Cognex Empowers Investors With Solid Returns and Fueling Shareholder Value

Cognex Empowers Investors With Solid Returns and Fueling Shareholder Value

At the end of today, March 14, 2024, Cognex (NASDAQ:CGNX) will distribute a dividend payout of $0.07 per share, translating to an annualized dividend yield of 0.83%. Shareholders who held the stock before the ex-dividend date on February 28, 2024 will benefit from this payout.

在今天结束时,也就是 2024 年 3 月 14 日, 康耐视(纳斯达克股票代码:CGNX) 将分配每股0.07美元的股息,相当于0.83%的年化股息收益率。在2024年2月28日除息日之前持有股票的股东将受益于这笔派息。

Cognex Recent Dividend Payouts

康耐视最近的股息支出

| Ex-Date | Payments per year | Dividend | Yield | Announced | Record | Payable |

|---|---|---|---|---|---|---|

| 2024-02-28 | 4$0.07 | 0.83% | 2024-02-15 | 2024-02-29 | 2024-03-14 | |

| 2023-11-16 | 4$0.07 | 0.86% | 2023-10-31 | 2023-11-17 | 2023-12-01 | |

| 2023-08-17 | 4$0.07 | 0.55% | 2023-08-03 | 2023-08-18 | 2023-09-01 | |

| 2023-05-18 | 4$0.07 | 0.59% | 2023-05-04 | 2023-05-19 | 2023-06-02 | |

| 2023-03-02 | 4$0.07 | 0.5% | 2023-02-16 | 2023-03-03 | 2023-03-17 | |

| 2022-11-17 | 4$0.07 | 0.66% | 2022-11-03 | 2022-11-18 | 2022-12-02 | |

| 2022-08-18 | 4$0.07 | 0.51% | 2022-08-02 | 2022-08-19 | 2022-09-02 | |

| 2022-05-19 | 4$0.07 | 0.38% | 2022-05-05 | 2022-05-20 | 2022-06-03 | |

| 2022-03-03 | 4$0.07 | 0.41% | 2022-02-17 | 2022-03-04 | 2022-03-18 | |

| 2021-11-18 | 4$0.07 | 0.29% | 2021-11-04 | 2021-11-19 | 2021-12-03 | |

| 2021-08-19 | 4$0.06 | 0.27% | 2021-08-05 | 2021-08-20 | 2021-09-03 | |

| 2021-05-20 | 4$0.06 | 0.3% | 2021-05-06 | 2021-05-21 | 2021-06-04 |

| 过期日期 | 每年付款 | 分红 | 收益率 | 已宣布 | 记录 | 应付款 |

|---|---|---|---|---|---|---|

| 2024-02-28 | 40.07 | 0.83% | 2024-02-15 | 2024-02-29 | 2024-03-14 | |

| 2023-11-16 | 40.07 | 0.86% | 2023-10-31 | 2023-11-17 | 2023-12-01 | |

| 2023-08-17 | 40.07 | 0.55% | 2023-08-03 | 2023-08-18 | 2023-09-01 | |

| 2023-05-18 | 40.07 | 0.59% | 2023-05-04 | 2023-05-19 | 2023-06-02 | |

| 2023-03-02 | 40.07 | 0.5% | 2023-02-16 | 2023-03-03 | 2023-03-17 | |

| 2022-11-17 | 40.07 | 0.66% | 2022-11-03 | 2022-11-18 | 2022-12-02 | |

| 2022-08-18 | 40.07 | 0.51% | 2022-08-02 | 2022-08-19 | 2022-09-02 | |

| 2022-05-19 | 40.07 | 0.38% | 2022-05-05 | 2022-05-20 | 2022-06-03 | |

| 2022-03-03 | 40.07 | 0.41% | 2022-02-17 | 2022-03-04 | 2022-03-18 | |

| 2021-11-18 | 40.07 | 0.29% | 2021-11-04 | 2021-11-19 | 2021-12-03 | |

| 2021-08-19 | 40.06 | 0.27% | 2021-08-05 | 2021-08-20 | 2021-09-03 | |

| 2021-05-20 | 40.06 | 0.3% | 2021-05-06 | 2021-05-21 | 2021-06-04 |

Cognex's dividend yield falls in the middle range when compared to its industry peers, with NAPCO Security Techs (NASDAQ:NSSC) having the highest annualized dividend yield at 0.99%.

