More Unpleasant Surprises Could Be In Store For China High Precision Automation Group Limited's (HKG:591) Shares After Tumbling 28%

More Unpleasant Surprises Could Be In Store For China High Precision Automation Group Limited's (HKG:591) Shares After Tumbling 28%

China High Precision Automation Group Limited (HKG:591) shareholders that were waiting for something to happen have been dealt a blow with a 28% share price drop in the last month. To make matters worse, the recent drop has wiped out a year's worth of gains with the share price now back where it started a year ago.

中国高精度自动化集团有限公司 (HKG: 591) 等待事情发生的股东受到了打击,上个月股价下跌了28%。更糟糕的是,最近的下跌抵消了一年的涨幅,股价现已回到了一年前的水平。

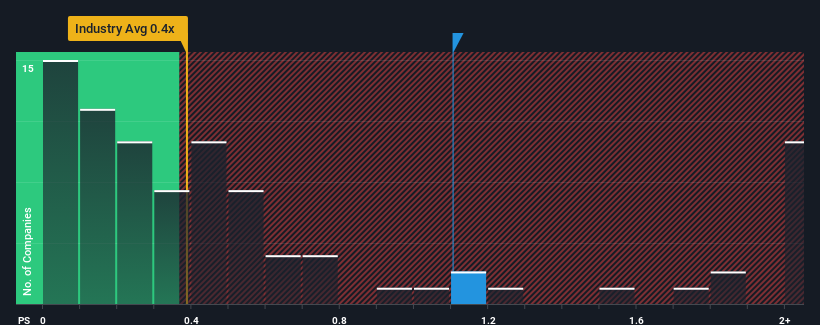

In spite of the heavy fall in price, when almost half of the companies in Hong Kong's Electronic industry have price-to-sales ratios (or "P/S") below 0.4x, you may still consider China High Precision Automation Group as a stock probably not worth researching with its 1.1x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

尽管价格大幅下跌,但当香港电子行业将近一半的公司的市售率(或 “市盈率”)低于0.4倍时,您仍然可以将中国高精度自动化集团视为一只可能不值得研究的股票,其市盈率为1.1倍。但是,市盈率高可能是有原因的,需要进一步调查才能确定其是否合理。

Check out our latest analysis for China High Precision Automation Group

查看我们对中国高精度自动化集团的最新分析

What Does China High Precision Automation Group's P/S Mean For Shareholders?

中国高精度自动化集团的市盈率对股东意味着什么?

For example, consider that China High Precision Automation Group's financial performance has been pretty ordinary lately as revenue growth is non-existent. One possibility is that the P/S is high because investors think the benign revenue growth will improve to outperform the broader industry in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

例如,考虑一下,由于收入没有增长,中国高精度自动化集团最近的财务表现相当普通。一种可能性是市盈率很高,因为投资者认为,在不久的将来,良性收入增长将有所改善,表现优于整个行业。如果不是,那么现有股东可能会对股价的可行性感到有些紧张。

Is There Enough Revenue Growth Forecasted For China High Precision Automation Group?

中国高精度自动化集团的收入增长预测是否足够?

There's an inherent assumption that a company should outperform the industry for P/S ratios like China High Precision Automation Group's to be considered reasonable.

有一种固有的假设是,如果像中国高精度自动化集团这样的市盈率被认为是合理的,一家公司的表现应该优于行业。

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. However, a few strong years before that means that it was still able to grow revenue by an impressive 43% in total over the last three years. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

如果我们回顾一下去年的收入,该公司公布的业绩与去年同期几乎没有任何差异。但是,在此之前的几年表现强劲,这意味着在过去三年中,它仍然能够将总收入增长43%,令人印象深刻。因此,股东会感到高兴,但对于过去的12个月,也有一些问题需要思考。

It's interesting to note that the rest of the industry is similarly expected to grow by 13% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

有趣的是,预计该行业的其他部门明年将增长13%,这与该公司最近的中期年化增长率相当。

In light of this, it's curious that China High Precision Automation Group's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly average recent growth rates and are willing to pay up for exposure to the stock. Nevertheless, they may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

有鉴于此,奇怪的是,中国高精度自动化集团的市盈率高于其他大多数公司。看来大多数投资者都忽视了近期相当平均的增长率,他们愿意为股票敞口付出代价。尽管如此,如果市盈率降至更符合近期增长率的水平,他们可能会为未来的失望做好准备。

What Does China High Precision Automation Group's P/S Mean For Investors?

中国高精度自动化集团的市盈率对投资者意味着什么?

Despite the recent share price weakness, China High Precision Automation Group's P/S remains higher than most other companies in the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

尽管最近股价疲软,但中国高精度自动化集团的市盈率仍高于业内大多数其他公司。仅使用市销比来确定是否应该出售股票是不明智的,但是它可以作为公司未来前景的实用指南。

We didn't expect to see China High Precision Automation Group trade at such a high P/S considering its last three-year revenue growth has only been on par with the rest of the industry. Right now we are uncomfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. If recent medium-term revenue trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

考虑到中国高精度自动化集团过去三年的收入增长仅与行业其他部门持平,我们没想到会看到中国高精度自动化集团的市盈率如此之高。目前,我们对高市盈率感到不舒服,因为这种收入表现不太可能长期支撑这种乐观情绪。如果最近的中期收入趋势继续下去,将使股东的投资面临风险,潜在投资者面临支付不必要的溢价的危险。

Before you settle on your opinion, we've discovered 1 warning sign for China High Precision Automation Group that you should be aware of.

在你确定自己的观点之前,我们已经发现 中国高精度自动化集团有 1 个警告信号 你应该知道的。

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

如果实力雄厚的公司让你大开眼界,那么你一定要看看这个 免费的 以低市盈率交易(但已证明可以增加收益)的有趣公司名单。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?担心内容吗? 取得联系 直接和我们在一起。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St 的这篇文章本质上是笼统的。 我们仅使用公正的方法根据历史数据和分析师的预测提供评论,我们的文章无意作为财务建议。 它不构成买入或卖出任何股票的建议,也没有考虑您的目标或财务状况。我们的目标是为您提供由基本面数据驱动的长期重点分析。请注意,我们的分析可能不考虑最新的价格敏感公司公告或定性材料。简而言之,华尔街在上述任何股票中都没有头寸。