | 看涨 | 06/21/24 | 290.00 美元 | 108.0 万美元 | 1.3K | 57 |

About Palo Alto Networks

关于帕洛阿尔托网络

Palo Alto Networks is a platform-based cybersecurity vendor with product offerings covering network security, cloud security, and security operations. The California-based firm has more than 85,000 customers across the world, including more than three fourths of the Global 2000.

Palo Alto Networks是一家基于平台的网络安全供应商,其产品涵盖网络安全、云安全和安全运营。这家总部位于加利福尼亚的公司在全球拥有超过8.5万名客户,其中包括全球2000强企业的四分之三以上。

In light of the recent options history for Palo Alto Networks, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鉴于帕洛阿尔托网络最近的期权历史,现在应该将重点放在公司本身上。我们的目标是探索其目前的表现。

Where Is Palo Alto Networks Standing Right Now?

帕洛阿尔托网络现在在哪里?

- Trading volume stands at 940,487, with PANW's price down by -0.41%, positioned at $285.6.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 57 days.

- 交易量为940,487美元,PANW的价格下跌了-0.41%,为285.6美元。

- RSI指标显示该股可能接近超卖。

- 预计将在57天后公布财报。

Professional Analyst Ratings for Palo Alto Networks

帕洛阿尔托网络的专业分析师评级

A total of 3 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $335.0.

在过去的30天中,共有3位专业分析师对该股发表了看法,将平均目标股价设定为335.0美元。

- Reflecting concerns, an analyst from Stifel lowers its rating to Buy with a new price target of $330.

- An analyst from Redburn Atlantic persists with their Buy rating on Palo Alto Networks, maintaining a target price of $350.

- Maintaining their stance, an analyst from Susquehanna continues to hold a Positive rating for Palo Alto Networks, targeting a price of $325.

- Stifel的一位分析师将其评级下调至买入,新的目标股价为330美元,这反映了人们的担忧。

- Redburn Atlantic的一位分析师坚持对帕洛阿尔托网络的买入评级,维持350美元的目标价。

- 萨斯奎哈纳的一位分析师保持立场,继续对帕洛阿尔托网络持正面评级,目标价格为325美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

与仅交易股票相比,期权是一种风险更高的资产,但它们具有更高的获利潜力。严肃的期权交易者通过每天自我教育、扩大交易规模、关注多个指标以及密切关注市场来管理这种风险。