American Battery Technology Company Announces Increased and Upgraded Lithium Resource to Measured and Indicated Classifications for One of the Largest Lithium Projects in the United States

American Battery Technology Company Announces Increased and Upgraded Lithium Resource to Measured and Indicated Classifications for One of the Largest Lithium Projects in the United States

Company continues to advance development of its Tonopah Flats Lithium Project, accelerating its path to commercialization of the domestic lithium supply chain

公司继续推进其Tonopah Flats锂项目的开发,加快了国内锂供应链的商业化之路

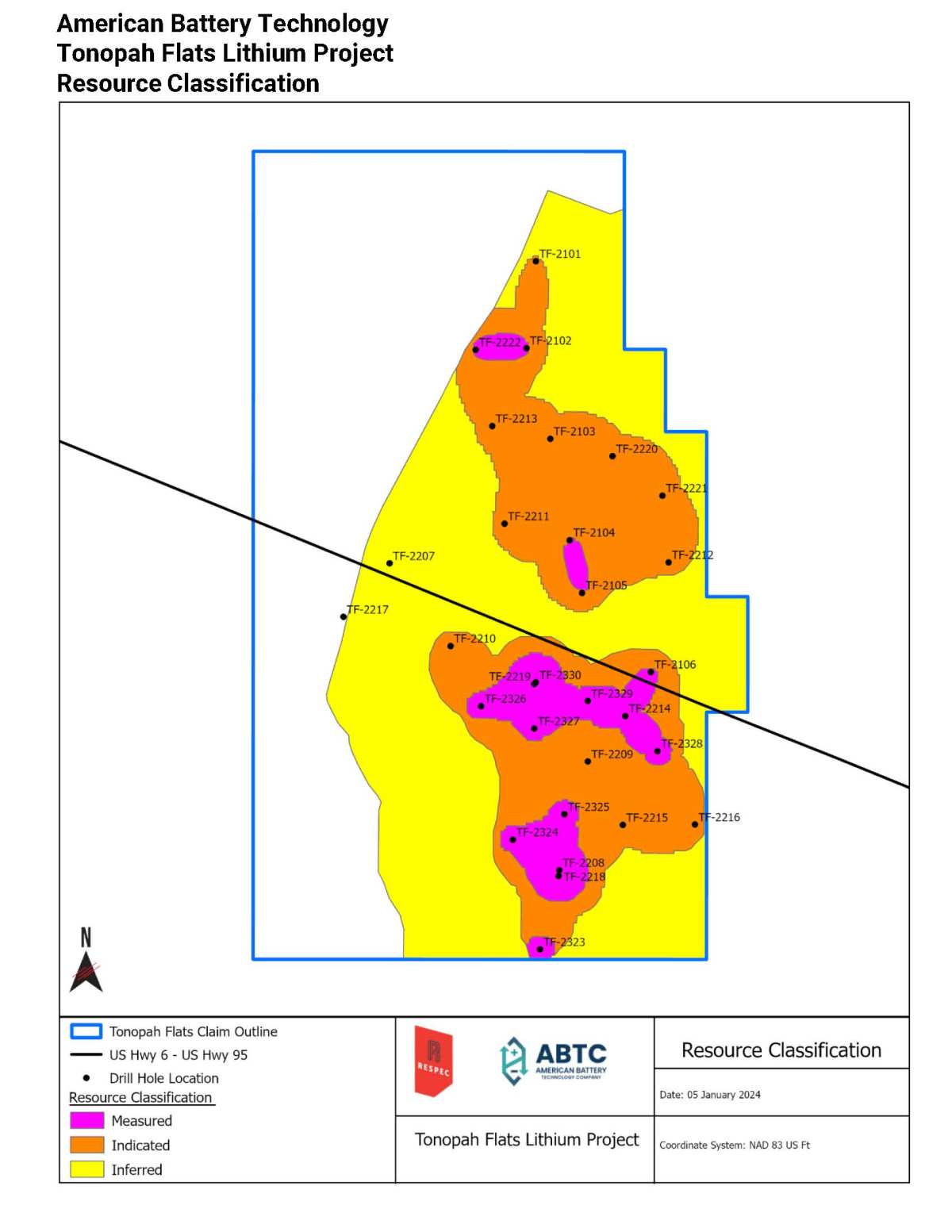

Reno, Nev., January 18, 2024 — American Battery Technology Company (ABTC) (NASDAQ: ABAT), an integrated critical battery materials company that is commercializing its technologies for both primary battery minerals manufacturing and secondary minerals lithium-ion battery recycling, is pleased to announce upgraded Measured Resource and Indicated Resource classifications for its Tonopah Flats Lithium Project (TFLP) located in Big Smoky Valley near Tonopah, Nevada. The favorable announcement, published in an S-K 1300 report titled Updated Resource Estimate and Initial Assessment with Project Economics for the Tonopah Flats Lithium Project, Esmeralda and Nye Counties, Nevada, USA (Updated Initial Assessment), increases the resource's classification and attractiveness for commercialization.

内华达州里诺,2024 年 1 月 18 日 — 美国电池技术公司 (ABTC)(纳斯达克股票代码:ABAT)是一家综合关键电池材料公司,正在将其原电池矿物制造和二次矿物锂离子电池回收技术商业化。该公司很高兴地宣布,其位于内华达州托诺帕附近的大烟谷的Tonopah Flats锂项目(TFLP)升级了实测资源和指示资源分类。这一有利的声明发表在一份名为 S-K 1300 的报告中 美国内华达州埃斯梅拉达县和奈县托诺帕弗拉特斯锂项目的最新资源估算和项目经济学初步评估(更新的初步评估)提高了资源的分类和对商业化的吸引力。

In December 2023, ABTC published its Initial Assessment for the TFLP which included data from its first two drill programs, and provided a preliminary technical and economic study of the performance of the resource. The company's Updated Initial Assessment incorporates data from its third drill program, which results in an increase in total resource size and an upgraded classification for significant portions of the resource.

2023 年 12 月,ABTC 发布了其 初步评估 TFLP包括其前两个钻探计划的数据,并对资源的表现进行了初步的技术和经济研究。该公司最新的初步评估纳入了其第三次钻探计划的数据,这导致了总资源规模的增加,并且对很大一部分资源的分类进行了升级。

- Overall increase in lithium resource size of 17% from the previous Initial Assessment

