-

市场

-

产品

-

资讯

-

Moo社区

-

课堂

-

查看更多

-

功能介绍

-

费用费用透明,无最低余额限制

投资选择、功能介绍、费用相关信息由Moomoo Financial Inc.提供

- English

- 中文繁體

- 中文简体

- 深色

- 浅色

Behind the Scenes of Affirm Holdings's Latest Options Trends

Behind the Scenes of Affirm Holdings's Latest Options Trends

Investors with a lot of money to spend have taken a bearish stance on Affirm Holdings (NASDAQ:AFRM).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with AFRM, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 16 uncommon options trades for Affirm Holdings.

This isn't normal.

The overall sentiment of these big-money traders is split between 18% bullish and 81%, bearish.

Out of all of the special options we uncovered, 7 are puts, for a total amount of $316,004, and 9 are calls, for a total amount of $357,634.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $32.0 and $50.0 for Affirm Holdings, spanning the last three months.

Volume & Open Interest Development

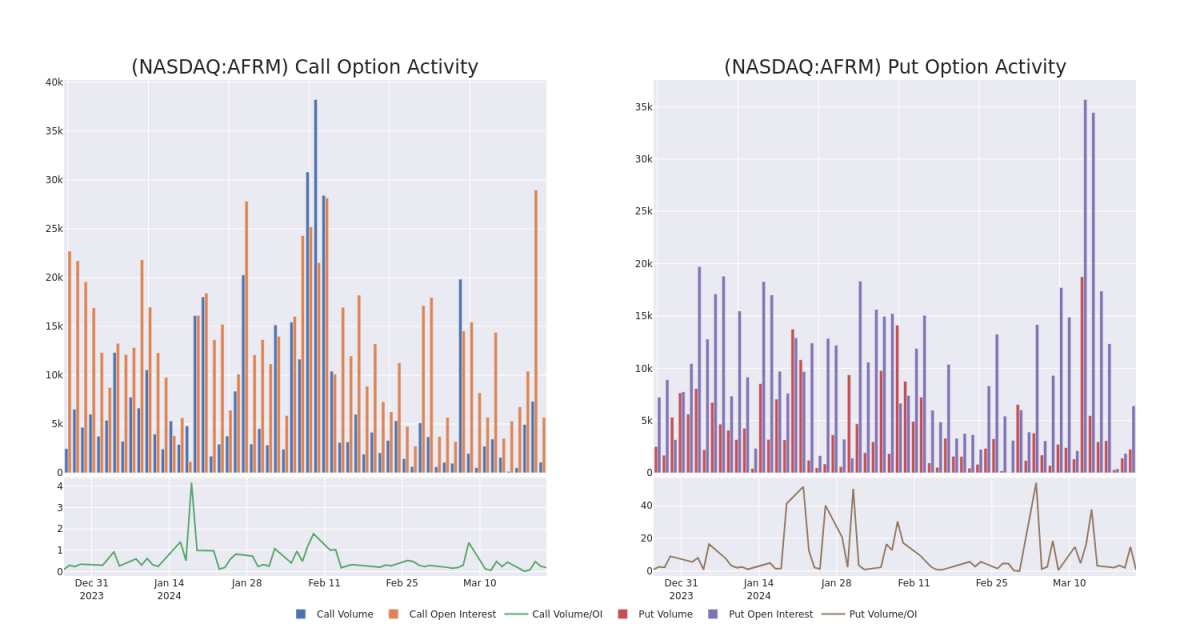

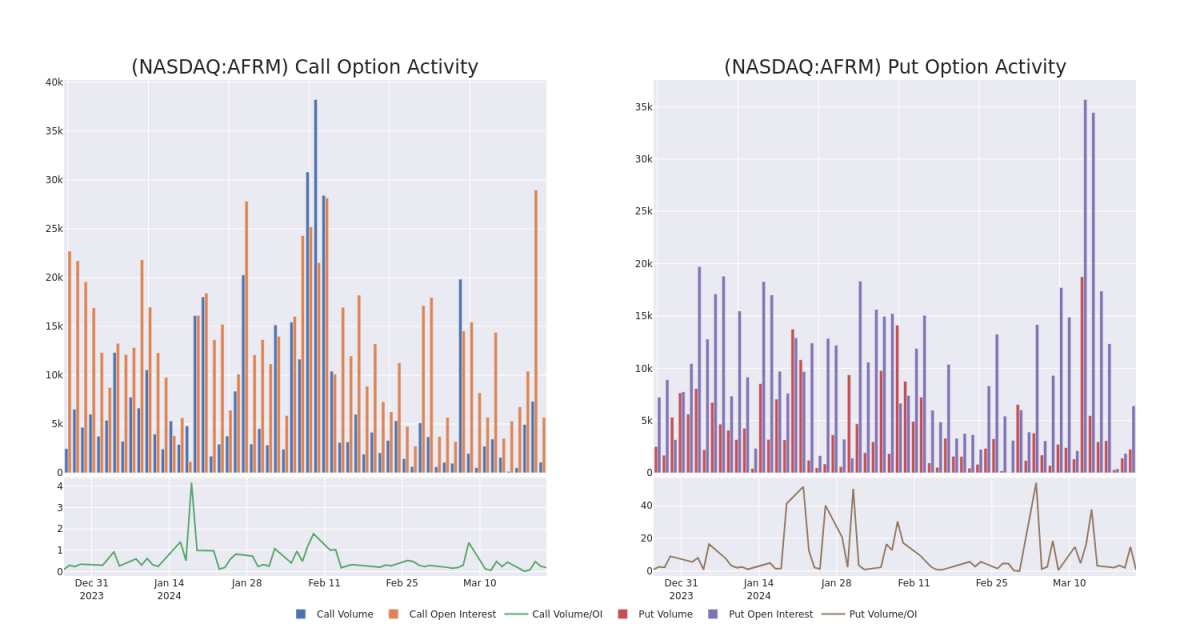

In today's trading context, the average open interest for options of Affirm Holdings stands at 928.77, with a total volume reaching 3,331.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Affirm Holdings, situated within the strike price corridor from $32.0 to $50.0, throughout the last 30 days.

Affirm Holdings Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| AFRM | CALL | SWEEP | NEUTRAL | 04/05/24 | $37.50 | $96.0K | 20 | 570 |

| AFRM | PUT | TRADE | NEUTRAL | 03/22/24 | $39.00 | $74.9K | 2.5K | 717 |

| AFRM | PUT | TRADE | BEARISH | 03/22/24 | $39.00 | $72.8K | 2.5K | 992 |

