Surpassing Expectations: Westamerica Bancorp Unleashes Growth Potential and Rewards Investors

Surpassing Expectations: Westamerica Bancorp Unleashes Growth Potential and Rewards Investors

By the close of today, February 16, 2024, Westamerica Bancorp (NASDAQ:WABC) will issue a dividend payout of $0.44 per share, resulting in an annualized dividend yield of 3.54%. This payout is exclusively for shareholders who held the stock before the ex-dividend date on February 02, 2024.

截至今天,即 2024 年 2 月 16 日收盘时, 西美银行(纳斯达克股票代码:WABC) 将发行每股0.44美元的股息,使年化股息收益率为3.54%。这笔派息仅适用于在2024年2月2日除息日之前持有股票的股东。

Westamerica Bancorp Recent Dividend Payouts

西美银行最近的股息支出

| Ex-Date | Payments per year | Dividend | Yield | Announced | Record | Payable |

|---|---|---|---|---|---|---|

| 2024-02-02 | 4$0.44 | 3.54% | 2024-01-25 | 2024-02-05 | 2024-02-16 | |

| 2023-11-03 | 4$0.44 | 3.84% | 2023-10-26 | 2023-11-06 | 2023-11-17 | |

| 2023-08-04 | 4$0.44 | 3.62% | 2023-07-27 | 2023-08-07 | 2023-08-18 | |

| 2023-05-05 | 4$0.42 | 4.24% | 2023-04-27 | 2023-05-08 | 2023-05-19 | |

| 2023-02-03 | 4$0.42 | 3.03% | 2023-01-26 | 2023-02-06 | 2023-02-17 | |

| 2022-11-04 | 4$0.42 | 2.7% | 2022-10-27 | 2022-11-07 | 2022-11-18 | |

| 2022-08-05 | 4$0.42 | 2.86% | 2022-07-28 | 2022-08-08 | 2022-08-19 | |

| 2022-05-06 | 4$0.42 | 2.85% | 2022-04-28 | 2022-05-09 | 2022-05-20 | |

| 2022-02-04 | 4$0.42 | 2.87% | 2022-01-27 | 2022-02-07 | 2022-02-18 | |

| 2021-11-05 | 4$0.42 | 3.1% | 2021-10-28 | 2021-11-08 | 2021-11-19 | |

| 2021-07-30 | 4$0.41 | 2.91% | 2021-07-22 | 2021-08-02 | 2021-08-13 | |

| 2021-04-30 | 4$0.41 | 2.58% | 2021-04-22 | 2021-05-03 | 2021-05-14 |

| 过期日期 | 每年付款 | 分红 | 收益率 | 已宣布 | 记录 | 应付款 |

|---|---|---|---|---|---|---|

| 2024-02-02 | 40.44 | 3.54% | 2024-01-25 | 2024-02-05 | 2024-02-16 | |

| 2023-11-03 | 40.44 | 3.84% | 2023-10-26 | 2023-11-06 | 2023-11-17 | |

| 2023-08-04 | 40.44 | 3.62% | 2023-07-27 | 2023-08-07 | 2023-08-18 | |

| 2023-05-05 | 40.42 | 4.24% | 2023-04-27 | 2023-05-08 | 2023-05-19 | |

| 2023-02-03 | 40.42 | 3.03% | 2023-01-26 | 2023-02-06 | 2023-02-17 | |

| 2022-11-04 | 40.42 | 2.7% | 2022-10-27 | 2022-11-07 | 2022-11-18 | |

| 2022-08-05 | 40.42 | 2.86% | 2022-07-28 | 2022-08-08 | 2022-08-19 | |

| 2022-05-06 | 40.42 | 2.85% | 2022-04-28 | 2022-05-09 | 2022-05-20 | |

| 2022-02-04 | 40.42 | 2.87% | 2022-01-27 | 2022-02-07 | 2022-02-18 | |

| 2021-11-05 | 40.42 | 3.1% | 2021-10-28 | 2021-11-08 | 2021-11-19 | |

| 2021-07-30 | 40.41 | 2.91% | 2021-07-22 | 2021-08-02 | 2021-08-13 | |

| 2021-04-30 | 40.41 | 2.58% | 2021-04-22 | 2021-05-03 | 2021-05-14 |

In terms of dividend yield, Westamerica Bancorp finds itself in the middle ground among its industry peers, while Northwest Bancshares (NASDAQ:NWBI) takes the lead with the highest annualized dividend yield at 6.64%.

