This Insider Has Just Sold Shares In Flywire

This Insider Has Just Sold Shares In Flywire

Some Flywire Corporation (NASDAQ:FLYW) shareholders may be a little concerned to see that the CEO & Director, Michael Massaro, recently sold a substantial US$995k worth of stock at a price of US$27.27 per share. However, that sale only accounted for 2.0% of their holding, so arguably it doesn't say much about their conviction.

飞汇公司(纳斯达克股票代码:FLYW)的一些股东可能会有点担心,首席执行官兼董事迈克尔·马萨罗最近以每股27.27美元的价格出售了价值99.5万美元的大量股票。但是,这笔出售仅占他们持股量的2.0%,因此可以说,这并不能说明他们的定罪。

Flywire Insider Transactions Over The Last Year

去年的飞汇内幕交易

The Independent Director, Alex Finkelstein, made the biggest insider sale in the last 12 months. That single transaction was for US$1.0m worth of shares at a price of US$29.50 each. So we know that an insider sold shares at around the present share price of US$26.97. We generally don't like to see insider selling, but the lower the sale price, the more it concerns us. In this case, the big sale took place at around the current price, so it's not too bad (but it's still not a positive).

独立董事亚历克斯·芬克尔斯坦进行了过去12个月中最大规模的内幕出售。这笔单笔交易是价值100万美元的股票,每股价格为29.50美元。因此,我们知道一位内部人士以目前的26.97美元左右的股价出售了股票。我们通常不喜欢看到内幕销售,但是销售价格越低,我们就越担心。在这种情况下,大甩卖是在当前价格左右进行的,因此还不错(但仍然不是积极的)。

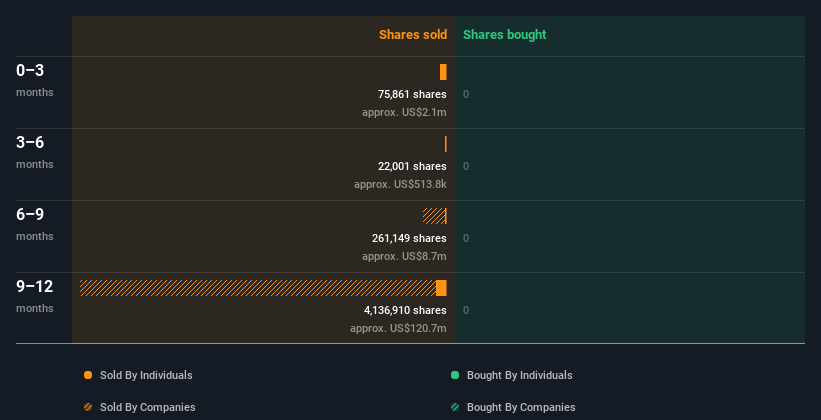

Flywire insiders didn't buy any shares over the last year. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. By clicking on the graph below, you can see the precise details of each insider transaction!

飞汇内部人士去年没有购买任何股票。你可以在下面看到过去 12 个月的内幕交易(公司和个人)的直观描述。通过点击下面的图表,你可以看到每笔内幕交易的确切细节!

I will like Flywire better if I see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

如果我看到一些重大的内幕收购,我会更喜欢Flywire。在我们等待的同时,请查看这份免费清单,列出了最近有大量内幕收购的成长型公司。

Insider Ownership

内部所有权

For a common shareholder, it is worth checking how many shares are held by company insiders. We usually like to see fairly high levels of insider ownership. Insiders own 2.6% of Flywire shares, worth about US$85m. This level of insider ownership is good but just short of being particularly stand-out. It certainly does suggest a reasonable degree of alignment.

对于普通股股东来说,值得检查一下公司内部人士持有多少股票。我们通常希望看到相当高的内部所有权水平。内部人士拥有飞汇2.6%的股份,价值约8500万美元。这种内部所有权水平不错,但还没有特别突出。这无疑表明了一定程度的一致性。

What Might The Insider Transactions At Flywire Tell Us?

飞汇的内幕交易能告诉我们什么?

Insiders sold Flywire shares recently, but they didn't buy any. And there weren't any purchases to give us comfort, over the last year. Insider ownership isn't particularly high, so this analysis makes us cautious about the company. So we'd only buy after careful consideration. While we like knowing what's going on with the insider's ownership and transactions, we make sure to also consider what risks are facing a stock before making any investment decision. Every company has risks, and we've spotted 2 warning signs for Flywire you should know about.

内部人士最近出售了飞汇股票,但他们没有购买任何股票。在过去的一年里,没有任何能让我们感到安慰的购买。内部所有权并不是特别高,因此这种分析使我们对公司持谨慎态度。因此,我们只有在仔细考虑后才会购买。虽然我们喜欢了解内部人士的所有权和交易情况,但在做出任何投资决策之前,我们一定要考虑股票面临的风险。每家公司都有风险,我们发现了两个你应该知道的Flywire警告信号。

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

当然,通过寻找其他地方,你可能会找到一笔不错的投资。因此,来看看这份有趣的公司的免费清单吧。

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

就本文而言,内部人士是指向相关监管机构报告其交易的个人。我们目前只考虑公开市场交易和私下处置的直接利益,不包括衍生品交易或间接权益。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧?直接联系我们。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St的这篇文章本质上是笼统的。我们仅使用公正的方法根据历史数据和分析师的预测提供评论,我们的文章无意作为财务建议。它不构成买入或卖出任何股票的建议,也没有考虑到您的目标或财务状况。我们的目标是为您提供由基本数据驱动的长期重点分析。请注意,我们的分析可能不考虑最新的价格敏感型公司公告或定性材料。简而言之,华尔街没有持有任何上述股票的头寸。