- Approximately 54% of the resource is now classified at an upgraded classification as a Measured Resource or an Indicated Resource, representing an increase in statistical confidence of quantity and quality of resource in progression of development towards commercialization

- TFLP continues to be one of the largest known lithium projects in the U.S., with a total quantified resource of 21.15 million tons of lithium hydroxide monohydrate (LHM)

- Deposit remains unexplored and open to the South, Southwest, and at depth, allowing for potential to expand the resource with further drilling in both the South and North claim blocks, however with a throughput of 33,000 tons LiOH/yr the current quantified resource already has a mine life of over 400 years

- Even without incorporation of improved data from the third drill program, the TFLP demonstrates attractive after-tax cash flows:

- Net Present Value of $4.41 billion @10% discount rate

- Internal Rate of Return of 65.8%

- 2.4-year payback period of initial investment

- Updated Initial Assessment provides necessary data and recommends next steps to further develop the resource, including the completion of a Pre-Feasibility Study

- 与之前的初步评估相比,锂资源规模总体增长了17%

- 现在,约有54%的资源在升级后的分类中被归类为计量资源或指示资源,这表明在向商业化发展过程中对资源数量和质量的统计信心有所提高

- TFLP仍然是美国已知最大的锂项目之一,其总量化资源为2,115万吨一水氢氧化锂(LHM)

- 矿床仍未开发,向南、西南和深度开放,这为在南部和北部索赔区块进行进一步钻探从而有可能扩大资源,但是,由于吞吐量为33,000吨 LIOH/年,目前的量化资源的矿山寿命已经超过400年

- 即使没有纳入第三次钻探计划的改进数据,TFLP仍显示出诱人的税后现金流:

- 净现值为44.1亿美元 @10% 折扣率

- 内部回报率为 65.8%

- 2.4 年的初始投资回报期

- 更新的初步评估提供了必要的数据,并建议了进一步开发资源的后续步骤,包括完成预可行性研究

"We are proud to have both further increased the total size of this critical material lithium resource through our step-out exploration, and, through our strategic infill drilling, to have evolved the majority of this resource up to the Measured and Indicated classifications," stated ABTC CEO Ryan Melsert. "This is an important milestone in the commercialization of this deposit, and combined with the current construction and installation of our integrated pilot system for the continuous demonstration of the manufacturing of battery grade lithium hydroxide from this unconventional lithium resource, we are excited to continue the rapid development and commercialization of these first-of-kind technologies."