| AFRM | PUT | SWEEP | BEARISH | 04/19/24 | $40.00 | $41.6K | 1.8K | 80 |

| AFRM | PUT | SWEEP | BEARISH | 01/17/25 | $40.00 | $40.9K | 1.3K | 33 |

About Affirm Holdings

Affirm Holdings Inc offers a platform for digital and mobile-first commerce. It comprises a point-of-sale payment solution for consumers, merchant commerce solutions, and a consumer-focused app. The firm generates its revenue from merchant networks, and through virtual card networks among others. Geographically, it generates a majority share of its revenue from the United States.

Following our analysis of the options activities associated with Affirm Holdings, we pivot to a closer look at the company's own performance.

Affirm Holdings's Current Market Status

- Trading volume stands at 3,212,632, with AFRM's price down by -1.36%, positioned at $37.0.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 46 days.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

Investors with a lot of money to spend have taken a bearish stance on Affirm Holdings (NASDAQ:AFRM).

有大量资金可以花的投资者对Affirm Holdings(纳斯达克股票代码:AFRM)采取了看跌立场。

And retail traders should know.

零售交易者应该知道。

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

今天,当交易出现在我们在本辛加追踪的公开期权历史记录上时,我们注意到了这一点。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with AFRM, it often means somebody knows something is about to happen.

无论这些是机构还是仅仅是富人,我们都不知道。但是,当AFRM发生这么大的事情时,通常意味着有人知道某件事即将发生。

So how do we know what these investors just did?

那么我们怎么知道这些投资者刚才做了什么?

Today, Benzinga's options scanner spotted 16 uncommon options trades for Affirm Holdings.

