Investor Anxiety Grows As VIX Index Records Dramatic Increase Amid Fed Rate Hike Concerns: Why Is Volatility Spiking Thursday?

Investor Anxiety Grows As VIX Index Records Dramatic Increase Amid Fed Rate Hike Concerns: Why Is Volatility Spiking Thursday?

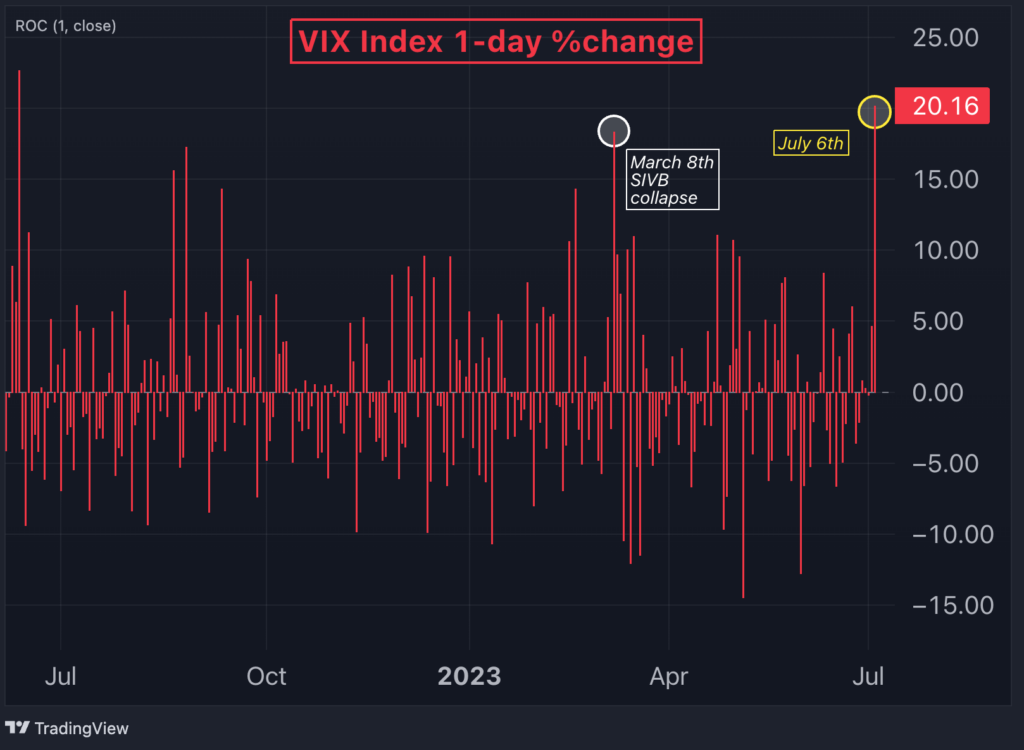

The CBOE Volatility (VIX) Index, commonly known as the "fear index," surged over 20% on Thursday, reflecting the prevailing market volatility across major U.S. stock indices.

芝加哥期权交易所波动率(VIX)指数(俗称 “恐惧指数”)周四飙升了20%以上,反映了美国主要股指当前的市场波动。

With a daily change of 20%, the VIX is on track for its best session of 2023, topping the spike seen on March 8, when it soared 18.3% following the banking failures of Silicon Valley Bank and Signature Capital.

VIX的每日涨幅为20%,有望创下2023年的最佳时段,超过3月8日的涨幅,当时在硅谷银行和Signature Capital银行倒闭后飙升了18.3%。

Chart: CBOE Volatility Index On Track For The Best 2023 Session

(1-day % change in VIX)

图表:芝加哥期权交易所波动率指数有望迎来2023年最佳时段

(VIX 的 1 天变化百分比)

Why is Stock Market Volatility Spiking on Thursday?

为什么周四股市波动率飙升?

The spike in the VIX was fueled by mounting concerns that the Federal Reserve may raise interest rates again in 2023, potentially with two more hikes by year-end, as indicated by the June dot plot.

正如6月点阵图所示,人们越来越担心美联储可能在2023年再次加息,到年底可能再加息两次,这推动了VIX指数的飙升。

Wednesday's minutes from the latest June FOMC Meeting revealed an unusual dissent within the board, with a minority of members preferring a rate hike in June rather than keeping rates unchanged.

周三最近一次6月联邦公开市场委员会会议纪要显示,董事会内部存在不寻常的异议,少数成员宁愿在6月加息,而不是维持利率不变。

The minutes also indicated a strong consensus to implement further rate increases, as reflected in the macroeconomic projections, with two hikes being the median preference among Fed members.

会议纪要还表明,正如宏观经济预测所反映的那样,人们强烈同意进一步加息,其中两次加息是美联储成员的中位偏好。

Strong Economic Data Backed by Hawkish Fed Remarks

美联储鹰派言论支持强劲的经济数据

On Thursday, better-than-expected economic data further fueled market expectations of rate hikes by the Federal Reserve.