ABTC首席执行官瑞安·梅尔瑟特表示:“我们很自豪能够通过逐步勘探进一步扩大这一关键材料锂资源的总规模,并通过我们的战略填充钻探,将大部分资源发展到测量和指示分类。”“这是该矿床商业化的一个重要里程碑,再加上我们目前正在建设和安装综合试验系统,以持续演示利用这种非常规锂资源生产电池级氢氧化锂,我们很高兴能够继续快速开发和商业化这些首创技术。”

American Battery Technology Company's Measured, Indicated, and Inferred Lithium Mineral Resource

美国电池技术公司的测量、指示和推断的锂矿产资源

| Classification | Total kTons | Average ppm Li | Li kTons | LHM kTons |

| Measured | 721,000 | 702 | 510 | 3,060 |

| Indicated | 2,439,000 | 565 | 1,380 | 8,340 |

| Measured + Indicated | 3,160,000 | 596 | 1,890 | 11,400 |

| Inferred | 2,931,000 | 550 | 1,610 | 9,750 |

| Total | 6,091,000 | 574 | 3,500 | 21,150 |

| 分类 | 总吨数 | 平均 ppm Li | Li KTons | LHM KTons |

| 已测量 | 721,000 | 702 | 510 | 3,060 |

| 已指示 | 2,439,000 | 565 | 1,380 | 8,340 |

| 已测量 + 已显示 | 3,160,000 | 596 | 1,890 | 11,400 |

| 推断 | 2,931,000 | 550 | 1,610 | 9,750 |

| 总计 | 6,091,000 | 574 | 3,500 | 21,150 |

This updated initial assessment utilized data from ABTC's recently completed Drill Program III, with samples collected at TFLP from eight core drill holes with approximately 6,700 feet of drilling.

这项更新的初步评估使用了来自ABTC最近完成的第三期钻探计划的数据,在TFLP从八个岩心钻孔中采集了样本,钻探深度约为6,700英尺。

"The data from this third drill program's additional eight core holes has resulted in increased level of confidence towards pre-feasibility and bankable feasibility status," stated ABTC Chief Mineral Resource Officer Scott Jolcover. "I am pleased with the updated report and excited to continue accelerated development of this resource by furthering progress with the recommended next steps."

ABTC首席矿产资源官Scott Jolcover表示:“来自第三个钻探计划的另外八个岩心孔的数据增强了人们对预可行性和银行可行性状况的信心。”“我对更新后的报告感到满意,也很高兴通过在建议的后续步骤方面取得进一步进展,继续加快该资源的开发。”

The Updated Initial Assessment maintains the previously-published Initial Assessment economic analysis and values, and notes that these values are conservative considering the improved updated classification of the resource in the Updated Initial Assessment. It is expected that with future updates the project economics will improve.

更新的初始评估保留了先前发布的初步评估经济分析和数值,并指出,考虑到更新后的初始评估中对资源的更新的分类进行了改进,这些值是保守的。预计随着未来的更新,项目经济性将有所改善。

As noted in the December 2023 Initial Assessment, the TFLP has an estimated mine life of over 400 years with average annual production of 33,000 tons LHM. For purposes of the economic analysis, the Initial Assessment limits the project to a mine life of 50 years for approximately 643.2 million tons of claystone processed with an average of 3,815ppm LHM grade processed. With $781.8 million in initial capital costs, production costs of $4,636/ton of LHM, overall operating costs of $6,080/ ton of LHM produced, and average annual production of 33,000 tons of LHM, the report estimates a $9.56 billion after-tax net present value (NPV) at a 5% discount rate.

