Gulfport Energy Corporation (NYSE:GPOR) Not Lagging Industry On Growth Or Pricing

Gulfport Energy Corporation (NYSE:GPOR) Not Lagging Industry On Growth Or Pricing

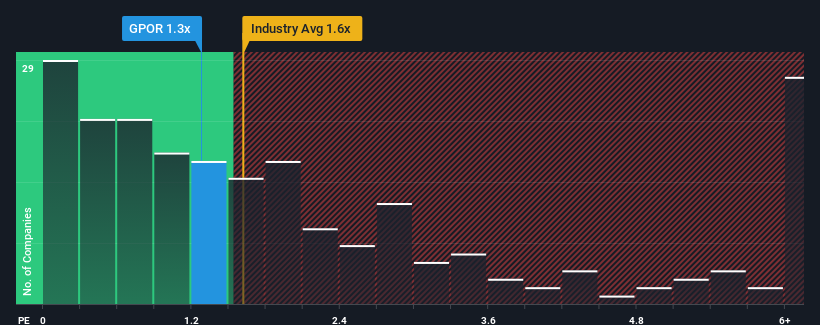

It's not a stretch to say that Gulfport Energy Corporation's (NYSE:GPOR) price-to-sales (or "P/S") ratio of 1.3x right now seems quite "middle-of-the-road" for companies in the Oil and Gas industry in the United States, where the median P/S ratio is around 1.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

这么说一点也不牵强湾港能源公司的(纽约证券交易所股票代码:GPOR)1.3倍的市销率(或“P/S”)对于美国石油和天然气行业的公司来说似乎相当“中间”,那里的P/S比率中值约为1.6倍。尽管这可能不会令人惊讶,但如果P/S比率不合理,投资者可能会错过潜在的机会,或者忽视迫在眉睫的失望情绪。

View our latest analysis for Gulfport Energy

查看我们对湾港能源的最新分析

How Has Gulfport Energy Performed Recently?

湾港能源最近表现如何?

Gulfport Energy could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

湾港能源可能会做得更好,因为它的收入最近一直在下降,而其他大多数公司的收入都出现了正增长。这可能是因为许多人预计黯淡的营收表现将积极增强,这使得市盈率S没有下跌。如果不是,那么现有股东可能会对股价的生存能力感到有点紧张。

How Is Gulfport Energy's Revenue Growth Trending?

湾港能源的收入增长趋势如何?

The only time you'd be comfortable seeing a P/S like Gulfport Energy's is when the company's growth is tracking the industry closely.

看到像湾港能源这样的P/S,你唯一会感到舒服的时候是该公司的增长正在密切跟踪行业的发展。

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 14%. Still, the latest three year period has seen an excellent 75% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

回顾过去一年的财务状况,我们沮丧地看到该公司的收入下降到了14%。尽管短期表现不尽如人意,但最近三年的营收总体增长了75%。因此,尽管股东们更愿意继续运营,但他们肯定会欢迎中期的收入增长率。

Shifting to the future, estimates from the five analysts covering the company are not great, suggesting revenue should decline by 4.8% per annum over the next three years. Meanwhile, the industry is forecast to moderate by 3.1% per year, which suggests the company won't escape the wider industry forces.

展望未来,跟踪该公司的五位分析师的估计并不高,他们表示,未来三年,该公司的收入将以每年4.8%的速度下降。与此同时,该行业预计将以每年3.1%的速度放缓,这表明该公司无法逃脱更广泛的行业力量。

With this information, it's not too hard to see why Gulfport Energy is trading at a fairly similar P/S in comparison. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. There is still potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth.

有了这些信息,就不难理解为什么湾港能源的市盈率与S相当。然而,我们认为,营收缩水不太可能带来长期稳定的市盈率/S,这可能会让股东们对未来的失望感到失望。如果该公司的营收增长得不到改善,市盈率仍有可能降至更低水平。

What Does Gulfport Energy's P/S Mean For Investors?

湾港能源的P/S对投资者意味着什么?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

虽然市销率不应该成为你是否买入一只股票的决定性因素,但它是一个很好的收入预期晴雨表。

As expected, we see that Gulfport Energy maintains its moderate P/S thanks to a revenue outlook that's pretty much level with the wider industry. Right now shareholders are comfortable with the P/S as they are confident future revenue won't throw up any further unpleasant surprises. However, we're slightly cautious about the company's ability to resist further pain to its business from the broader industry turmoil. In the meantime, unless the company's prospects change they will continue to support the share price at these levels.

正如预期的那样,我们看到湾港能源保持了温和的市盈率S,这要归功于其收入前景与整个行业基本持平。目前,股东们对P/S很满意,因为他们相信未来的收入不会再带来任何令人不快的惊喜。然而,我们对该公司抵御更广泛行业动荡给其业务带来的进一步痛苦的能力略微持谨慎态度。与此同时,除非该公司的前景发生变化,否则它们将继续支撑股价在这些水平上。

Before you settle on your opinion, we've discovered 4 warning signs for Gulfport Energy (2 are significant!) that you should be aware of.

在你决定你的观点之前,我们发现湾港能源的4个警示标志(其中两项意义重大!)这一点你应该知道。

If these risks are making you reconsider your opinion on Gulfport Energy, explore our interactive list of high quality stocks to get an idea of what else is out there.

如果这些风险让你重新考虑对湾港能源的看法,探索我们的高质量股票互动列表,以了解还有什么。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有什么反馈吗?担心内容吗? 保持联系直接与我们联系。或者,也可以给编辑组发电子邮件,地址是implywallst.com。

本文由Simply Wall St.撰写,具有概括性。我们仅使用不偏不倚的方法提供基于历史数据和分析师预测的评论,我们的文章并不打算作为财务建议。它不构成买卖任何股票的建议,也没有考虑你的目标或你的财务状况。我们的目标是为您带来由基本面数据驱动的长期重点分析。请注意,我们的分析可能不会将最新的对价格敏感的公司公告或定性材料考虑在内。Simply Wall St.对上述任何一只股票都没有持仓。

The only time you'd be comfortable seeing a P/S like Gulfport Energy's is when the company's growth is tracking the industry closely.

The only time you'd be comfortable seeing a P/S like Gulfport Energy's is when the company's growth is tracking the industry closely.