Analysts Expect Breakeven For Global-E Online Ltd. (NASDAQ:GLBE) Before Long

Analysts Expect Breakeven For Global-E Online Ltd. (NASDAQ:GLBE) Before Long

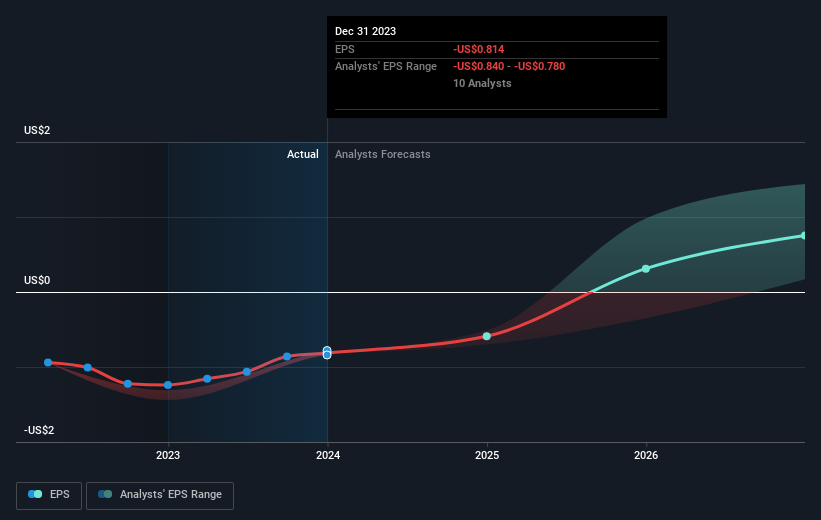

We feel now is a pretty good time to analyse Global-E Online Ltd.'s (NASDAQ:GLBE) business as it appears the company may be on the cusp of a considerable accomplishment. Global-E Online Ltd., together with its subsidiaries, provides a platform to enable and accelerate direct-to-consumer cross-border e-commerce in Israel, the United Kingdom, the United States, and internationally. The US$5.9b market-cap company announced a latest loss of US$134m on 31 December 2023 for its most recent financial year result. As path to profitability is the topic on Global-E Online's investors mind, we've decided to gauge market sentiment. We've put together a brief outline of industry analyst expectations for the company, its year of breakeven and its implied growth rate.

我们认为现在是分析Global-E Online Ltd的好时机。”s(纳斯达克股票代码:GLBE)的业务看来该公司可能正处于取得重大成就的风口浪尖。Global-E Online Ltd. 及其子公司为在以色列、英国、美国和国际上实现和加速直接面向消费者的跨境电子商务提供了一个平台。这家市值为59亿美元的公司于2023年12月31日宣布其最新财年业绩亏损1.34亿美元。由于盈利之路是Global-E Online投资者心目中的话题,我们决定评估市场情绪。我们简要概述了行业分析师对该公司、盈亏平衡年份和隐含增长率的预期。

According to the 14 industry analysts covering Global-E Online, the consensus is that breakeven is near. They anticipate the company to incur a final loss in 2025, before generating positive profits of US$148m in 2026. The company is therefore projected to breakeven around 2 years from today. In order to meet this breakeven date, we calculated the rate at which the company must grow year-on-year. It turns out an average annual growth rate of 85% is expected, which is extremely buoyant. Should the business grow at a slower rate, it will become profitable at a later date than expected.

根据报道Global-E Online的14位行业分析师的说法,人们的共识是盈亏平衡已临近。他们预计该公司将在2025年蒙受最终亏损,然后在2026年产生1.48亿美元的正利润。因此,预计从今天起大约2年后,该公司将实现盈亏平衡。为了达到这个盈亏平衡日期,我们计算了公司必须同比增长的速度。事实证明,预计年均增长率为85%,非常活跃。如果业务增长速度放缓,则盈利的时间将比预期的晚。

Given this is a high-level overview, we won't go into details of Global-E Online's upcoming projects, but, keep in mind that by and large a high forecast growth rate is not unusual for a company that is currently undergoing an investment period.

鉴于这是一个高层次的概述,我们不会详细介绍Global-E Online即将推出的项目,但请记住,总的来说,高预测增长率对于目前处于投资期的公司来说并不少见。

Before we wrap up, there's one aspect worth mentioning. Global-E Online currently has no debt on its balance sheet, which is rare for a loss-making growth company, which usually has a high level of debt relative to its equity. This means that the company has been operating purely on its equity investment and has no debt burden. This aspect reduces the risk around investing in the loss-making company.

在我们总结之前,有一个方面值得一提。Global-E Online目前的资产负债表上没有债务,这对于亏损的成长型公司来说是罕见的,因为相对于其股权而言,债务水平通常很高。这意味着该公司一直完全依靠股权投资运营,没有债务负担。这方面降低了投资这家亏损公司的风险。

Next Steps:

后续步骤:

There are too many aspects of Global-E Online to cover in one brief article, but the key fundamentals for the company can all be found in one place – Global-E Online's company page on Simply Wall St. We've also compiled a list of pertinent aspects you should further research:

Global-E Online的很多方面都无法在一篇简短的文章中介绍,但是该公司的关键基础知识都可以在一个地方找到——Global-E Online在Simply Wall St的公司页面。我们还整理了一份值得进一步研究的相关方面清单:

- Valuation: What is Global-E Online worth today? Has the future growth potential already been factored into the price? The intrinsic value infographic in our free research report helps visualize whether Global-E Online is currently mispriced by the market.

- Management Team: An experienced management team on the helm increases our confidence in the business – take a look at who sits on Global-E Online's board and the CEO's background.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

- 估值:Global-E Online 今天的价值是多少?价格中是否已经考虑了未来的增长潜力?我们的免费研究报告中的内在价值信息图有助于可视化Global-E Online目前是否被市场错误定价。

- 管理团队:一支经验丰富的管理团队掌舵增强了我们对业务的信心——看看谁是Global-E Online董事会成员以及首席执行官的背景。

- 其他表现优异的股票:还有其他股票可以提供更好的前景并有良好的往绩记录吗?在这里浏览我们免费列出的这些优质股票。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧?直接联系我们。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St的这篇文章本质上是笼统的。我们仅使用公正的方法根据历史数据和分析师的预测提供评论,我们的文章无意作为财务建议。它不构成买入或卖出任何股票的建议,也没有考虑到您的目标或财务状况。我们的目标是为您提供由基本数据驱动的长期重点分析。请注意,我们的分析可能不考虑最新的价格敏感型公司公告或定性材料。简而言之,华尔街没有持有任何上述股票的头寸。