It's Down 29% But Maoye International Holdings Limited (HKG:848) Could Be Riskier Than It Looks

It's Down 29% But Maoye International Holdings Limited (HKG:848) Could Be Riskier Than It Looks

The Maoye International Holdings Limited (HKG:848) share price has fared very poorly over the last month, falling by a substantial 29%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 28% share price drop.

这个茂业国际控股有限公司(HKG:848)过去一个月,股价表现非常糟糕,大幅下跌29%。在过去12个月里一直持有股票的股东非但没有获得回报,反而坐在股价下跌28%的位置上。

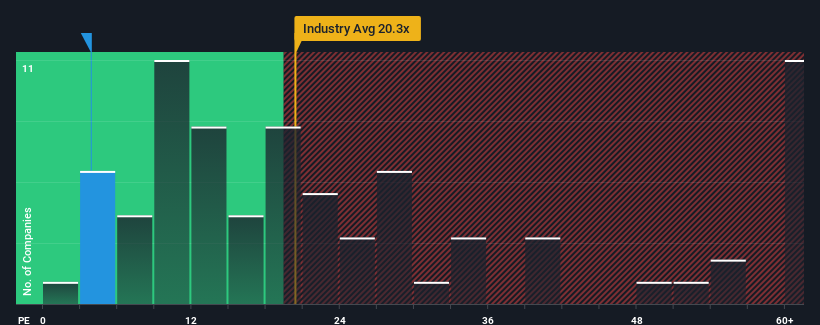

In spite of the heavy fall in price, Maoye International Holdings' price-to-earnings (or "P/E") ratio of 3.9x might still make it look like a strong buy right now compared to the market in Hong Kong, where around half of the companies have P/E ratios above 10x and even P/E's above 20x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

尽管股价大幅下跌,但与香港股市相比,茂业国际控股3.9倍的市盈率仍可能让它看起来是一笔强劲的买入。在香港,大约一半的公司的市盈率超过10倍,甚至市盈率高于20倍的情况也很常见。尽管如此,我们还需要更深入地挖掘,以确定市盈率大幅下降是否有合理的基础。

Recent times have been quite advantageous for Maoye International Holdings as its earnings have been rising very briskly. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

最近对茂业国际控股公司来说是相当有利的,因为它的收益一直在快速增长。一种可能性是,市盈率较低,因为投资者认为,这种强劲的收益增长在不久的将来实际上可能会逊于大盘。如果不能实现这一点,那么现有股东有理由对未来股价的走势相当乐观。

See our latest analysis for Maoye International Holdings

查看我们对茂业国际控股的最新分析

What Are Growth Metrics Telling Us About The Low P/E?

增长指标告诉我们关于低市盈率的哪些信息?

In order to justify its P/E ratio, Maoye International Holdings would need to produce anemic growth that's substantially trailing the market.

为了证明其市盈率是合理的,茂业国际控股需要实现大幅落后于市场的疲软增长。

If we review the last year of earnings growth, the company posted a terrific increase of 131%. The latest three year period has also seen an excellent 474% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

如果我们回顾过去一年的收益增长,该公司公布了131%的惊人增长。在最近三年期间,得益于短期表现,每股收益也出现了474%的出色整体涨幅。因此,股东们可能会欢迎这样的中期盈利增长率。

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 25% shows it's noticeably more attractive on an annualised basis.

将最近的中期收益轨迹与大盘一年增长25%的预测进行比较,结果显示,按年率计算,这一数字明显更具吸引力。

In light of this, it's peculiar that Maoye International Holdings' P/E sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

有鉴于此,茂业国际控股的市盈率低于大多数其他公司,这是很奇怪的。看起来,大多数投资者并不相信该公司能够保持最近的增长速度。

What We Can Learn From Maoye International Holdings' P/E?

我们可以从茂业国际控股的市盈率中学到什么?

Shares in Maoye International Holdings have plummeted and its P/E is now low enough to touch the ground. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

茂业国际控股的股价暴跌,其市盈率现在已经低到可以触地的程度。一般来说,我们倾向于限制市盈率的使用,以确定市场对公司整体健康状况的看法。

We've established that Maoye International Holdings currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

我们已经确定,茂业国际控股目前的市盈率远低于预期,因为其最近三年的增长高于更广泛的市场预测。当我们看到强劲的收益和快于市场的增长时,我们认为潜在的风险可能会给市盈率带来重大压力。如果最近的中期盈利趋势持续下去,至少价格风险看起来非常低,但投资者似乎认为,未来的盈利可能会出现很大的波动。

Plus, you should also learn about these 4 warning signs we've spotted with Maoye International Holdings (including 2 which are a bit concerning).

另外,你还应该了解这些我们在茂业国际控股公司发现了4个警告信号(包括两个有点令人担忧的问题)。

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

如果你对市盈率感兴趣,你可能想看看这个免费其他盈利增长强劲、市盈率较低的公司的集合。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有什么反馈吗?担心内容吗? 保持联系直接与我们联系。或者,也可以给编辑组发电子邮件,地址是implywallst.com。

本文由Simply Wall St.撰写,具有概括性。我们仅使用不偏不倚的方法提供基于历史数据和分析师预测的评论,我们的文章并不打算作为财务建议。它不构成买卖任何股票的建议,也没有考虑你的目标或你的财务状况。我们的目标是为您带来由基本面数据驱动的长期重点分析。请注意,我们的分析可能不会将最新的对价格敏感的公司公告或定性材料考虑在内。Simply Wall St.对上述任何一只股票都没有持仓。