ITT (NYSE:ITT) Shareholders Have Earned a 16% CAGR Over the Last Five Years

ITT (NYSE:ITT) Shareholders Have Earned a 16% CAGR Over the Last Five Years

When we invest, we're generally looking for stocks that outperform the market average. And in our experience, buying the right stocks can give your wealth a significant boost. For example, the ITT Inc. (NYSE:ITT) share price is up 97% in the last 5 years, clearly besting the market return of around 62% (ignoring dividends). On the other hand, the more recent gains haven't been so impressive, with shareholders gaining just 31% , including dividends .

当我们投资时,我们通常是在寻找表现超过市场平均水平的股票。根据我们的经验,购买合适的股票可以显著增加您的财富。例如,ITT公司(纽约证券交易所代码:ITT)的股价在过去5年中上涨了97%,显然超过了62%左右的市场回报率(不计股息)。另一方面,最近的涨幅并不那么令人印象深刻,股东仅增长了31%,包括股息。

Let's take a look at the underlying fundamentals over the longer term, and see if they've been consistent with shareholders returns.

让我们来看看长期的基本面,看看它们是否与股东的回报一致。

Check out our latest analysis for ITT

查看我们对 ITT 的最新分析

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

尽管一些人继续教导高效市场假说,但事实证明,市场是反应过度的动态系统,投资者并不总是理性的。评估公司情绪变化的一种有缺陷但合理的方法是将每股收益(EPS)与股价进行比较。

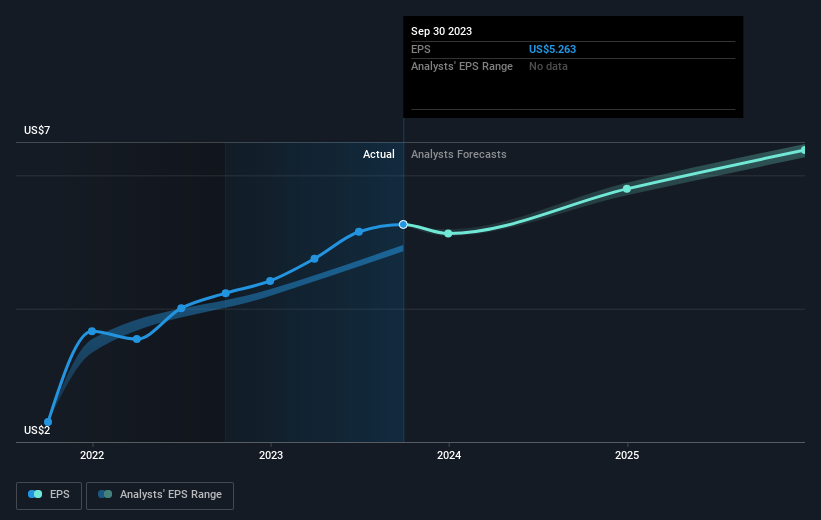

Over half a decade, ITT managed to grow its earnings per share at 17% a year. So the EPS growth rate is rather close to the annualized share price gain of 15% per year. That suggests that the market sentiment around the company hasn't changed much over that time. In fact, the share price seems to largely reflect the EPS growth.

在过去的五年中,ITT设法将其每股收益增长到每年17%。因此,每股收益的增长率相当接近每年15%的年化股价涨幅。这表明,在那段时间内,公司周围的市场情绪没有太大变化。实际上,股价似乎在很大程度上反映了每股收益的增长。

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

你可以在下面看到 EPS 是如何随着时间的推移而发生的变化(点击图片发现确切的数值)。

We know that ITT has improved its bottom line over the last three years, but what does the future have in store? It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

我们知道在过去三年中,ITT的利润有所提高,但是未来会发生什么?可能值得一看我们关于其财务状况如何随着时间的推移而变化的免费报告。

What About Dividends?

那股息呢?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of ITT, it has a TSR of 108% for the last 5 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

除了衡量股价回报率外,投资者还应考虑股东总回报率(TSR)。股东总回报率包含任何分拆或贴现资本筹集的价值,以及任何股息,前提是股息是再投资的。可以公平地说,股东总回报率为支付股息的股票提供了更完整的画面。就ITT而言,在过去的5年中,其股东总回报率为108%。这超过了我们之前提到的其股价回报率。因此,该公司支付的股息提高了 总 股东回报。

A Different Perspective

不同的视角

It's nice to see that ITT shareholders have received a total shareholder return of 31% over the last year. That's including the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 16% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 1 warning sign for ITT you should be aware of.

很高兴看到ITT股东去年获得的股东总回报率为31%。这包括股息。由于一年期股东总回报率好于五年期股东总回报率(后者为每年16%),因此该股的表现似乎在最近有所改善。鉴于股价势头仍然强劲,可能值得仔细研究该股,以免错过机会。我发现将长期股价视为业务绩效的代表非常有趣。但是,要真正获得见解,我们还需要考虑其他信息。一个很好的例子:我们发现了一个你应该注意的ITT警告标志。

We will like ITT better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

如果我们看到一些大规模的内幕买入,我们会更喜欢ITT。在我们等待的同时,请查看这份免费名单,列出了最近有大量内幕买入的成长型公司。

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

请注意,本文引用的市场回报反映了目前在美国交易所交易的股票的市场加权平均回报率。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧?直接联系我们。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St 的这篇文章本质上是笼统的。我们仅使用公正的方法提供基于历史数据和分析师预测的评论,我们的文章并非旨在提供财务建议。它不构成买入或卖出任何股票的建议,也没有考虑到您的目标或财务状况。我们的目标是为您提供由基本数据驱动的长期重点分析。请注意,我们的分析可能不会考虑最新的价格敏感型公司公告或定性材料。华尔街只是没有持有上述任何股票的头寸。