Slammed 59% Baijiayun Group Ltd (NASDAQ:RTC) Screens Well Here But There Might Be A Catch

Slammed 59% Baijiayun Group Ltd (NASDAQ:RTC) Screens Well Here But There Might Be A Catch

To the annoyance of some shareholders, Baijiayun Group Ltd (NASDAQ:RTC) shares are down a considerable 59% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 91% loss during that time.

令一些股东烦恼的是,百佳云集团有限公司(纳斯达克股票代码:RTC)的股价在上个月下跌了59%,这延续了该公司的糟糕表现。对于股东来说,最近的下跌结束了灾难性的十二个月,在此期间,股东亏损了91%。

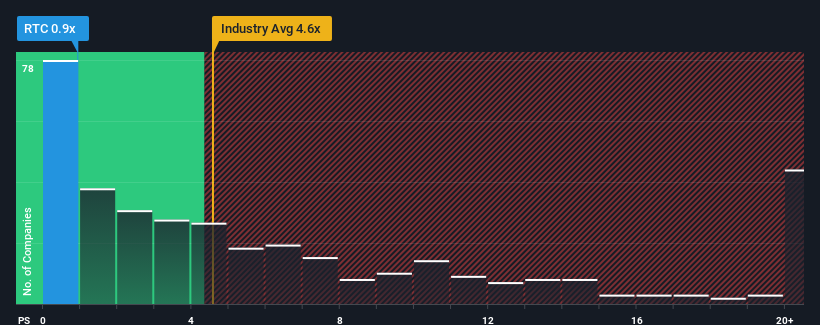

After such a large drop in price, Baijiayun Group may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.9x, since almost half of all companies in the Software industry in the United States have P/S ratios greater than 4.6x and even P/S higher than 11x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

在价格大幅下跌之后,百佳云集团目前可能发出了非常看涨的信号,其市销率(或 “市盈率”)为0.9倍,因为美国软件行业几乎有一半公司的市盈率大于4.6倍,甚至市盈率高于11倍也并不罕见。但是,市销率可能很低是有原因的,需要进一步调查以确定其是否合理。

NasdaqGM:RTC Price to Sales Ratio vs Industry February 1st 2024

纳斯达克通用汽车公司:RTC 与行业的股价销售比率 2024 年 2 月 1 日

How Baijiayun Group Has Been Performing

百佳云集团的表现如何

Revenue has risen firmly for Baijiayun Group recently, which is pleasing to see. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

最近,百佳云集团的收入稳步增长,这令人高兴。许多人可能预计,可观的收入表现将大幅下降,这抑制了市销率。如果最终没有出现这种情况,那么现有股东就有理由对股价的未来走向持乐观态度。

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Baijiayun Group's earnings, revenue and cash flow.

我们没有分析师的预测,但您可以查看我们关于百佳云集团收益、收入和现金流的免费报告,了解最近的趋势如何为公司的未来做好准备。

What Are Revenue Growth Metrics Telling Us About The Low P/S?

关于低市盈率,收入增长指标告诉我们什么?

Baijiayun Group's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

对于一家预计增长非常糟糕甚至收入下降的公司,百佳云集团的市销率是典型的,而且重要的是,其表现要比行业差得多。

Taking a look back first, we see that the company grew revenue by an impressive 20% last year. The strong recent performance means it was also able to grow revenue by 252% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

首先回顾一下,我们发现该公司去年的收入增长了令人印象深刻的20%。最近的强劲表现意味着它在过去三年中总收入增长了252%。因此,我们可以首先确认该公司在这段时间内在增加收入方面做得很好。

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 15% shows it's noticeably more attractive.

将最近的中期收入轨迹与该行业15%的年度增长预测进行比较,可以看出该行业明显更具吸引力。

With this information, we find it odd that Baijiayun Group is trading at a P/S lower than the industry. It looks like most investors are not convinced the company can maintain its recent growth rates.

有了这些信息,我们感到奇怪的是,百佳云集团的市销售率低于该行业。看来大多数投资者不相信该公司能够维持其最近的增长率。

The Key Takeaway

关键要点

Having almost fallen off a cliff, Baijiayun Group's share price has pulled its P/S way down as well. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

在几乎跌下悬崖之后,百佳云集团的股价也大幅下调了市销率。仅使用市销率来确定是否应该出售股票是不明智的,但它可以作为公司未来前景的实用指南。

Our examination of Baijiayun Group revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

我们对百佳云集团的调查显示,其三年收入趋势并没有像我们预期的那样提高市销率,因为这些趋势看起来好于当前的行业预期。当我们看到强劲的收入增长超过行业时,我们认为公司的未来业绩存在明显的潜在风险,这给市销率带来了下行压力。尽管过去中期最近的收入趋势表明价格下跌的风险很低,但投资者似乎认为未来收入可能会出现波动。

We don't want to rain on the parade too much, but we did also find 4 warning signs for Baijiayun Group (2 are potentially serious!) that you need to be mindful of.

我们不想在游行队伍中下太多雨,但我们也确实发现了百佳云集团的4个警告标志(2个可能很严重!)这是你需要注意的。

If you're unsure about the strength of Baijiayun Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

如果您不确定百佳云集团的业务实力,为什么不浏览我们的互动股票清单,这些股票具有稳健的业务基本面,您可能错过的其他一些公司。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧吗?请直接联系我们。或者,也可以发送电子邮件至编辑团队 (at) simplywallst.com。

Simply Wall St的这篇文章本质上是笼统的。我们仅使用公正的方法根据历史数据和分析师的预测提供评论,我们的文章无意作为财务建议。它不构成买入或卖出任何股票的建议,也没有考虑到您的目标或财务状况。我们的目标是为您提供由基本数据驱动的长期重点分析。请注意,我们的分析可能不考虑最新的价格敏感型公司公告或定性材料。简而言之,华尔街没有持有任何上述股票的头寸。