与业内同行相比,康耐视的股息收益率处于中间区间, NAPCO 安全技术公司(纳斯达克股票代码:NSSC) 年化股息收益率最高,为0.99%。

Analyzing Cognex Financial Health

分析康耐视财务状况

Companies that pay out steady cash dividends are attractive to income-seeking investors, and companies that are financially healthy tend to maintain their dividend payout schedule. For this reason, investors can find it insightful to see if a company has been increasing or decreasing their dividend payout schedule and if their earnings are growing.

支付稳定现金分红的公司对寻求收入的投资者具有吸引力,而财务状况良好的公司往往会维持其股息支付时间表。出于这个原因,投资者可以深入了解一家公司是增加还是减少了股息支付时间表,以及他们的收益是否在增长。

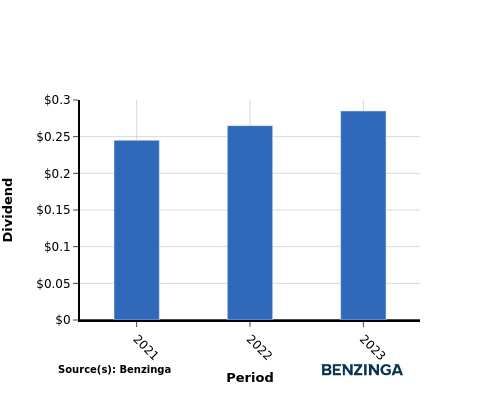

YoY Growth in Dividend Per Share

每股股息同比增长

During the period of 2021 to 2023, the company experienced a notable growth in its dividend per share. The dividend per share increased from $0.24 to $0.29, reflecting the company's focus on providing greater returns to its shareholders.

在2021年至2023年期间,该公司的每股股息显著增长。每股股息从0.24美元增加到0.29美元,反映出该公司专注于为股东提供更大的回报。

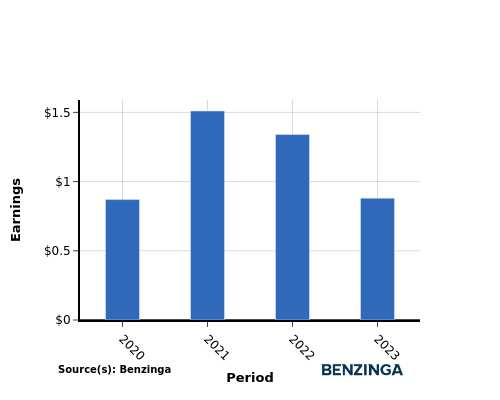

YoY Earnings Growth For Cognex

康耐视的同比收益增长

The earnings chart above shows that from 2021 to 2023, Cognex has experienced an increase in their earnings from $0.87 per share to $0.88 per share. This positive earnings trend is promising for income-seeking investors as it suggests that the company has more potential to increase its cash dividend payout if the trend continues.

上面的收益图表显示,从2021年到2023年,康耐视的收益从每股0.87美元增长到每股0.88美元。这种积极的收益趋势对寻求收入的投资者来说是有希望的,因为这表明如果这种趋势持续下去,该公司更有可能增加现金股息支出。

Recap

回顾

This article provides an in-depth analysis of Cognex's recent dividend distribution and the impact it has on shareholders. The company is currently distributing a dividend of $0.07 per share, resulting in an annualized dividend yield of 0.83%.

本文深入分析了康耐视最近的股息分配及其对股东的影响。该公司目前分配每股0.07美元的股息,年化股息收益率为0.83%。

Cognex's dividend yield falls in the middle range when compared to its industry peers, with NAPCO Security Techs having the highest annualized dividend yield at 0.99%.

与业内同行相比,康耐视的股息收益率处于中间区间,NAPCO Security Techs的年化股息收益率最高,为0.99%。

Considering the increase in dividend per share from 2021 to 2023 along with an increase in earnings per share, Cognex appears to be in a strong financial position, indicating their ability to sustain dividend distributions to investors.

考虑到 2021 年至 2023 年每股股息的增加以及每股收益的增加,康耐视似乎处于强劲的财务状况,这表明他们有能力维持对投资者的股息分配。

Keeping a close watch on the company's performance in the coming quarters will enable investors to stay abreast of any modifications in financials or dividend disbursements.

密切关注公司未来几个季度的表现将使投资者能够及时了解财务或股息支付的任何变化。

[See current stock movements Cognex on Benzinga.](Cognex (NASDAQ: CGNX))

[查看康耐视在 Benzinga 上的当前股票走势。] (康耐视(纳斯达克股票代码:CGNX))

This article was generated by Benzinga's automated content engine and reviewed by an editor.

本文由Benzinga的自动内容引擎生成,并由编辑审阅。