JSTI Group's (SZSE:300284) Biggest Owners Are Retail Investors Who Got Richer After Stock Soared 7.0% Last Week

JSTI Group's (SZSE:300284) Biggest Owners Are Retail Investors Who Got Richer After Stock Soared 7.0% Last Week

Key Insights

主要见解

- The considerable ownership by retail investors in JSTI Group indicates that they collectively have a greater say in management and business strategy

- A total of 7 investors have a majority stake in the company with 50% ownership

- Insider ownership in JSTI Group is 21%

- 散户投资者对JSTI集团的大量持股表明,他们共同在管理和商业战略方面拥有更大的发言权

- 共有7名投资者持有该公司50%的多数股权

- JSTI集团的内部人持股比例为21%

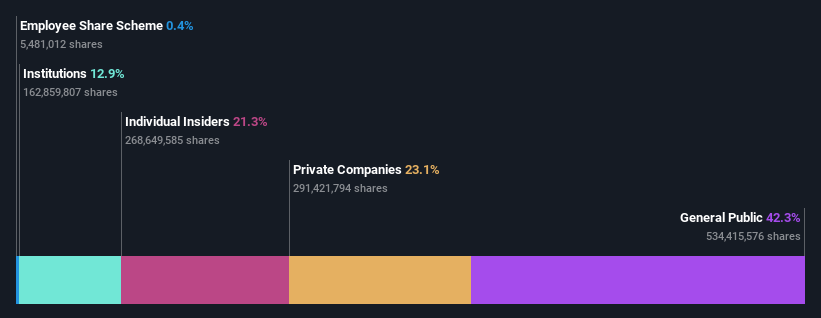

A look at the shareholders of JSTI Group (SZSE:300284) can tell us which group is most powerful. We can see that retail investors own the lion's share in the company with 42% ownership. In other words, the group stands to gain the most (or lose the most) from their investment into the company.

看看江苏科创集团(SZSE:300284)的股东,我们就知道哪个集团最有权势。我们可以看到,散户投资者拥有该公司最大的份额,拥有42%的股份。换句话说,该集团将从他们对公司的投资中获得最大(或损失最大)。

As a result, retail investors collectively scored the highest last week as the company hit CN¥8.3b market cap following a 7.0% gain in the stock.

因此,散户投资者上周的得分最高,该公司在股价上涨7.0%后,市值达到人民币83亿元。

Let's delve deeper into each type of owner of JSTI Group, beginning with the chart below.

让我们从下面的图表开始,更深入地研究JSTI Group的每种类型的所有者。

Check out our latest analysis for JSTI Group

查看我们对JSTI Group的最新分析

What Does The Institutional Ownership Tell Us About JSTI Group?

关于JSTI集团,机构所有权告诉了我们什么?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

机构通常在向自己的投资者报告时,以基准来衡量自己,因此一旦一只股票被纳入主要指数,它们往往会对这只股票变得更加热情。我们预计,大多数公司都会有一些机构登记在册,特别是在它们正在增长的情况下。

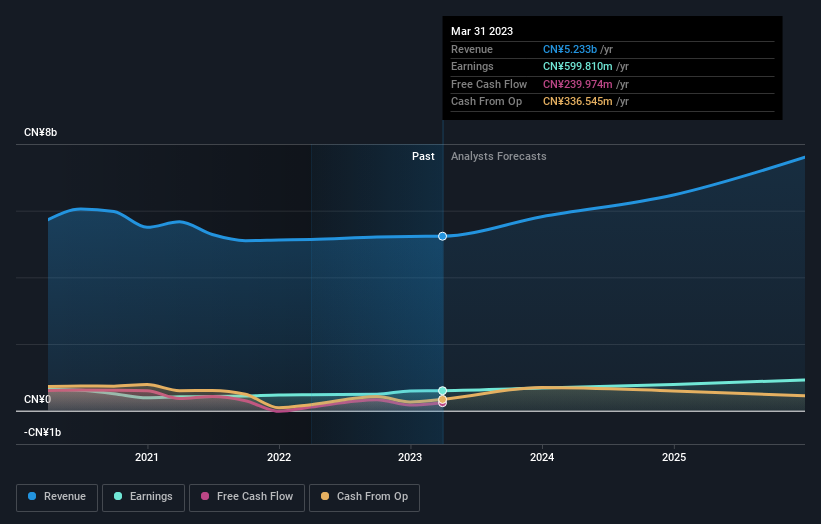

JSTI Group already has institutions on the share registry. Indeed, they own a respectable stake in the company. This suggests some credibility amongst professional investors. But we can't rely on that fact alone since institutions make bad investments sometimes, just like everyone does. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of JSTI Group, (below). Of course, keep in mind that there are other factors to consider, too.

