The Price Is Right For Jiading International Group Holdings Ltd (HKG:8153) Even After Diving 30%

The Price Is Right For Jiading International Group Holdings Ltd (HKG:8153) Even After Diving 30%

Jiading International Group Holdings Ltd (HKG:8153) shareholders that were waiting for something to happen have been dealt a blow with a 30% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 59% loss during that time.

嘉定国际集团控股有限公司(HKG:8153)上个月,等待着什么事情发生的股东受到了打击,股价下跌了30%。最近的下跌为股东们灾难性的12个月画上了句号,在此期间,他们坐拥59%的损失。

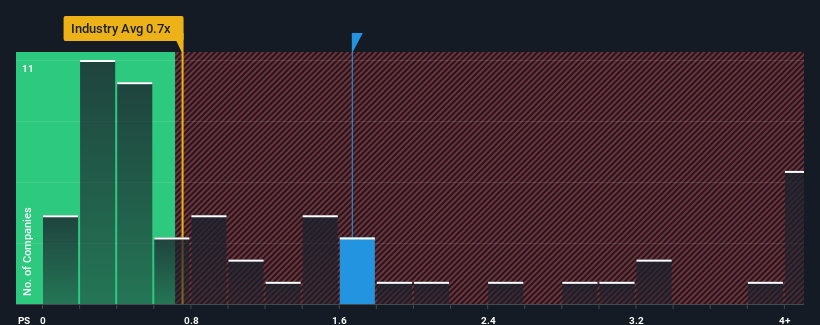

In spite of the heavy fall in price, when almost half of the companies in Hong Kong's Media industry have price-to-sales ratios (or "P/S") below 0.7x, you may still consider Jiading International Group Holdings as a stock probably not worth researching with its 1.7x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

尽管股价大幅下跌,但当香港传媒业近一半的公司市盈率(P/S)低于0.7倍时,你可能仍会认为嘉定国际集团控股有限公司的股票可能不值得研究,因为它的市盈率为1.7倍。然而,仅仅从市盈率/S的表面价值来看是不明智的,因为可能会有一个解释,为什么它会这么高。

See our latest analysis for Jiading International Group Holdings

查看我们对嘉定国际集团控股的最新分析

How Jiading International Group Holdings Has Been Performing

嘉定国际集团控股公司的表现如何

Jiading International Group Holdings certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. The P/S ratio is probably high because investors think this strong revenue growth will be enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

嘉定国际集团控股最近确实做得很好,因为它一直在以非常快的速度增长收入。市盈率/S比率可能很高,因为投资者认为,这种强劲的营收增长在不久的将来将足以跑赢整体行业。然而,如果情况并非如此,投资者可能会被发现为该股支付过高的价格。

What Are Revenue Growth Metrics Telling Us About The High P/S?

收入增长指标告诉我们关于高市盈率的哪些信息?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Jiading International Group Holdings' to be considered reasonable.

有一个固有的假设,即一家公司的表现应该好于行业,才能让嘉定国际控股这样的市盈率被认为是合理的。

Retrospectively, the last year delivered an exceptional 48% gain to the company's top line. This great performance means it was also able to deliver immense revenue growth over the last three years. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

回顾过去一年,该公司营收实现了48%的不同寻常的增长。这一出色的表现意味着它在过去三年中也能够实现巨大的收入增长。因此,股东们会对这些中期营收增长率感到欣喜若狂。

Comparing that to the industry, which is only predicted to deliver 19% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

相比之下,该行业预计在未来12个月只会实现19%的增长,从最近的中期年化收入结果来看,该公司的增长势头更强劲。

With this information, we can see why Jiading International Group Holdings is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

有了这些信息,我们就可以理解为什么嘉定国际集团控股的市盈率比行业高出这么高/S。似乎大多数投资者都预计这种强劲的增长将持续下去,并愿意为该股支付更高的价格。

The Final Word

最后的结论

Despite the recent share price weakness, Jiading International Group Holdings' P/S remains higher than most other companies in the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

尽管最近股价疲软,嘉定国际集团控股有限公司的市盈率S仍高于业内大多数其他公司。通常情况下,在做出投资决策时,我们会告诫不要过度解读市盈率,尽管它可以充分揭示其他市场参与者对该公司的看法。

It's no surprise that Jiading International Group Holdings can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

考虑到嘉定国际集团在过去三年经历的强劲收入增长优于当前的行业前景,嘉定国际集团控股能够支撑其高市盈率也就不足为奇了。在股东看来,出现持续增长轨迹的可能性很大,足以阻止P/S回调。如果近期的中期营收趋势持续下去,在这种情况下,很难看到股价在不久的将来强劲下跌。

You should always think about risks. Case in point, we've spotted 5 warning signs for Jiading International Group Holdings you should be aware of, and 3 of them are a bit concerning.

你应该时刻考虑风险。举个例子,我们发现嘉定国际集团控股的5个警示信号你应该知道,其中有3个有点令人担忧。

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

当然了,利润丰厚、盈利增长迅速的公司通常是更安全的押注。所以你可能想看看这个免费其他市盈率合理、盈利增长强劲的公司的集合。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有什么反馈吗?担心内容吗? 保持联系直接与我们联系。或者,也可以给编辑组发电子邮件,地址是implywallst.com。

本文由Simply Wall St.撰写,具有概括性。我们仅使用不偏不倚的方法提供基于历史数据和分析师预测的评论,我们的文章并不打算作为财务建议。它不构成买卖任何股票的建议,也没有考虑你的目标或你的财务状况。我们的目标是为您带来由基本面数据驱动的长期重点分析。请注意,我们的分析可能不会将最新的对价格敏感的公司公告或定性材料考虑在内。Simply Wall St.对上述任何一只股票都没有持仓。