Will Connect Biopharma Holdings (NASDAQ:CNTB) Spend Its Cash Wisely?

Will Connect Biopharma Holdings (NASDAQ:CNTB) Spend Its Cash Wisely?

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

即使企业亏损,如果股东以合适的价格收购一家好的企业,他们也有可能赚钱。例如,尽管Amazon.com在上市后多年亏损,但如果您自1999年以来一直买入并持有股票,您本来可以发大财。但是,尽管成功是众所周知的,但投资者不应忽视许多无利可图的公司,这些公司干脆耗尽了所有现金然后倒闭。

So, the natural question for Connect Biopharma Holdings (NASDAQ:CNTB) shareholders is whether they should be concerned by its rate of cash burn. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. Let's start with an examination of the business' cash, relative to its cash burn.

因此,对于Connect Biopharma Holdings(纳斯达克股票代码:CNTB)股东来说,自然而然的问题是,他们是否应该担心其现金消耗率。在本文中,我们将现金消耗定义为其年度(负)自由现金流,即公司每年花费为其增长提供资金的金额。让我们首先研究一下企业的现金,与其现金消耗的关系。

Check out our latest analysis for Connect Biopharma Holdings

查看我们对Connect Biopharma Holdings的最新分析

Does Connect Biopharma Holdings Have A Long Cash Runway?

Connect Biopharma Holdings 有漫长的现金流吗?

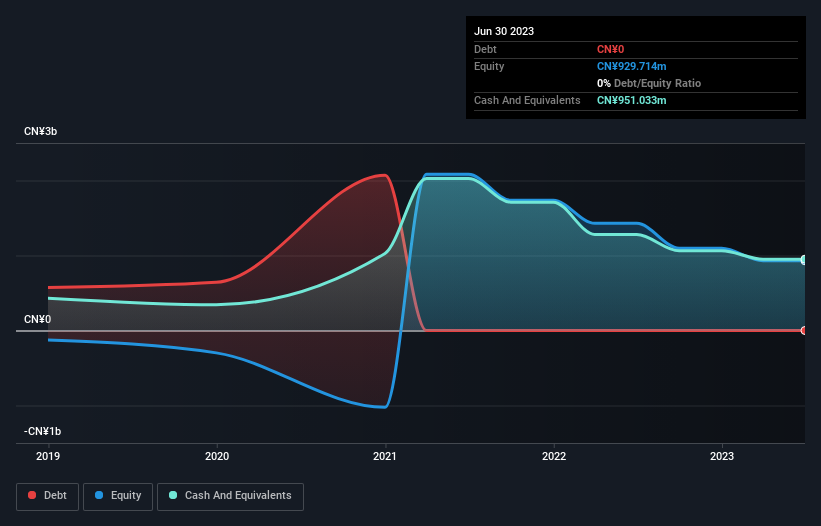

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. When Connect Biopharma Holdings last reported its balance sheet in June 2023, it had zero debt and cash worth CN¥951m. Looking at the last year, the company burnt through CN¥573m. That means it had a cash runway of around 20 months as of June 2023. That's not too bad, but it's fair to say the end of the cash runway is in sight, unless cash burn reduces drastically. The image below shows how its cash balance has been changing over the last few years.

现金跑道的定义是,如果一家公司继续以目前的现金消耗率进行支出,则需要多长时间才能耗尽资金。当Connect Biopharma Holdings上次在2023年6月公布资产负债表时,其债务为零,现金价值为9.51亿元人民币。纵观去年,该公司的支出为5.73亿元人民币。这意味着截至2023年6月,它的现金周转期约为20个月。这还算不错,但可以公平地说,除非现金消耗大幅减少,否则现金跑道的终结在眼前。下图显示了其现金余额在过去几年中发生了怎样的变化。

How Is Connect Biopharma Holdings' Cash Burn Changing Over Time?

随着时间的推移,Connect Biopharma Holdings的现金消耗如何变化?

Connect Biopharma Holdings didn't record any revenue over the last year, indicating that it's an early stage company still developing its business. Nonetheless, we can still examine its cash burn trajectory as part of our assessment of its cash burn situation. With cash burn dropping by 12% it seems management feel the company is spending enough to advance its business plans at an appropriate pace. Clearly, however, the crucial factor is whether the company will grow its business going forward. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

Connect Biopharma Holdings去年没有录得任何收入,这表明它是一家仍在发展业务的早期公司。尽管如此,作为评估其现金消耗状况的一部分,我们仍然可以研究其现金消耗轨迹。随着现金消耗下降12%,管理层似乎认为该公司的支出足以以适当的速度推进其业务计划。但是,显然,关键因素是该公司未来是否会发展业务。出于这个原因,看看我们的分析师对公司的预测很有意义。

How Easily Can Connect Biopharma Holdings Raise Cash?

连接生物制药控股公司如何轻松筹集资金?

Even though it has reduced its cash burn recently, shareholders should still consider how easy it would be for Connect Biopharma Holdings to raise more cash in the future. Companies can raise capital through either debt or equity. Many companies end up issuing new shares to fund future growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

尽管Connect Biopharma Holdings最近减少了现金消耗,但股东们仍应考虑将来筹集更多现金有多容易。公司可以通过债务或股权筹集资金。许多公司最终发行新股来为未来的增长提供资金。通过观察公司相对于其市值的现金消耗,我们可以深入了解如果公司需要筹集足够的现金来弥补另一年的现金消耗,股东将被摊薄多少。

Since it has a market capitalisation of CN¥508m, Connect Biopharma Holdings' CN¥573m in cash burn equates to about 113% of its market value. Given just how high that expenditure is, relative to the company's market value, we think there's an elevated risk of funding distress, and we would be very nervous about holding the stock.

由于市值为5.08亿元人民币,Connect Biopharma Holdings的5.73亿元人民币现金消耗相当于其市值的113%左右。鉴于这笔支出相对于公司的市值有多高,我们认为资金困境的风险更高,我们会对持有该股感到非常紧张。

How Risky Is Connect Biopharma Holdings' Cash Burn Situation?

Connect Biopharma Holdings的现金消耗情况有多危险?

Even though its cash burn relative to its market cap makes us a little nervous, we are compelled to mention that we thought Connect Biopharma Holdings' cash runway was relatively promising. Summing up, we think the Connect Biopharma Holdings' cash burn is a risk, based on the factors we mentioned in this article. On another note, Connect Biopharma Holdings has 4 warning signs (and 2 which are significant) we think you should know about.

尽管其相对于市值的现金消耗让我们有些紧张,但我们不得不提到,我们认为Connect Biopharma Holdings的现金渠道相对乐观。总而言之,基于我们在本文中提到的因素,我们认为Connect Biopharma Holdings的现金消耗是一种风险。另一方面,Connect Biopharma Holdings有4个警告信号(还有2个很重要),我们认为你应该知道。

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

当然,通过寻找其他地方,你可能会找到一笔不错的投资。因此,来看看这份内部人士正在买入的公司的免费清单,以及这份成长型股票清单(根据分析师的预测)

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧?直接联系我们。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St的这篇文章本质上是笼统的。我们仅使用公正的方法根据历史数据和分析师的预测提供评论,我们的文章无意作为财务建议。它不构成买入或卖出任何股票的建议,也没有考虑到您的目标或财务状况。我们的目标是为您提供由基本数据驱动的长期重点分析。请注意,我们的分析可能不考虑最新的价格敏感型公司公告或定性材料。简而言之,华尔街没有持有任何上述股票的头寸。