JSTI集团已经在股票登记处登记了机构。事实上,他们在该公司拥有可观的股份。这表明在专业投资者中有一定的可信度。但我们不能仅仅依靠这一事实,因为机构有时会做出糟糕的投资,就像每个人一样。如果两个大型机构投资者试图同时抛售一只股票,股价大幅下跌的情况并不少见。因此,检查JSTI Group过去的收益轨迹是值得的(见下图)。当然,请记住,还有其他因素需要考虑。

Hedge funds don't have many shares in JSTI Group. Guangzhou Urban Construction Investment Group Co., Ltd. is currently the company's largest shareholder with 23% of shares outstanding. For context, the second largest shareholder holds about 12% of the shares outstanding, followed by an ownership of 5.5% by the third-largest shareholder. Junhua Wang, who is the third-largest shareholder, also happens to hold the title of Vice Chairman.

对冲基金在JSTI Group的股份并不多。广州城建投资集团有限公司目前是该公司的第一大股东,持有23%的流通股。作为参考,第二大股东持有约12%的流通股,第三大股东持有5.5%的股份。第三大股东王俊华也恰好持有副董事长头衔。

We also observed that the top 7 shareholders account for more than half of the share register, with a few smaller shareholders to balance the interests of the larger ones to a certain extent.

我们还观察到,前7名股东占股东名册的一半以上,少数小股东在一定程度上平衡了大股东的利益。

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. There are plenty of analysts covering the stock, so it might be worth seeing what they are forecasting, too.

研究机构持股是衡量和筛选股票预期表现的好方法。通过研究分析师的情绪,也可以达到同样的效果。有很多分析师在追踪这只股票,所以他们的预测可能也是值得的。

Insider Ownership Of JSTI Group

JSTI集团的内部人所有权

The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

公司内部人的定义可能是主观的,而且在不同的司法管辖区之间确实有所不同。我们的数据反映了个别内部人士,至少捕捉到了董事会成员。管理层最终要向董事会负责。然而,经理人担任执行董事会成员并不少见,尤其是如果他们是创始人或首席执行官的话。

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

我通常认为内部人持股是一件好事。然而,在某些情况下,这会让其他股东更难让董事会对决策负责。

Our information suggests that insiders maintain a significant holding in JSTI Group. It has a market capitalization of just CN¥8.3b, and insiders have CN¥1.8b worth of shares in their own names. That's quite significant. Most would say this shows a good degree of alignment with shareholders, especially in a company of this size. You can click here to see if those insiders have been buying or selling.

我们的信息显示,内部人士持有JSTI集团的大量股份。它的市值仅为83亿元人民币,内部人士以自己的名义持有价值18亿元的股票。这是非常重要的。大多数人会说,这表明与股东的关系很好,特别是在这样一家规模如此大的公司。你可以点击这里,看看这些内部人士是一直在买入还是卖出。

General Public Ownership

一般公有制

The general public-- including retail investors -- own 42% stake in the company, and hence can't easily be ignored. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

包括散户投资者在内的普通公众持有该公司42%的股份,因此不能轻易忽视。虽然这群人不一定能发号施令,但它肯定能对公司的运营方式产生真正的影响。

Private Company Ownership

私营公司所有权

We can see that Private Companies own 23%, of the shares on issue. It might be worth looking deeper into this. If related parties, such as insiders, have an interest in one of these private companies, that should be disclosed in the annual report. Private companies may also have a strategic interest in the company.

我们可以看到,私营公司拥有23%的已发行股份。或许有必要对此进行更深入的研究。如果关联方,如内部人士,对这些私营公司中的一家有利害关系,则应在年报中披露。私营公司也可能对该公司拥有战略利益。

Next Steps:

接下来的步骤:

While it is well worth considering the different groups that own a company, there are other factors that are even more important. To that end, you should be aware of the 1 warning sign we've spotted with JSTI Group .

虽然考虑拥有一家公司的不同集团是很值得的,但还有其他更重要的因素。为此,您应该意识到1个警告标志我们发现了JSTI集团。

Ultimately the future is most important. You can access this free report on analyst forecasts for the company.

最终未来是最重要的。您可以访问此免费分析师对该公司的预测报告。

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

注:本文中的数字是使用过去12个月的数据计算的,指的是截至财务报表日期的最后一个月的12个月期间。这可能与全年的年度报告数字不一致。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有什么反馈吗?担心内容吗? 保持联系直接与我们联系。或者,也可以给编辑组发电子邮件,地址是implywallst.com。

本文由Simply Wall St.撰写,具有概括性。我们仅使用不偏不倚的方法提供基于历史数据和分析师预测的评论,我们的文章并不打算作为财务建议。它不构成买卖任何股票的建议,也没有考虑你的目标或你的财务状况。我们的目标是为您带来由基本面数据驱动的长期重点分析。请注意,我们的分析可能不会将最新的对价格敏感的公司公告或定性材料考虑在内。Simply Wall St.对上述任何一只股票都没有持仓。