Suncorp Technologies Limited (HKG:1063) Stock Rockets 26% As Investors Are Less Pessimistic Than Expected

Suncorp Technologies Limited (HKG:1063) Stock Rockets 26% As Investors Are Less Pessimistic Than Expected

Suncorp Technologies Limited (HKG:1063) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 32% in the last twelve months.

Suncorp Technologies Limited(HKG:1063)股价经历了令人印象深刻的一个月,在经历了一段不稳定的时期后上涨了26%。并非所有股东都会感到欢欣鼓舞,因为在过去12个月里,该公司股价仍下跌了非常令人失望的32%。

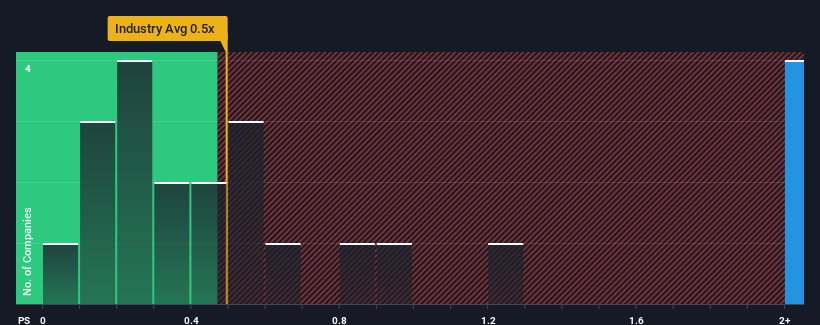

After such a large jump in price, when almost half of the companies in Hong Kong's Communications industry have price-to-sales ratios (or "P/S") below 0.5x, you may consider Suncorp Technologies as a stock not worth researching with its 3.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

在股价如此大幅上涨之后,当香港通信业近一半的公司的市盈率(P/S)低于0.5倍时,你可能会认为Suncorp Technologies的市盈率为3.2倍,不值得研究。尽管如此,仅仅从表面上看待P/S是不明智的,因为可能会有一个解释为什么它如此之高。

See our latest analysis for Suncorp Technologies

查看我们对Suncorp Technologies的最新分析

What Does Suncorp Technologies' Recent Performance Look Like?

Suncorp Technologies最近的表现如何?

As an illustration, revenue has deteriorated at Suncorp Technologies over the last year, which is not ideal at all. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

举例来说,Suncorp Technologies的收入在过去一年里一直在恶化,这根本不是理想的情况。许多人可能预计,在未来一段时间内,该公司的表现仍将好于大多数其他公司,这使得P/S指数没有崩盘。然而,如果情况并非如此,投资者可能会被发现为该股支付过高的价格。

Do Revenue Forecasts Match The High P/S Ratio?

收入预测是否与高市盈率相匹配?

In order to justify its P/S ratio, Suncorp Technologies would need to produce outstanding growth that's well in excess of the industry.

为了证明其P/S比率是合理的,Suncorp Technologies需要实现远远超出行业的出色增长。

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 36%. As a result, revenue from three years ago have also fallen 37% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

先回过头来看,该公司去年的收入增长并不令人兴奋,因为它公布了令人失望的36%的下降。因此,三年前的整体营收也下降了37%。因此,公平地说,最近的收入增长对公司来说是不可取的。

In contrast to the company, the rest of the industry is expected to grow by 17% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

与该公司形成鲜明对比的是,该行业其他业务预计明年将增长17%,这确实让人对该公司最近的中期收入下降有了正确的认识。

With this in mind, we find it worrying that Suncorp Technologies' P/S exceeds that of its industry peers. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

考虑到这一点,我们感到担忧的是,Suncorp Technologies的P/S超过了行业同行。似乎大多数投资者都忽视了最近糟糕的增长率,并希望该公司的业务前景有所好转。只有最大胆的人才会认为这些价格是可持续的,因为最近收入趋势的延续最终可能会对股价造成沉重压力。

The Key Takeaway

关键的外卖

Shares in Suncorp Technologies have seen a strong upwards swing lately, which has really helped boost its P/S figure. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Suncorp Technologies的股价最近出现了强劲的上行,这确实帮助提振了其市盈率/S数字。有人认为,在某些行业中,市销率是衡量价值的次要指标,但它可能是一个强大的商业信心指标。

Our examination of Suncorp Technologies revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. Right now we aren't comfortable with the high P/S as this revenue performance is highly unlikely to support such positive sentiment for long. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

我们对Suncorp Technologies的调查显示,考虑到该行业将会增长,该公司中期营收缩水并没有导致市盈率S像我们预期的那样低。目前,我们对高市盈率S并不满意,因为这种收入表现不太可能长期支持这种积极的情绪。如果近期的中期营收趋势持续下去,将使股东的投资面临重大风险,潜在投资者面临支付过高溢价的危险。

Plus, you should also learn about this 1 warning sign we've spotted with Suncorp Technologies.

另外,你也应该了解一下这一点我们发现了Suncorp Technologies的一个警告信号。

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

如果过去收益增长稳健的公司符合你的胃口,你可能想看看这个免费其他盈利增长强劲、市盈率较低的公司的集合。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有什么反馈吗?担心内容吗? 保持联系直接与我们联系。或者,也可以给编辑组发电子邮件,地址是implywallst.com。

本文由Simply Wall St.撰写,具有概括性。我们仅使用不偏不倚的方法提供基于历史数据和分析师预测的评论,我们的文章并不打算作为财务建议。它不构成买卖任何股票的建议,也没有考虑你的目标或你的财务状况。我们的目标是为您带来由基本面数据驱动的长期重点分析。请注意,我们的分析可能不会将最新的对价格敏感的公司公告或定性材料考虑在内。Simply Wall St.对上述任何一只股票都没有持仓。