今天,本辛加的期权扫描仪发现了Affirm Holdings的16笔不常见的期权交易。

This isn't normal.

这不正常。

The overall sentiment of these big-money traders is split between 18% bullish and 81%, bearish.

这些大额交易者的整体情绪分为18%看涨和81%(看跌)。

Out of all of the special options we uncovered, 7 are puts, for a total amount of $316,004, and 9 are calls, for a total amount of $357,634.

在我们发现的所有特殊期权中,有7个是看跌期权,总额为316,004美元,9个是看涨期权,总额为357,634美元。

What's The Price Target?

目标价格是多少?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $32.0 and $50.0 for Affirm Holdings, spanning the last three months.

在评估了交易量和未平仓合约之后,很明显,主要市场走势者正在关注过去三个月Affirm Holdings在32.0美元至50.0美元之间的价格区间。

Volume & Open Interest Development

交易量和未平仓合约的发展

In today's trading context, the average open interest for options of Affirm Holdings stands at 928.77, with a total volume reaching 3,331.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Affirm Holdings, situated within the strike price corridor from $32.0 to $50.0, throughout the last 30 days.

在当今的交易背景下,Affirm Holdings期权的平均未平仓合约为928.77,总交易量达到3,331.00。随附的图表描绘了过去30天Affirm Holdings高价值交易的看涨和看跌期权交易量以及未平仓合约的变化情况,行使价走势从32.0美元到50.0美元不等。

Affirm Holdings Option Activity Analysis: Last 30 Days

Affirm Holdings 期权活动分析:过去 30 天

Significant Options Trades Detected:

检测到的重要期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| AFRM | CALL | SWEEP | NEUTRAL | 04/05/24 | $37.50 | $96.0K | 20 | 570 |

| AFRM | PUT | TRADE | NEUTRAL | 03/22/24 | $39.00 | $74.9K | 2.5K | 717 |

| AFRM | PUT | TRADE | BEARISH | 03/22/24 | $39.00 | $72.8K | 2.5K | 992 |

| AFRM | PUT | SWEEP | BEARISH | 04/19/24 | $40.00 | $41.6K | 1.8K | 80 |

| AFRM | PUT | SWEEP | BEARISH | 01/17/25 | $40.00 | $40.9K | 1.3K | 33 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|

| 农场 | 打电话 | 扫 | 中立 | 04/05/24 | 37.50 | 96.0 万美元 | 20 | 570 |

| 农场 | 放 | 贸易 | 中立 | 03/22/24 | 39.00 美元 | 74.9 万美元 | 2.5K | 717 |

| 农场 | 放 | 贸易 | 粗鲁的 | 03/22/24 | 39.00 美元 | 72.8 万美元 | 2.5K | 992 |

| 农场 | 放 | 扫 | 粗鲁的 | 04/19/24 | 40.00 美元 | 41.6K | 1.8K | 80 |

| 农场 | 放 | 扫 | 粗鲁的 | 01/17/25 | 40.00 美元 | 40.9 万美元 | 1.3K | 33 |

About Affirm Holdings

关于 Affirm 控股公司

Affirm Holdings Inc offers a platform for digital and mobile-first commerce. It comprises a point-of-sale payment solution for consumers, merchant commerce solutions, and a consumer-focused app. The firm generates its revenue from merchant networks, and through virtual card networks among others. Geographically, it generates a majority share of its revenue from the United States.

Affirm Holdings Inc为数字和移动优先商务提供了一个平台。它包括面向消费者的销售点支付解决方案、商户商务解决方案和以消费者为中心的应用程序。该公司的收入来自商户网络以及虚拟卡网络等。从地理上讲,它的大部分收入来自美国。

Following our analysis of the options activities associated with Affirm Holdings, we pivot to a closer look at the company's own performance.

在分析了与Affirm Holdings相关的期权活动之后,我们将转向仔细研究公司自身的业绩。

Affirm Holdings's Current Market Status

Affirm Holdings的当前市场状况

- Trading volume stands at 3,212,632, with AFRM's price down by -1.36%, positioned at $37.0.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 46 days.