正如在2023年12月的初步评估中指出的那样,TFLP的矿山寿命估计超过400年,平均年产量为33,000吨LHM。出于经济分析的目的,初步评估将该项目的矿山寿命限制为50年,处理的粘土石约为6.432亿吨,平均处理的LHM等级为3,815ppm。该报告估计,LHM的初始资本成本为7.818亿美元,每吨LHM的生产成本为4,636美元,LHM的总运营成本为6,080美元/吨,LHM的平均年产量为33,000吨,按5%的折扣率估计,税后净现值(NPV)为95.6亿美元。

Recommended Next Steps for Project Commercialization:

建议的项目商业化后续步骤:

- Perform expanded bench scale metallurgy, pit optimization, and engineering analyses to further refine processing operations

- Further develop the resource to achieve a Probable and/or Proven Mineral Reserve

- Perform Hydrological and Geotechnical Drill Programs of TFLP property

- Complete remaining baseline environmental studies and National Environmental Policy Act (NEPA) review process

- Complete Pre-Feasibility Study

- Complete commissioning and commence operations of ABTC integrated pilot refinery system that will process TFLP claystone materials, and utilize this data from a continuously operating integrated pilot refinery to further optimize the design of the commercial-scale refinery

- Complete commercial-scale engineering design, construction, and commissioning for ABTC's commercial refinery with lead EPC firm Black & Veatch

- 进行扩展的基准冶金、矿坑优化和工程分析,以进一步完善加工操作

- 进一步开发资源以实现可能和/或探明的矿产储量

- 执行 TFLP 物业的水文和岩土工程钻探计划

- 完成剩余的基准环境研究和《国家环境政策法》(NEPA)审查流程

- 完成预可行性研究

- 完成调试并开始运营ABTC综合中试炼油厂系统,该系统将处理TFLP粘土石材料,并利用来自持续运营的综合中试炼油厂的这些数据进一步优化商业规模炼油厂的设计

- 与领先的 EPC 公司 Black & Veatch 合作,完成 ABTC 商业炼油厂的商业规模工程设计、施工和调试

The information contained in this press release is qualified in its entirety by reference to the complete text of the Updated Initial Assessment effective December 21, 2023, including but not limited to the mineral resource estimates and economic analysis. To read the full Updated Initial Assessment, visit: www.americanbatterytechnology.com_TonopahFlats_MI-Resource-Update.

本新闻稿中包含的信息是参照2023年12月21日生效的更新初步评估的完整文本,包括但不限于矿产资源估算和经济分析,对本新闻稿中包含的信息进行了全面限定。要阅读完整的最新初步评估,请访问: www.americanbatteryTechnology.com_tonopahflats_mi-资源更新。

Qualified Person

The mineral resource estimates presented in the ABTC Tonopah Flats Initial Assessment were performed by third-party, qualified person RESPEC, LLC and were classified by geological and quantitative confidence in accordance with the Securities and Exchange Commission (SEC) Regulation S-K 1300.

合格人员

ABTC Tonopah Flats初步评估中提出的矿产资源估算是由第三方合格人员RESPEC, LLC进行的,并根据美国证券交易委员会(SEC)第S-K 1300号条例按地质和定量信心进行了分类。

Initial Assessment

Initial assessment is a preliminary technical and economic study of the economic potential of all or parts of mineralization to support the disclosure of mineral resources. The initial assessment must be prepared by a qualified person and must include appropriate assessments of reasonably assumed technical and economic factors, together with any other relevant operational factors, that are necessary to demonstrate at the time of reporting that there are reasonable prospects for economic extraction. An initial assessment is required for disclosure of mineral resources but cannot be used as the basis for disclosure of mineral reserves.

