Market Still Lacking Some Conviction On AdaptHealth Corp. (NASDAQ:AHCO)

Market Still Lacking Some Conviction On AdaptHealth Corp. (NASDAQ:AHCO)

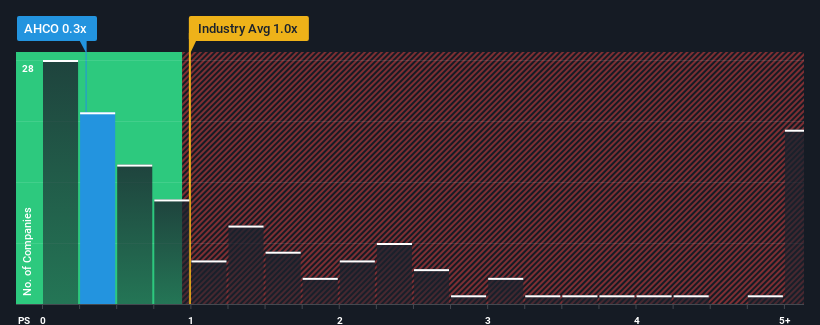

You may think that with a price-to-sales (or "P/S") ratio of 0.3x AdaptHealth Corp. (NASDAQ:AHCO) is a stock worth checking out, seeing as almost half of all the Healthcare companies in the United States have P/S ratios greater than 1x and even P/S higher than 3x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

你可能会认为,市销率(或 “市盈率”)为0.3倍AdaptHealth Corp.(纳斯达克股票代码:AHCO)值得一试,因为美国几乎有一半的医疗保健公司的市销率大于1倍,即使市盈率高于3倍也并非不寻常。但是,我们需要更深入地挖掘以确定降低市销率是否有合理的依据。

Check out our latest analysis for AdaptHealth

查看我们对 AdaptHealth 的最新分析

NasdaqCM:AHCO Price to Sales Ratio vs Industry January 18th 2024

纳斯达克股票代码:AHCO 与行业的股价销售比率 2024 年 1 月 18 日

How AdaptHealth Has Been Performing

AdaptHealth 的表现如何

AdaptHealth could be doing better as it's been growing revenue less than most other companies lately. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

AdaptHealth可能会做得更好,因为它最近的收入增长低于大多数其他公司。市销率可能很低,因为投资者认为这种乏善可陈的收入表现不会好转。如果你仍然喜欢这家公司,你希望收入不会恶化,也希望在股票失宠的时候买入一些股票。

Want the full picture on analyst estimates for the company? Then our free report on AdaptHealth will help you uncover what's on the horizon.

想全面了解分析师对公司的估计吗?然后,我们关于AdaptHealth的免费报告将帮助您发现即将发生的事情。

Do Revenue Forecasts Match The Low P/S Ratio?

收入预测与低市销率相匹配吗?

There's an inherent assumption that a company should underperform the industry for P/S ratios like AdaptHealth's to be considered reasonable.

人们固有的假设是,如果像AdaptHealth这样的市销率被认为是合理的,公司的表现应该低于该行业。

If we review the last year of revenue growth, the company posted a worthy increase of 7.6%. The latest three year period has also seen an excellent 264% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

如果我们回顾一下去年的收入增长,该公司公布了7.6%的可观增长。在最近三年中,总收入也实现了264%的出色增长,这在一定程度上得益于其短期表现。因此,我们可以首先确认该公司在这段时间内在增加收入方面做得很好。

Turning to the outlook, the next three years should generate growth of 11% per annum as estimated by the ten analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 7.3% each year, which is noticeably less attractive.

展望来看,根据关注该公司的十位分析师的估计,未来三年将实现每年11%的增长。同时,预计该行业的其他部门每年仅增长7.3%,这明显降低了吸引力。

With this information, we find it odd that AdaptHealth is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

有了这些信息,我们感到奇怪的是,AdaptHealth的市销率低于该行业。显然,一些股东对预测表示怀疑,并一直在接受大幅降低的销售价格。

The Key Takeaway

关键要点

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

我们可以说,市销比率的力量主要不是作为一种估值工具,而是用来衡量当前的投资者情绪和未来预期。

A look at AdaptHealth's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

看看AdaptHealth的收入就会发现,尽管对未来的增长预测很高,但其市销率远低于我们的预期。可能有一些主要的风险因素给市销率带来下行压力。尽管由于预计该公司将实现高增长,股价暴跌的可能性似乎不大,但市场似乎确实有些犹豫。

It is also worth noting that we have found 1 warning sign for AdaptHealth that you need to take into consideration.

还值得注意的是,我们发现了AdaptHealth的1个警告信号,你需要考虑这个信号。

If these risks are making you reconsider your opinion on AdaptHealth, explore our interactive list of high quality stocks to get an idea of what else is out there.

如果这些风险让你重新考虑你对AdaptHealth的看法,请浏览我们的高质量股票互动清单,了解还有什么。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧吗?请直接联系我们。或者,也可以发送电子邮件至编辑团队 (at) simplywallst.com。

Simply Wall St 的这篇文章本质上是笼统的。我们仅使用公正的方法提供基于历史数据和分析师预测的评论,我们的文章并非旨在提供财务建议。它不构成买入或卖出任何股票的建议,也没有考虑到您的目标或财务状况。我们的目标是为您提供由基本数据驱动的长期重点分析。请注意,我们的分析可能不会考虑最新的价格敏感型公司公告或定性材料。华尔街只是没有持有上述任何股票的头寸。