We Think Some Shareholders May Hesitate To Increase Royal Deluxe Holdings Limited's (HKG:3789) CEO Compensation

We Think Some Shareholders May Hesitate To Increase Royal Deluxe Holdings Limited's (HKG:3789) CEO Compensation

Key Insights

主要见解

- Royal Deluxe Holdings' Annual General Meeting to take place on 19th of September

- Salary of HK$4.80m is part of CEO Lai Heng Chao's total remuneration

- The total compensation is 151% higher than the average for the industry

- Royal Deluxe Holdings' EPS declined by 7.4% over the past three years while total shareholder loss over the past three years was 38%

- 皇家豪华控股公司年度股东大会将于9月19日举行

- 480万港元的薪酬是行政总裁黎恒超总薪酬的一部分

- 总薪酬比该行业的平均水平高出151%

- 皇家豪华控股公司的每股收益在过去三年中下降了7.4%,而股东在过去三年中的总亏损为38%

In the past three years, the share price of Royal Deluxe Holdings Limited (HKG:3789) has struggled to grow and now shareholders are sitting on a loss. Per share earnings growth is also poor, despite revenues growing. Shareholders will have a chance to take their concerns to the board at the next AGM on 19th of September and vote on resolutions including executive compensation, which studies show may have an impact on company performance. Here's why we think shareholders should hold off on a raise for the CEO at the moment.

在过去三年中,该公司的股价皇家豪华控股有限公司(HKG:3789)一直在艰难地增长,现在股东坐拥亏损。尽管营收在增长,但每股收益增长也很糟糕。股东们将有机会在9月19日的下一届年度股东大会上向董事会表达他们的担忧,并就包括高管薪酬在内的决议进行投票,研究表明,这可能会对公司业绩产生影响。这就是为什么我们认为股东目前应该暂缓为CEO加薪的原因。

Check out our latest analysis for Royal Deluxe Holdings

查看我们对皇家豪华控股公司的最新分析

Comparing Royal Deluxe Holdings Limited's CEO Compensation With The Industry

皇家豪华控股有限公司CEO薪酬与行业的比较

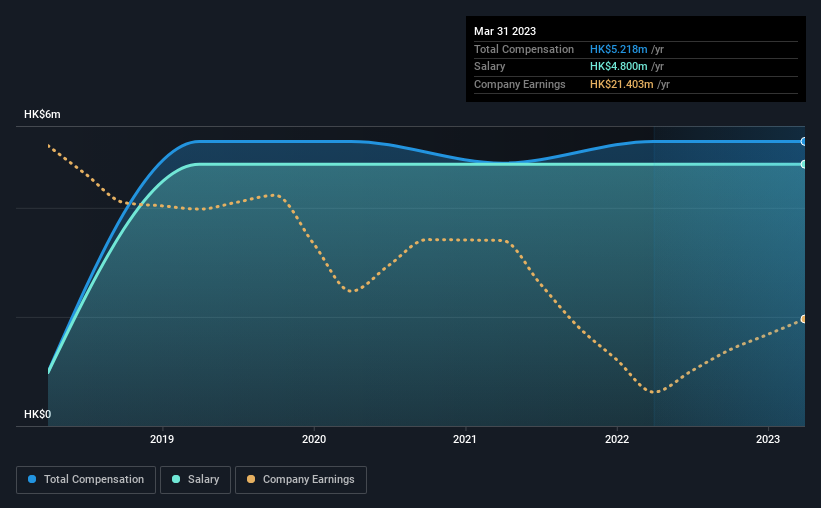

According to our data, Royal Deluxe Holdings Limited has a market capitalization of HK$97m, and paid its CEO total annual compensation worth HK$5.2m over the year to March 2023. This was the same as last year. Notably, the salary which is HK$4.80m, represents most of the total compensation being paid.

根据我们的数据,皇家豪华控股有限公司的市值为9700万港元,在截至2023年3月的一年中,向其首席执行官支付了总计520万港元的年薪。这与去年持平。值得注意的是,480万港元的薪酬占到了全部薪酬的大部分。

In comparison with other companies in the Hong Kong Construction industry with market capitalizations under HK$1.6b, the reported median total CEO compensation was HK$2.1m. Accordingly, our analysis reveals that Royal Deluxe Holdings Limited pays Lai Heng Chao north of the industry median.