初步评估

初步评估是对全部或部分矿化的经济潜力的初步技术和经济研究,以支持矿产资源的披露。初步评估必须由合格人员编写,必须包括对合理假定的技术和经济因素的适当评估,以及任何其他相关的操作因素,这些因素是报告时证明经济开采的合理前景所必需的。披露矿产资源需要进行初步评估,但不能用作披露矿产储量的依据。

Inferred Resource

Inferred mineral resource is that part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. The level of geological uncertainty associated with an inferred mineral resource is too high to apply relevant technical and economic factors likely to influence the prospects of economic extraction in a manner useful for evaluation of economic viability. Because an inferred mineral resource has the lowest level of geological confidence of all mineral resources, which prevents the application of the modifying factors in a manner useful for evaluation of economic viability, an inferred mineral resource may not be considered when assessing the economic viability of a mining project, and may not be converted to a mineral reserve.

Indicated Resource

Indicated mineral resource is that part of a mineral resource for which quantity and grade or quality are estimated on the basis of adequate geological evidence and sampling. The level of geological certainty associated with an indicated mineral resource is sufficient to allow a qualified person to apply modifying factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Because an indicated mineral resource has a lower level of confidence than the level of confidence of a measured mineral resource, an indicated mineral resource may only be converted to a probable mineral reserve.

推断资源

推断的矿产资源是指矿产资源中根据有限的地质证据和取样估算其数量、等级或质量的部分。与推断的矿产资源有关的地质不确定性水平过高,无法以有助于评估经济可行性的方式应用可能影响经济开采前景的相关技术和经济因素。由于推断的矿产资源在所有矿产资源中具有最低的地质可信度,因此无法以有益于评估经济可行性的方式应用修改因素,因此在评估采矿项目的经济可行性时不得考虑推断的矿产资源,也不得转换为矿产储量。

指定资源

所示矿产资源是指矿产资源中根据充分的地质证据和取样估算其数量、等级或质量的部分。与指定矿产资源相关的地质确定性水平足以让合格人员足够详细地应用修改因素,以支持矿山规划和矿床经济可行性评估。由于指示矿产资源的可信度低于所测矿产资源的可信度,因此指示的矿产资源只能转换为可能的矿产储量。

Measured Resource

Measured mineral resource is that part of a mineral resource for which quantity and grade or quality are estimated on the basis of conclusive geological evidence and sampling. The level of geological certainty associated with a measured mineral resource is sufficient to allow a qualified person to apply modifying factors, as defined in this section, in sufficient detail to support detailed mine planning and final evaluation of the economic viability of the deposit. Because a measured mineral resource has a higher level of confidence than the level of confidence of either an indicated mineral resource or an inferred mineral resource, a measured mineral resource may be converted to a proven mineral reserve or to a probable mineral reserve.

Probable Mineral Reserve

Probable mineral reserve is the economically mineable part of an indicated and, in some cases, a measured mineral resource.

Proven Mineral Reserve

Proven mineral reserve is the economically mineable part of a measured mineral resource and can only result from conversion of a measured mineral resource.

Pre-Feasibility Study

A preliminary feasibility study (or pre-feasibility study) is a comprehensive study of a range of options for the technical and economic viability of a mineral project that has advanced to a stage where a qualified person has determined (in the case of underground mining) a preferred mining method, or (in the case of surface mining) a pit configuration, and in all cases has determined an effective method of mineral processing and an effective plan to sell the product. A pre-feasibility study includes a financial analysis based on reasonable assumptions, based on appropriate testing, about the modifying factors and the evaluation of any other relevant factors that are sufficient for a qualified person to determine if all or part of the indicated and measured mineral resources may be converted to mineral reserves at the time of reporting. The financial analysis must have the level of detail necessary to demonstrate, at the time of reporting, that extraction is economically viable. A pre-feasibility study is less comprehensive and results in a lower confidence level than a feasibility study. A pre-feasibility study is more comprehensive and results in a higher confidence level than an initial assessment.

