Have Backblaze Insiders Been Selling Stock?

Have Backblaze Insiders Been Selling Stock?

Some Backblaze, Inc. (NASDAQ:BLZE) shareholders may be a little concerned to see that the Co-Founder, Gleb Budman, recently sold a substantial US$1.6m worth of stock at a price of US$10.66 per share. However, it's crucial to note that they remain very much invested in the stock and that sale only reduced their holding by 8.3%.

一些Backblaze, Inc.(纳斯达克股票代码:BLZE)的股东可能会有点担心,联合创始人格列布·布德曼最近以每股10.66美元的价格出售了价值160万美元的大量股票。但是,值得注意的是,他们仍然对股票进行了大量投资,而此次出售仅使他们的持股量减少了8.3%。

Backblaze Insider Transactions Over The Last Year

Backblaze 去年的内幕交易

In fact, the recent sale by Gleb Budman was the biggest sale of Backblaze shares made by an insider individual in the last twelve months, according to our records. While we don't usually like to see insider selling, it's more concerning if the sales take place at a lower price. The good news is that this large sale was at well above current price of US$9.95. So it may not shed much light on insider confidence at current levels.

实际上,根据我们的记录,格列布·布德曼最近的出售是内部人士在过去十二个月中对Backblaze股票的最大一笔出售。虽然我们通常不喜欢看到内幕销售,但更令人担忧的是是否以较低的价格进行销售。好消息是,此次大宗销售远高于当前9.95美元的价格。因此,在当前水平上,这可能无法为内部信心提供太多启示。

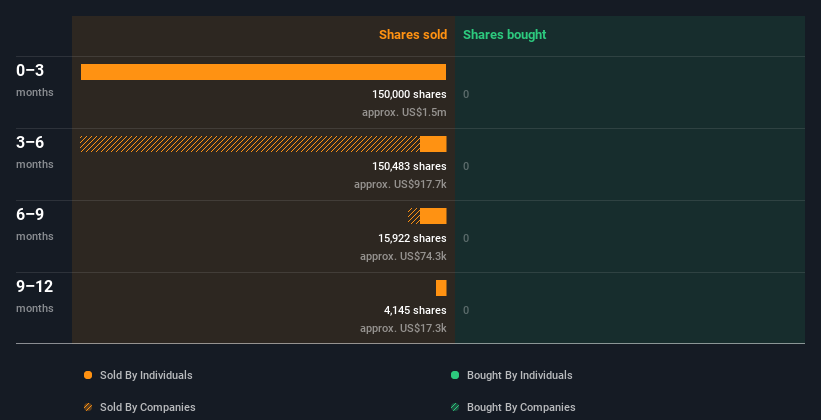

Insiders in Backblaze didn't buy any shares in the last year. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

去年,Backblaze的内部人士没有购买任何股票。你可以在下面看到过去 12 个月内幕交易(公司和个人)的直观描述。如果你点击图表,你可以看到所有的个人交易,包括股价、个人和日期!

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

如果你像我一样,那么你不会想错过这份业内人士正在收购的成长型公司的免费名单。

Insider Ownership

内部所有权

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. I reckon it's a good sign if insiders own a significant number of shares in the company. Backblaze insiders own about US$150m worth of shares (which is 39% of the company). This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

测试公司领导者与其他股东之间一致性的另一种方法是查看他们拥有多少股份。我认为,如果内部人士拥有该公司的大量股份,这是一个好兆头。Backblaze内部人士拥有价值约1.5亿美元的股份(占该公司的39%)。内部人士的这种重要所有权通常会增加公司为所有股东的利益而经营的机会。

So What Do The Backblaze Insider Transactions Indicate?

那么 Backblaze 内幕交易表明了什么呢?

An insider hasn't bought Backblaze stock in the last three months, but there was some selling. And there weren't any purchases to give us comfort, over the last year. The company boasts high insider ownership, but we're a little hesitant, given the history of share sales. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Backblaze. While conducting our analysis, we found that Backblaze has 4 warning signs and it would be unwise to ignore them.

在过去的三个月中,一位内部人士没有买入Backblaze的股票,但有一些抛售。在过去的一年里,没有任何能让我们感到安慰的购买。该公司拥有很高的内部所有权,但考虑到股票销售的历史,我们有点犹豫。除了了解正在进行的内幕交易外,确定Backblaze面临的风险也是有益的。在进行分析时,我们发现Backblaze有4个警告信号,忽略它们是不明智的。

But note: Backblaze may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

但请注意:Backblaze可能不是最好的买入股票。因此,来看看这份投资回报率高、债务低的有趣公司的免费清单。

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

就本文而言,内部人士是指向相关监管机构报告其交易的个人。我们目前只考虑公开市场交易和私下处置的直接利益,不包括衍生品交易或间接权益。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧?直接联系我们。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St的这篇文章本质上是笼统的。我们仅使用公正的方法根据历史数据和分析师的预测提供评论,我们的文章无意作为财务建议。它不构成买入或卖出任何股票的建议,也没有考虑到您的目标或财务状况。我们的目标是为您提供由基本数据驱动的长期重点分析。请注意,我们的分析可能不考虑最新的价格敏感型公司公告或定性材料。简而言之,华尔街没有持有任何上述股票的头寸。