与香港建筑业其他市值低于16亿港元的公司相比,报告的CEO总薪酬中值为210万港元。据此,我们的分析显示,皇家豪华控股有限公司支付的里恒超以北的行业中位数。

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | HK$4.8m | HK$4.8m | 92% |

| Other | HK$418k | HK$418k | 8% |

| Total Compensation | HK$5.2m | HK$5.2m | 100% |

| 组件 | 2023年 | 2022 | 比例(2023年) |

| 薪金 | 港币480万元 | 港币480万元 | 百分之九十二 |

| 其他 | 港币41.8万元 | 港币41.8万元 | 8% |

| 全额补偿 | 港币520万元 | 港币520万元 | 100% |

Speaking on an industry level, nearly 88% of total compensation represents salary, while the remainder of 12% is other remuneration. Although there is a difference in how total compensation is set, Royal Deluxe Holdings more or less reflects the market in terms of setting the salary. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

从行业层面来看,近88%的薪酬是工资,其余12%是其他薪酬。尽管薪酬总额的确定方式有所不同,但皇家豪华控股在薪酬设置方面或多或少反映了市场。如果总薪酬倾向于薪酬,这意味着可变部分--通常与业绩挂钩--更低。

Royal Deluxe Holdings Limited's Growth

皇家豪华控股有限公司的增长

Over the last three years, Royal Deluxe Holdings Limited has shrunk its earnings per share by 7.4% per year. In the last year, its revenue is up 49%.

在过去的三年里,皇家豪华控股有限公司的每股收益每年缩水7.4%。去年,它的收入增长了49%。

The reduction in EPS, over three years, is arguably concerning. On the other hand, the strong revenue growth suggests the business is growing. It's hard to reach a conclusion about business performance right now. This may be one to watch. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

三年来每股收益的减少可以说是令人担忧的。另一方面,强劲的收入增长表明该业务正在增长。目前很难对企业业绩做出结论。这可能是一部值得关注的影片。我们没有分析师的预测,但你可以通过查看这张更详细的收益、收入和现金流的历史图表来更好地了解它的增长。

Has Royal Deluxe Holdings Limited Been A Good Investment?

皇家豪华控股有限公司是一笔不错的投资吗?

With a total shareholder return of -38% over three years, Royal Deluxe Holdings Limited shareholders would by and large be disappointed. This suggests it would be unwise for the company to pay the CEO too generously.

由于三年来股东总回报率为-38%,Royal Deluxe Holdings Limited的股东大体上会感到失望。这表明,该公司向首席执行官支付过高薪酬是不明智的。

In Summary...

总结一下..。

The returns to shareholders is disappointing along with lack of earnings growth, which goes some way in explaining the poor returns. In the upcoming AGM, shareholders will get the opportunity to discuss any issues with the board, including those related to CEO remuneration and assess if the board's plan is in line with their expectations.

对股东的回报令人失望,同时盈利增长乏力,这在一定程度上解释了回报不佳的原因。在即将举行的年度股东大会上,股东将有机会与董事会讨论任何问题,包括与CEO薪酬相关的问题,并评估董事会的计划是否符合他们的预期。

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We identified 3 warning signs for Royal Deluxe Holdings (1 is significant!) that you should be aware of before investing here.

CEO薪酬是一个值得关注的重要领域,但我们也需要关注公司的其他属性。我们确认了皇家豪华控股公司的3个警告标志(1很重要!)在这里投资之前你应该意识到这一点。

Switching gears from Royal Deluxe Holdings, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

从皇家豪华控股公司转型,如果你正在寻找原始的资产负债表和溢价回报,这是免费高回报、低负债的公司名单是一个很好的地方。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有什么反馈吗?担心内容吗? 保持联系直接与我们联系。或者,也可以给编辑组发电子邮件,地址是implywallst.com。

本文由Simply Wall St.撰写,具有概括性。我们仅使用不偏不倚的方法提供基于历史数据和分析师预测的评论,我们的文章并不打算作为财务建议。它不构成买卖任何股票的建议,也没有考虑你的目标或你的财务状况。我们的目标是为您带来由基本面数据驱动的长期重点分析。请注意,我们的分析可能不会将最新的对价格敏感的公司公告或定性材料考虑在内。Simply Wall St.对上述任何一只股票都没有持仓。