在股息收益率方面,西美银行发现自己在业内同行中处于中间地带,而 西北银行股份(纳斯达克股票代码:NWBI) 以最高的年化股息收益率领先,为6.64%。

Analyzing Westamerica Bancorp Financial Health

分析西美银行的财务状况

Companies that pay out steady cash dividends are attractive to income-seeking investors, and companies that are financially healthy tend to maintain their dividend payout schedule. For this reason, investors can find it insightful to see if a company has been increasing or decreasing their dividend payout schedule and if their earnings are growing.

支付稳定现金分红的公司对寻求收入的投资者具有吸引力,而财务状况良好的公司往往会维持其股息支付时间表。出于这个原因,投资者可以深入了解一家公司是增加还是减少了股息支付时间表,以及他们的收益是否在增长。

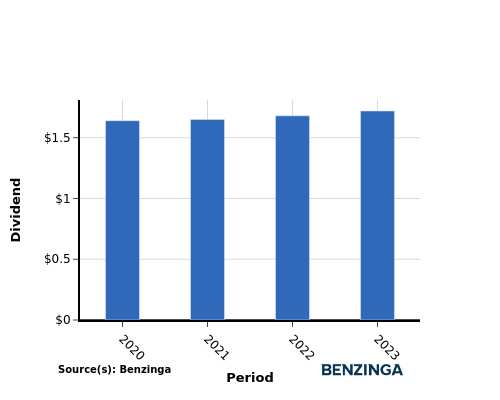

YoY Growth in Dividend Per Share

每股股息同比增长

From 2020 to 2023, the company's dividend per share showed a positive trend, increasing steadily from $1.64 in 2020 to $1.72 in 2023. This demonstrates the company's commitment to rewarding shareholders by consistently raising dividends.

从2020年到2023年,该公司的每股股息呈现积极趋势,从2020年的1.64美元稳步增长到2023年的1.72美元。这表明公司致力于通过持续提高股息来奖励股东。

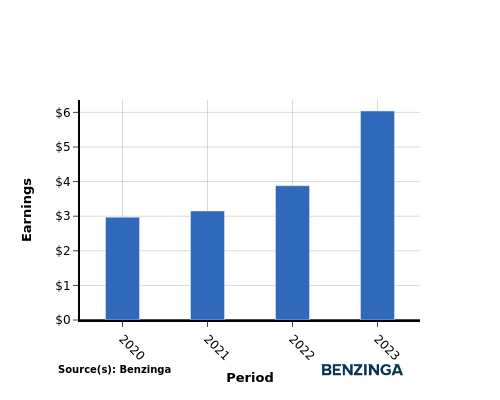

YoY Earnings Growth For Westamerica Bancorp

西美银行的同比收益增长

The earnings chart illustrates an increase in Westamerica Bancorp's earnings per share, from $2.97 in 2020 to $6.04 in 2023. This positive earnings growth provides income-seeking investors with optimism, as it suggests potential for higher cash dividend payouts in the future.

收益图表显示,西美银行的每股收益从2020年的2.97美元增加到2023年的6.04美元。这种正的收益增长使寻求收入的投资者感到乐观,因为它表明未来有可能增加现金股息支出。

Recap

回顾

This article takes an in-depth look at Westamerica Bancorp's recent dividend payout and its implications for shareholders. The company is currently distributing a dividend of $0.44 per share today, translating to an annualized dividend yield of 3.54%.

本文深入探讨了西美银行最近的股息支付及其对股东的影响。该公司目前分配的股息为每股0.44美元,相当于年化股息收益率为3.54%。

In terms of dividend yield, Westamerica Bancorp finds itself in the middle ground among its industry peers, while Northwest Bancshares takes the lead with the highest annualized dividend yield at 6.64%.

在股息收益率方面,西美银行发现自己在业内同行中处于中间地带,而西北银行则以最高的年化股息收益率领先,为6.64%。

With an increase in dividend per share and earnings per share from 2020 to 2023, Westamerica Bancorp demonstrates a healthy financial status and is likely to maintain their dividend distribution to investors.

随着2020年至2023年每股股息和每股收益的增加,西美银行表现出健康的财务状况,并可能维持对投资者的股息分配。

To stay well-informed about potential changes in financials or dividend disbursements, investors should closely observe the company's performance in the upcoming quarters.

为了随时了解财务状况或股息支付的潜在变化,投资者应密切关注公司在未来几个季度的表现。

\To stay up-to-date with the companies that are announcing their dividends, click here to visit our Dividends Calendar.

\ 要了解宣布分红的公司的最新情况,请点击此处访问我们的股息日历。

This article was generated by Benzinga's automated content engine and reviewed by an editor.

本文由Benzinga的自动内容引擎生成,并由编辑审阅。