Tesla To $322? Here's What The Technicals Suggest For The Stock

Tesla To $322? Here's What The Technicals Suggest For The Stock

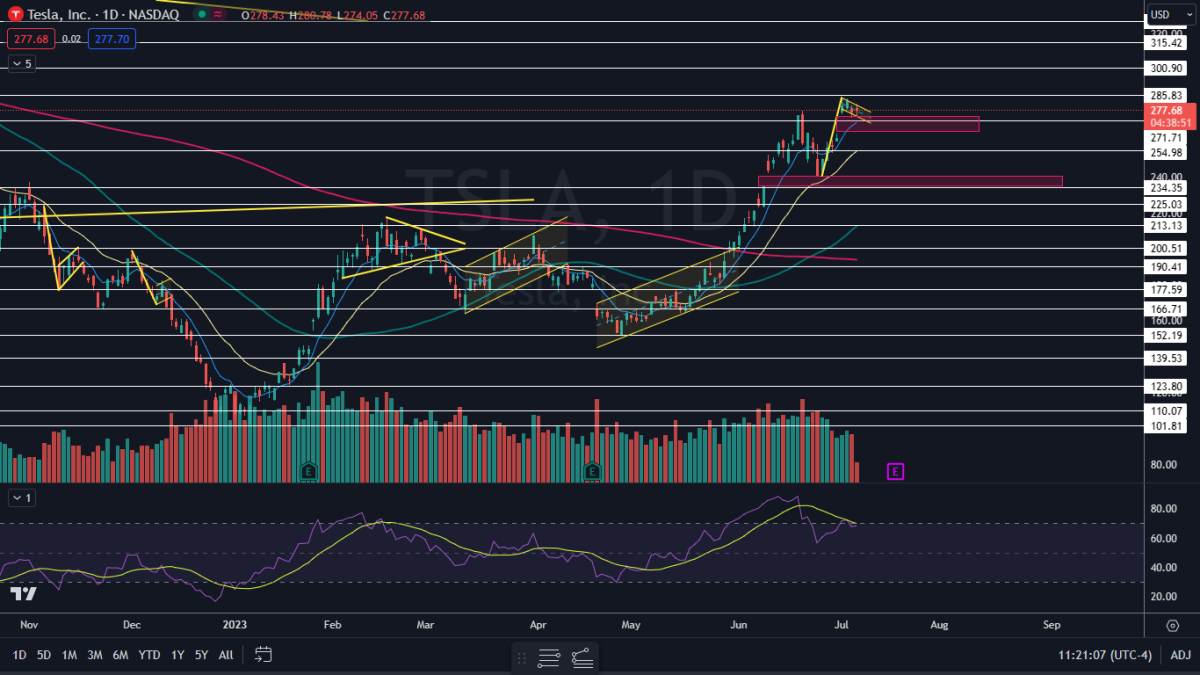

Tesla, Inc (NASDAQ:TSLA) was trading flat on Friday, continuing to consolidate on below-average-volume as the stock settles into a possible bull flag pattern on the daily chart.

特斯拉公司 纳斯达克股票代码:TSLA)周五交易持平,随着该股在日线图上进入可能的牛旗模式,交易量继续以低于平均水平的水平盘整。

The bull flag pattern is created with a sharp rise higher forming the pole, which is then followed by a consolidation pattern that brings the stock lower between a channel with parallel lines or into a tightening triangle pattern.

牛旗形态是在急剧上涨形成极点时形成的,然后是盘整模式,使股票在具有平行线的通道之间走低或进入收紧的三角形模式。

For bearish traders, the "trend is your friend" (until it's not) and the stock may continue downwards within the following channel for a short period of time. Aggressive traders may decide to short the stock at the upper trendline and exit the trade at the lower trendline.

对于看跌的交易者来说,“趋势是你的朋友”(直到不是),股票可能会在短时间内在以下通道内继续下跌。激进的交易者可能会决定在上方趋势线做空股票,并在较低的趋势线退出交易。

Traders with a bullish outlook should look for a surge beyond the top descending trendline of the flag pattern, accompanied by high trading volume, as a signal for entry. When a stock breaks up from a bull flag pattern, the measured move higher is equal to the length of the pole and should be added to the lowest price within the flag.

前景看涨的交易者应该寻找突破旗形态顶部下降趋势线的飙升,同时伴随着高交易量,作为进入的信号。当一只股票从牛旗形态中突破时,测得的上涨幅度等于极点的长度,应加到旗帜内的最低价格中。

A bull flag is negated when a stock closes a trading day below the lower trendline of the flag pattern, or if the flag falls more than 50% down the length of the pole.

当一只股票在一个交易日收于旗形模式的下趋势线下方,或者如果旗帜向下跌超过该极点的50%,则牛旗被否定。

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

想要直接分析?在 BZ Pro 休息室找我!点击此处免费试用。

The Tesla Chart: Tesla has created a possible bull flag pattern between June 27 and Friday, with the pole formed over the first five trading days of that timeframe and the flag formed since. The measured move of the bull flag is about 18%, which suggests Tesla could rise toward $322.

特斯拉图表: 特斯拉在6月27日至周五之间创造了可能的牛市旗形态,在该时间段的前五个交易日形成了极点,此后形成了旗帜。牛市的衡量走势约为18%,这表明特斯拉可能升至322美元。

- Bullish traders want to see substantial bullish volume pushing Tesla beyond the upper descending trendline of the flag pattern, thus confirming the pattern's recognition. If that happens, the stock will also form a higher high, which will confirm a new uptrend is in the cards.

- Bearish traders want to see big bullish volume come in and break Tesla down under the eight-day exponential moving average, which would negate the bull flag and confirm a short-term downtrend. If that happens, a gap that exists between $265.63 and $274.05 is likely to fill.

- Tesla has resistance above at $285.83 and $300.90 and support below at $271.71 and $254.98.

- 看涨交易者希望看到大量的看涨交易量将特斯拉推向旗形态的上行趋势线,从而证实该模式的认可。如果发生这种情况,该股也将形成更高的高点,这将证实新的上涨趋势即将到来。

- 看跌交易者希望看到大量的看涨交易量出现,并将特斯拉跌破八天指数移动平均线,这将抵消牛市信号并确认短期下跌趋势。如果发生这种情况,265.63美元和274.05美元之间的差距很可能会填补。

- 特斯拉的阻力位高于285.83美元和300.90美元,下方的支撑位为271.71美元和254.98美元。

Read Next:Â Tesla, Amazon And 2 Other Stocks Insiders Are Selling

阅读下一篇:特斯拉、亚马逊和其他两只股票内部人士正在抛售