Revenues Tell The Story For Glory Flame Holdings Limited (HKG:8059) As Its Stock Soars 47%

Revenues Tell The Story For Glory Flame Holdings Limited (HKG:8059) As Its Stock Soars 47%

Glory Flame Holdings Limited (HKG:8059) shares have continued their recent momentum with a 47% gain in the last month alone. Unfortunately, despite the strong performance over the last month, the full year gain of 4.2% isn't as attractive.

荣耀火焰控股有限公司(HKG:8059)仅在过去一个月,股价就延续了近期的势头,上涨了47%。不幸的是,尽管过去一个月表现强劲,但4.2%的全年涨幅并不具有吸引力。

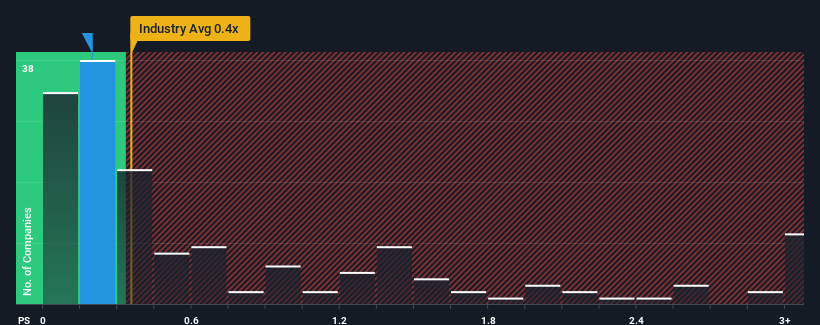

In spite of the firm bounce in price, it's still not a stretch to say that Glory Flame Holdings' price-to-sales (or "P/S") ratio of 0.2x right now seems quite "middle-of-the-road" compared to the Construction industry in Hong Kong, where the median P/S ratio is around 0.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

尽管房价强劲反弹,但可以毫不夸张地说,与香港建筑业相比,荣耀火焰控股目前0.2倍的市售比(P/S)似乎相当“中等”,后者的P/S比率中值约为0.4倍。然而,如果市盈率没有理性基础,投资者可能会忽视一个明显的机会或潜在的挫折。

See our latest analysis for Glory Flame Holdings

查看我们对Glory Flame Holdings的最新分析

How Glory Flame Holdings Has Been Performing

荣耀火焰控股公司的表现如何

Glory Flame Holdings certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. Perhaps the market is expecting future revenue performance to taper off, which has kept the P/S from rising. Those who are bullish on Glory Flame Holdings will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

荣耀火焰控股公司最近确实做得很好,因为它的收入一直在以非常快的速度增长。或许,市场预期未来的营收表现将逐渐减弱,这使得市盈率S不再上涨。那些看好Glory Flame Holdings的人希望情况并非如此,这样他们就可以以较低的估值买入该股。

Do Revenue Forecasts Match The P/S Ratio?

收入预测是否与市盈率匹配?

The only time you'd be comfortable seeing a P/S like Glory Flame Holdings' is when the company's growth is tracking the industry closely.

唯一能让你放心地看到像荣耀火焰控股这样的P/S的时候,就是该公司的增长正在密切跟踪该行业的时候。

Retrospectively, the last year delivered an exceptional 37% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 51% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

回顾过去一年,该公司营收实现了37%的不同寻常的增长。最近的强劲表现意味着,该公司在过去三年的总收入也增长了51%。因此,公平地说,最近的收入增长对公司来说是一流的。

Comparing that to the industry, which is predicted to deliver 16% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

相比之下,该行业预计在未来12个月内将实现16%的增长,根据最近的中期年化收入结果,该公司的增长势头非常相似。

In light of this, it's understandable that Glory Flame Holdings' P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

有鉴于此,荣耀火焰控股的P/S与大多数其他公司坐在一起是可以理解的。显然,只要假设公司将继续保持低调,股东们就会感到放心。

The Final Word

最后的结论

Glory Flame Holdings appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

荣耀火焰控股似乎再次受到青睐,它的股价稳步上涨,使其市盈率与业内其他公司的市盈率重新保持一致。仅用市销率来决定你是否应该出售股票是不明智的,但它可以成为该公司未来前景的实用指南。

As we've seen, Glory Flame Holdings' three-year revenue trends seem to be contributing to its P/S, given they look similar to current industry expectations. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

正如我们已经看到的,荣耀火焰控股的三年收入趋势似乎正在推动其市盈率/S,因为它们看起来与当前行业的预期相似。目前,股东们对P/S很满意,因为他们非常有信心未来的收入不会带来任何惊喜。如果近期的中期营收趋势继续下去,在这种情况下,很难看到股价在不久的将来向任何一个方向强劲移动。

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Glory Flame Holdings that you should be aware of.

别忘了,可能还有其他风险。例如,我们已经确定荣耀火焰控股的3个警告标志这一点你应该知道。

If you're unsure about the strength of Glory Flame Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

如果你.不确定荣耀火焰控股的业务实力,为什么不探索我们的互动列表,为其他一些你可能没有达到预期的公司提供坚实的商业基本面。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有什么反馈吗?担心内容吗? 保持联系直接与我们联系。或者,也可以给编辑组发电子邮件,地址是implywallst.com。

本文由Simply Wall St.撰写,具有概括性。我们仅使用不偏不倚的方法提供基于历史数据和分析师预测的评论,我们的文章并不打算作为财务建议。它不构成买卖任何股票的建议,也没有考虑你的目标或你的财务状况。我们的目标是为您带来由基本面数据驱动的长期重点分析。请注意,我们的分析可能不会将最新的对价格敏感的公司公告或定性材料考虑在内。Simply Wall St.对上述任何一只股票都没有持仓。