- 交易量为3,212,632美元,AFRM的价格下跌了-1.36%,为37.0美元。

- RSI指标显示该股可能接近超买。

- 预计将在46天内公布财报。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

与仅交易股票相比,期权是一种风险更高的资产,但它们具有更高的获利潜力。严肃的期权交易者通过每天自我教育、扩大交易规模、关注多个指标以及密切关注市场来管理这种风险。

moomoo是Moomoo Technologies Inc.公司提供的金融信息和交易应用程序。

在美国,moomoo上的投资产品和服务由Moomoo Financial Inc.提供,一家受美国证券交易委员会(SEC)监管的持牌主体。 Moomoo Financial Inc.是金融业监管局(FINRA)和证券投资者保护公司(SIPC)的成员。

在新加坡,moomoo上的投资产品和服务是通过Moomoo Financial Singapore Pte. Ltd.提供,该公司受新加坡金融管理局(MAS)监管(牌照号码︰CMS101000) ,持有资本市场服务牌照 (CMS) ,持有财务顾问豁免(Exempt Financial Adviser)资质。本内容未经新加坡金融管理局的审查。

在澳大利亚,moomoo上的金融产品和服务是通过Futu Securities (Australia) Ltd提供,该公司是受澳大利亚证券和投资委员会(ASIC)监管的澳大利亚金融服务许可机构(AFSL No. 224663)。请阅读并理解我们的《金融服务指南》、《条款与条件》、《隐私政策》和其他披露文件,这些文件可在我们的网站 https://www.moomoo.com/au中获取。

在加拿大,通过moomoo应用提供的仅限订单执行的券商服务由Moomoo Financial Canada Inc.提供,并受加拿大投资监管机构(CIRO)监管。

在马来西亚,moomoo上的投资产品和服务是通过Moomoo Securities Malaysia Sdn. Bhd. 提供,该公司受马来西亚证券监督委员会(SC)监管(牌照号码︰eCMSL/A0397/2024) ,持有资本市场服务牌照 (CMSL) 。本内容未经马来西亚证券监督委员会的审查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd., Futu Securities (Australia) Ltd, Moomoo Financial Canada Inc.,和Moomoo Securities Malaysia Sdn. Bhd.是关联公司。

风险及免责提示

moomoo是Moomoo Technologies Inc.公司提供的金融信息和交易应用程序。

在美国,moomoo上的投资产品和服务由Moomoo Financial Inc.提供,一家受美国证券交易委员会(SEC)监管的持牌主体。 Moomoo Financial Inc.是金融业监管局(FINRA)和证券投资者保护公司(SIPC)的成员。

在新加坡,moomoo上的投资产品和服务是通过Moomoo Financial Singapore Pte. Ltd.提供,该公司受新加坡金融管理局(MAS)监管(牌照号码︰CMS101000) ,持有资本市场服务牌照 (CMS) ,持有财务顾问豁免(Exempt Financial Adviser)资质。本内容未经新加坡金融管理局的审查。

在澳大利亚,moomoo上的金融产品和服务是通过Futu Securities (Australia) Ltd提供,该公司是受澳大利亚证券和投资委员会(ASIC)监管的澳大利亚金融服务许可机构(AFSL No. 224663)。请阅读并理解我们的《金融服务指南》、《条款与条件》、《隐私政策》和其他披露文件,这些文件可在我们的网站 https://www.moomoo.com/au中获取。

在加拿大,通过moomoo应用提供的仅限订单执行的券商服务由Moomoo Financial Canada Inc.提供,并受加拿大投资监管机构(CIRO)监管。

在马来西亚,moomoo上的投资产品和服务是通过Moomoo Securities Malaysia Sdn. Bhd. 提供,该公司受马来西亚证券监督委员会(SC)监管(牌照号码︰eCMSL/A0397/2024) ,持有资本市场服务牌照 (CMSL) 。本内容未经马来西亚证券监督委员会的审查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd., Futu Securities (Australia) Ltd, Moomoo Financial Canada Inc.,和Moomoo Securities Malaysia Sdn. Bhd.是关联公司。

- 分享到weixin

- 分享到qq

- 分享到facebook

- 分享到twitter

- 分享到微博

- 粘贴板

使用浏览器的分享功能,分享给你的好友吧