测得的资源

测得的矿产资源是指矿产资源中根据确凿的地质证据和抽样估算其数量、等级或质量的部分。与测得的矿产资源相关的地质确定性水平足以让合格人员足够详细地应用本节中定义的修改因素,以支持详细的采矿规划和对矿床经济可行性的最终评估。由于测得的矿产资源的可信度高于指示矿产资源或推断矿产资源的可信度,因此测得的矿产资源可能会转化为已探明的矿产储量或可能的矿产储量。

可能的矿产储量

可能的矿产储量是指明的矿产资源中经济上可开采的部分,在某些情况下,是可测的矿产资源。

探明的矿产储量

已探明的矿产储量是测定矿产资源中经济上可开采的部分,只能通过转换测得的矿产资源产生。

预可行性研究

初步可行性研究(或预可行性研究)是对矿产项目技术和经济可行性的一系列备选方案的综合研究,该项目已发展到合格人员已经确定(就地下采矿而言)首选采矿方法或(露天采矿)矿坑配置的阶段,并且在所有情况下都确定了有效的矿物加工方法和有效的产品销售计划。预可行性研究包括基于合理假设、基于适当测试的对修改因素的财务分析,以及对任何其他相关因素的评估,这些因素足以让合格人员在报告时确定所有或部分标示和测定的矿产资源是否可以转化为矿产储量。财务分析必须具有必要的详细程度,以便在报告时证明开采在经济上是可行的。与可行性研究相比,预可行性研究不够全面,其可信度也较低。与初步评估相比,预可行性研究更全面,可信度更高。

About American Battery Technology Company

American Battery Technology Company (ABTC), headquartered in Reno, Nevada, has pioneered first-of-kind technologies to unlock domestically manufactured and recycled battery metals critically needed to help meet the significant demand from the electric vehicle, stationary storage, and consumer electronics industries. Committed to a circular supply chain for battery metals, ABTC works to continually innovate and master new battery metals technologies that power a global transition to electrification and the future of sustainable energy.

关于美国电池技术公司

总部位于内华达州里诺的美国电池技术公司(ABTC)开创了同类首创的技术,可以解锁国产和回收的电池金属,这些金属是满足电动汽车、固定存储和消费电子行业的巨大需求所必需的。ABTC致力于电池金属的循环供应链,致力于不断创新和掌握新的电池金属技术,为全球向电气化的过渡和可持续能源的未来提供动力。

Forward-Looking Statements

This press release contains "forward-looking statements" within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, are "forward-looking statements." Although the American Battery Technology Company's (the "Company") management believes that such forward-looking statements are reasonable, it cannot guarantee that such expectations are, or will be, correct. These forward-looking statements involve a number of risks and uncertainties, which could cause the Company's future results to differ materially from those anticipated. Potential risks and uncertainties include, among others, risks and uncertainties related to the Company's ability to continue as a going concern; interpretations or reinterpretations of geologic information, unfavorable exploration results, inability to obtain permits required for future exploration, development or production, general economic conditions and conditions affecting the industries in which the Company operates; the uncertainty of regulatory requirements and approvals; fluctuating mineral and commodity prices, final investment approval and the ability to obtain necessary financing on acceptable terms or at all. Additional information regarding the factors that may cause actual results to differ materially from these forward-looking statements is available in the Company's filings with the Securities and Exchange Commission, including the Annual Report on Form 10-K for the year ended June 30, 2023. The Company assumes no obligation to update any of the information contained or referenced in this press release.

前瞻性陈述

本新闻稿包含1995年美国私人证券诉讼改革法案安全港条款所指的 “前瞻性陈述”。除历史事实陈述外,所有陈述均为 “前瞻性陈述”。尽管美国电池技术公司(“公司”)的管理层认为此类前瞻性陈述是合理的,但它不能保证此类预期是正确或将会是正确的。这些前瞻性陈述涉及许多风险和不确定性,这可能导致公司的未来业绩与预期存在重大差异。潜在风险和不确定性包括与公司持续经营能力相关的风险和不确定性;对地质信息的解释或重新解释、不利的勘探结果、无法获得未来勘探、开发或生产所需的许可证、总体经济状况和影响公司经营行业的条件;监管要求和批准的不确定性;矿产和大宗商品价格的波动、最终投资批准和能力以可接受的条件或完全获得必要的融资。有关可能导致实际业绩与这些前瞻性陈述存在重大差异的因素的更多信息,请参阅公司向美国证券交易委员会提交的文件,包括截至2023年6月30日的10-K表年度报告。公司没有义务更新本新闻稿中包含或引用的任何信息。