Do Zhejiang Wanma's (SZSE:002276) Earnings Warrant Your Attention?

Do Zhejiang Wanma's (SZSE:002276) Earnings Warrant Your Attention?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

投资者通常以发现 “下一件大事” 的想法为指导,即使这意味着在没有任何收入的情况下购买 “故事股票”,更不用说获利了。有时,这些故事可能会给投资者的思想蒙上阴影,导致他们用自己的情感进行投资,而不是根据良好的公司基本面的优点进行投资。亏损的公司可以像海绵一样争夺资本,因此投资者应谨慎行事,不要一笔又一笔地投入好钱。

In contrast to all that, many investors prefer to focus on companies like Zhejiang Wanma (SZSE:002276), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

与此形成鲜明对比的是,许多投资者更愿意关注像浙江万马(SZSE:002276)这样的公司,这些公司不仅有收入,还有利润。尽管利润不是投资时应考虑的唯一指标,但值得表彰能够持续生产利润的企业。

View our latest analysis for Zhejiang Wanma

查看我们对浙江万马的最新分析

How Fast Is Zhejiang Wanma Growing?

浙江万马的增长速度有多快?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Impressively, Zhejiang Wanma has grown EPS by 37% per year, compound, in the last three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

市场在短期内是投票机,但从长远来看是一台权衡器,因此您预计股价最终将跟随每股收益(EPS)的结果。因此,有很多投资者喜欢购买每股收益不断增长的公司的股票。令人印象深刻的是,在过去三年中,浙江万马每股收益复合增长了37%。如果这样的增长持续到未来,那么股东们将有很多值得微笑的地方。

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Zhejiang Wanma maintained stable EBIT margins over the last year, all while growing revenue 6.7% to CN¥15b. That's a real positive.

收入增长是可持续增长的重要指标,再加上较高的息税前收益(EBIT)利润率,这是公司保持市场竞争优势的好方法。去年,浙江万马保持了稳定的息税前利润率,同时收入增长了6.7%,达到150亿元人民币。这确实是一个积极的方面。

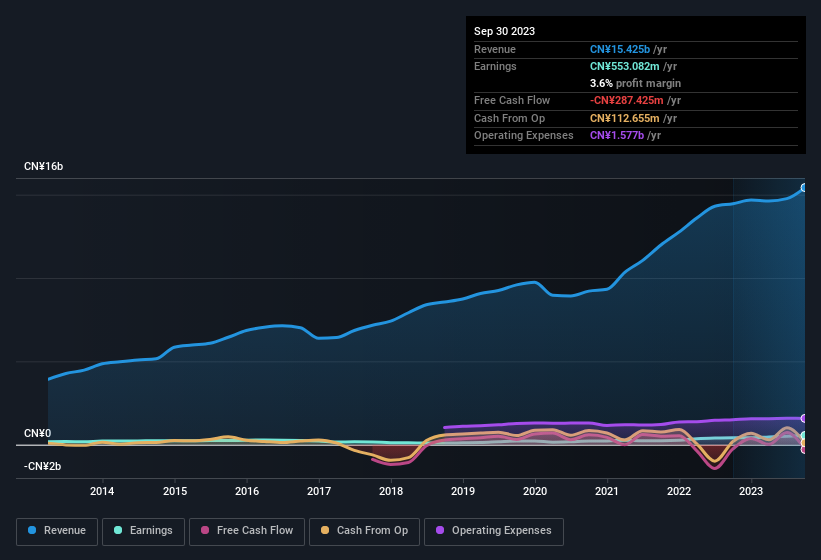

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

下图显示了该公司的收入和收入随着时间的推移是如何发展的。要了解更多细节,请点击图片。

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Zhejiang Wanma's future EPS 100% free.

作为投资者,诀窍是找到符合投资者的公司 去 将来表现良好,而不仅仅是过去。虽然不存在水晶球,但您可以100%免费查看我们对浙江万马未来每股收益的共识预测的可视化。

Are Zhejiang Wanma Insiders Aligned With All Shareholders?

浙江万马内部人士是否与所有股东一致?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. So it is good to see that Zhejiang Wanma insiders have a significant amount of capital invested in the stock. With a whopping CN¥464m worth of shares as a group, insiders have plenty riding on the company's success. This should keep them focused on creating long term value for shareholders.

可以说,看到公司领导者将资金投入到危险之中真是令人高兴,因为这提高了企业经营者与其真正所有者之间激励措施的一致性。因此,很高兴看到浙江万马内部人士将大量资金投资于该股。集团拥有高达4.64亿元人民币的股票,内部人士对该公司的成功有很大帮助。这应该使他们专注于为股东创造长期价值。

Does Zhejiang Wanma Deserve A Spot On Your Watchlist?

浙江万马值得在你的关注清单上占有一席之地吗?

If you believe that share price follows earnings per share you should definitely be delving further into Zhejiang Wanma's strong EPS growth. With EPS growth rates like that, it's hardly surprising to see company higher-ups place confidence in the company through continuing to hold a significant investment. The growth and insider confidence is looked upon well and so it's worthwhile to investigate further with a view to discern the stock's true value. What about risks? Every company has them, and we've spotted 1 warning sign for Zhejiang Wanma you should know about.

如果你认为股价跟随每股收益,那么你肯定应该进一步研究浙江万马的强劲每股收益增长。在每股收益增长率如此之高的情况下,看到公司高层通过继续持有大量投资对公司充满信心也就不足为奇了。增长和内部信心备受关注,因此值得进一步调查,以辨别该股的真实价值。那风险呢?每家公司都有它们,我们已经发现了一个你应该知道的浙江万马的警告标志。

Although Zhejiang Wanma certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with insider buying, then check out this handpicked selection of Chinese companies that not only boast of strong growth but have also seen recent insider buying..

尽管浙江万马看起来确实不错,但如果内部人士买入股票,它可能会吸引更多的投资者。如果你想看看有内幕买入的公司,那就看看这些精心挑选的中国公司,这些公司不仅拥有强劲的增长,而且最近也出现了内幕买盘。

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

请注意,本文中讨论的内幕交易是指相关司法管辖区内应报告的交易。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧?直接联系我们。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St的这篇文章本质上是笼统的。我们仅使用公正的方法根据历史数据和分析师的预测提供评论,我们的文章无意作为财务建议。它不构成买入或卖出任何股票的建议,也没有考虑到您的目标或财务状况。我们的目标是为您提供由基本数据驱动的长期重点分析。请注意,我们的分析可能不考虑最新的价格敏感型公司公告或定性材料。简而言之,华尔街没有持有任何上述股票的头寸。