周四,好于预期的经济数据进一步推动了市场对美联储加息的预期。

The ADP National Employment Report revealed an impressive 497,000 new payrolls in June, a remarkable jump from May's 278,000 and well above the forecast of 220,000.

ADP《全国就业报告》显示,6月份新增就业人数为49.7万人,比5月份的27.8万人大幅增长,远高于预期的22万人。

Shortly after, the Institute for Supply Management (ISM) reported a surge in the Services PMI to 53.9 in June, up from 50.3 in May and beating expectations of 51. This marks the sixth consecutive expansion reading for the private services sector.

不久之后,美国供应管理协会(ISM)报告称,服务业采购经理人指数从5月份的50.3激增至6月份的53.9,超过了预期的51。这标志着私营服务业连续第六次出现扩张数据。

Adding fuel to the fire, Lorie K. Logan, president and CEO of the Federal Reserve Bank of Dallas and a Federal Committee Member this year, stated that "more restrictive policy and rate hikes are needed for the FOMC to reach goals." She also expressed concern about the speed at which inflation will cool down and revealed her preference for a June rate hike.

火上浇油, Lorie K. Logan达拉斯联邦储备银行行长兼首席执行官、今年的联邦委员会成员表示:“联邦公开市场委员会需要更严格的政策和加息才能实现目标。”她还对通货膨胀降温的速度表示担忧,并透露她倾向于6月加息。

Traders Now Fear the Fed Will Hike Twice

交易员现在担心美联储将加息两次

All these events have led traders to anticipate an increased likelihood of Fed rate hikes.

所有这些事件都使交易者预计美联储加息的可能性会增加。

The probability of a 25 basis points hike in July has now risen to 95%, up from 90% yesterday.

7月份加息25个基点的可能性现已从昨天的90%上升至95%。

More worrisome is the probability of a consecutive hike in September, which has increased from yesterday's 18% to 28.5%, and the likelihood of a second rate hike in November now stands at over 40%, according to CME Group Fed Watch tool.

芝加哥商品交易所集团美联储观察工具显示,更令人担忧的是,9月份连续加息的可能性已从昨天的18%增加到28.5%,而11月第二次加息的可能性现在已超过40%。

CME Group Fedwatch: FOMC Meeting Probabilities as of July 6

芝加哥商品交易所集团Fedwatch:截至7月6日的联邦公开市场委员会会议概率

| MEETING DATE | 450-475 | 475-500 | 500-525 | 525-550 | 550-575 | 575-600 |

|---|---|---|---|---|---|---|

| 26/07/2023 | 5,1% | 94,9% | ||||

| 20/09/2023 | 3,6% | 67,9% | 28,5% | |||

| 01/11/2023 | 2,5% | 49,0% | 40,1% | 8,4% | ||

| 13/12/2023 | 0,2% | 6,7% | 48,2% | 37,3% | 7,6% | |

| 31/01/2024 | 1,3% | 13,6% | 46,4% | 32,4% | 6,4% | |

| 20/03/2024 | 0,4% | 4,7% | 22,7% | 42,4% | 25,1% | 4,6% |

| 会议日期 | 450-475 | 475-500 | 500-525 | 525-550 | 550-575 | 575-600 |

|---|---|---|---|---|---|---|

| 26/07/2023 | 5,1% | 94,9% | ||||

| 20/09/2023 | 3,6% | 67,9% | 28,5% | |||

| 2023 年 11 月 1 日 | 2,5% | 49,0% | 40,1% | 8,4% | ||

| 13/12/2023 | 0,2% | 6,7% | 48,2% | 37,3% | 7,6% | |

| 31/01/2024 | 1,3% | 13,6% | 46,4% | 32,4% | 6,4% | |

| 20/03/2024 | 0,4% | 4,7% | 22,7% | 42,4% | 25,1% | 4,6% |

ETFs Tracking The VIX Index

追踪 VIX 指数的交易所买卖基金

There are several ETFs available that track the VIX index. Here are a few examples:

有几只追踪VIX指数的ETF可供选择。以下是几个例子:

- ProShares VIX Short-Term Futures ETF (NYSE:VIXY)

- iPath Series B S&P 500 VIX Short-Term Futures ETN (NYSE:VXX)

- VelocityShares Daily 2x VIX Short-Term ETN (NYSE:TVIX)

- ProShares Ultra VIX Short-Term Futures ETF (NYSE:UVXY)

- ProShares VIX 短期期货 ETF (纽约证券交易所代码:VIXY)

- iPath B 系列标准普尔 500 指数 VIX 短期期货 ETN (纽约证券交易所代码:VXX)

- VelocityShares Daily 2x VIX 短期 ETN (纽约证券交易所代码:TVIX)

- ProShares Ultra VIX 短期期货 ET (纽约证券交易所代码:UVXY)

ProShares VIX Mid-Term Futures ETF (NYSE:VIXM)

Photo: Shutterstock

ProShares VIX 中期期货ETF (纽约证券交易所代码:VIXM)

照片:Shutterstock